![]() SuperOne launched in 2018 as a easy smart-contract Ponzi scheme.

SuperOne launched in 2018 as a easy smart-contract Ponzi scheme.

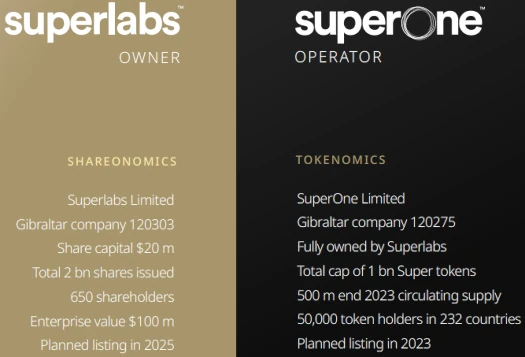

Mentioned Ponzi scheme was run by means of SuperOne tokens (SRX), of which 2 billion had been created out of skinny air.

SuperOne proprietor Andreas Christensen owns half of the 2 billion SuperOne tokens created. Evidently he has a vested monetary curiosity in getting the tokens to pump so he can money out.

SuperOne’s authentic iteration collapsed shortly after launch. In 2020 the Ponzi scheme was rebooted with a cell trivia app.

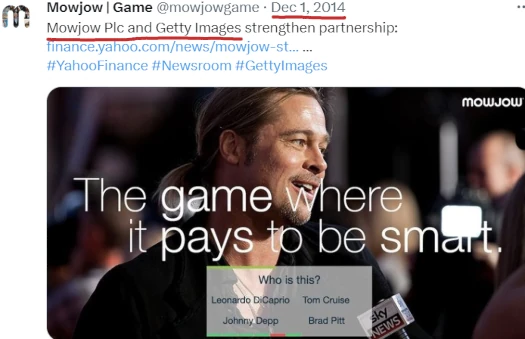

This was primarily an integration of Mowjow, a failed quiz app improvement firm Christensen launched in 2013.

To summarize, the concept was that new trivia app customers would finally spend cash, permitting Christensen and the unique SuperOne token bagholders to money out.

That didn’t occur. SuperOne’s reboot was as a lot a failure as the unique smart-contract Ponzi.

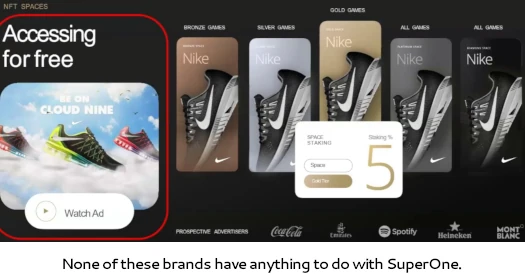

Since 2020, SuperOne rode the NFT and metaverse grift trains by integrating each into its Ponzi scheme.

We have now launched 150,000 NFTs, which might be built-in into the sport and the neighborhood. And now, we’re increase our Fandom Metaverse, the place followers can work together, join, and compete with one another.

The imaginative and prescient is to have a Fan Metaverse the place all of the completely different fan communities can see and go to one another and to assemble as many followers as attainable to assemble a digital metropolis.

The above is quoted from a June 2022 article revealed on SuperOne’s web site.

Quick ahead to 2023 and metaverse and NFT grifts are as useless as a doornail.

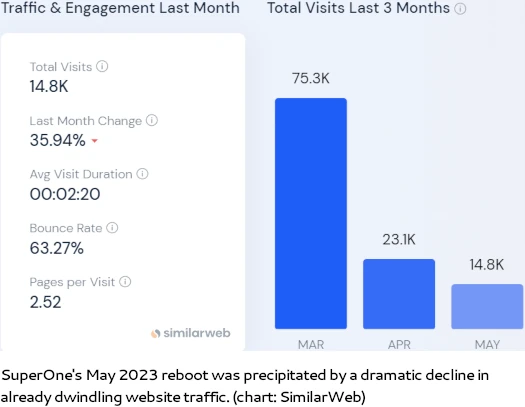

As per one more reboot in mid Could 2023 (deceivingly being pitched as a “prelaunch”), SuperOne is returning to their failed trivia app roots.

