Swiss Valorem Financial institution launched in mid Could. The corporate is a rebranding of GSPartners.

Swiss Valorem Financial institution launched in mid Could. The corporate is a rebranding of GSPartners.

GSPartners is owned and operated by Josip Heit.

Initially from Croatia, Heit is believed to carry a German passport.

GSPartners was launched again in 2021 following the collapse of Karatbars Worldwide’s KBC cryptocurrency Ponzi scheme.

Karatbars Worldwide was owned and operated by Harald Seiz. Seiz partnered with Heit and his Gold Commonplace Financial institution circa 2017-2018.

Heit’s partnership with Seiz finally led to Karatbars Worldwide lunching KaratGold Coin (KBC) in mid 2019.

The launch was a catastrophe, with KBC dumping 62% inside just a few days.

Sitting on funds they’d milked buyers out of, Seiz and Heit laid low for many of 2019 and 2020.

Someday in early 2020 “Gold Commonplace” was launched, and together with it one more token reboot. This time it was G999.

After Gold Commonplace’s launch, Harald Seiz and Josip Heit had a falling out. This led to Heit leaving Karatbars Worldwide and launching GSPartners in late 2020.

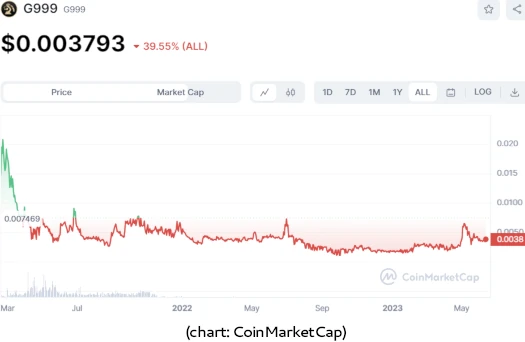

The unique iteration of GSPartners was a easy MLM crypto funding scheme constructed round G999 token (the identical token launched below Karatbars earlier in 2020).

G999 wasn’t price something inside GSPartners. The token was dumped on public exchanges in February 2021.

Early GSPartners buyers had been fast to money out, prompting the inevitable Ponzi coin dump. G999 by no means recovered.

Since GSPartners’ unique G999 funding scheme, Heit has launched quite a few failed iterations;

- J One – failed Dubai real-estate scheme constructed round short-lived JONE token (June 2021)

- XLT – JONE token substitute for real-estate and Lydian World metaverse grift (July 2021)

- Lydian Lions – NFT grift (January 2022)

- LYS token – created across the time the Lydian Lions NFT grift launched, was artificially pumped to $1800 in early 2022 – now $3.23

In Could 2022 GSPartners launched its present “metaverse certificates” funding scheme. This coincided with the launch of GEUR, one more token.

GEUR is cashed out 1:1 towards the euro, however isn’t publicly tradeable and doesn’t exist outdoors of GSPartners.

Over the subsequent 12 months GSPartners acquired regulatory fraud warnings from a number of jurisdictions:

Because the regulatory fraud warnings started to pile up, GSPartners rebranded itself as Swiss Valorem Financial institution in mid Could, 2023.

Put up rebranding, British Columbia and Saskatchewan have each issued GSPartners and Swiss Valorem Financial institution securities fraud warnings.

