![]() Trent Staggs is and has been the mayor of Riverton, Utah since 2018.

Trent Staggs is and has been the mayor of Riverton, Utah since 2018.

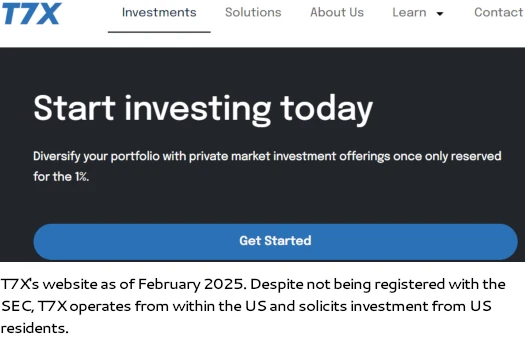

In what’s doubtlessly an abuse of workplace with respect to conflicts arising from verifiable securities fraud, Staggs can be a member of T7X’s Board of Administrators.

In his capability as Mayor of Riverton, Staggs appeared on a Trusted Good Chain advertising and marketing webinar on January twenty eighth.

On this unique interview, Travis Flaherty sits down with Mayor Trent Staggs, former Trump-endorsed U.S. candidate, to dive deep into the political panorama of the blockchain business.

Trent shares his insights on the way forward for tokenizing real-world property (RWAs), and why he selected to take a key place on the board of T7x.

Ah shit, right here we go once more…

Earlier than we get into Stagg’s advertising and marketing “interview”, I need to body the interview by establishing the place the priority lies with respect to T7X and Trusted Good Chain.

Trusted Good Chain is an MLM alternative tied to T7X, a purported “trade specializing in real-world property”.

That is from the FAQ part of Trusted Good Chain’s web site;

The founding father of T7X additionally established and launched the Trusted Good Chain (TSC) blockchain.

Virtually talking Trusted Good Chain and T7X are the identical entity run by the identical individuals.

In violation of federal securities legislation, neither Trusted Good Chain and T7X disclose firm possession on their respective web sites.

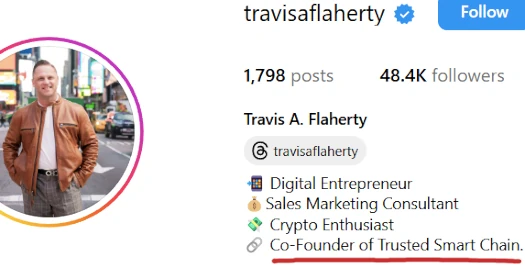

In BehindMLM’s printed Trusted Good Chain assessment, we cited advertising and marketing materials figuring out Billy Seashore, aka Mark Williams Schuler, as founding father of Trusted Good Chain and T7X.

Billy Seashore’s possession of T7X is hidden from shoppers on its web site. Seashore is as a substitute introduced as T7X’s “VP of Enterprise Growth”.

Trusted Good Chain’s MLM alternative revolves round two funding alternatives constructed round its TSC token.

- investments of $2500 ro $125,000 are solicited on the promise of passive returns, paid in TSC tokens (cited as each day token rewards)

- invested in TSC tokens might be staked with Trusted Good Chain on the promise of a share in 20% of passive returns paid out to buyers

As per a beforehand filed securities fraud lawsuit filed by the SEC, pertaining to his involvement within the collapsed iX World Ponzi scheme, Billy Seashore relies out of Utah.

As of January 2025, SimilarWeb is monitoring 100% of Trusted Good Chain’s web site visitors as originating from the US.

Regardless of being owned and operated from the US, efforts to hide this from shoppers embrace:

- T7X offering a company handle in Prague, Czech Republic on its web site; and

- Trusted Good Chain failing to supply a company handle in any way

Neither Trusted Good Chain, T7X or founder Billy Seashore are registered with the SEC.

Inside the authorized framework regulating securities (the Howey Check and Securities Change Act), Trusted Good Chain and T7X are a clear-cut case of securities fraud.

Trusted Good Chain’s reply to that’s basically “however we don’t assure something”.

What Makes the TSC Node Exempt from SEC Registration?

TSC Nodes are unbiased software program that should be put in and managed by a Node proprietor. There is no such thing as a promise of return worth or revenue.

Nodes earn digital rewards within the type of TSC tokens for supporting and securing the blockchain. These digital rewards will not be assured to have a selected worth, and no projections or guarantees are made concerning their price.

This can be a strawman protection that has no authorized foundation.

There is no such thing as a “unregistered securities are OK in the event you don’t assure something” carve out within the Securities Change Act. Likewise there’s no “however we don’t assure returns” exemption from the Howey Check.

