Remitano fails to offer possession or govt info on its web site.

Remitano fails to offer possession or govt info on its web site.

“Babylon Options Restricted” is introduced as Remitano’s mother or father firm, however no info aside from the corporate identify is supplied.

Remitano’s web site area (“remitano.com”), was first registered in 2014. The non-public registration was final up to date in January 2018.

As of April 2023, SimilarWeb tracks prime sources of site visitors to Remitano’s web site as Vietnam (71%), Nigeria (8%) and the US (5%).

Remitano being primarily energetic in Vietnam will be attributed to its founders, Phuong Nguyen, Dung Huynh, Phuoc Nguyen and Tam Vo being Vietnamese nationals.

Nguyen’s and Huynh’s respective LinkedIn profiles make no point out of Remitano, which is odd.

They do point out Quoine although, which seems to be the place Nguyen and Huynh met.

Quoine was a Japanese cryptocurrency buying and selling platform with an workplace in Vietnam.

Remitano can also be a cryptocurrency buying and selling platform, with Quoine the apparent inspiration behind it.

Past having the ability to determine Remitano’s co-founders, there’s scarce little details about them out there.

That is doubtless because of Remitano working illegally, which we’ll cowl within the conclusion of the evaluate.

As all the time, if an MLM firm shouldn’t be brazenly upfront about who’s working or owns it, assume lengthy and laborious about becoming a member of and/or handing over any cash.

Remitano’s Merchandise

Remitano has no retailable services or products.

Associates are solely in a position to market Remitano affiliate membership itself.

Remitano’s Compensation Plan

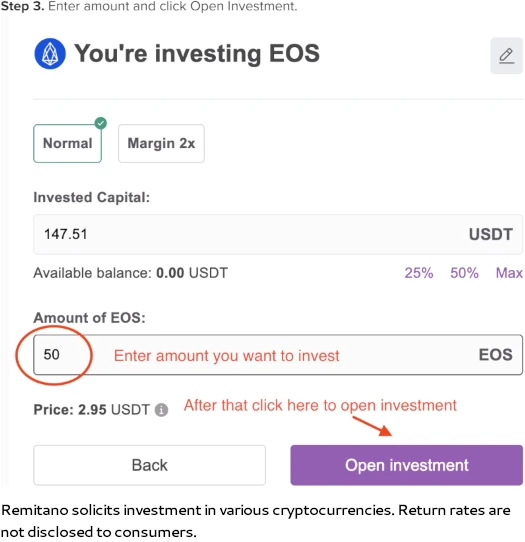

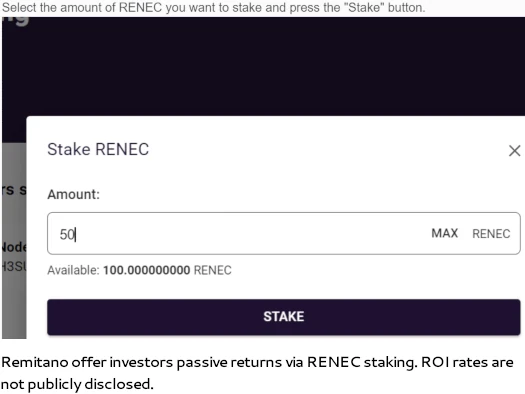

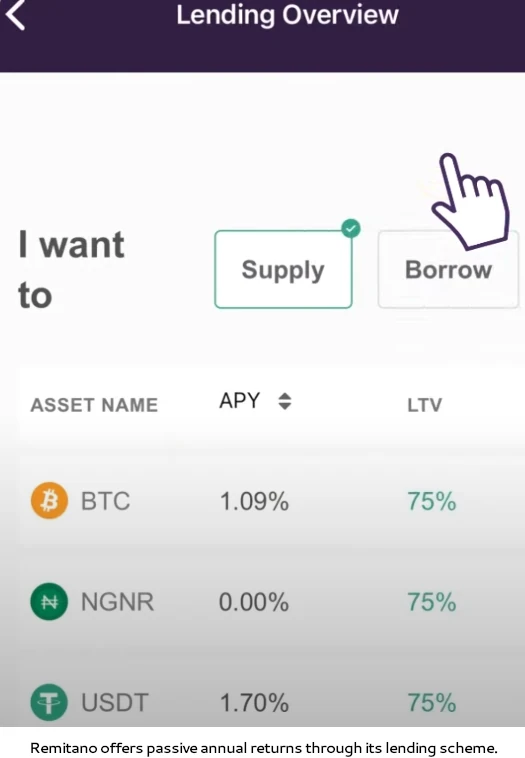

Remitano affords three passive funding alternatives to its associates:

- undisclosed funding plans

- staking plans and

- a lending funding scheme

All three alternatives see associates make investments cryptocurrency on the promise of passive returns.

The MLM aspect of Remitano pays referral commissions down two ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 40%

- degree 2 – 10%

Remitano’s referral commissions are paid as a proportion of charges the corporate collects from its associates.

Becoming a member of Remitano

Remitano affiliate membership is free.

Full participation within the connected earnings alternative requires funding in cryptocurrency.

Remitano Conclusion

Remitano pitches itself as an “escrowed P2P Bitcoin market the place folks purchase and promote Bitcoin simply and safely”.

Remitano was first based in 2015 by Babylon Options Restricted as a peer-to-peer crypto change.

Whereas that may have been how Remitano began out, at the moment it’s a cryptocurrency funding platform that operates illegally.

Remitano’s funding plans see associates click on a button to speculate cryptocurrency.

That is executed on the promise of a return, which associates can see accumulate in real-time.

Remitano’s staking is the same old “make investments cryptocurrency on the promise of a passive annual return” affair.

Lastly, Reminato’s lending platform sees associates put money into a lending ruse, once more pitching varied passive annual returns.

All three of Remitano’s funding schemes represent securities choices. In an effort to function legally, Remitano has to register these securities choices with monetary regulators.

Nowhere on Remitano’s web site does it present proof of getting registered with monetary regulators in any jurisdiction.

Which means at a naked minimal, Remitano is committing securities fraud and working illegally.

Securities fraud and Ponzi schemes go hand in hand. And it’s extremely in all probability Remitano are working a Ponzi scheme.

One may level and ask how the corporate has thus been working since 2014, to which I say the funding fraud aspect of the enterprise is comparatively current.

Remitano co-founders Phuong Nguyen and Dung Huynh labored at Quoine. Nguyen was VP of Engineering and Huynh was a Full Stack Developer.

Like all cryptocurrency exchanges, Quoine was dodgy. In 2017 a consumer of the change sued Quoine for manipulating 3092 BTC in trades.

A Singapore courtroom discovered Quoine liable in 2019. Quoine misplaced a subsequent attraction in 2020.

Whereas that case was happening, Quoine rebranded as Liquid in 2018.

In February 2022, Liquid merged its Ponzi scheme with that of FTX by way of acquisition by the latter.

FTX’s Ponzi scheme infamously collapsed in early November 2022. Liquid subsequently collapsed on November fifteenth, 2022.

I’m unsure on straight funding plans, however each FTX and Liquid had the identical staking and lending funding fraud nonsense Remitano has.

Remitano is beholden to the identical Ponzi math Quoine, Liquid and FTX had been.

A significant contributing issue for Remitano having the ability to maintain off Ponzi math, no less than for now, is its use of RENEC.

RENEC is an in-house shitcoin that doesn’t exist exterior of Remitano. In different phrases, Remitano manipulated RENEC at free will and values, or devalues it, because it sees match.

Remitano’s Ponzi collapse is inevitable. For anybody doing their due-diligence on the corporate now nonetheless, the extra urgent difficulty is securities fraud.

On that observe, Vietnamese authorities seem to have fully dropped the ball. Vietnam isn’t actually identified for energetic regulation of cryptocurrency or MLM associated securities fraud.

That is to the detriment of residents of Vietnam, the vast majority of whom make up Remitano’s buyers.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This may starve Remitano of ROI income, ultimately prompting a collapse.

The mathematics behind MLM Ponzi schemes ensures that after they collapse, the vast majority of individuals lose cash.