Satoshi Sq. Desk operates within the MLM cryptocurrency area of interest.

Satoshi Sq. Desk operates within the MLM cryptocurrency area of interest.

Satoshi Steady’s web site area (“satoshistable.com”), was privately registered on December sixth, 2024.

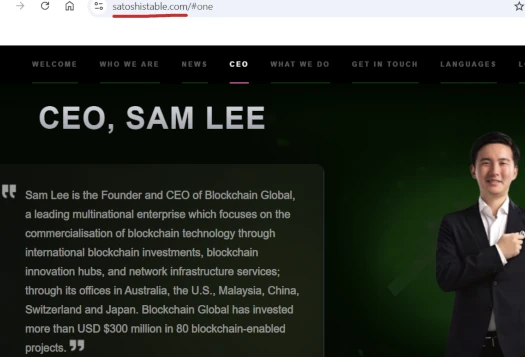

Serial fraudster Sam Lee is cited as Satoshi Sq. Desk’s CEO.

Xue Samuel Lee is a wished fugitive hiding in Dubai.

With partner-in-crime Ryan Xu, Lee launched HyperCash, HyperCapital, HyperFund and Hyperverse – all Ponzi schemes by which nearly all of traders misplaced cash.

After these Hyper* Ponzi schemes got here HyperNation and HyperOne, though Lee’s direct involvement in these follow-ups is much less clear.

Lee spent most of 2022 hiding in his Dubai house. Initially from Australia, Lee fled to the MLM crime capital of the world in 2021 as HyperFund took off.

In late 2022 Lee reemerged with StableDAO. Geared toward victims of Lee’s earlier scams, StableDAO pitched an 11% a month return.

StableDAO additionally served as a rip-off incubator platform, by way of which Lee has launched StableOpinion and VidiLook.

StableOpinion failed to achieve any important traction. VidiLook did however collapsed on April twenty first.

Recent off VidiLook’s collapse We Are All Satoshi launched, marking Lee’s third StableDAO spinoff. We Are All Satoshi collapsed in September 2023.

In January 2024 Lee and two conspirators had been indicted on HyperFund associated fraud fees. The SEC filed parallel civil fraud fees towards Lee that very same month.

In October 2024 Lee was detained in Dubai on an Interpol arrest warrant. Lee was launched in December 2024 and, as at time of publication, stays a fugitive wished by US authorities.

Learn on for a full overview of Satoshi Sq. Desk’s MLM alternative.

Satoshi Sq. Desk’s Merchandise

Satoshi Sq. Desk has no retailable services or products.

Associates are solely in a position to market Satoshi Sq. Desk affiliate membership itself.

Satoshi Sq. Desk’s Compensation Plan

Satoshi Sq. associates make investments molecular future (MOF) or tether (USDT) into “Hyper Wealth Packages”.

The price of a Hyper Wealth Package deal isn’t disclosed however one package deal corresponds with 1000 Hyper Items (HU).

That is achieved on the promise of a 15% to 30% per 30 days passive returns, paid out in HU.

Word that returns are capped at 3000 HU (3000%), after which new funding is required to proceed incomes.

20% of Satoshi Sq. Desk earned MLM commissions should be reinvested. Satoshi Sq. Desk additionally fees a ten% price on all withdrawals.

The MLM aspect of Satoshi Sq. Desk contributes to the 300% ROI cap and pays out as follows:

Satoshi Sq. Desk Affiliate Ranks

There are 4 ranks inside Satoshi Sq. Desk’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- 1 Star – generate 1,000,000 HU in downline funding quantity

- 2 Star – generate 3,000,000 HU in downline funding quantity

- 3 Star – generate 5,000,000 HU in downline funding quantity

- 4 Star – generate 10,000,000 HU in downline funding quantity

Word that HU generated from the strongest recruitment leg is excluded for the aim of rank qualification.

ROI Match

Satoshi Sq. Desk pays out a ROI Match by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel staff, with each personally recruited affiliate positioned straight beneath them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel staff.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Satoshi Sq. Desk caps the ROI Match at twenty unilevel staff ranges.

The ROI Match is paid as a proportion of the every day HU return paid throughout these twenty ranges as follows:

- degree 1 (personally recruited associates) – 20% match

- degree 2 – 15% match

- degree 3 – 10% match

- ranges 4 to six – 5% match

- ranges 7 to fifteen – 2% match

- ranges 16 to twenty – 1% match

Word that unlocking unilevel staff ranges is tied to recruitment. Satoshi Sq. Desk associates should recruit one affiliate investor to unlock degree 1. Recruit two affiliate traders to unlock degree 2 and so forth and so forth.

VIP Reward

The VIP Reward is a proportion enhance on the ROI Match:

- 1 Star ranked associates obtain a bonus 5%

- 2 Star ranked associates obtain a bonus 6%

- 3 Star ranked associates obtain a bonus 7%

- 4 Star ranked associates obtain a bonus 8%

International Rewards

Satoshi Sq. Desk takes 4% of company-wide funding and splits it into 4 smaller International Rewards swimming pools.

The International Rewards pool are shared with ranked Satoshi Sq. Desk every month:

- 1 Star ranked associates obtain a share in a 1% International Rewards pool

- 2 Star ranked associates obtain a share in a 1% International Rewards pool

- 3 Star ranked associates obtain a share in a 1% International Rewards pool

- 4 Star ranked associates obtain a share in a 1% International Rewards pool

Becoming a member of Satoshi Sq. Desk

Satoshi Sq. Desk affiliate membership is free.

Full participation within the hooked up earnings alternative requires a minimal undisclosed funding right into a Hyper Wealth Package deal.

Satoshi Sq. Desk solicits funding in MOF tokens and USDT.

Satoshi Sq. Desk Conclusion

There’s not a lot too Satoshi Sq. Desk.

- hyper unit (HU) was the unique shit token Lee’s HyperFund Ponzi scheme ran on

- molecular future (MOF) was one of many many shit tokens launched after HU collapsed in a bid to maintain HyperFund going

Seeing as Lee’s firm HyperTech Group owned HyperFund and HU, what we have now right here is recycling of a useless Ponzi token to launch one more Ponzi.

Acceptance of MOF to take a position demonstrates concentrating on of Lee’s HyperFund victims. All that’ll occur there’s MOF bagholders will grow to be HU bagholders.

Tether is offered in a determined try to solicit new funding, with out which no person in Satoshi Sq. Desk can money out.

And simply in case there was any doubt Satoshi Sq. Desk is one more Sam Lee Ponzi scheme, that is from Satoshi Sq. Desk’s personal web site;

Satoshi Group takes a considerate method to innovation, learning the journeys of Hyper Capital, Trage, Novatech, WAAS, and Empirex—their successes and challenges alike.

- HyperCapital was the unique HyperTech Group Ponzi scheme, its collapse prompted the launch of HyperFund

- TrageTech was an MLM crypto Ponzi that collapsed in December 2024

- NovaTech FX was an MLM crypto Ponzi that collapsed in February 2023 (SEC fraud lawsuit filed in February 2024)

- WAAS = We Are All Satoshi, an already collapsed Sam Lee MLM crypto Ponzi

- EmpiresX was an MLM crypto Ponzi that collapsed in October 2021 (homeowners indicted, SEC and CFTC fraud lawsuits filed in July 2022)

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This may starve Satoshi Sq. Desk of ROI income, finally prompting a collapse.

The maths behind Ponzi schemes ensures that after they collapse, nearly all of contributors lose cash.