Earlier this week it grew to become obvious that GSPartners is on the highway to break down.

Earlier this week it grew to become obvious that GSPartners is on the highway to break down.

This began with the disabling of weekly returns on Monday, swiftly adopted up by a 50% withdrawal charge on Tuesday.

Formally, GSPartners has fed traders baloney a few “downturn within the markets”. The precise cause for the collapse is much less complicated.

The Achilles’ heel of GSPartners buying and selling representations is that there’s no proof of buying and selling going down, or buying and selling income getting used to pay withdrawals.

It is a authorized requirement that may solely be happy through registration with monetary regulators and periodic submitting of audited monetary reviews.

GSPartners isn’t registered with monetary regulators. Nor has it filed any audited monetary reviews, for what must be apparent causes by now.

With that in thoughts, as posted in GSPartners’ official personal FaceBook group, right here’s the buying and selling ruse they’re going with;

With that in thoughts, as posted in GSPartners’ official personal FaceBook group, right here’s the buying and selling ruse they’re going with;

In case you have adopted the markets over the previous 45 days you’d have seen market drops throughout a number of sectors.

A number of the trades took huge drops, while others have grown profitably.

A number of the unfavorable trades reached margin name limits on accounts, triggering the necessity to high up the accounts or shut these trades.

Upon recommendation the choice was made to high up accounts, and await the shedding trades to reverse route. This motion was taken.

Nonetheless over an prolonged interval of research, it was determined that the shedding developments wouldn’t reverse quickly, and the choice was made to shut these trades, and not using a second “high up”, while persevering with on with the worthwhile trades.

Your accounts might be up to date to indicate the loss your account has felt, while calculating any compound quantities which you’ll have performed, which lessened the loss for you.

Even when you purchase into GSPartners’ ruse, which you completely shouldn’t, there are a number of factors of competition to contemplate:

- what’s to cease this taking place once more (in a number of months)?

- given returns paid to traders who weren’t withdrawing have been additionally purportedly derived through buying and selling, how come their balances didn’t change?

- GSPartners’ advertising pitch was as much as 5% every week, assured. The pitch by no means factored in losses and customers weren’t suggested of the opportunity of having to reinvest to proceed to obtain the weekly passive ROI.

Within the full absence of verifiable proof GSPartners is and has been paying withdrawals with buying and selling income, clearly their ruse is fiction.

So what’s really taking place?

Indicators of GSPartners’ collapse have been increase within the background, when you’ve been paying consideration.

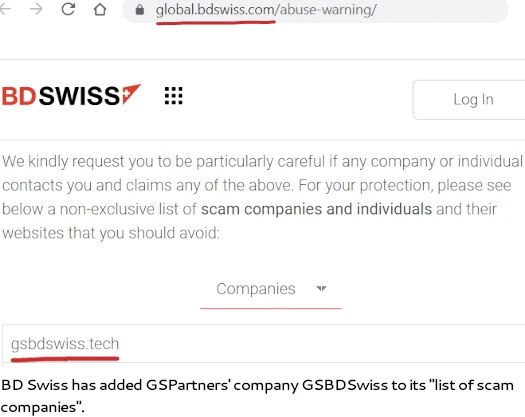

When it launched its certificates funding scheme in Might 2022, GSPartners initially represented BDSwiss was buying and selling on its behalf.

This ruse fell aside when BDSwiss publicly confirmed it had nothing to do with GSPartners in January 2023.

GSPartners swept this underneath the rug by pretending they meant Skygroup Group. That led to the creation of the shell entity GSBDSwiss.

BDSwiss’ response to GSBDSwiss was to situation a GSPartners and GSBDSwiss rip-off firm abuse warning.

Regulatory issues for GSPartners started earlier this yr with rolling securities fraud warnings out of Canada:

Swiss Valorem Financial institution rebranding was an try to get in entrance of the warnings. Whereas GSPartners’ web site nonetheless retains up the charade, the rebranding was in any other case deserted after Canadian authorities included Swiss Valorem Financial institution of their warnings.

Upon launching its certificates funding scheme final yr, GSPartners primarily solicited funding from US and Canadian residents.

The Canadian regulatory fraud warnings and assumption that US authorities aren’t far behind dampened these recruitment efforts.

