Ranieri Property fails to offer possession or government data on its web site.

Ranieri Property fails to offer possession or government data on its web site.

Ranieri Property’ web site area (“ranieriasset.com”), was first registered in 2015. The non-public area registration was final up to date on June twenty second, 2024.

Via the Wayback Machine we are able to see Ranieri Property’ area was on the market as of March 2022.

Ranieri Property’ web site because it seems at this time seems to have been uploaded in late 2023.

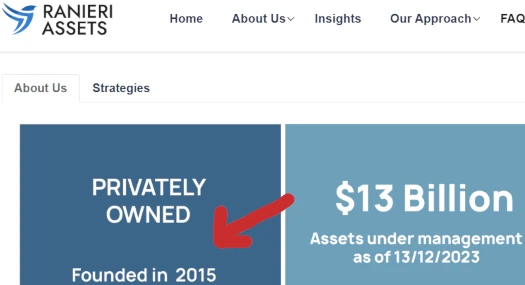

Regardless of current for lower than a 12 months, on its web site Ranieri Property pretends it has been round since 2015.

Ranieri Property supplies two company addresses on its web site, neither of which has something to do with the corporate.

Ranieri’s offered Toronto, Canada tackle is owned by Davinci Digital Workplace. Ranieri Property’ Delaware tackle is random workplace house.

As at all times, if an MLM firm shouldn’t be brazenly upfront about who’s working or owns it, suppose lengthy and laborious about becoming a member of and/or handing over any cash.

Ranieri Property’ Merchandise

Ranieri Property has no retailable services or products.

Associates are solely capable of market Ranieri Property affiliate membership itself.

Ranieri Property’ Compensation Plan

Ranieri Property associates make investments $100 or $1500 minimums in cryptocurrency.

If $100 is invested withdrawals can’t be made for 9 months.

If $1500 is invested associates are capable of make withdrawals on investments made for as much as 9 months.

Ranieri Property cover ROI from shoppers. Promoter advertising cites ROI charges of 21% to 42% a month.

Ranieri Property pays referral commissions on invested cryptocurrency down three ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 12%

- degree 2 – 6%

- degree 3 – 3%

Becoming a member of Ranieri Property

Ranieri Property affiliate membership is free.

Full participation within the hooked up earnings alternative requires a minimal $100 funding.

Ranieri Property solicits funding in numerous cryptocurrencies.

Ranieri Property Conclusion

Ranieri Property is your typical generic finance template Ponzi scheme.

Along with mendacity concerning the basis of the corporate, Ranieri Property’ web site presents itself as a generic finance themed template.

The location is populated with copious quantities of generic finance jargon, accompanied by a plethora of inventory photographs.

The workplace constructing Ranieri Property represents as its personal is poorly photoshopped:

In Ranieri Property’ web site FAQ we discover further lies about funding insurance coverage:

Does Ranieri property insure the capital ought to unexpected circumstances come up?

Sure, the capital is insured for 97.9%.

Which firm is the insurance coverage with?

Ranieri property Insurance coverage Board is owned by Ranieri however acts independently and in addition reviews on to the Delaware state division.

Ranieri Property is insured… by itself. Riiiiiiiiiiiigh…..t.

Ranieri Property’ declare about reporting to the Delaware State Division can be baloney. There is no such thing as a such factor.

As a passive returns funding scheme, Ranieri Property is required to register itself with monetary regulators. Ranieri Property fails to offer proof it has registered with any monetary regulators.

Thus, at a minimal, Ranieri Property is committing securities fraud.

Ranieri Property’ enterprise mannequin additionally fails the Ponzi logic take a look at. As per the “based lies” screenshot within the introduction of this overview, Ranieri Property additionally claims to be managing $13 billion in property.

If Ranieri Property was solely taking part in round with half of its claimed managed property, at 21% to 42% a month this nonetheless involves $1.3 to $2.7 billion a month.

Why precisely does Ranieri Property want your cash once more? And why are they losing time soliciting $100 investments in cryptocurrency from randoms over the web?

Because it stands the one verifiable income getting into Ranieri Property is new funding.

Utilizing new funding to pay ROI withdrawals would make Ranieri Property a Ponzi scheme. Moreover with nothing marketed or bought to retail prospects, the MLM facet of Ranieri Property operates as a pyramid scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

It will starve Ranieri Property of ROI income, ultimately prompting a collapse.

The maths behind Ponzi schemes ensures that once they collapse, nearly all of contributors lose cash.