Like each iteration earlier than it, Richard Smith’s TranzactCard has collapsed.

Like each iteration earlier than it, Richard Smith’s TranzactCard has collapsed.

Following disabling of DBO recruitment and member referral yesterday, a “FinMore” reboot was introduced on a TranzactCard company name.

For essentially the most half, FinMore seems to be an beauty rebranding with extra charges.

- TranzactCard DBO –> FinMore Enterprise Proprietor (FBO)

- TranzactCard Member (retail buyer) –> Finmore Cardholder

- ZClub –> FinMore Market Place

- ZBucks –> FinCredits

FinMore Cardholders shall be charged $4.95 a month for entry to FinMore. “Legacy” TranzactCard members will obtain entry to the identical service for $2.49 a month, up till March 2025.

As to what providers FinMore is offering entry to, it’s a normal providing of “me too” low cost providers from undisclosed third-parties.

The providers are damaged down into numerous classes with “Flourish” branding.

Flourish Well being and Wellness

- telemedicine

- a vitamin program

- a health program

- weight administration program

- medical hashish financial savings

- medicare concierge service

- prescription reductions

- senior financial savings advantages

- dental financial savings

- medical data vault

Flourish Resolution Maker

- finance monitoring

- overspending corrector

- budgeting device

Notice that Flourish prices a further $50 a month and “different Flourish bundles” shall be launched sooner or later.

Evidently this appears nothing like what TranzactCard initially pitched.

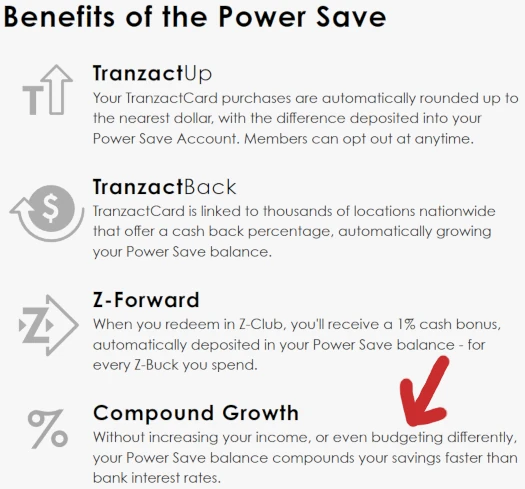

They’ve gone from “right here’s a bank card you’ll get a 1:1 greenback match on have the ability to purchase Nikes with”, plus a “compound development” financial savings account…

…to “right here’s some low cost providers you will get from a bunch of locations”.

With Flourish costing $50 a month additional, what I’m misplaced on is what FinMore members are paying month-to-month charges for.

I get that associates (FBOs) could be charged for backoffice entry, however what precisely are the FinMore member retail clients paying for?

On the MLM aspect of issues, FinMore is charging new recruits $199 plus $50 yearly. That is down from the $495 TranzactCard DBOs have been charged.

Retail clients are being charged $50 yearly plus $4.95 a month (I nonetheless don’t know why you’d join this).

Commissions are paid out by way of what seems to be a unilevel, capped at ten ranges on recruitment and 9 ranges for retail clients. This matches what TranzactCard was providing.

Flourish, which is new, pays $5 a month for direct referrals (FBOs and retail clients), and $3 upline 9 ranges (primarily based on rank).

Stating the apparent, FinMore seems to be a renewed effort to disassociate from TranzactCard founder and proprietor Richard Smith.

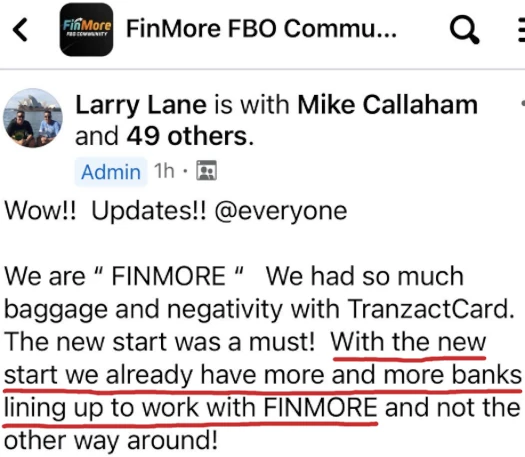

Communication from TranzactCard/FinMore distributors definitely suggests banks are being misled with the rebranding:

How lengthy that goes undetected is anybody’s guess.

One thing else I haven’t seen addressed is whether or not $495 TranzactCard DBOs are in a position to declare a refund. Given what they purchased into has collapsed, providing full refunds can be the legally accountable route.

Nonetheless no company response on the 32,000 TranzactCard accounts being breached, or what the plan goes ahead.

Richard Smith “resigned” from TranzactCard company final November however nonetheless owned father or mother firm TZT Holdings LLC.

It’s unclear whether or not Smith nonetheless owns no matter shell firm FinMore has been arrange behind (straight or by proxy).