Following the collapse of its short-lived IN8 NFT Ponzi scheme, iX International has tripled down on securities fraud with CloudX.

Following the collapse of its short-lived IN8 NFT Ponzi scheme, iX International has tripled down on securities fraud with CloudX.

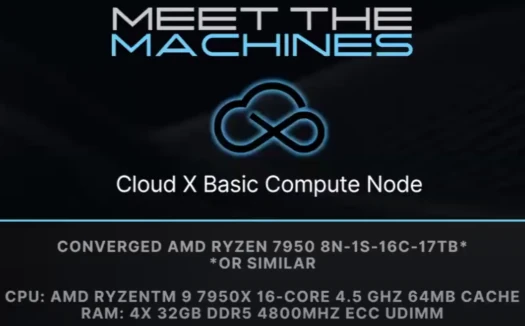

In a nutshell, iX International’s CloudX is a variation of the “node positions” mannequin, besides blockchain has been swapped out for hosting.

The ruse this time round is CloudX internet hosting companies:

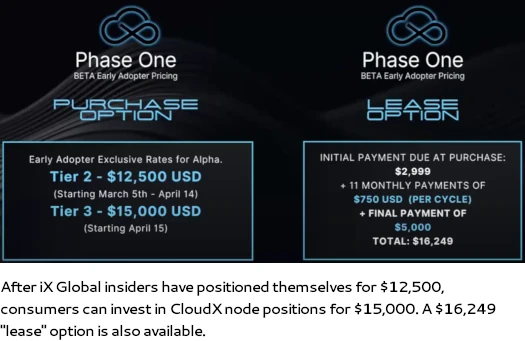

iX International associates can spend money on CloudX node positions for $15,000 outright or $16,249 leased.

Outdoors of the US, iX International associates can make investments as little as $250 for a smaller node funding place.

iX International markets CloudX as a “hybrid cloud” service, “powered by IN8 Tech”.

IN8 is an organization owned by iX International proprietor and wished fugitive Joe Martinez.

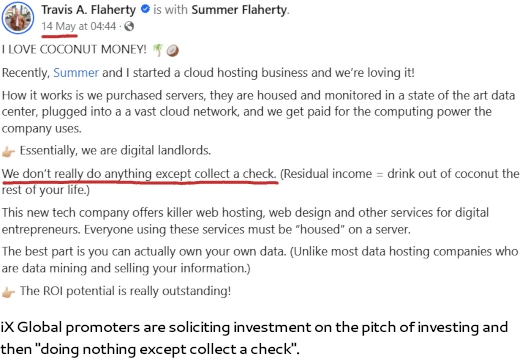

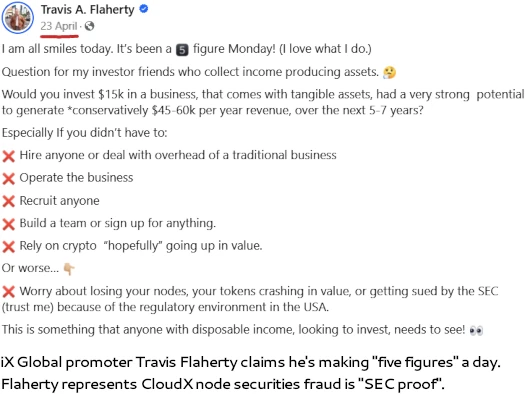

Right here’s the pitch from high iX International promoter Travis Flaherty (proper);

Right here’s the pitch from high iX International promoter Travis Flaherty (proper);

[11:01] It’s a hybrid cloud with decentralized possession [editor’s note: CloudX is “powered by IN8 Tech” which is owned by Joe Martinez, there’s nothing decentralized about it].

So as an alternative of us getting in and spending lots of of hundreds of thousands of {dollars} to construct some knowledge middle someplace, after which fill it with racks upon racks of servers, what we’re doing is we’re giving the typical particular person the power to have the ability to be an proprietor of that gear. And have the ability to home it in one in every of our knowledge storage facilities.