The hope now’s to pump SRX by particularly focusing on soccer gamers.

The Firm

Again in 2020 SuperOne was integrated as SuperOne Restricted, a UK shell firm.

As of 2023 SuperOne is ready up by means of two layers of shell firms in Gibraltar; SuperOne Restricted and SuperLabs Restricted;

If truth be told SuperOne is and at all times has been run by proprietor Andreas Christensen out of Norway:

SuperOne’s Merchandise

SuperOne’s trivia app is free to play with microtransactions.

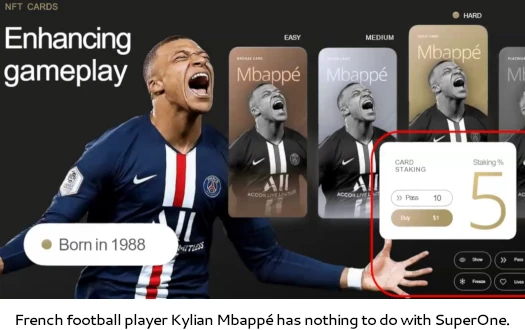

The newest advertising ruse is tailoring the trivia to sports activities. The thought is that soccer followers might be manipulated into pondering answering trivia questions and shopping for NFTs equates to supporting their membership.

It must be famous that SuperOne has no direct partnerships with any of the gamers or sporting golf equipment of their advertising materials.

Images of gamers are purportedly inventory photographs licensed by means of ShutterStock:

That is one thing Andreas Christensen has been doing for over a decade:

SuperOne hopes to recruit new SRX token bagholders by means of Objective.com, who it claims can present them publicity to “800 million followers”.

In an try to confirm this I ran a seek for “superone” showing on Objective.com’s web site:

Oddly sufficient once I clicked by means of on any outcomes SuperOne wasn’t talked about on the linked pages. I suppose that is simply SuperOne shopping for promoting however I’m undecided.

In any occasion, I’ve reached out to Objective.com for touch upon SuperOne claiming to be in partnership with them for his or her newest Ponzi reboot. I’ll report again if I get a response.

Further people SuperOne claims to have partnered with embrace Jeff Burton, John Wright and John Arne Riise.

SuperOne’s Compensation Plan

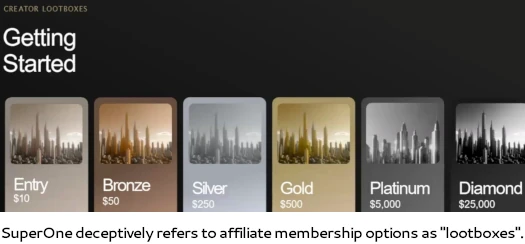

SuperOne’s second reboot sees them cut back funding from $100 to $100,000 to $10 to $25,000.