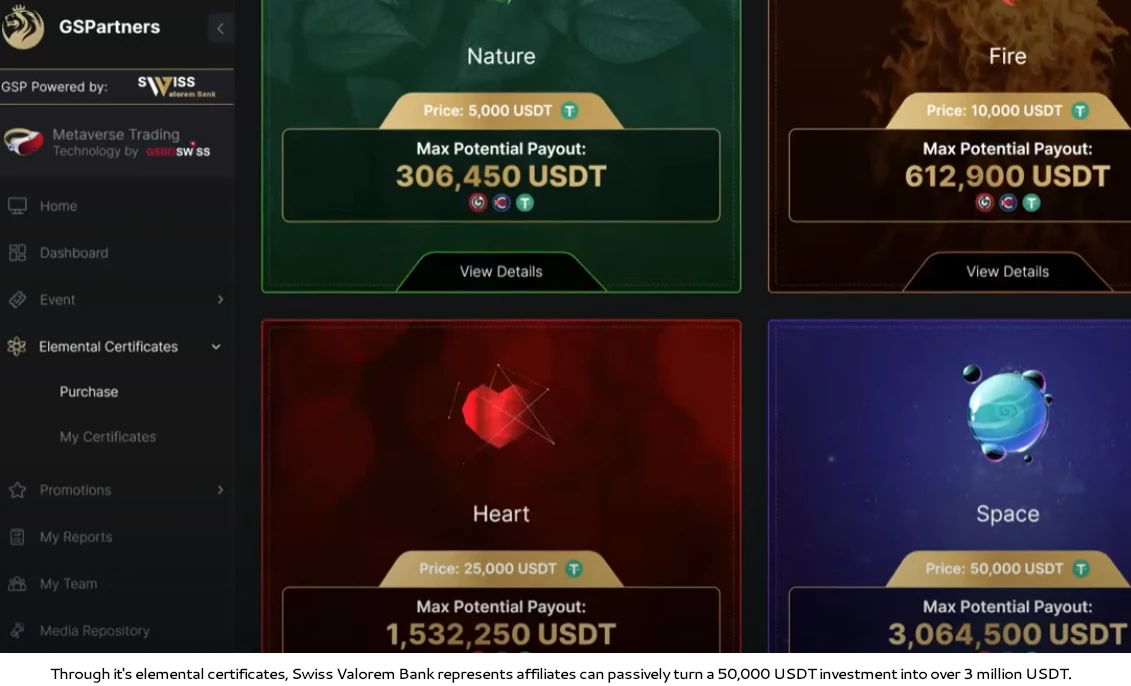

Because the metaverse certificates launch in mid 2022, GSPartners has launched two further iterations. The third, “elemental certificates”, coincided with the Swiss Valorem Financial institution rebranding.

It’s this third elemental certificates iteration that we’re reviewing as we speak.

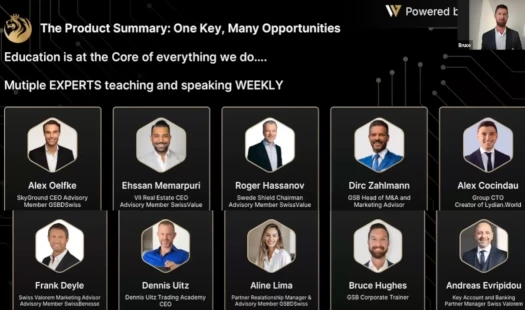

Along with Josip Heit, Swiss Valorem Financial institution lists the next people as insiders:

- Alex Oelfke – Skyground CEO advisory, member GSBDSwiss

- Ehssan Memarpuri – VII Actual Property CEO, advisory member SwissValue

- Roger Hassanov – Swede Defend Chairman, advisory member SwissValue

- Dirc Zahlmann – GSB Head of M&A and advertising advisor

- Alex Cocindau – Group CTO, creator of Lydian World

- Frank Deyle – Swiss Valorem Advertising and marketing Advisor, advisory member SwissBenesse

- Dennis Uitz – Dennis Uitz Buying and selling Academy CEO

- Aline Lima – Companion Relationship Supervisor, advisory member GSBDSwiss

- Bruce Hughes – GSB Company Coach

- Andreas Evripidou – Key Account and Banking Companion Supervisor Swiss Valorem

It must be famous that Josip Heit relocated from Germany to Dubai shortly after GSPartners’ launch.

Though it’s tied to the German shell firm GSB Gold Commonplace Company AG, GSPartners is run out of Dubai.

This isn’t a coincidence. Dubai is the MLM crime capital of the world.

Different shell corporations listed on Swiss Valorem Financial institution’s web site embrace:

- GSB Gold Commonplace Financial institution LTD (pretend Mwali shell firm)

- Swiss Valorem Financial institution LTD (Kazakhstan)

- IBBP Pay Providers LTD (Kazakhstan) and

- CoinX24 AG (Switzerland)

With respect to Swiss Valorem Financial institution being operated from Dubai, BehindMLM’s tips for Dubai are:

- If somebody lives in Dubai and approaches you about an MLM alternative, they’re attempting to rip-off you.

- If an MLM firm relies out of or represents it has ties to Dubai, it’s a rip-off.

If you wish to know particularly how this is applicable to Swiss Valorem Financial institution, learn on for a full evaluation.

Swiss Valorem Financial institution’s Merchandise

Swiss Valorem Financial institution has no retailable services or products.

Associates are solely capable of market Swiss Valorem Financial institution affiliate membership itself.