We provision the gear. We monitor the gear and finally provide help to even fill the gear.

And guess what? You generate a income as a “digital landlord”.

[11:57] When you personal or lease to personal and you’ve got your gear, it’s shipped over to our knowledge facilities.

They rack it and stack it, they get it plugged into our cloud, after which we begin serving to you load your server with tenants. And also you receives a commission primarily based on the utilization.

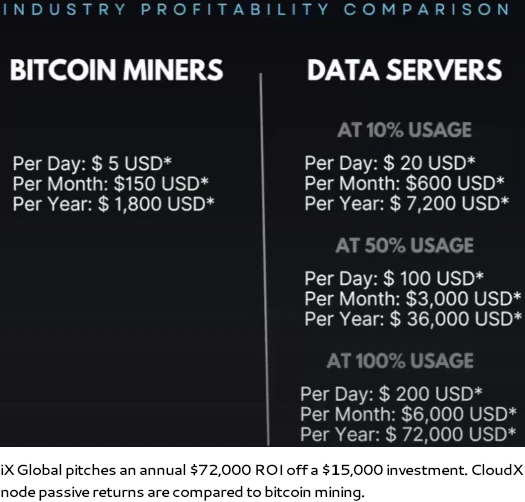

Passive returns pitched by iX International high out at $72,000 yearly of a single $15,000 funding.

In order that’s iX International’s CloudX advertising and marketing pitch. Now lets get into the issues.

At the start, as per the Howey Take a look at, iX International’s CloudX node funding scheme constitutes a securities providing.

The Howey Take a look at is 4 standards an asset should meet to qualify as an “funding contract.”

If the asset is an “funding of cash in a typical enterprise, with an inexpensive expectation of earnings to be derived from the efforts of others” it’s thought-about a safety.

It’s then topic to disclosure and registration necessities beneath the Securities Act of 1933 and the Securities Trade Act of 1934.

iX International associates make investments $15,000 into iX International/CloudX/IN8 Tech (a “frequent enterprise”).

That is executed on the promise of every day passive returns (“a “cheap expectation of earnings”), represented to be funded by the efforts of others (“derived from the efforts of others”).

All an iX International affiliate does is make investments $15,000 per node funding place they need. iX International populates every node funding place with “utilization”, equivalent to the every day ROI fee paid out ($2 a day per 1% of claimed utilization).

Neither iX International, CloudX or IN8 Tech or proprietor Joe Martinez (proper) are registered with the SEC. This constitutes securities fraud.

Neither iX International, CloudX or IN8 Tech or proprietor Joe Martinez (proper) are registered with the SEC. This constitutes securities fraud.

Tellingly, there isn’t any point out of the CloudX node funding scheme on iX International’s web site.

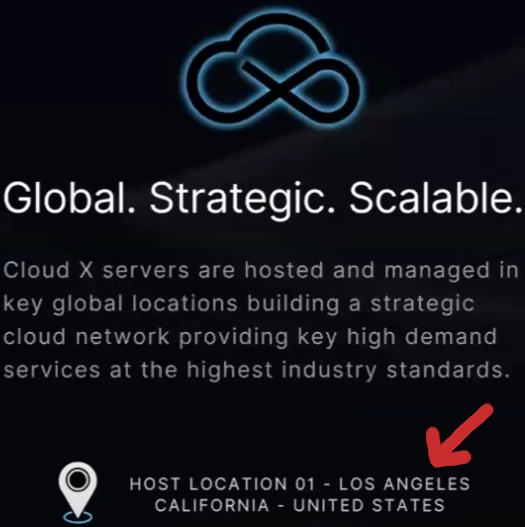

As to iX International’s node funding scheme mannequin itself, iX International advertising and marketing represents CloudX’s/IN8 Tech’s “knowledge storage middle” is predicated out of Los Angeles, California.

