Regardless of the Australian Securities and Funding Fee (ASIC) issuing two fraud warnings, a gaggle of die-hard traders proceed to advertise Auratus and Billionico.

Regardless of the Australian Securities and Funding Fee (ASIC) issuing two fraud warnings, a gaggle of die-hard traders proceed to advertise Auratus and Billionico.

At the moment we check out how Australian traders are violating ASIC’s Auratus and Billionico fraud warnings.

A lot of the Australian Auratus and Billionico promoters are leftovers from the collapsed GSPartners fraudulent funding scheme.

GSPartners was tied to mother or father firm Gold Customary Company AG, or GSB. Auratus and Billionico are GSB adjoining, with the identical individuals concerned on the prime.

ASIC issued a GSPartners fraud warning in November 2023. This was adopted by an Auratus fraud warning in August 2024. ASIC issued a second third “digital gold vaults” warning in September 2024, pertaining to Auratus’ since collapsed “gold in a vault” advertising ruse.

Our supply materials is from “The Legacy Undertaking”, a gaggle of Australian Auratus and Billionico promoters led by Kirsten Duggan, Jessica Catherine, Lorien Cameron and Nyoni Holm.

At time of publication, The Legacy Undertaking’s personal FaceBook group numbers 369 members.

The Legacy Undertaking’s advertising materials claims, once more regardless of ASIC’s a number of fraud warnings, that there are “many strategies” to speculate into Auratus and Billionico.

The really useful methodology nevertheless is “Pay It Now” (PIN).

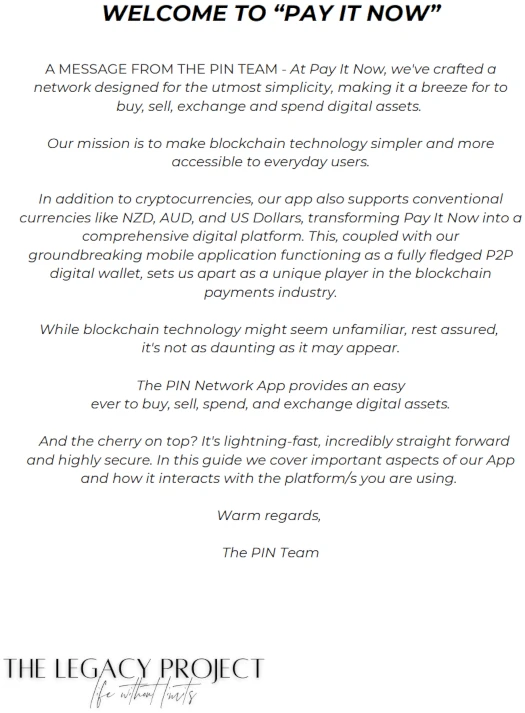

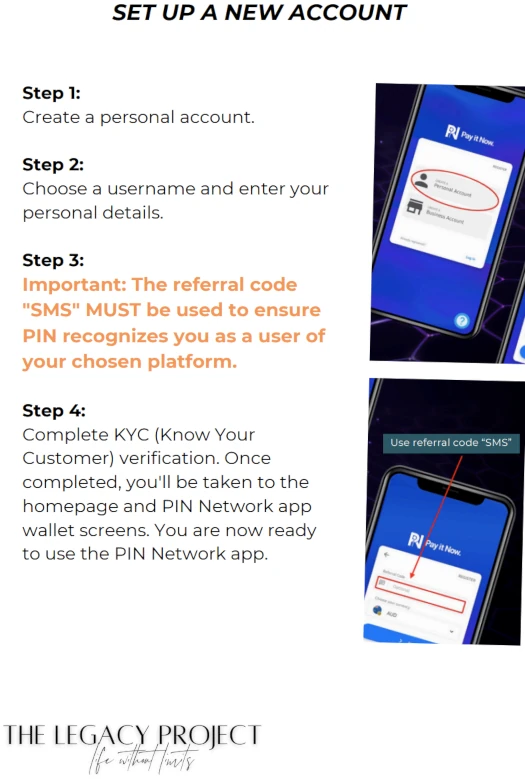

The Legacy Undertaking instructs newly recruited traders to acquire PIN’s app by way of the Google Play or Apple app shops.

Recruits are then instructed to finish PIN’s KYC course of, which incorporates checking account verification.

