GSPartners has acquired a securities fraud desist and chorus order from California.

GSPartners has acquired a securities fraud desist and chorus order from California.

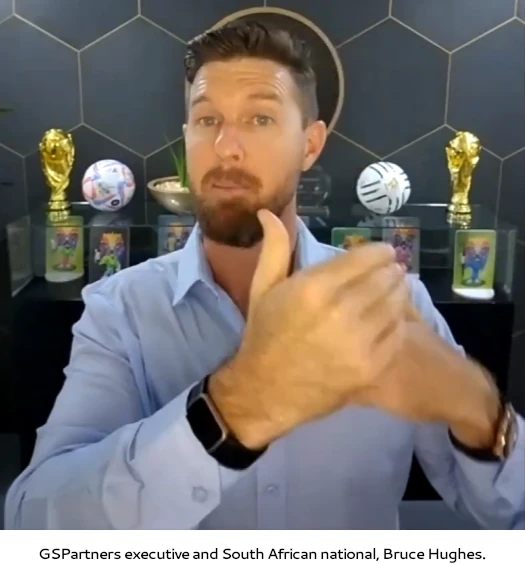

The Division of Monetary Safety and Innovation’s November sixteenth order names GSPartners, proprietor Josip Heit and executives Bruce Innes Wylde Hughes and Dirc Zahlmann as respondents.

As per DFPI’s order;

Starting a minimum of as early as 2023, GSPartners supplied and offered securities within the type of funding contracts in California by way of basic solicitations on its web site.

GSPartners referred to those funding contracts as “Certificates,” “MetaCertificates,” “Elemental Certificates,” and “Success Certificates” (collectively, Certificates).

Beneath Swiss Valorem Financial institution branding, BehindMLM reviewed the then newest iteration of GSPartners’ MetaCertificates again in Might.

GSPartners held itself out as an funding platform.

The purported objective of the securities choices was for GSPartners to make use of investor funds to commerce within the foreign exchange market and to spend money on a various assortment of real-world trade sectors, together with actual property, fintech, funds methods, renewable power, dietary supplements, and gaming, which in flip would generate returns for traders who bought Certificates.

As a part of their investigation, DFPI honed in on GSPartners’ illustration it had “partnered with a selected foreign exchange dealer”. The unnamed dealer is believed to be BDSwiss.

Based on GSPartners, this dealer would offer companies to GSPartners’ traders, together with buying and selling and managing investor funds deposited into GSPartners by way of Certificates.

Buyers had been advised that this dealer was one of many largest on the planet, was licensed, regulated, and had a reliable fame, and that buying GSPartners’ Certificates would give traders unique entry to this dealer’s expertise and information.

GSPartners was purportedly in a position to pay such excessive returns on the Certificates in a sustainable method due to the worthwhile

trades carried out by this dealer’s skilled merchants. Nevertheless, GSPartners’ representations had been false.In actuality, no such partnership existed, and the purported returns weren’t being generated by the dealer managing and buying and selling GSPartners’ traders’ funds.

DFPI confirming GSPartners is just not producing exterior income as represented, blows a large open gap in its Ponzi ruse.

Additionally a violation of California legislation is GSPartners and Heit (proper), representing it to be a financial institution.

Additionally a violation of California legislation is GSPartners and Heit (proper), representing it to be a financial institution.

GSPartners, by way of its web site and advertising, represented that it was a regulated financial institution.

For instance, along with utilizing the time period “financial institution” within the identify Swiss Valorem Financial institution, GSPartners additionally represented that it was a “licensed financial institution with a strong stability sheet and digital custody insurance coverage.”

GSPartners additionally represented that it was “revolutionising the banking trade,” that its “modern method to banking combines one of the best of each worlds, providing cutting-edge digital options alongside the steadiness and safety of conventional banking,” and that it could possibly be “trusted” as a result of it was a “absolutely regulated financial institution.”

GSPartners additionally claimed to “ship enticing returns in digital belongings markets in a protected and absolutely regulated method,” and touted its “strict adherence to regulatory framework as is required of a licensed banking and securities supplier.”

And at last we now have securities fraud, by the use of GSPartners not being registered to supply securities in California.

The Certificates supplied by GSPartners had been securities that had been neither certified nor exempt from the qualification requirement beneath the CSL. The Division has not issued a allow or different type of qualification authorizing GSPartners to promote these securities in California.

Albeit not directly, DFPI additionally references retaliatory litigation filed by GSPartners concentrating on BehindMLM.

GSPartners made efforts to stop the dissemination of any unfavourable details about GSPartners and its investments.

GSPartners initiated litigation in the US and Europe to suppress criticism of its investments, significantly in opposition to web sites and social media content material that described GSPartners as a Ponzi scheme or a fraud.

GSPartners branded the creators of those web sites as “criminals” and threatened to take motion in opposition to anybody “discovered to be spreading this unlawful content material.”

Summing up GSPartners’ violations of Californian legislation, DFPI writes;

In reference to the supply or sale of those securities, GSPartners, Heit, Hughes, and Zahlmann made, or triggered to be made, unfaithful statements of fabric truth and materials omissions to traders and potential traders, together with however not restricted to the next:

a. falsely representing that GSPartners was partnered with a selected foreign exchange dealer to supply companies to GSPartners’ traders, together with buying and selling and managing traders’ funds deposited into GSPartners;

b. representing that GSPartners was a licensed financial institution whereas omitting the truth that its “license” was granted by a fictitious regulator (Comoros);

c. utilizing the phrases “financial institution” and “banking” whereas omitting the truth that GSPartners was not licensed to have interaction within the enterprise of banking in California and that investor funds weren’t FDIC-insured;

d. misrepresenting the anticipated earnings and danger of loss; and

e. failing to reveal that the supply or sale of GSPartners’ securities was not certified in California.

On account of committing securities fraud and working illegally, DFPI has ordered

GSB Gold Customary Financial institution Ltd. d/b/a GSPartners, GSP, and Gold Customary Companions, Swiss Valorem Financial institution Ltd., GSB Gold Customary Company AG, Josip Heit, Bruce Innes Wylde Hughes, and Dirc Zahlmann … to desist and chorus from the additional supply or sale of securities in California, together with however not restricted to funding contracts referred to as Certificates, except and till the qualification necessities of the CSL have been met.

GSPartners is at present gearing as much as maintain a advertising occasion on November 18th in Cape City, South Africa.

It’s anticipated, in violation of a number of state-level desist orders issued as we speak, that on the occasion GSPartners will additional violate US securities legislation.

Along with California, Washington, Alabama and Texas have all taken regulatory motion. BehindMLM additionally lately confirmed ongoing CFTC and SEC investigations into GSPartners.