GSPartners’ newest ploy to disable investor accounts is KYC.

GSPartners’ newest ploy to disable investor accounts is KYC.

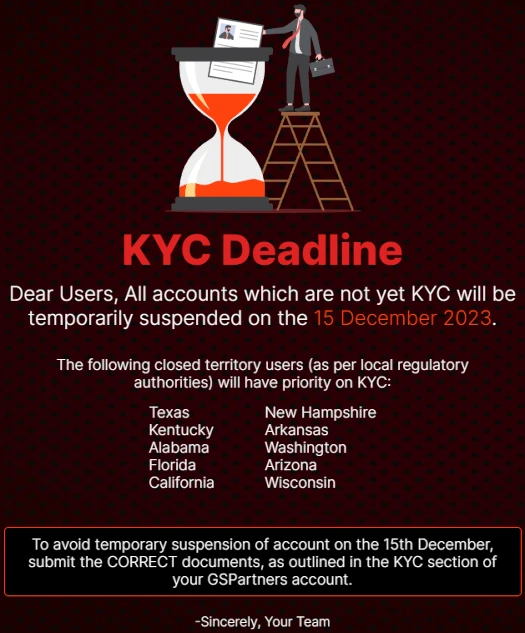

Regardless of not caring about KYC because it launched in 2020, GSPartners has suggested traders they’ve till December fifteenth to conform.

Traders to who fail to supply GSPartners with photograph ID and different private paperwork, run the chance of their accounts being “briefly suspended”.

As per the KYC discover proven to traders of their backoffice, US states which have taken regulatory motion in opposition to GSPartners obtain “precedence on KYC”.

To this point eleven US states have taken motion in opposition to GSPartners; Mississippi, Florida, Arizona, New Hampshire, Arkansas, Wisconsin, Kentucky, California, Washington, Alabama and Texas.

We’re unsure what the purpose of amassing KYC from these traders is, seeing as GSPartners is licensed to be working illegally in these states.

One risk is GSPartners may very well be gearing as much as disable investor accounts in US states which have taken securities fraud associated enforcement actions.

Supporting that is GSPartners referring to those states as “closed territories”.

It needs to be famous that securities fraud is a federal crime within the US. Particular person states taking GSPartners to activity over securities fraud is reflective of violations of the Securities and Change Act on the federal stage.

In different phrases if GSPartners is committing securities fraud in a single US state, it’s committing securities fraud throughout all US states.

BehindMLM has beforehand confirmed ongoing CFTC and SEC investigations into GSPartners.

With GSPartners unlikely to register itself with the SEC and CFTC (doing so would require it to file periodic audited monetary studies), it’s wanting like GSPartners will doubtless disable US investor accounts sooner or later.

What that appears like on the cash facet of issues stays to be seen. To this point GSPartners has failed to handle any of the securities fraud warnings it has acquired.