Again in August BehindMLM lined Monetary Schooling Providers’ $324 million FTC settlement.

Again in August BehindMLM lined Monetary Schooling Providers’ $324 million FTC settlement.

The settlement pertained to the FTC alleging FES “rip-off[med] customers out of greater than $213 million”.

On September twenty seventh I obtained an electronic mail from Sue Griffin, representing herself to be VP of Agent Assist for United Wealth Schooling Providers, previously FES.”

As per Griffin’s electronic mail;

Hiya,

I’m the VP of Agent Assist for United Wealth Schooling Providers, previously FES. Please be aware, the FTC has not ordered the corporate to shut.

Two defendants who haven’t been related to the corporate since Might of 2022 have been banned from credit score restore and working an MLM.

The corporate continues to function on an MLM platform. I would love the chance to share some extra details about the settlement with you.

I despatched again the next reply later the identical day;

FES doesn’t exist anymore, so dialogue round it closing is moot. It’s gone.

I had a glance on United Wealth Schooling’s web site for BehindMLM’s pending evaluation. I famous UWE fails to reveal firm possession or compensation particulars to customers. Each are potential violations of the FTC Act.

Seeing as you’ve supplied to share “extra info”, are you able to please affirm who owns and runs UWE and a duplicate of UWE’s compensation plan.

Over two weeks have handed and Griffin has did not reply.

At present United Wealth Schooling (UWE) got here up for evaluation. Sadly UWE nonetheless fails to offer customers with fundamental due-diligence info, leaving them unable to make knowledgeable selections concerning the firm.

Throughout the context of FES’ current FTC settlement, at the moment I believed we’d method UWE’s potential FTC Act violations.

UWE launched following a $1.75 million pyramid fraud effective by the US state of Georgia in 2019, and the lead as much as the FTC’s FES fraud lawsuit in 2022.

At present UWE basically operates as a reboot of FES, minus FES’ co-founder Mike Toloff.

UWE operates from the area “myuwe.internet”, privately registered on February twenty third, 2021.

A go to to UWE’s web site reveals the corporate fails to reveal possession and govt particulars.

This by itself is a possible FTC Act violation, however with UWE is essential given the FES pyramid fraud effective in Georgia and subsequent FTC fraud settlement.

As a possible UWE retail buyer, a go to to UWE’s web site homepage redirects me to its MLM alternative.

On this web page UWE urges web site guests to “enroll as an Agent”, “begin rising your corporation at the moment” and “learn to change your monetary future without end”.

On face worth, UWE’s lack of retail concentrate on its web site is a robust indication the corporate operates a pyramid scheme. The FTC has beforehand warned MLM firms with out important retail exercise are working illegally.

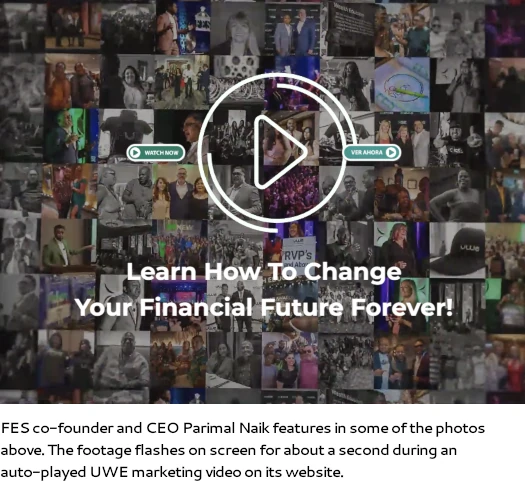

It was solely be probability and attributable to BehindMLM’s protection of the FES settlement, that I noticed Parimal Naik for a short second in an autoplayed UWE web site advertising video.

Naik co-founded FES with Mike Toloff. Past an uncredited split-second look in a advertising video, there isn’t a point out of Naik on UWE’s web site.

Naik co-founded FES with Mike Toloff. Past an uncredited split-second look in a advertising video, there isn’t a point out of Naik on UWE’s web site.

Whether or not Naik alone owns and runs UWE is unclear primarily based on the data UWE gives to customers on its web site.

Having failed to determine who owns or runs UWE, subsequent I moved on to the corporate’s merchandise.

UWE markets a “safety plan”, “playing cards”, “will & belief” and “mortgage merchandise” on its web site.

UWE’s safety plan is offered by United Credit score Schooling Providers, or UCES. UCES operates as a faceless firm connected to a PO Field in Michigan.

If there may be widespread possession between UWE and UCES, this isn’t disclosed on both firm’s web site.

No retail pricing for UCES’ safety plan is offered on UWE’s or UCES’ web site.

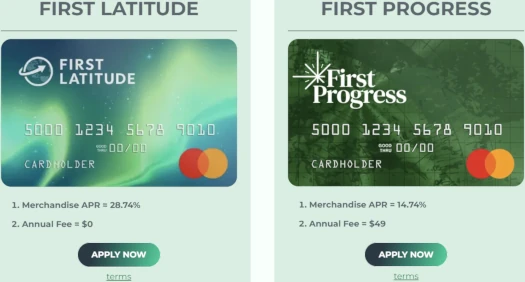

The “playing cards” part of UWE’s web site pitches “secured” bank cards issued by Synovus Financial institution.

There are two card choices out there:

UWE’s supplied secured playing cards are branded “First Latitude” and “First Progress”. No details about both entity is offered.

First Latitude has its personal web site. It once more presents as a faceless firm with no possession particulars disclosed.

UWE additionally provides unsecured bank cards. No retail pricing is offered.

UWE’s “will & belief” providing is marketed as “MyCare Plan”. A “create now” button on the MyCare Plan part of UWE’s web site redirects guests to UWE’s “contact us” web site kind.

No retail pricing for UWE’s MyCare Plan is offered.

Lastly now we have the “mortgage merchandise” part of UWE’s web site.

UWE apparently provides enterprise loans by means of a non-disclosed entity. No charges are disclosed. Clicking buttons to “apply for funding” redirects potential retail prospects to the “contact us” kind on UWE’s web site.

Having failed to determine retail pricing for UWE’s merchandise, past two third-party supplied secured bank cards, I moved onto UWE’s compensation plan.

Effectively, I tried to. Not surprisingly, UWE fails to offer customers with compensation documentation on its web site.

In abstract;

- UWE fails to reveal possession or govt info to customers, together with a previous regulatory effective in Georgia and $324 fraud settlement with the FTC

- all guests to UWE’s web site homepage are redirected to the MLM alternative (Agent enroll)

- possession of United Credit score Schooling Providers no disclosed

- possession of First Latitude and First Progress just isn’t disclosed

- retail pricing isn’t disclosed for almost all of UWE’s supplied services

- UWE fails to offer customers with compensation documentation

The entire above represent potential violations of the FTC Act (disclosures).

And this isn’t some form of negligent oversight. When an UWE govt reached out to me I requested them level clean to reveal who owns and runs UWE, and for compensation documentation.

Two weeks later and counting I’ve obtained no reply.

Potential FTC Act violations apart, if I used to be evaluating UWE as a part of my BehindMLM analysis it’d be a stable keep away from.

Shoppers ought to keep away from any MLM firm that fails to offer them with possession, govt, product (together with pricing) and compensation particulars.