I do know that was a little bit of a diversion from Mayor Staggs’ Trusted Good Chain “interview”, but it surely’s essential to determine what Staggs and host Travis Flaherty are selling.

Staggs’ introduces himself within the Trusted Good Chain advertising and marketing webinar as somebody acquainted with securities legislation within the US who completely ought to know higher.

[1:10] I bought an MBA. I labored in finance throughout a few totally different sectors however uh, having labored at Morgan Stanley, [I] held just about each securities license underneath the solar as a VP there and managing massive groups.

[1:44] After which, [I] even have somewhat little bit of a background into know-how and naturally the governmental house. Right here within the final twelve years I’ve been in elected workplace, or going into my twelfth yr now domestically.

And, as you said um, I ended operating for america senate final yr … we ended up not succeeding.

Stagg’s advertising and marketing interview is front-loaded with generalizations about cryptocurrency which have. It has nothing to do with Trusted Good Chain’s funding alternative or T7X.

It isn’t till eight minutes in that Staggs explains what attracted him to T7X.

[7:55] What drew me to it’s the tokenization of real-world property. Y’know um, having taken an organization public, y’know the board of administrators of that firm, seeing the ache and the expense of paying for audits and for uh y’know, all of the accounting and authorized.

After which seeing as soon as you might be public, the extent of manipulation and shorting and bare shorting and all of the stuff that goes on. It truly is, to me, problematic.

And I believe the tokenization of real-world property, seeing how that may actually democratize, if you’ll, finance and permit on a regular basis buyers to go forward and begin taking part in offers they wouldn’t in any other case have the ability to.

In abstract, Staggs sees T7X as an unregistered, unaudited and unregulated different to the inventory marketplace for retail buyers.

Sadly Staggs doesn’t elaborate on how an MLM firm very a lot centralized underneath management of its founder constitutes “democratization” of investing in introduced “offers”.

Once more, in potential violation of federal securities legislation and the FTC Act, Staggs doesn’t disclose whether or not he’s been compensated by T7X or whether or not he’s invested.

However it positive does sound prefer it;

[26:20] Effectively I believe the timing is fairly impeccable. I imply you’ve heard the expression that “there’s nothing as highly effective as an thought whose time has come”.

And I actually imagine that that’s the case as a result of we have now such nice tailwinds now, with the Trump administration coming in, with all of the issues that we’ve talked about, with this framework that’s being created. The strategic bitcoin reserves or others which can be occurring right here.

And so I actually really feel like we’re proper there and we’re at a second the place um, the place digital property throughout the board… I imply it’s simply going to take off.

We all know that so many consultants have hypothesized or guessed that we’re going to hit y’know, sixteen trillion by, in tokenization of real-world property by 2030.

Some are saying even a lot, a lot increased than that. Thirty trillion or extra. I imply I’ve seen figures which have considerably exceeded the sixteen trillion estimation.

So all of that being mentioned, and figuring out that you just’ve bought an organization and a platform like T7X, that’s providing this skill to essentially deal with the tokenization of real-world property.

And having this ecosystem with the Trusted Good Chain, I believe it’s only a nice, nice alternative. An ideal time to have the ability to get entangled and be proper there.

On the flipside Travis Flaherty spells out why Staggs being concerned is essential to Trusted Good Chain and T7X.

[22:04] It’s nice to have people, y’know like your self, which can be right here. Which are serving to steer the ship.

It’s basic “legitimacy by way of affiliation”.

On Trusted Good Chain and T7X committing securities fraud (and potential commodities fraud with T7X working as an unregistered trade coping with the buying and selling of purposed “real-world property”), Staggs states;

[9:28] That is what actually excites me. What I imagine we’re doing with the Reg A, with the Reg D filings with um, y’know the “EDGAR’ising” or making public of the audits and the financials, I believe that’s going to be the usual.

[9:52] To have a bunch that’s already acknowledged that and are prepared to have and implement self-imposed, proper?

That stage of uh, regulation, of compliance if you’ll, transparency, that’s what’s actually attracted me to it. And I believe there’s an enormous upside with respect to the T7X platform, in onboarding all of those property which can be already coming to us and asking to be tokenized.

[17:17] The massive, huge distinction with T7X is the truth that we’re imposing this requirement, via the Reg A and Reg D choices, to go forward and legitimize it.

Listing it as safety, don’t attempt to cover round it, and publicly disclose financials and audits. Stand behind it.

As beforehand said, neither Trusted Good Chain or T7X are registered with the SEC. There are not any Regulation A filings. There are not any Regulation D filings. There are not any filed audited monetary studies.

