![]() Secure Swap fails to offer possession or govt particulars on its web site.

Secure Swap fails to offer possession or govt particulars on its web site.

Secure Swap’s web site area (“stableswap.dwell”), was privately registered on October twenty sixth, 2023.

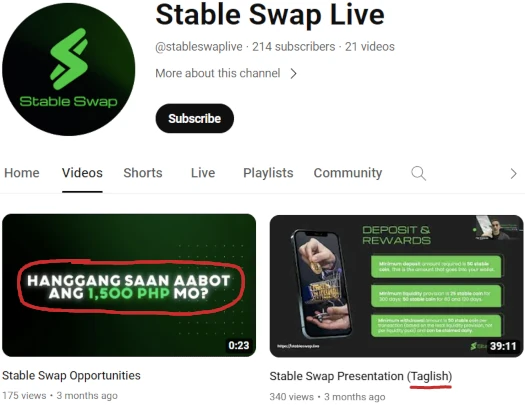

A hyperlink on Secure Swap’s web site takes us to its official YouTube channel.

There we discover movies in Taglish, a mixture of Tagalog and English. Taglish is primarily used within the Philippines.

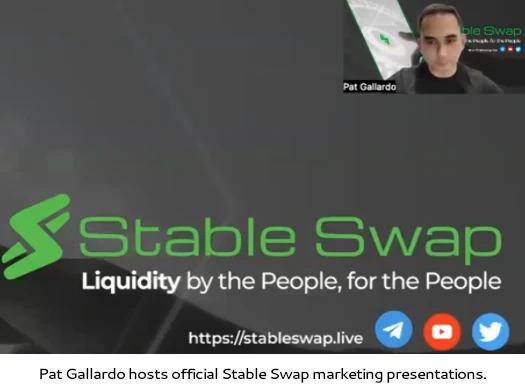

Secure Swap advertising movies are hosted by Pat Gallardo:

Gallardo has his personal YouTube channel, on which Secure Swap advertising movies have additionally been uploaded.

Earlier than Secure Swap, circa September 2023, Gallardo was selling Swych.

That appears to have lasted about 5 months. The primary Secure Swap advertising went up on January ninth, 2024.

As of March 2024, SimilarWeb tracked high sources of site visitors to Secure Swap’s web site because the Philippines (71%) and Australia (23%).

As at all times, if an MLM firm isn’t overtly upfront about who’s working or owns it, suppose lengthy and arduous about becoming a member of and/or handing over any cash.

Secure Swap’s Merchandise

Secure Swap has no retailable services or products.

Associates are solely in a position to market Secure Swap affiliate membership itself.

Secure Swap’s Compensation Plan

Secure Swap associates make investments USD equivalents in cryptocurrency.

That is achieved on the promise of marketed returns:

- Quick Time period – as much as 0.1% a day for 60 days

- Medium Time period – as much as 0.2% a day for 120 days

- Lengthy Time period – as much as 0.35% a day for 300 days

Word that Secure Swap don’t specify a minimal funding quantity.

The MLM facet of Secure Swap pays on recruitment of affiliate traders.

Referral Commissions

Secure Swap pays referral commissions on invested cryptocurrency down three ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 5%

- degree 2 – 2%

- degree 3 – 1%

ROI Match

Secure Swap pays a ten% match on dails returns paid to personally recruited associates.

Becoming a member of Secure Swap

Secure Swap affiliate membership is free.

Full participation within the connected revenue alternative requires an funding in cryptocurrency.

Secure Swap solicits funding in tether (USDT) and USD Coin (USDC).

Secure Swap Conclusion

Secure Swap represents it generates exterior income through “charge sharing”.

We provide enticing APRs (Annual Share Charges) and Referral Rewards by our enterprise mannequin, which is predicated on charge sharing.

No verifiable proof of Secure Swap utilizing charges of any form of any variety to pay ROI withdrawals is offered.

An instance of a verifiable proof could be audited monetary stories filed with monetary regulators in international locations Secure Swap solicits funding in.

Primarily based on its web site site visitors, this could be the Philippines SEC and Australian Securities and Investments Fee (ASIC).

Secure Swap fails to offer proof it has registered with both, which means the corporate is committing securities fraud.

That is primarily based on Secure Swap’s passive returns funding alternative, which in any nation with a regulated monetary market constitutes a securities providing.

As a substitute of registering with monetary regulators and offering audited monetary stories, Secure Swap presents up baloney about “Topjuan Tech”.

First off legitimacy through affiliation isn’t a factor. Topjuan Tech doesn’t absolve Secure Swap from its authorized necessities with respect to securities legislation.

Secondly, Topjuan Tech isn’t registered with the Philippine SEC.

Topjuan Tech operates from the area “topwallet.ph”. I can’t inform you when the area was registered as a result of the registrar’s web site is down at time of publication (“dot.ph”).

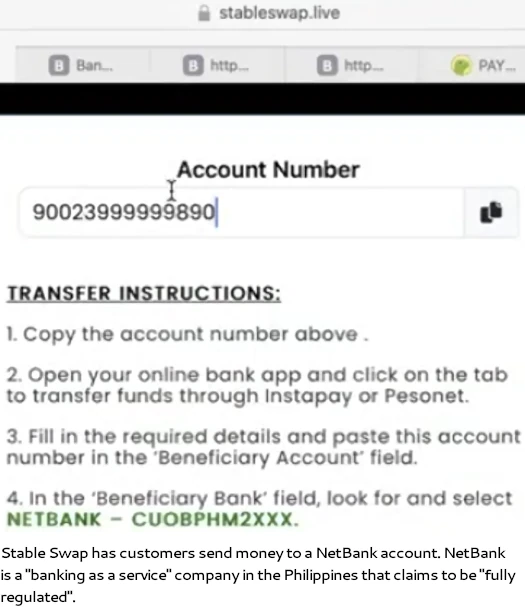

However by High Pockets, Topjuan Tech offers service provider fee processor providers.

Because it stands, the one verifiable income coming into Secure Swap is new funding.

Utilizing new funding to pay ROI withdrawals would make Secure Swap a Ponzi scheme. With nothing marketed or bought to retail clients, the MLM facet of Secure Swap moreover operates as a pyramid scheme.

Such to the extent any relationship between TopJuan Tech and Secure Swap exists, it seems to solely be for cash laundering functions.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This may starve Secure Swap of ROI income, ultimately prompting a collapse.

The maths behind Ponzi schemes ensures that after they collapse the vast majority of contributors lose cash.