Swiss Valorem Financial institution’s Compensation Plan

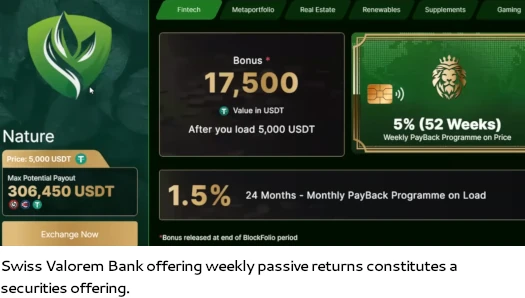

Swiss Valorem Financial institution associates make investments tether (USDT) in what the corporate refers to as “elemental certificates”.

- Terra 100 USDT

- Mild – 250 USDT

- Water – 1000 USDT

- Wind – 2500 USDT

- Nature – 5000 USDT

- Fireplace – 10,000 USDT

- Coronary heart – 25,000 USDT

- House – 50,000 USDT

- Prana – 100,000 USDT

That is finished on the promise of a passive return, with six out there themed tiers to select from:

- fintech – 5% every week for 52 weeks plus bonus 3500 USDT

- metaportfolio – 2.5% every week for 52 weeks plus bonus 2000 USDT

- actual property – 3.5% every week for 52 weeks plus bonus 3000 USDT at finish of 52 weeks

- renewables – 4% every week for 52 weeks plus bonus 4000 USDT at finish of 52 weeks

- dietary supplements – 5% every week for 52 weeks plus bonus 4000 USDT at finish of 52 weeks (notice reinvestment required each 3 months)

- gaming – 4% every week for 52 weeks plus bonus 4000 USDT at finish of 52 weeks (notice reinvestment required each 3 months)

Word that returns are paid out in GEUR, a token that’s nugatory outdoors of Swiss Valorem Financial institution.

Swiss Valorem Financial institution represents GEUR is pegged to the euro. It’s convertible for precise cryptocurrency inside the Swiss Valorem Financial institution backoffice.

Along with preliminary funding quantities, Swiss Valorem Financial institution associates can make investments further tether in every of the six funding tiers supplied:

- fintech – 1.5% a month paid on further funding for twenty-four months

- metaportfolio – variable return paid each quarter for 18 months

- actual property – 1.5% a month paid on further funding for 36 months

- renewables – 1.5% a month paid on further funding for 30 months

- dietary supplements – doesn’t look like any bonus ROI

- gaming – doesn’t look like any bonus ROI

Extra funding seems to be capped at the price of a certificates.

E.g. every tier of a Water certificates prices 1000 USDT (6000 USDT max throughout six tiers). Because of this 1000 USDT might be moreover invested at every tier.

The MLM facet of Swiss Valorem Financial institution pays on recruitment of affiliate buyers.

Swiss Valorem Financial institution Affiliate Ranks

There are ten affiliate ranks inside Swiss Valorem Financial institution’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- Affiliate – join as a Swiss Valorem Financial institution affiliate and make investments

- Director – recruit three associates and generate 9999 USDT in downline funding quantity (not more than 3999.6 USDT from anybody recruitment leg)

- Regional Director – keep three personally recruited associates and generate 29,999 USDT in downline funding (not more than 11,999.6 USDT from anybody recruitment leg)

- Nationwide Director – keep three personally recruited associates and generate 59,999 USDT In downline funding (not more than 23,999.6 USDT from anybody recruitment leg)

- Govt – recruit six associates and generate 99,999 USDT in downline funding (not more than 39,999.6 USDT from anybody recruitment leg)

- Continental Govt – keep six personally recruited associates and generate 299,999 USDT in downline funding (not more than 119,999.6 USDT from anybody recruitment leg)

- Worldwide Govt – keep six personally recruited associates and generate 599,999 USDT in downline funding (not more than 239,999.6 USDT from anybody recruitment leg)

- Ambassador – recruit 9 associates and generate 999,999 USDT in downline funding (not more than 399,999.6 USDT from anybody recruitment leg)

- World Ambassador – keep 9 personally recruited associates and generate 2,999,999 USDT in downline funding (not more than 1,199,999.6 USDT from anybody recruitment leg)

- Crown Ambassador – keep 9 personally recruited associates and generate 2,399,999.6 USDT in downline funding (not more than 2,399,999.6 USDT from anybody recruitment leg)

Word that to rely in direction of rank qualification, recruited associates will need to have an lively funding.

Referral Commissions

Swiss Valorem Financial institution associates earn a 15% fee on funding by personally recruited associates.