Why Staggs is misrepresenting T7X and Trusted Good Chain’s unregistered securities providing to potential buyers is unclear.

It’s not like Staggs doesn’t know why present securities legislation exists;

[17:57] My understanding and what I’ve seen, and I do know different individuals on this name might have skilled with another teams, is that um y’know, they weren’t doing what they mentioned they had been doing.

[20:30] After which, simply the um, having the ability to vet the entire real-world property which can be going to return on-board the trade … it’s essential these are properly established.

That they’ve um, an enterprise worth you could realistically verify y’know, via a valuation, via the audit at first. And that they’ve been round for quite a lot of years and are placing out cashflow – that may come again within the type of a dividend, proper? By way of the TSC [token], via your layer one coin.

All that’s extremely essential.

Certainly, which begs the query why Staggs is and continues to show a blind-eye to neither Trusted Good Chain or T7X being registered with the SEC and submitting audited monetary studies?

As for not “hiding” Trusted Good Chain’s and T7X’s securities choices, Travis Flaherty clearly has very totally different concepts to Staggs.

[22:12] Our nodes are software program, not securities. There’s no ensures of positive aspects or claims on the contrary are false. And so they’re not endorsed by Trusted Good Chain Chain, T7X or Prosper Hyperlink.

A lot for “standing behind” what Trusted Smartchain and T7X are providing.

And simply so we’re 100% clear on what Trusted Good Chain and T7X are providing, right here’s Trent Staggs a couple of minute after Travis Flaherty’s securities providing denial;

[23:17] You’ve bought um, you’ve bought… you’ve these real-world property which have y’know, tangible worth. However they’re placing out a money circulate, as you indicated, dividends on a quarterly foundation.

And so when you’ve that um, that state of affairs, the place you’ve say, 100 real-world property which can be paying, I’m simply utilizing random numbers right here, however say 5 million {dollars} in um, in an annual distribution; y’know that’s 5 hundred million {dollars} price of distributions which can be going to be paid out in that TSC coin.

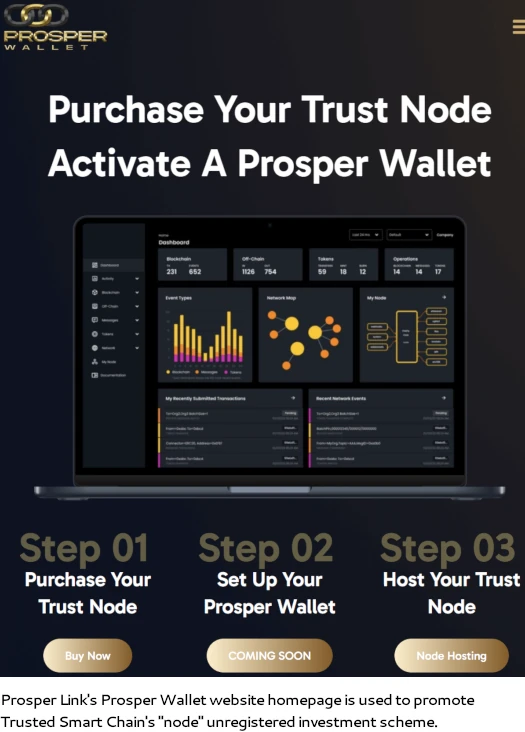

Additionally a sidenote; I hadn’t heard of “Prosper Hyperlink” earlier than. Seems Trusted Good Chain just lately got here up with a reputation for its MLM compensation plan. A bit dorky however no matter.

Prosper Hyperlink has been arrange as an LLC shell firm that operates from the web site area “prosperwallet.io”:

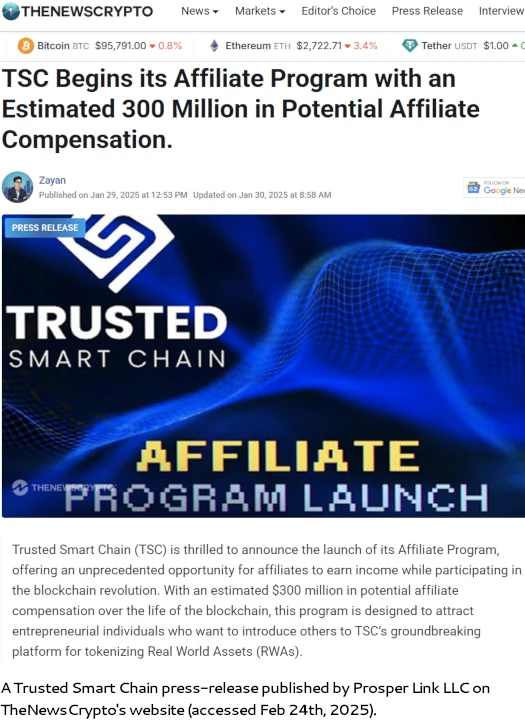

What’s eyebrow elevating although is Trusted Good Chain advertising and marketing its “Prosper Hyperlink” MLM alternative as providing “an estimated $300 million in potential affiliate compensation“.

