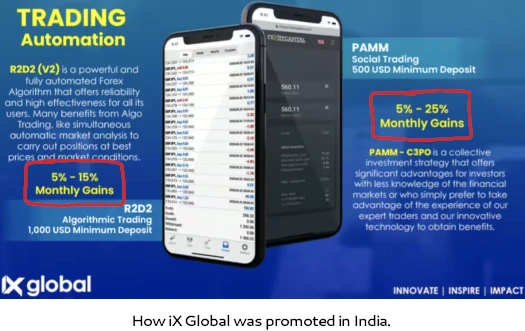

Between the SEC suing it for securities fraud and Indian authorities arresting cash launderers, iX World’s unique foreign exchange and crypto mining ruses are lifeless.

Between the SEC suing it for securities fraud and Indian authorities arresting cash launderers, iX World’s unique foreign exchange and crypto mining ruses are lifeless.

In an effort to proceed violating US federal securities regulation, iX World has introduced a brand new NFT “rewards” grift.

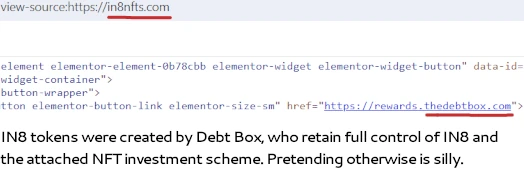

iX World’s new NFT grift is run by way of IN8 tokens. IN8 is a BEP-20 token, created by Debt Field.

BEP-20 tokens could be created in a couple of minutes at little to no price.

Regardless of having clear possession, “decentralization” is a key IN8 advertising and marketing level. That is from IN8’s whitepaper;

iX believes that the decentralization motion is the long run, and that it’s a motion taking place on many fronts.

The IN8 NFT mission, powered by D.E.B.T., is a world decentralized rewards program in sync with the complete iX ecosystem in help of the iN8 tokenomics.

That is after all baloney. iX World is owned by Joseph Martinez (proper).

That is after all baloney. iX World is owned by Joseph Martinez (proper).

Debt Field (aka D.E.B.T) is owned by Jason Anderson, Jacob Anderson, Schad Brannon and Roydon Nelson.

These people centrally management all facets of IN8 and its hooked up NFT “rewards program”.

iX World is promoting 200,000 IN8 funding positions as NFTs. Every IN8 NFT prices $25 and supply entry to a staking funding scheme.

On the launch of the IN8 mission, 200,000 NFTs shall be made out there to wallets which have staked a DEBT token.

With a view to take part within the IN8 mission, all NFTs are required to be minted and staked.

A minting payment of $25 per NFT is required to mint NFTs.

Reward distributions to NFT homeowners will start solely in any case IN8 NFTs have been minted.

Customers should manually “stake” their NFT to a third-party platform, such because the D.E.B.T. platform, with a view to obtain reward distributions.

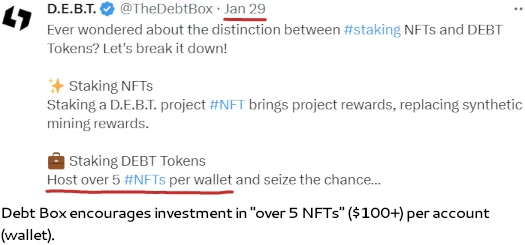

In a nutshell; buy DEBT tokens (one other centrally managed cryptocurrency), use DEBT tokens to put money into $25 NFT positions, stake NFTs (park them with Debt Field), receives a commission passive rewards.

DEBT tokens are leftover from a earlier Debt Field funding scheme, tied to numerous fictional income producing ruses (as alleged by the SEC).