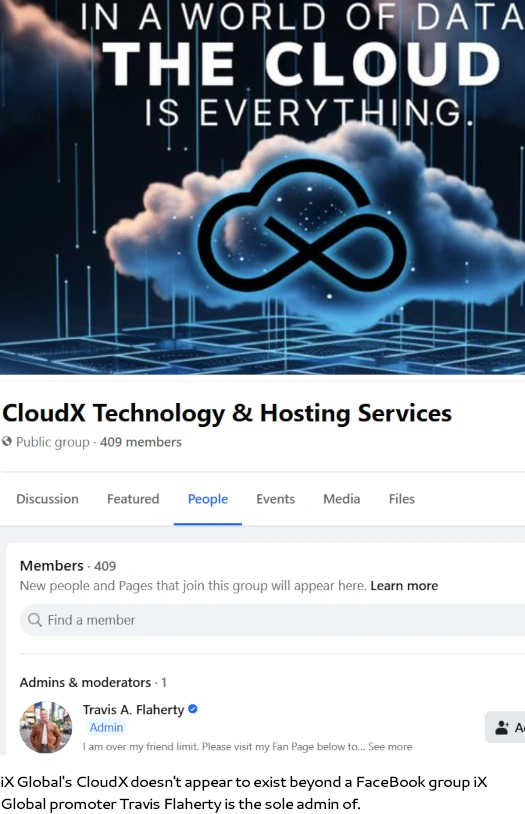

Shoppers don’t have any solution to confirm if this info is correct. Moreover, neither CloudX or IN8 Tech seem to exist exterior of iX International’s advertising and marketing.

There are just a few “CloudX” firms however none of them have something to do with iX International. IN8 Tech doesn’t have any digital footprint to talk of.

This brings us to the “we’ll populate your internet hosting node with shoppers” part of iX International’s advertising and marketing. If neither IN8 Tech or CloudX have a verifiable internet presence, how on Earth are they advertising and marketing something to anybody? Who’re these shoppers and the way are they being solicited?

Moreover, if iX International can generate $72,000 yearly off a $15,000 funding, they usually’ve already bought a knowledge middle up and working, what do they want your cash for?

At even 10% of iX International’s claimed “utilization” you’re nonetheless taking a look at a $7200 annual ROI. If iX International can’t make the most of greater than 10% of its hosting capability after a 12 months of operation I’d recommend the enterprise isn’t viable.

So if we assume utilization might be greater than 10% inside a 12 months, that greater than possible brings iX International into revenue per node funding place.

So once more, why lavatory that down with an MLM compensation plan paying commissions if iX International is doing all of the work (shopping for the gear, internet hosting the gear and producing utilization tied to the every day ROI fee)?

From a regulatory and common sense angle, iX International’s CloudX node funding scheme is unnecessary. Nicely, provided that taken at face worth.

If you happen to think about iX International’s securities fraud within the US with Debt Field (pegged at $110 million), securities fraud and cash laundering in India which is the topic of an ongoing felony investigation, and the short-lived IN8 NFT Ponzi scheme… issues turn into extra apparent.

- iX International –> AI buying and selling bot –> run by Debt Field

- iX International –> foreign currency trading bot –> run by TP International FX

- iX International –> NFT token staking Ponzi scheme –> run by Debt Field

- iX International –> hosting funding scheme –> run by CloudX and IN8 Tech

As of Might 2024 SimilarWeb tracked ~6500 month-to-month visits to iX International’s web site.

The highest three sources of site visitors are India (23%), Turkey (18%) and the US (14%). So as soon as once more we are able to see iX International is concentrating on Indian and US customers with one other fraudulent funding scheme.

Following voluntary dismissal of the SEC’s $110 million greenback fraud case towards iX International final month, it’s anticipated the federal regulator will refile sooner or later.

By way of continued securities fraud efforts iX International have demonstrated that, except stopped by a regulator, customers within the US and elsewhere will proceed to be harmed.