Estimated by whom? And what on Earth is that $300 million determine based mostly on?

Actually not audited monetary studies filed with the SEC.

Whereas it’s uncommon, US politicians attaching themselves to fraudulent MLM crypto funding schemes isn’t remarkable.

USFIA was an MLM crypto funding scheme constructed round “gemcoin”.

In researching USFIA in 2015, BehindMLM unearthed the involvement of former mayor after which Arcadia Metropolis councilman, John Wuo.

The SEC filed costs in September 2015, alleging USFIA was a $32 million greenback Ponzi scheme.

A month later Wuo, who initially denied having something to do with USFIA, resigned in shame.

Because the SEC’s case progressed and information was analyzed, USFIA sufferer losses climbed to over $180 million.

It could later be revealed Wuo obtained $1.8 million in undisclosed compensation from USFIA. A separate investigation by California’s Truthful Political Practices Fee resulted in a $2000 high-quality.

Wuo by no means held public workplace once more.

USFIA founder Steve Chen pled responsible to USFIA associated prison costs in 2020.

Chen was sentenced to 10 years in jail in February 2022. Chen died in custody whereas serving his sentence in December 2022.

Along with its personal potential securities and commodities fraud costs, Trusted Good Chain and T7X function underneath risk of a second SEC iX World lawsuit.

The primary iX World lawsuit was filed in August 2023 and alleged $49 million in fraud. Investigations by a court-appointed Receiver would see that determine rise to $110 million.

iX World offered funding positions in Debt Field’s purported tokenization of real-world asset initiatives (sound acquainted?).

As iX World and Debt Field insiders, each Billy Seashore and Travis Flaherty had been named defendants within the SEC’s lawsuit.

Owing to SEC brokers prosecuting the unique case getting some dates unsuitable and never rectifying with the court docket as soon as realized, the case was voluntarily dismissed on the request of the SEC in Might 2024.

Whereas there’s no excuse of the SEC agent’s conduct (the brokers later resigned), secret is the case being dismissed on procedural grounds.

The court docket explicitly famous in its dismissal order that the deserves of the underlying fraud allegations remained unaddressed.

The SEC is known to be making ready a second iX World fraud case with totally different prosecuting attorneys. Initially defiant in regards to the first case dismissed, iX World founder Joe Martinez shut iX World down upon studying a second case was looming.

Up to now a second iX World fraud case hasn’t materialized. Over in India although, Joe Martinez stays a needed fugitive on iX World prison costs.

India’s prime iX World promoter, Viraj Patil, has been in custody pending the end result of his iX World prison case since December 2023.

Trusted Good Chain and T7X are clearly reboot spinoffs of iX World and Debt Field – and that is what Trent Staggs, in his capability as mayor of Riverton, has hooked up himself to via “a key place on the board of T7x”.

To cite Staggs yet one more time on Trusted Good Chain and T7X;

[18:20] Travis Flaherty: We all know that utility is essential in terms of a mission but additionally the individuals which can be behind the mission itself.

So I’d love so that you can, y’know, elaborate somewhat bit on the infrastructure, or the group, or the individuals which can be concerned. I do know that you just’ve had interactions with the real-world asset managers, the founding father of T7X you’ve identified for fairly a while.

Discuss to me somewhat in regards to the infrastructure. Do we have now, have they got the power to have the ability to actually pull off one thing like this?

Trent Staggs: Yeah no nice query, and that’s um, y’know individuals must conduct their very own due-diligence, proper?

Because it stands, that is what due-diligence into Trusted Good Chain and T7X seems like. Pending any additional updates, we’ll maintain you posted.

Replace twenty fifth February 2025 – Inside 24 hours of this text being printed Trusted Good Chain marked its Trent Staggs advertising and marketing video as personal.

The video had in any other case been publicly obtainable since publication on Trusted Good Chain’s official YouTube channel on January thirtieth.

This text initially contained a hyperlink to the video. As Trusted Good Chain has now disabled public entry to the video I’ve disabled the beforehand accessible video hyperlink.