- Entry – make investments $10 and obtain 100 SRX

- Bronze – make investments $50 and obtain 500 SRX

- Silver – make investments $250 and obtain 2500 SRX

- Gold – make investments $500 and obtain 6000 SRX

- Platinum – make investments $5000 and obtain 65,000 SRX

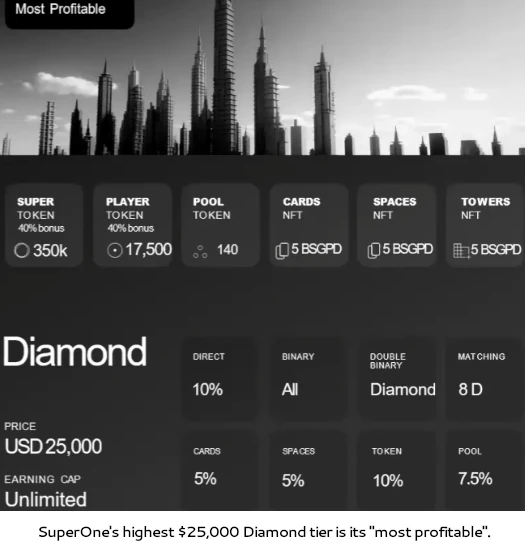

- Diamond – make investments $25,000 and obtain 350,000 SRX

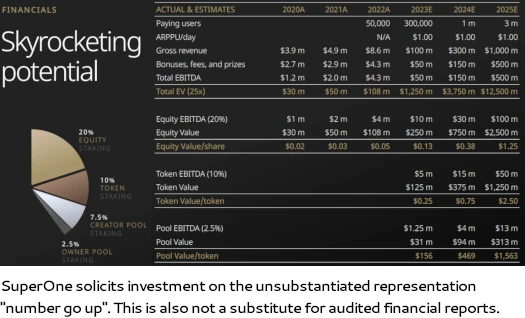

So far as SRX tokens go, it’s the identical play. Onboard new bagholders within the hopes of producing sufficient funding such that Christensen and earlier SRX bagholders can money out.

There’s additionally “participant tokens”, “pool tokens” and NFT positions, which as I perceive it are every connected to smaller passive ROI streams (recycling invested funds a method or one other).

Tower NFT positions, for instance, seem like connected to a “staking” Ponzi mannequin:

The MLM aspect of SuperOne pays on recruitment of affiliate traders.

Incomes Restrictions

SuperOne restricts earnings primarily based on how a lot an affiliate has invested:

- Entry tier associates can earn as much as $100

- Bronze tier associates can earn as much as $500

- Silver tier associates can earn as much as $2500

- Gold tier associates and better don’t have an incomes cap

Though not explicitly clarified, I imagine SuperOne’s incomes caps are each day.

Referral Commissions

SuperOne associates obtain a ten% referral fee on funding by personally recruited associates.

Residual Commissions

SuperOne pays residual commissions by way of a binary compensation construction.

I wasn’t capable of suss out particular percentages and what now as a result of SuperOne hides that data from customers.

Again in 2020 SuperOne’s residual commissions paid 10% on new weaker binary group aspect funding. I don’t think about that may have modified an excessive amount of, if in any respect.

SuperOne’s advertising additionally references a “double binary”. No concept what that’s about as once more the data is hidden from customers.

Becoming a member of SuperOne

SuperOne affiliate membership is prices between $10 to $25,000.

The extra a SuperOne affiliate spends on membership the upper their earnings potential.

SuperOne Conclusion

You’d suppose after ten years Andreas Christensen would surrender on beating a useless horse. But right here we’re.

Trivia apps are a dime a dozen and all SuperOne has going for it’s its SRX token. One might argue given the bagholder baggage over 4 years, SRX is definitely a detriment to the chance.

Backside line is if you wish to play sports activities trivia, even crypto sports activities trivia, there are already a bajillion choices. With that in thoughts, SuperOne’s app is prone to stay in the identical failed state as when it first launched in 2020.

That leaves us with a gutted MLM compensation plan (that’s largely hidden from customers), and a bunch of bagholders nonetheless unable to money out.

SuperOne’s Could 2023 “prelaunch” may lure some new suckers in, however that’s not going to final as soon as they cease pretending remodelling their trivia app round soccer is a brand new launch.

On the regulatory entrance SuperOne stays unregistered to supply securities in any jurisdiction.

Norway does have an energetic monetary regulator within the Monetary Supervisory Authority of Norway (Finanstilsynet).

Finanstilsynet have been recognized to go after MLM pyramid and Ponzi schemes actively focusing on Norway over time – so it’s a bit unusual they haven’t gone after SuperOne and Christensen but.

I’m placing that right down to SuperOne largely going nowhere and probably not ever being energetic in Norway. And definitely Norway’s inaction to date doesn’t detract from SuperOne committing securities fraud and working illegally.

As with SuperOne’s first two iterations, the one verifiable income coming into the scheme is new funding.

Recycling newly invested funds to fund “passive earnings streams” paid to current associates makes SuperOne a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This may starve SuperOne of ROI income, finally prompting a collapse.

The mathematics behind MLM Ponzi schemes ensures that once they collapse, nearly all of members lose cash.