Capital One USD fails to supply possession or government info on its web site.

Capital One USD’s web site area (“capitaloneusd.vip”), was registered with bogus particulars on November seventh, 2024.

Of be aware is Capital One USD’s web site area being registered by the Chinese language registrar Alibaba (Singapore).

As all the time, if an MLM firm will not be overtly upfront about who’s operating or owns it, assume lengthy and exhausting about becoming a member of and/or handing over any cash.

Capital One USD’s Merchandise

Capital One USD has no retailable services or products.

Associates are solely in a position to market Capital One USD affiliate membership itself.

Capital One USD’s Compensation Plan

Capital One USD associates make investments tether (USD). That is accomplished on the promise of marketed returns:

- VIP 1 – make investments 18 to 77 USDT and obtain 20% a day

- VIP2 – make investments 78 to 267 USDT and obtain 21% a day

- VIP3 – make investments 268 to 657 USDT and obtain 22% a day

- VIP4 – make investments 658 to 1587 USDT and obtain 24% a day

- VIP5 – make investments 1588 to 3587 USDT and obtain 26% a day

- VIP6 – make investments 3588 to 8887 USDT and obtain 28% a day

- VIP7 – make investments 8888 to 22,887 USDT and obtain 31% a day

- VIP8 – make investments 22,888 to 55,887 USDT and obtain 35% a day

- VIP9 – make investments 55,888 to 128,887 USDT and obtain 40% a day

- VIP10 – make investments 128,888 or extra USDT and obtain 48% a day

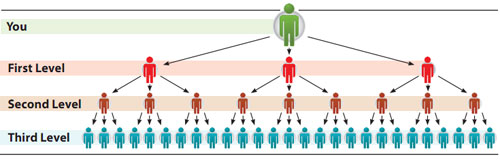

Capital One USD pays referral commissions on invested USDT down three ranges of recruitment (unilevel):

- stage 1 (personally recruited associates) – 10%

- stage 2 – 2%

- stage 3 – 1%

Becoming a member of Capital One USD

Capital One USD affiliate membership is free.

Full participation within the hooked up earnings alternative requires a minimal 18 USDT funding.

Capital One USD Conclusion

Capital One USD is one more “click on a button” app Ponzi scheme.

Capital One USD misappropriates the title and branding of Capital One, an American financial institution holding firm.

Evidently Capital One USD has nothing to do with Capital One the American firm.

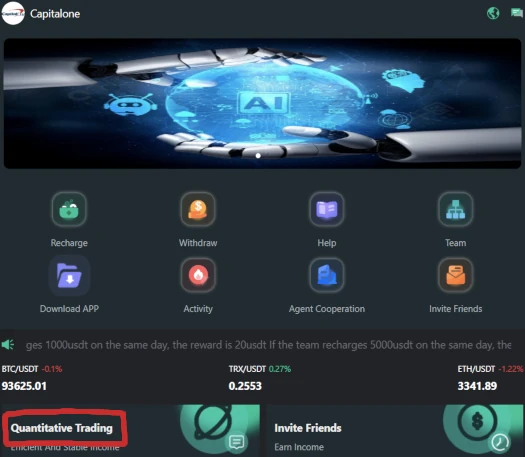

Capital One USD’s Ponzi ruse is “quantitative buying and selling”:

The offered ruse is Capital One USD associates log in and click on a button (the extra invested the extra the button must be clicked).

Clicking the button purportedly generates income by way of quantitative buying and selling, which for some motive Capital One USD shares a share of with affiliate buyers.

If that is senseless it’s as a result of it doesn’t. Randoms clicking a button in an app doesn’t set off quantitative buying and selling.

In actuality clicking a button inside Capital One USD’s app does nothing. All Capital One USD does is recycle newly invested funds to pay earlier buyers.

Examples of already collapsed “click on a button” app Ponzis utilizing the stolen id ruse are Puma Make investments, TCDD USD and Lactalis USD. Latest quantitative buying and selling ruse examples are QUA AI Bot, Bytesi and AQR Quantify.

Since 2021 BehindMLM has documented a whole lot of “click on a button” app Ponzis. Most of them final just a few weeks to some months earlier than collapsing.

“Click on a button” app Ponzis disappear by disabling each their web sites and app. This tends to occur with out discover, leaving the vast majority of buyers with a loss (inevitable Ponzi math).

As a part of a collapse, “click on a button” Ponzi scammers typically provoke restoration scams. This sees the scammers demand buyers pay a price to entry funds and/or re allow withdrawals.

If any funds are made withdrawals stay disabled or the scammers stop communication.

Organized crime pursuits from China function rip-off factories behind “click on a button” Ponzis from south-east Asian international locations.

In September 2024, the US Division of Treasury sanctioned Cambodian politician Ly Yong Phat over ties to Chinese language human trafficking rip-off factories.

By means of varied firms he owns, Phat is alleged to shelter Chinese language scammers working out of Cambodia.

No matter which nation they function from, the identical group of Chinese language scammers are believed to be behind the “click on a button” app Ponzi plague.