![]() Fundwise fails to offer possession or government data on its web site.

Fundwise fails to offer possession or government data on its web site.

Fundwise’s web site area (“fundwise.com”), was first registered in 2004. The non-public registration was final up to date on January tenth, 2024.

From BehindMLM’s latest Sensible Desktop AI assessment nevertheless, we all know Fundwise is run by Corey Value.

In response to his LinkedIn profile, Value relies out of Utah within the US.

Previous to launching Sensible Desktop AI Value was selling Native Metropolis Locations and TranzactCard.

As at all times, if an MLM firm just isn’t brazenly upfront about who’s working or owns it, suppose lengthy and exhausting about becoming a member of and/or handing over any cash.

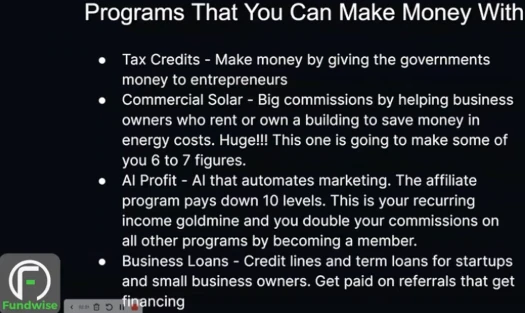

FundWise’s Merchandise

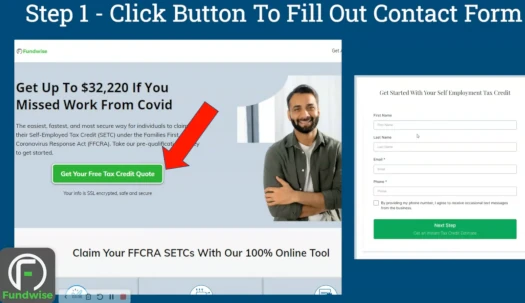

Fundwise markets loans, photo voltaic companies and and commissions on getting self-employed taxpayers to use for the Self-Employed Tax Credit score (SETC).

No pricing or disclosures about which third-parties are used are supplied on FundWise’s web site.

Corey Value’s different MLM enterprise, Sensible Desktop AI, can be marketed by way of Fundwise. Observe there isn’t a retail providing by way of Sensible Desktop AI.

Fundwise’s Compensation Plan

Fundwise pays commissions when associates join prospects to any of their supplied third-party companies.

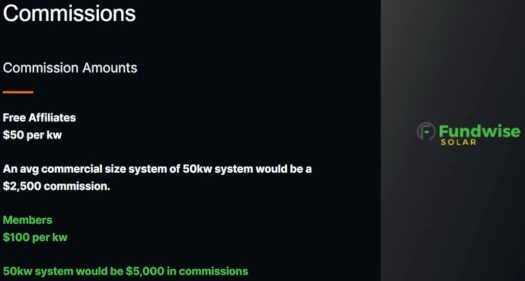

No specifics are supplied on Fundwise’s web site. Advertising supplies estimates for Fundwise’s photo voltaic vitality scheme:

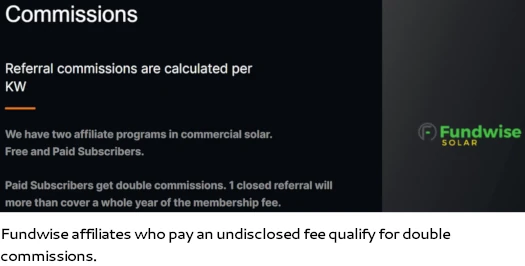

What we do know particularly is that if Fundwise associates pay a charge, they qualify for double commissions on signed up photo voltaic vitality prospects.

Sensible Desktop AI is obtainable by way of Fundwise. As per BehindMLM’s revealed Sensible Desktop AI assessment, the corporate operates as an MLM pyramid scheme.

Becoming a member of Fundwise

Fundwise is free to enroll. Charge pricing for double commissions on photo voltaic vitality buyer signups just isn’t disclosed.

Entry to Sensible Desktop AI is at the moment $27 a month.

Fundwise Conclusion

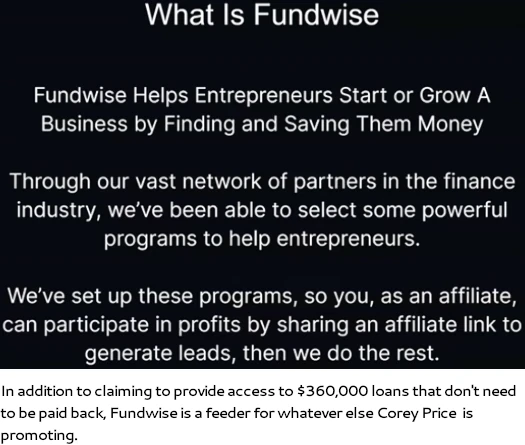

Though it began off pushing enterprise loans, right this moment Fundwise as an MLM firm is principally a feeder into Sensible Desktop AI.

That is problematic as Sensible Desktop AI operates as an MLM pyramid scheme.

Though it’s not MLM, from a regulatory perspective the remainder of Fundwise can be problematic.

- Fundwise doesn’t disclose firm possession and/or government data

- Fundwise doesn’t present shoppers with a transparent breakdown of its supplied third-party retail services and products (together with pricing)

- Fundwise doesn’t present shoppers with clear compensation particulars on any of its supplied third-party companies (together with Sensible Desktop AI)

These are all potential violations of the FTC Act with respect to disclosures.

