GetFit Mining fails to supply possession or govt info on its web site.

GetFit Mining fails to supply possession or govt info on its web site.

GetFit Mining’s web site area (“getfitmining.com”), was registered in March 2022. The personal registration was final up to date on March twenty sixth, 2023.

A YouTube video embedded on GetFit Mining’s web site results in a YouTube channel titled “GetFit Exercise Mining”. There we discover GetFit Mining advertising and marketing movies hosted by “Lynette”.

“Lynette” corresponds to Shirley Lynette Artin Crawford (proper).

“Lynette” corresponds to Shirley Lynette Artin Crawford (proper).

On April sixteenth, Danny Dehek held a livestream overlaying GetFit Mining on his “The Crypto Ponzi Scheme Avenger” YouTube channel.

At round [1:29:11] DeHek reveals he was contacted by Crawford in her capability as GetFit Mining’s proprietor. This tracks with Crawford that includes in GetFit Mining’s advertising and marketing movies.

DeHek calls Artin as a part of his livestream. She doesn’t reply however did name him again at [2:03:22].

Crawford, a US resident who additionally goes by “Lynette Artin”, is understood to BehindMLM as a net-winner within the Zeek Rewards Ponzi scheme.

How a lot Crawford stole by Zeek Rewards is unclear, nevertheless it was sufficient to see her focused by clawback litigation.

After Zeek Rewards was shut down by US authorities in 2012, Crawford’s title popped up in affiliation with quite a few reload scams; GoFunRewards, OfferHubb, Uptown Provides, Fast Pay Group and CrowdFundFast.

As all the time, if an MLM firm is just not overtly upfront about who’s operating or owns it, assume lengthy and exhausting about becoming a member of and/or handing over any cash.

GetFit Mining’s Merchandise

GetFit Mining has no retailable services or products.

Associates are solely capable of market GetFit Mining affiliate membership itself.

GetFit Mining’s Compensation Plan

GetFit Mining’s compensation plan combines a passive returns staking funding scheme with referral commissions.

Passive Returns (staking)

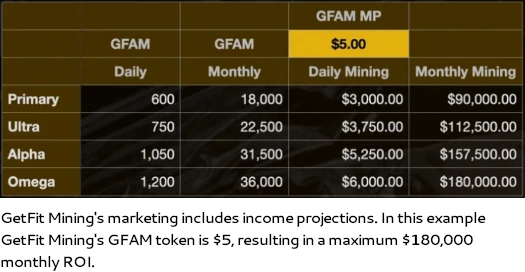

GetFit Mining associates make investments GFAM tokens on the promise of a passive ROI of as much as 25% per funding.

GetFit Mining associates can both buy GFAM tokens by the corporate, or generate them by a convoluted activity course of.

Acquiring GFAM tokens by GetFit Mining requires buy by an inside change. GetFit Mining units the GFAM token worth they promote at.

GetFit Mining’s convoluted activity course of sees associates generate GFAM by bodily exercise.

This begins with a GetFit Mining affiliate buying their token technology fee (observe the quantity spent additionally correlates to the staking ROI):

- Major – pay $99 for a 100% token technology fee

- Extremely – pay $199 for a 125% token technology fee

- Alpha – pay $499 for 175% token technology fee

- Omega – pay $899 for 300% token technology fee

GFAM token technology charges are tracked by NFT positions. Observe that associates can buy a number of positions to extend the quantity of GFAM tokens they will generate each day (and enhance their passive staking ROI).

GetFit Mining caps bodily exercise at 20,000 steps or 10 miles (16,000 km) per 24 hours. Additional restrictions embody as much as 2 hours of each day recorded exercise.

There may be additionally a tier system inside GetFit Mining, which provides a multiplier to generated tokens:

- Tier 1 – 5% bonus

- Tier 2 – 10% bonus

- Tier 3 – 20% bonus

- Tier 4 – 30% bonus

Observe these tiers aren’t outlined inside GetFit Mining’s advertising and marketing materials.

The tiers nevertheless are named “depth tiers steps”, suggesting they could correlate to depth ranges tracked throughout bodily exercise.

There are further undisclosed token technology bonuses based mostly on energy burned and tracked sleep time (as much as 8 hours a day).

No matter whether or not bought by GetFit Mining or obtained by the convoluted activity based mostly scheme, token technology fee charges have to be paid to take part in GetFit Mining’s passive returns staking scheme.

It’s because returns throughout the staking funding scheme are decided by how a lot in charges have been paid.

GetFit Mining pays staking returns out in tether (USDT). The full ROI per GFAM token funding made is calculated based mostly on the whole token technology fee a GetFit Mining has paid for.

This begins at 1.39% for a 100% token technology fee (one Major NFT place), and will increase by 1.39% per 100% token technology fee as much as 1700%. 1700% to 1800% provides 1.37% to the each day ROI fee.

Maxxed out at 1800% (six Omega NFT positions @ $5394), GetFit Mining associates are capable of make investments GFAM tokens for a 25% ROI.

The return is paid out by what seems to be a each day variable fee over 90 days.

As soon as invested, GFAM tokens are unlocked if both

- if the whole ROI fee is hit inside 90 days (1.39% to 25%);or

- the whole ROI fee is just not hit at 90 days from the date of preliminary funding

Residual Commissions

GetFit Mining associates pays referral commissions through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel workforce, with each personally recruited affiliate positioned straight beneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel workforce.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

GetFit Mining caps payable unilevel workforce ranges at ten.

Referral commissions are paid as a proportion of token technology adjustment charges paid throughout these ten ranges as follows:

- stage 1 (personally recruited associates) – 25%

- stage 2 – 5%

- stage 3 – 4%

- ranges 4 and 5 – 3%

- ranges 6 and seven – 2%

- stage 8 – 3%

- ranges 9 and 10 – 5%

- stage 11 – 8%

Becoming a member of GetFit Mining

GetFit Mining affiliate membership is free.

