![]() Holton Buggs has filed motions searching for dismissal of the case towards him and dissolvement of a court-appointed Receiver.

Holton Buggs has filed motions searching for dismissal of the case towards him and dissolvement of a court-appointed Receiver.

Buggs is one in every of sixteen The Merchants Area defendants sued by the CFTC final month.

Based mostly on leaked investor information, The Merchants Area was a Ponzi scheme estimated to have defrauded shoppers out of ~$3.3 billion.

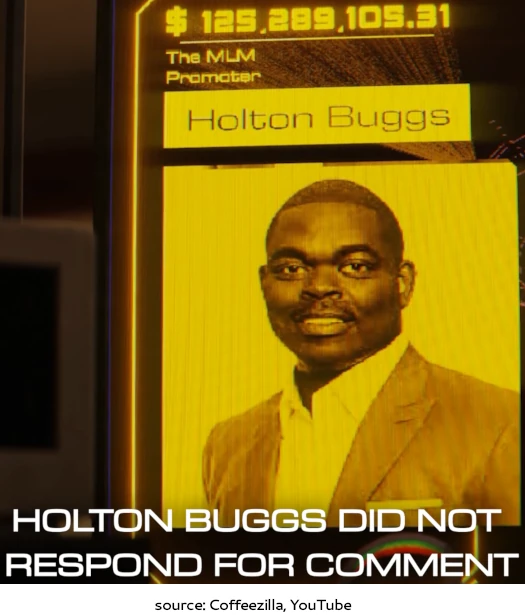

Buggs is personally believed to have stolen over $125 million by the rip-off.

In his November eleventh filed movement to dismiss, Buggs argues the CFTC’s case towards him

is predicated on nothing greater than a single incidental look at a convention in Miami and imprecise, generalized allegations of promotional actions accessible nationwide.

Buggs argues this “remoted contact” fails to determine “constitutional due course of necessities”.

In his November twelfth filed movement to dissolve the The Merchants Area Receivership, Buggs pleads ignorance.

Defendant Holton Buggs, Jr., by and thru undersigned counsel, respectfully strikes this Court docket to dissolve the receivership order issued towards him within the above-referenced case.

This movement is predicated on Defendant Buggs’ restricted, good-faith involvement in Merchants Area and his lack of information or intent relating to any alleged fraudulent exercise.

In an accompanying affidavit, Buggs throws Ted Safranko (proper), The Merchants Area’s founder and co-defendant, beneath the bus.

In an accompanying affidavit, Buggs throws Ted Safranko (proper), The Merchants Area’s founder and co-defendant, beneath the bus.

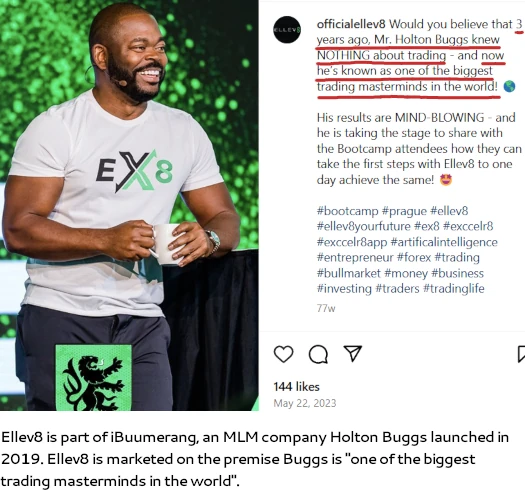

I’ve no formal schooling, expertise, or coaching in commodity buying and selling, securities buying and selling, or any associated monetary subject.

As such, in making investments, I’ve sought alternatives by respected channels and have relied on professionals in my community for investment-related recommendation and introductions.

I turned conscious of Merchants Area FX Ltd. (hereinafter “TD”) by an introduction made by one in every of my trusted workers, who beneficial TD as a possible funding alternative.

Upon studying of TD, I made a decision to rearrange a gathering with Ted Safranko, the principal of TD, to raised perceive the character of TD’s enterprise and buying and selling method.

Throughout out assembly, Mr. Safranko introduced himself as a conservative and disciplined dealer.

He argued me that his buying and selling technique concerned isolating one commerce entry per day to attenuate dangers, which he emphasised was essentially completely different from high-risk, high-frequency buying and selling methods that always lead to losses for much less skilled merchants.

Mr. Safranko defined that he had 9 years of buying and selling expertise and 7 years in compliance.

It needs to be famous that at no time was The Merchants Area or Safranko registered with the CFTC. Buggs may have confirmed this with a five-second search of the NFA’s public BASIC database.

[Safranko] additional defined that many newbie merchants endure substantial losses by partaking in a number of commerce entries all through the day.

He assured me that his single-trade-per-day technique was efficient in mitigating these dangers. Moreover, he acknowledged that he executed his once-a-day commerce personally, and that his methodology was designed to protect investor capital whereas nonetheless aiming for constant returns.

The cautious method that Mr. Safranko described appeared credible to me.

Mr. Safranko additionally mentioned his personal conservative way of life, mentioning that he lived merely in Vancouver.

His easy method and way of life bolstered my impression that he was a accountable particular person working a respectable enterprise with integrity and warning.

Along with not being registered with the CFTC, The Merchants and Area weren’t registered with the SEC both. That is once more one thing Buggs may have confirmed with a five-second search of the SEC’s public EDGAR database.

Based mostly on Mr. Safranko’s representations and assurances, I made a decision to take a position passively in TD.

I believed in good religion that TD was a respectable buying and selling enterprise and had no motive to suspect in any other case or that anybody associated to TD was partaking in any misconduct.

On his private involvement in The Merchants Area, Buggs states;

My involvement with TD was restricted to a passive participation function, during which I shared details about my expertise with a detailed circle of household and associates who expressed curiosity in it.

I’ve no official function in TD’s administration, operations, decision-making, or fund administration.

Not that it issues with respect to the CFTC’s filed fees, however Buggs admitting he promoted The Merchants Area while claiming he was solely a passive investor is, at a minimal, contradictory.

As a normal matter, I’d by no means have interaction in or take part in any exercise that I knew or had motive to consider was fraudulent of unlawful.

Along with instantly investing into and selling The Merchants Area, Buggs co-founded the Meta Bounty Hunters and Meta Bounty Huntresses Ponzi schemes.

It’s believed Buggs fed his Meta Bounty Hunters/Huntresses Ponzis into The Merchants Area. Each scams collapsed in February 2023, a number of months after The Merchants Area collapsed in late 2022.

In gentle of his claims, Buggs asks the courtroom to “relieve [him] from the receivership order”.

As a part of its lawsuit, the CFTC is searching for injunctive reduction towards the The Merchants Area defendants. A number of defendants have already consented to preliminary injunctions.

On November seventh the courtroom continued a pending TRO present trigger and preliminary injunction listening to, scheduled for November twelfth, to December tenth.

It’s anticipated the courtroom may also deal with Bugg’s filed motions as a part of the listening to.