Residual Commissions

Swiss Valorem Financial institution pays residual commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel workforce, with each personally recruited affiliate positioned straight below them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel workforce.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

Swiss Valorem Financial institution caps payable unilevel workforce ranges at 9.

Residual commissions are paid as a share of tether invested throughout these 9 ranges as follows:

- Administrators earn 18% on stage 1 (personally recruited associates)

- Regional Administrators earn 18% on stage 1 and 4% on stage 2

- Nationwide Administrators earn 18% on stage 1, 4% on stage 2 and three% on stage 3

- Executives earn 18% on stage 1, 4% on stage 2, 3% on stage 3 and a pair of% on stage 4

- Continental Executives earn 18% on stage 1, 4% on stage 2, 3% on stage 3 and a pair of% on ranges 4 and 5

- Worldwide Executives earn 18% on stage 1, 4% on stage 2, 3% on stage 3, 2% on ranges 4 and 5 and three% on stage 6

- Ambassadors earn 18% on stage 1, 4% on stage 2, 3% on stage 3, 2% on ranges 4 and 5, 3% on stage 6 and 4% on stage 7

- World Ambassadors earn 18% on stage 1, 4% on stage 2, 3% on stage 3, 2% on ranges 4 and 5, 3% on stage 6 and 4% on ranges 7 and eight

- Crown Ambassadors earn 18% on stage 1, 4% on stage 2, 3% on stage 3, 2% on ranges 4 and 5, 3% on stage 6, 4% on ranges 7 and eight and 6% on stage 9

Accelerator Pool

Swiss Valorem Financial institution takes an unspecified share of company-wide funding and makes use of it to fund the Accelerator Pool.

The Accelerator Pool is damaged down into smaller rank-specific swimming pools, that are paid out month-to-month to rank-qualified associates:

- Administrators obtain a share in 20% of the Accelerator Pool

- Regional Administrators obtain a share in 16% of the Accelerator Pool

- Nationwide Administrators obtain a share in 16% of the Accelerator Pool

- Executives obtain a share in 9% of the Accelerator Pool

- Continental Executives obtain a share in 9% of the Accelerator Pool

- Worldwide Executives obtain a share in 9% of the Accelerator Pool

- Ambassadors obtain a share in 7% of the Accelerator Pool

- World Ambassadors obtain a share in 7% of the Accelerator Pool

- Crown Ambassadors obtain a share in 7% of the Accelerator Pool

BlockStar Pool

Swiss Valorem Financial institution takes 4% of company-wide funding and locations it into the BlockStar Pool.

There are three ranks inside the BlockStar Pool:

- Rising Blockstar – generate 3000 USDT of downline funding inside 30 days of signing up as an affiliate

- Blockstar – generate 9999 USDT in month-to-month downline funding quantity

- Blockstar Supreme – generate 29,999 USDT in month-to-month downline funding quantity

Word that Rising Blockstar has a restricted qualification interval. Blockstar and Blockstar Supreme have month-to-month recurring qualification standards.

The Blockstar Pool is paid out primarily based on shares, which correspond to the three out there ranks:

- Rising Blockstar – one share within the BlockStar Pool for a month and one everlasting Blockstar Pool share

- Blockstar – two shares within the Blockstar Pool for a month (elevated to a few shares if affiliate certified as a Rising Blockstar)

- Blockstar Supreme – 4 shares within the Blockstar Pool for a month (elevated to 5 shares if affiliate certified as a Rising Blockstar)

If a Swiss Valorem Financial institution affiliate qualifies for the Blockstar Pool (any rank), additionally they obtain a 25% match on BlockStar Pool earnings by personally recruited associates.

Infinity Pool Bonus

Swiss Valorem Financial institution pays a month-to-month Infinity Pool Bonus to Administrators and better:

- Administrators obtain a 1000 USDT a month Infinity Pool Bonus

- Regional Administrators obtain a 1500 USDT a month Infinity Pool Bonus

- Nationwide Administrators obtain a 2300 USDT a month Infinity Pool Bonus

- Executives obtain a 6000 USDT a month Infinity Pool Bonus

- Continental Executives obtain a 9000 USDT a month Infinity Pool Bonus

- Worldwide Executives obtain a 15,000 USDT a month Infinity Pool Bonus

- Ambassadors obtain a 20,000 USDT a month Infinity Pool Bonus

- World Ambassadors obtain a 40,000 USDT a month Infinity Pool Bonus

- qualify at Crown Ambassador and obtain 90,000 USDT

Becoming a member of Swiss Valorem Financial institution

Swiss Valorem Financial institution affiliate membership is 33 USDT a month.