Full participation within the connected revenue alternative requires cost of token technology charges:

- Major – pay $99 for a 100% token technology fee

- Extremely – pay $199 for a 125% token technology fee

- Alpha – pay $499 for 175% token technology fee

- Omega – pay $899 for 300% token technology fee

Observe that with the intention to maximize passive returns and GetFit Mining’s compensation plan, a number of charge funds are essential.

GetFit Mining Conclusion

GetFit Mining is your basic task-based Ponzi scheme. Right here the duty is bodily exercise however GetFit Mining may simply as simply have traders rub their bellies or depend backwards from a thousand.

It’s because the duty assigned in task-based Ponzi schemes has nothing to do with income technology.

Don’t get me mistaken, extra bodily exercise is nice however shouldn’t be construed as a blanket legitimacy for GetFit Mining as an entire.

That comes all the way down to regulatory compliance which GetFit Mining wholly fails at.

For starters GetFit Mining fails to supply shoppers with info that permits them to make an knowledgeable determination about becoming a member of the corporate. This contains possession and compensation particulars on the corporate’s web site.

Then we’ve got the elephant within the room, GetFit Mining’s staking funding scheme.

Both by finishing a activity or straight buying them, GetFit Mining associates purchase GFAM tokens.

GFAM is a BSC-20 token. BSC-20 tokens might be created in a couple of minutes at little to no value.

As soon as acquired, GFAM tokens are then invested with GetFit Mining on the promise of a passive return.

To ascertain whether or not US securities legislation comes into play we have to set up the existence of an funding contract.

That is performed by utility of the Howey Check.

An funding contract exists if there may be an “funding of cash in a standard enterprise with an affordable expectation of earnings to be derived from the efforts of others.”

In GetFit Mining we’ve got associates investing GFAM tokens (whether or not they had been straight bought or task-allocated is irrelevant).

This funding is finished into GetFit Mining by their staking funding scheme (a “frequent enterprise”), on the promise of a passive return decided by how a lot a GetFit Mining affiliate has paid in charges (“an affordable expectation of earnings’).

GetFit Mining associates purchase GFAM tokens and pay ROI fee charges however returns are generated solely passively (“from the efforts of others”).

GetFit Mining’s providing satisfies the Howey Check, which means its GFAM token “staking” funding scheme constitutes an funding contract.

Underneath US legislation this requires GetFit Mining and Shirley Crawford to register with the SEC.

A search of the SEC’s public Edgar database reveals neither GetFit Mining or Crawford are registered with the SEC.

This constitutes securities fraud, which the SEC asserts goes hand-in-hand with Ponzi schemes.

From a shopper due-diligence perspective, there is no such thing as a verifiable supply of exterior income coming into GetFit Mining.

The one acceptable and legally required type of verification can be audited monetary reviews filed with the SEC.

It must be famous that securities legislation globally is, for all intents and functions, much like that of the US. In a rustic the place monetary markets are regulated, registration of securities providing with monetary regulators in obligatory.

For reference, as of March 2024 SimilarWeb tracked prime sources of visitors to GetFit Mining’s web site because the US (79%), Canada (8%), Mexico (8%) and Norway (5%).

Regardless of committing securities fraud and having no verifiable supply of exterior income to fund USDT ROI withdrawals, on her name with Danny Dehek Crawford asserted GetFit Mining is “not a Ponzi scheme and never a rip-off, 5 thousand p.c” [2:10:16].

Having been sued for clawback as a part of Zeek Reward’s securities fraud proceedings, not surprisingly GetFit Mining tries to brush off issues on its web site.

The GetFit tokens are usually not supposed to represent, and shall not represent, securities in any jurisdiction.

- What GetFit tokens are supposed or not supposed to represent is irrelevant to what they’re; and

- the problem isn’t the tokens themselves being a securities providing, GetFit Mining’s “staking” funding scheme is a securities providing.

I’ll end up by noting GetFit Mining is fairly much like SmartSteps, one other health task-based Ponzi BehindMLM reviewed earlier this yr.

At time of publication SmartSteps’ web site is now not accessible. What it was reside although, SmartSteps ran the identical NFT funding place staking scheme by its BOLTYX BSC-20 tokens.

Taking a step again, task-based Ponzi schemes are nothing new. In Zeek Rewards, which launched in 2011, traders needed to dump penny public sale bids to qualify for returns.

As a result of nature of compounding, the quantity of bids prime traders needed to dump each day shortly turned unmanageable. This resulted within the creation of 1000’s of dummy accounts to dump bids on to.

Not that it mattered, dumping bids had nothing to do with income technology. Like all task-based Ponzi schemes, the assigned activity was simply busy-body work.

Once more placing apart well being advantages, with respect to income technology the identical is true of GetFit and its each day health duties.

The first verifiable income is fairly clearly GetFit Mining’s token technology NFT place charges – which is why they correlate to how a lot of a return is paid out through the staking scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding. GetFit Mining associates promoting GFAM tokens internally with out taking part within the staking funding scheme may even dry withdrawable USDT up.

Both approach this may starve GetFit Mining of ROI income, leaving it unable to pay USDT ROI withdrawals.

Given the variable nature of the return fee, this may doubtless current itself in mentioned return dropping to near-zero earlier than collapsing altogether.

Math ensures that when a Ponzi scheme collapses, the vast majority of individuals lose cash.

In GetFit Mining, this may lead to associates bagholding GFAM, which outdoors of GetFit Mining’s staking funding scheme, is in any other case nugatory.