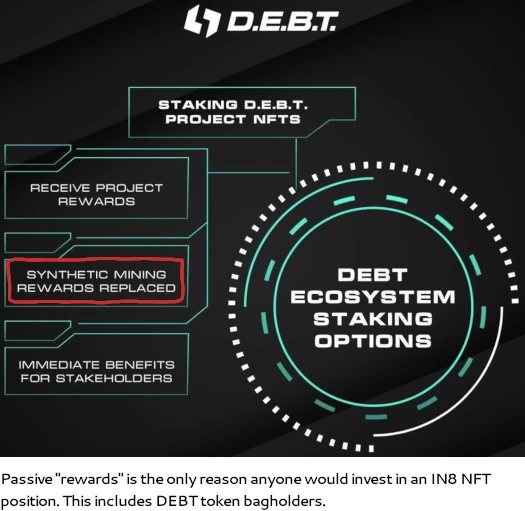

Passive rewards are paid in IN8, which is generated on demand (as much as 888 million). All of that is coordinated by way of a smart-contract, owned and arrange by Debt Field.

Cashing out IN8 happens by way of Debt Field. The one recognized sources of funding are

a portion of the company income from way of life merchandise, mentorship applications, and different providers supplied by iX.

After the SEC filed go well with in August iX World tried to reboot as an schooling platform. That flopped therefore the NFT funding scheme grift.

A part of iX World’s “providers” contains promoting $25 NFTs. 200,000 NFTs offered for $25 involves a fast $5 million.

Oh and IN8 NFT buyers are additionally slugged with all kinds of hefty charges:

- 10% passive rewards payment

- 10% transaction payment

- $1 withdrawal payment

- “extra charges might apply”

Past that there doesn’t appear to be a plan to permit buyers to maintain cashing out.

There’s a plan to launch an countless parade of NFT funding schemes nevertheless – and that is tied to present DEBT token bagholders;

By staking DEBT token, customers shall be rewarded a possibility to obtain free NFTs from every upcoming Model 2 mission.

Every pockets can stake as much as 5 DEBT tokens*. When a pockets stakes a DEBT token, that pockets is eligible to obtain one free NFT per future mission per DEBT token staked (for instance: 3 DEBT tokens staked = 3 free NFTs from all future tasks whereas staked and whereas provides final).

All NFTs have to be minted (for a payment) and staked to obtain reward distributions.

Seemingly conscious it’s violating US securities regulation, the IN8 NFT funding scheme whitepaper states;

DEBT token staking isn’t ROI staking.

NFT homeowners are NOT investing into iX Ventures, the IN8 mission, third-party companions, associates, or mother and father.

As defined above, that is clearly nonsense. Calling a passive return a “reward” doesn’t change what it’s.

Particularly, with respect to US securities regulation, we are able to apply the Howey Check to iX World’s IN8 NFT funding scheme.

The U.S. Supreme Courtroom’s Howey case and subsequent case regulation have discovered that an “funding contract” exists when there may be the funding of cash in a typical enterprise with an inexpensive expectation of income to be derived from the efforts of others.

With respect to iX World’s IN8 NFT funding scheme:

- a $25 funding is required to acquire an NFT funding place

- the $25 funding is made into Debt Field (by way of iX World), each of which represent frequent enterprises

- the one purpose anybody would make investments into an IN8 NFT funding place is the marketed “IN8 Rewards Program”

- rewards paid out by way of the IN8 Rewards Program are passive in nature and derived by way of the efforts of Debt Field and iX World (“others”).

As you may see, iX World’s IN8 funding positions fulfill each prong of the Howey Check.

Just like the passive returns foreign exchange scheme earlier than it, as soon as once more iX World and Debt Field are violating US securities regulation.

Because it stands the SEC intends voluntarily dismiss the $110 million securities fraud case it introduced towards iX World and Debt Field.

This is because of unique attorneys dealing with the case mixing up some dates when making use of for a TRO. It has nothing to do with iX World’s and Debt Field’s alleged securities fraud.

With a brand new group of “skilled trial attorneys” assigned the case, it’s anticipated the SEC will refile sooner or later. Aligning with ongoing parallel felony proceedings in India, the DOJ may also file felony fees.

Whether or not iX World’s new IN8 NFT funding scheme components right into a refiled lawsuit or felony fees, stays to be seen.