Full participation within the connected earnings alternative requires a minimal 100 USDT funding.

Swiss Valorem Financial institution solicits funding in tether and USDT equivalents of bitcoin, ethereum,

Swiss Valorem Financial institution Conclusion

There isn’t a lot to Swiss Valorem Financial institution as an MLM alternative. Associates put money into certificates on the promise of a passive return.

With nothing marketed or offered to retail clients the MLM facet of Swiss Valorem Financial institution operates as a pyramid scheme.

What’s price noting is Swiss Valorem Financial institution’s “elemental certificates” are the third (fourth?) iteration of the identical funding scheme.

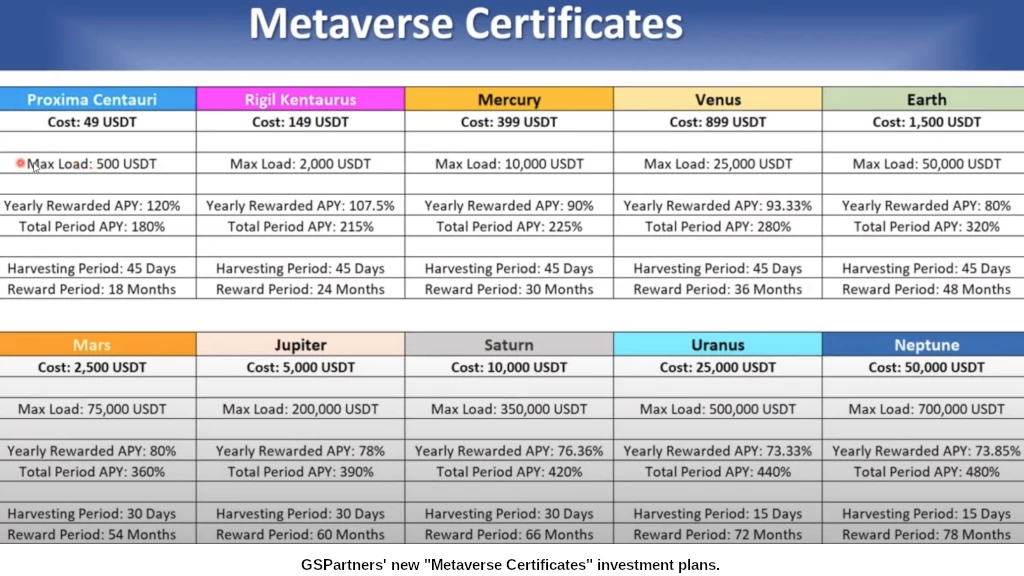

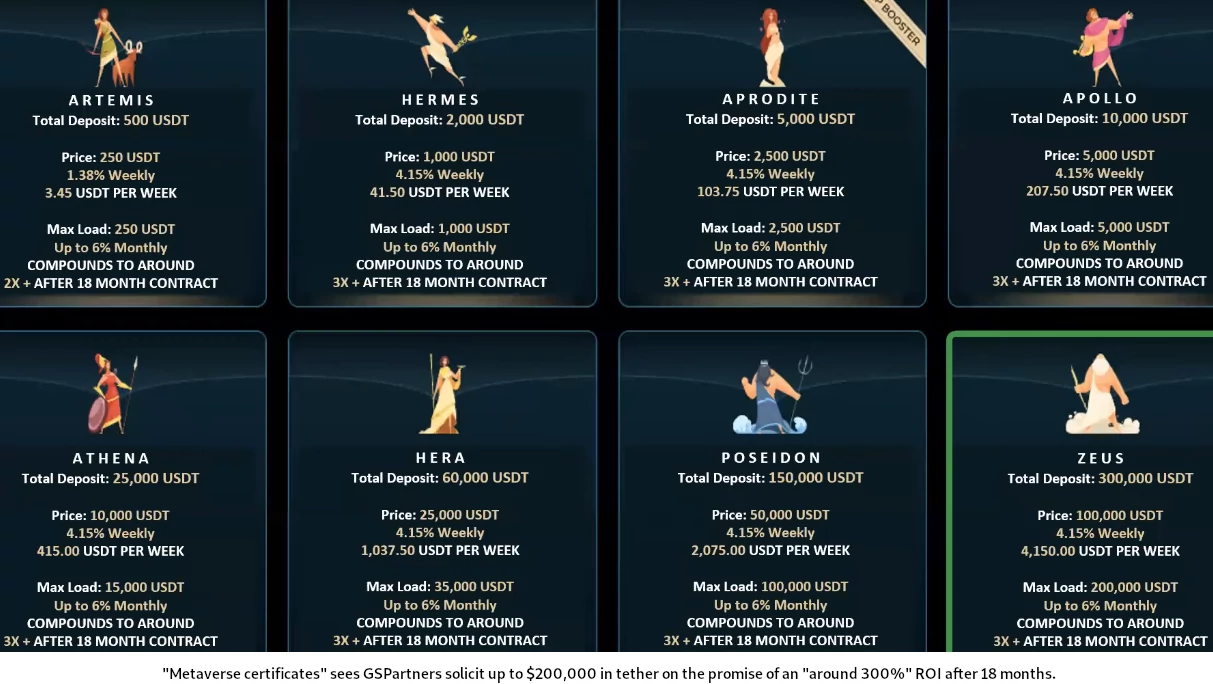

First we had “planet certificates” (additionally launched as metaverse certificates, click on to enlarge beneath):

Then “olympus certificates” (click on to enlarge once more):

And now we have now “elemental certificates” (click on to enlarge once more):

“Planet certificates” had been additionally apparently launched however appear to have been largely ignored. Nonetheless, I suppose technically that makes “elemental certificates” the fourth certificates launch.

In any occasion, what you’ll discover between the certificates launches is the ROI and the way a lot might be trapped within the certificates will increase.

The highest “prana” tier of “elemental certificates” tops out at 1.3 million USDT (100,000 USDT preliminary funding, 100,000 USDT *6 for the person funding tiers after which 100,000 USDT *6 once more for extra funding on every tier).

I’m stating the apparent right here however the recreation plan is clearly to maintain associates rolling over paid returns on the promise of ever-higher ROI charges.

Over time relaunching new certificates to lure cash will hit a diminishing returns roadblock (gathered GEUR being withdrawn will develop exponentially, inevitably outstripping new funding).