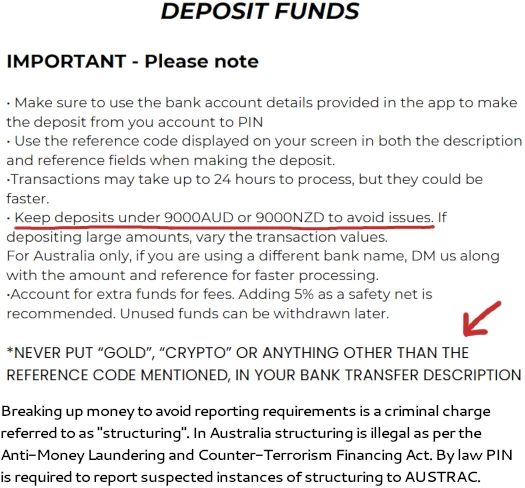

As soon as arrange, recruits are instructed to maintain transactions beneath $9000 AUD or NZD to “keep away from points”.

To deceive Australian banks, The Legacy Undertaking instructs new recruits;

By no means put “gold”, “crypto” or something apart from the reference code talked about in your financial institution switch description.

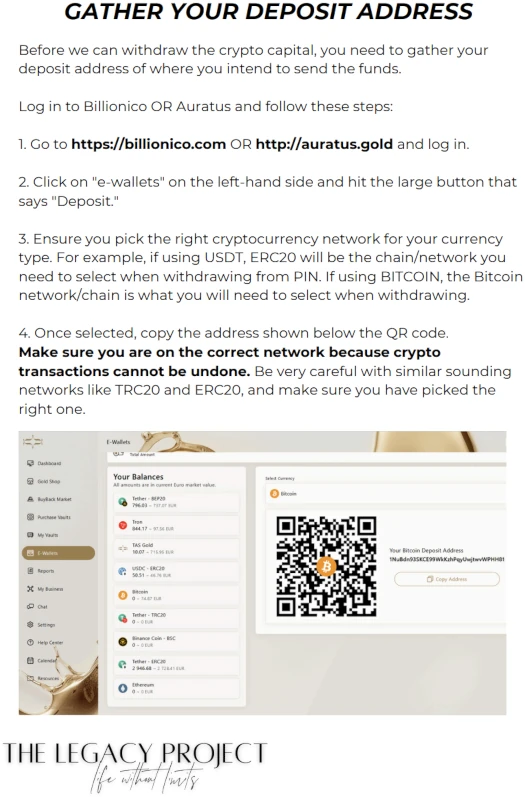

As soon as funds have been transferred from Australian banks to PIN, presumably in violation of Australian finance legislation, recruits should “collect [a] deposit handle” from Billionico or Auratus.

Withdrawing sees recruits switch from Billionico or Auratus to PIN, who then switch funds to native Australian financial institution accounts, once more in potential violation of Australian finance legislation.

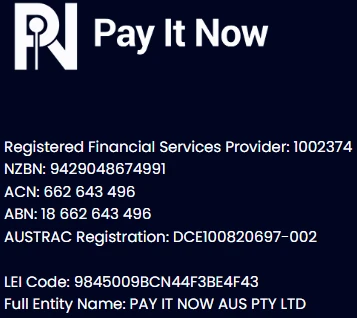

Of their advertising information The Legacy Undertaking gives monetary licensing particulars for PIN.

This consists of an

- Australian Firm Quantity (ACN);

- Monetary Companies Supplier quantity for New Zealand (FSD, though I feel that’s purported to be FSP); and

- AUSTRAC registration quantity

A go to to PIN’s web site (“payitnow.io”), reveals an extra Authorized Entity Identifier quantity (LEI code):

A LEI code is required in Australia when an organization participates in sure buying and selling markets (OTC, commodities, CFDs, securities and self-managed superannuation funds).

Co-founders Craig Duffield and Jitendra Maharaj launched Pay It Ahead in New Zealand in 2021. The corporate has ties to the US by PIN USA and Director Trenton Stanley.

Why PIN would danger its monetary licenses with clearly insufficient KYC tied to servicing of fraudulent funding schemes is unclear.

In an try to search out out, BehindMLM has reached out to PIN for remark. We’ve supplied PIN with a replica of The Legacy Undertaking’s advertising information and a hyperlink to this text.

Tying in to PIN’s ACN and FSD (FSP?) registrations, we’ve additionally reached out to ASIC and New Zealand’s FMA for remark. The FMA issued its personal Auratus securities fraud warning in September 2024.

Pending any responses from PIN, ASIC or FMA I’ll go away an replace beneath.

It must be famous that, for essentially the most half, Auratus and Billionico have been ditched for just lately launched DAO1.

Whereas the underlying unregistered securities fraud is identical, DAO1 is a transparent try to cover ties to GSB.

Whether or not PIN is getting used to solicit funding from Australian customers into DAO1 is unclear.