James O. Ward Jr., an Alabama resident, has been sued by the SEC over fraud allegations regarding his Apex Monetary funding scheme.

James O. Ward Jr., an Alabama resident, has been sued by the SEC over fraud allegations regarding his Apex Monetary funding scheme.

As per the SEC’s September tenth, 2024 filed Grievance, Ward, by Apex Monetary, defrauded “not less than 70 buyers” out of “not less than $852,000”.

Ward arrange Apex Monetary in 2021 as a shell firm within the British Virgin Islands. Ward’s companions within the enterprise had been Jason Rose and Hitesh Juneja.

BehindMLM reviewed Apex Monetary in April 2021, figuring out it as a Ponzi scheme constructed round APT token.

The SEC identifies Apex Monetary as a “non-public fund” Ward falsely represented was “an precise hedge fund”.

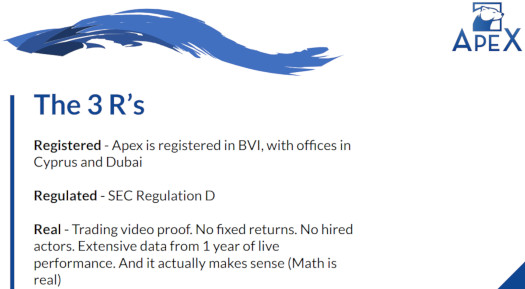

As recognized by the SEC, false advertising and marketing claims Ward made embody Apex Monetary

- was regulated (registered) with the SEC;

- had $25 million in property;

- “had efficiently carried out a 12-month beta take a look at of its buying and selling methods”;

- generated exterior income through “buying and selling methods that supplied buyers the chance to expertise substantial features with none danger of loss”; and

- had “a number of worldwide places of work”

In actuality, whereas Apex hoped to open places of work sooner or later, it by no means had any places of work; quite, it was run remotely out of the houses of its three principals.

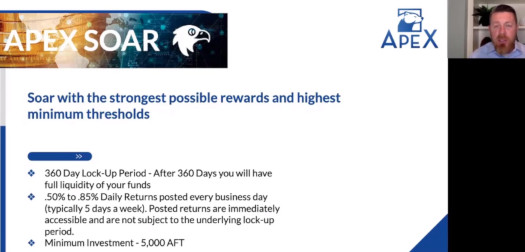

Under is an Apex Advertising and marketing monetary slide offered by Ward, cited by BehindMLM in its 2021 evaluation:

Additional to his efforts to solicit funding by deception, Ward additionally lied about earlier associations with fraudulent funding schemes.

Ward additionally touted his personal credibility and integrity, telling potential buyers that he would by no means be concerned in an illegitimate enterprise.

But he did not disclose that he beforehand had engaged in a $20 million Ponzi scheme and directed accomplices to destroy paperwork after receiving a subpoena from the Federal Commerce Fee (“FTC”) regarding that Ponzi scheme.

Ward settled with the CFTC in January 2023. The CFTC’s case tied Ward to JetCoin, an MLM crypto Ponzi launched previous to Apex Monetary.

On the core of Apex Monetary’s unregistered securities providing was Apex Monetary Token (APT token).

A key element of Ward’s gross sales pitch was the “Apex Monetary Token,” which Ward falsely claimed was pegged to the U.S. greenback.

The truth is, there was no token. AFT … by no means existed and nothing concerning the fictitious token was pegged to the greenback.

Versus the advertising and marketing baloney Ward was feeding Apex Monetary buyers, right here’s what truly occurred;

Apex invested the vast majority of investor proceeds in third-party funds. From the outset, these investments sustained substantial losses.

In or round September 2021, Apex stopped accepting investments and subsequently started to wind down its operations.

The SEC notes in its Grievance that after Apex Monetary collapsed, Rose and Juneja “used their private funds to assist repay buyers.”

Ward didn’t contribute any of the cash used to repay buyers.

James Ward doubled down on fraud and went on to launch Full Velocity in March 2022.

Full Velocity collapsed in Could 2022, producing upwards of 90% in losses for buyers. Whether or not Ward will face fraud prices in relation to Full Velocity stays to be seen.

Within the meantime, throughout three counts of fraud associated to Apex Monetary, the SEC has charged Ward with a number of violations of the Securities and Change Act.

The SEC is in search of a everlasting injunction in opposition to Ward, prohibiting him from having something to do with securities, in addition to civil penalties.

Disgorgement isn’t particularly requested by the SEC has requested the court docket for “such different and additional aid”.

It’s unclear whether or not Jason Rose and Hitesh Juneja can be charged for his or her involvement in Apex Monetary. I’m leaning in the direction of “no” given the repayments and assumed cooperation with the SEC.

Keep tuned for up to date as BehindMLM continues to trace James Ward’s Apex Monetary fraud case.