Swiss Valorem Financial institution and GSPartners earlier than it do symbolize exterior income is generated by way of exterior sources (fintech, metaportfolio, actual property, renewables, dietary supplements and gaming).

What’s lacking are audited monetary studies proving these claims. This can be a authorized requirement that Swiss Valorem Financial institution fails to fulfill with respect to shoppers and monetary regulators.

And that brings us to Swiss Valorem Financial institution committing securities fraud.

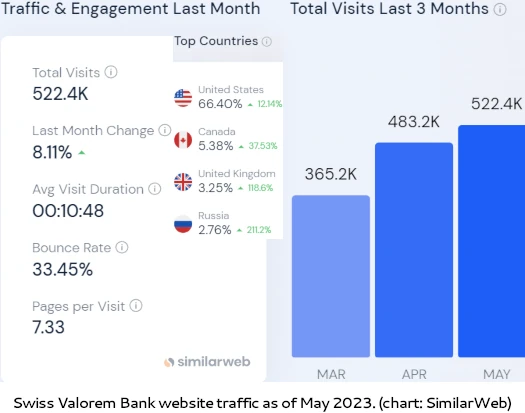

As tracked by SimilarWeb for Could 2023, prime sources of visitors to Swiss Valorem Financial institution’s web site area are the US (66%), Canada (5%), the UK (3%), Russia (3%) and Greece (3%).

We’ve already seen Canadian authorities make strikes towards Swiss Valorem Financial institution by issued securities fraud warnings.

Within the US securities are regulated by the SEC. To date US authorities haven’t taken motion towards Swiss Valorem Financial institution or Josip Heit.

With simply over half one million Swiss Valorem Financial institution web site visits final month and the vast majority of that being US visitors, how lengthy earlier than we see motion from the SEC, CFTC and/or DOJ stays to be seen.

Securities fraud and MLM corporations working Ponzi schemes go hand in hand.

With respect to the US, the SEC states

any funding in securities within the America stays topic to the jurisdiction of the SEC.

We’re involved that the rising use of digital currencies within the international market might entice fraudsters to lure

buyers into Ponzi and different schemes.Ponzi schemes sometimes contain investments that haven’t been registered with the SEC or with state securities regulators.

As with all MLM Ponzi schemes, as soon as Swiss Valorem Financial institution affiliate recruitment dries up so too will new funding.

It will starve Swiss Valorem Financial institution of ROI income, finally prompting a collapse.

The mathematics behind MLM Ponzi schemes ensures that after they collapse, the vast majority of individuals lose cash.