Fundwise’s advertising and marketing can be seemingly a violation of the FTC Act with respect to false, deceptive, or misleading representations.

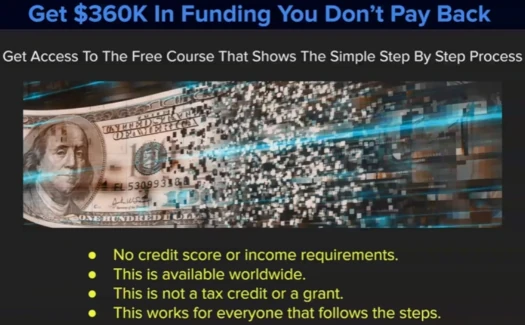

Fundwise markets its loans companies as getting “360K in funding you don’t pay again”.

Fundwise pitching this to most of the people as achievable is clearly nonsense. But the corporate claims “this works for everybody”.

An FTC investigation into this advertising and marketing illustration would see the regulator request data on the variety of $360,000 loans Fundwise was capable of acquire for shoppers that didn’t need to be paid again.

Until the share was 100% of enquiries or near (“everybody” and “worldwide”), Fundwise could be in violation of the FTC Act.

Fundwise initially began off with its mortgage scheme some years in the past. This implies there’d be loads of knowledge for the FTC to find out whether or not Fundwise’s advertising and marketing claims are misleading or not with.

That Fundwise doesn’t present this knowledge themselves on their web site is telling.

4 years on from the beginning of the COVID-19 pandemic, signing folks up for tax credit is a bit lengthy within the tooth. It’s not unattainable however you’re unlikely to seek out anybody who qualifies who hasn’t already utilized (Fundwise is much from the one enterprise hoping to signal folks up for COVID-19 tax credit for a fee).

Photo voltaic vitality is one other aggressive business. Its inclusion in Fundwise’s providing is more likely to be complimentary versus one thing you may construct regular earnings round.

Providing double commissions to paid associates can be one other potential violation of the FTC Act (“pay to play”). How a lot you pay for entry to any earnings alternative ought to by no means dictate fee charges.

That leaves us with Corey Value hoping to leap on the AI grift bandwagon, and subsequent launch of Sensible Desktop AI earlier this 12 months.

As said 3 times now, Sensible Desktop AI operates as a pyramid scheme and is most positively a violation of the FTC Act.

Exterior of paying a charge for double photo voltaic service commissions and entry to Sensible Desktop AI, Fundwise isn’t more likely to price you anymore than time.

When you think about becoming a member of Sensible Desktop AI nevertheless, the truth that the vast majority of contributors in pyramid schemes lose cash comes into play.

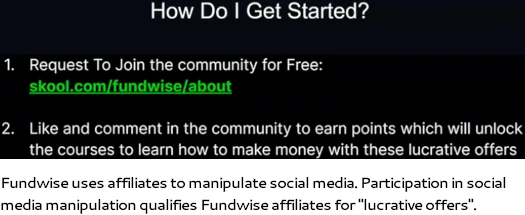

As per Fundwise’s advertising and marketing above, I’ll briefly contact on Skool. Skool is a third-party platform on which customers can create public/non-public and free/paid teams to speak by way of. Consider it because the “teams” part of FaceBook by itself platform.

We don’t usually deliver up social media platforms that enable scammers to speak however Skool is a little bit completely different.

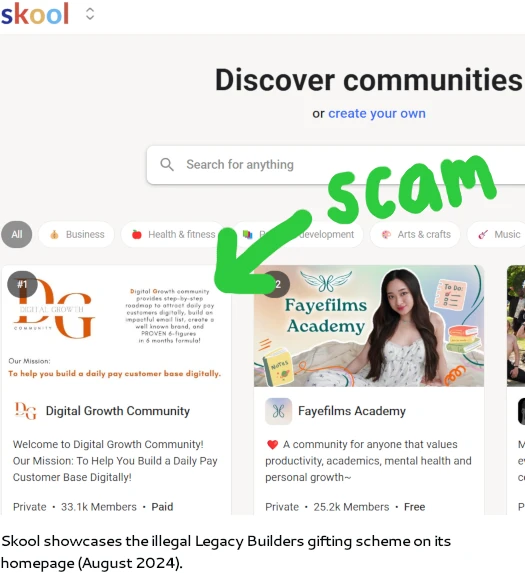

As of August 2024, that is Skool’s homepage:

It’s not the most important group on Skool however for some cause Skool’s “primary” group is Digital Progress Group.

Digital Progress Group is hooked up to the Legacy Builders gifting scheme.

Two latest dodgy MLM corporations utilizing Skool as a communication platform isn’t a pattern. If I hold seeing it pop up although I would begin flagging Skool as an incubator for unlawful MLM corporations defrauding shoppers.

If Skool is prepared to showcase an unlawful gifting scheme on its homepage, they’re clearly not doing any due-diligence into who’s utilizing their platform.

Getting again to Fundwise; I assume the apparent consumer-side litmus check is taking Fundwise’s $360,000 mortgage advertising and marketing at face worth.

Irrespective of who you’re (“everybody”) and the place you’re on the earth (“obtainable worldwide”), if Fundwise can’t offer you $360,000 in funding “you don’t pack again” (“works for everybody”), stop communication and report back to the FTC for false promoting.