GSPartners, caught off guard by Canada and cautious of a US regulatory investigation, started to focus recruitment efforts elsewhere.

In June 2023 GSPartners ratcheted up recruitment efforts in first India after which Hong Kong.

Notably, GSPartners founder Josip Heit was a no-show at both occasion.

The Canadian securities fraud warnings noticed Josip Heit isolate himself within the perceived security of Dubai.

The final time Heit set foot outdoors of Dubai for GSPartners advertising was again in March, for occasions held in Seychelles and South Africa.

In some unspecified time in the future Heit seems to have realized he wanted a public GSPartners fall man. German nationwide Dirc Zahlmann was promoted to CEO in July 2023.

GSPartners’ recruitment efforts in India and Hong Kong each flopped.

In late September, Zahlmann and a contingent of high GSPartners promoters have been despatched to the Caribbean to drum up recruitment of recent victims.

It was whereas these promotional occasions have been occurring, that GSPartners dropped its ROI and withdrawal charge updates in early October.

From the next disaster assembly that have been held, it seems no person within the Caribbean was conscious of the pending modifications.

However why now?

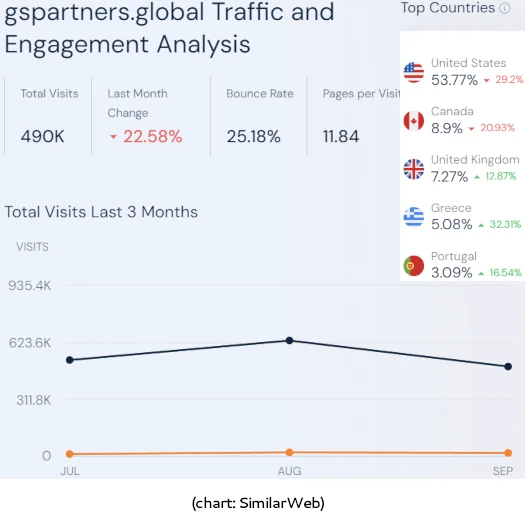

For the month of September 2023, SimilarWeb estimated GSPartners’ web site visitors plummeted by 23%.

Hardest hit have been the US (down 29% month on month) and Canada (down 21% month on month). Each nations have been beforehand GSPartners’ largest supply of recent traders investor recruitment.

Evidently Canadian fraud warnings have taken maintain, curbing recruitment of recent GSPartners victims within the US and Canada.

GSPartners continues to be energetic within the UK, Greece and Portugal, however that is nowhere close to sufficient to cowl GSPartners’ ever-growing “as much as 5% every week” ROI legal responsibility.

For an MLM firm that requires new funding to pay out withdrawals, a 23% drop in web site visitors month on month is catastrophic. And so this final week performed out the way in which it did.

The ultimate factor to notice is the timing of GSPartners’ ROI disabling and 50% withdrawal charge.

Subsequent month marks the start of the vacation season, a time when Ponzi schemes bleed on account of traders withdrawing to cowl elevated spending.

In earlier years we’ve seen main MLM Ponzi schemes collapse round this identical time.

In 2021 CashFX Group disabled withdrawals in November. In 2022 NovaTech FX began having withdrawals issues in October.

The timing of those occasions isn’t a coincidence. If GSPartners is already in hassle now, they know issues are solely going to worsen over the approaching months.

So what occurs now?

What we don’t know is how a lot in invested funds GSPartners has left. Mathematically talking, clawing again ~27% of initially invested funds and reducing withdrawals by 50% buys them a while.

On the opposite facet of that although is what’s left of GSPartners recruitment prone to utterly collapse. Which means the speed of recent funding will plummet even additional.

Sadly the precise second a Ponzi scheme collapses is unimaginable to foretell. CashFX Group by no means recovered. NovaTech FX managed to limp alongside until February 2023.

Hopefully traders who’ve woken as much as the actual fact they’ve been ensnared in an countless loop of *EUR shitcoins and certificates releases, have or are at the very least excited about submitting complaints with the SEC and DOJ.

Anybody in GSPartners who publicly complains and is recognized, is threatened with account termination and invested fund seizure.

Not a lot totally different to having your funds seized except you pay a ~27% charge, however the risk appears to be working.

Trying ahead, no matter occurs subsequent, BehindMLM might be right here to cowl it.