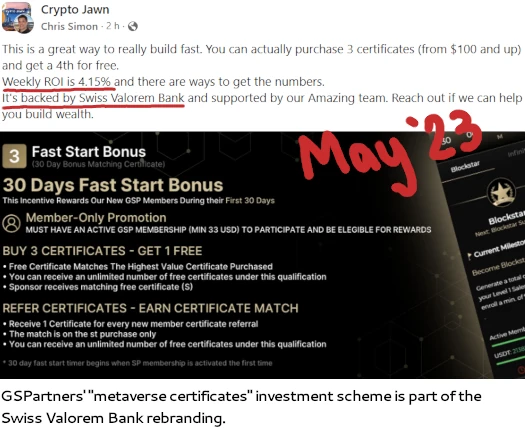

GSPartners has rebranded as Swiss Valorem Financial institution.

GSPartners has rebranded as Swiss Valorem Financial institution.

The transfer follows a number of GSPartners associated securities fraud warnings from monetary regulators.

Swiss Valorem Financial institution is ready up by Swiss Valorem Financial institution LTD and IBBP Pay Companies LTD, each shell firms just lately registered in Kazakhstan.

CoinX24 AG can also be listed on Swiss Valorem Financial institution as a shell firm registered in Switzerland.

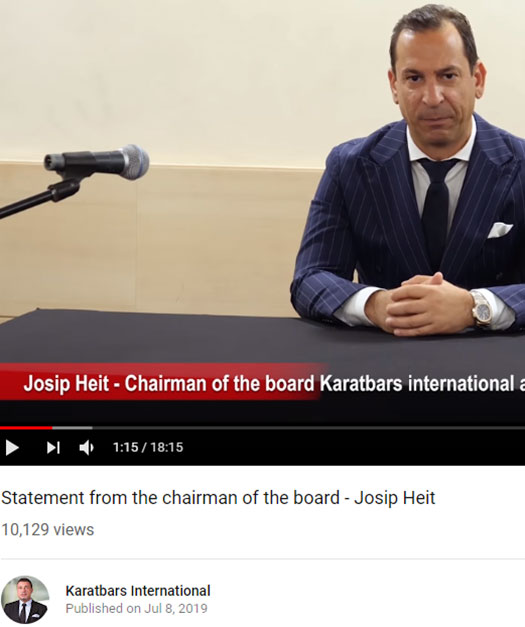

There is no such thing as a point out of GSPartners or proprietor Josip Heit on Swiss Valorem Financial institution’s web site, though the rebrand operates from the identical “gspartners.international” area.

GSPartners is run by Josip Heit out of Dubai. Initially from Croatia, Heit is believed to carry a German passport.

Neither GSPartners or any off its related shell firms have a bodily presence in Kazakhstan.

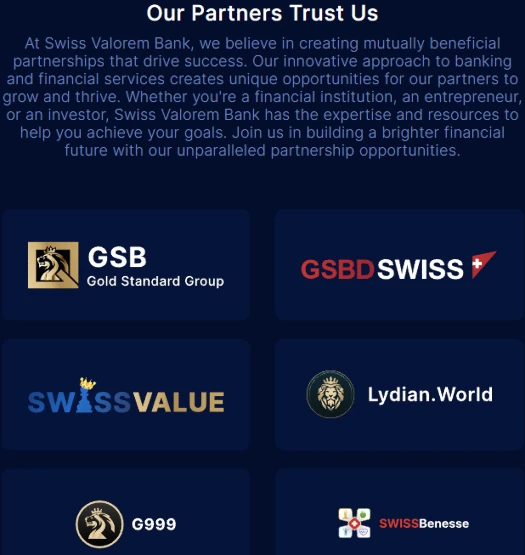

Different branding on Swiss Valorem Financial institution’s web site consists of GSB Gold Normal Group, GSBDSwiss, Swiss Worth, Lydian World, G999 and SwissBenesse.

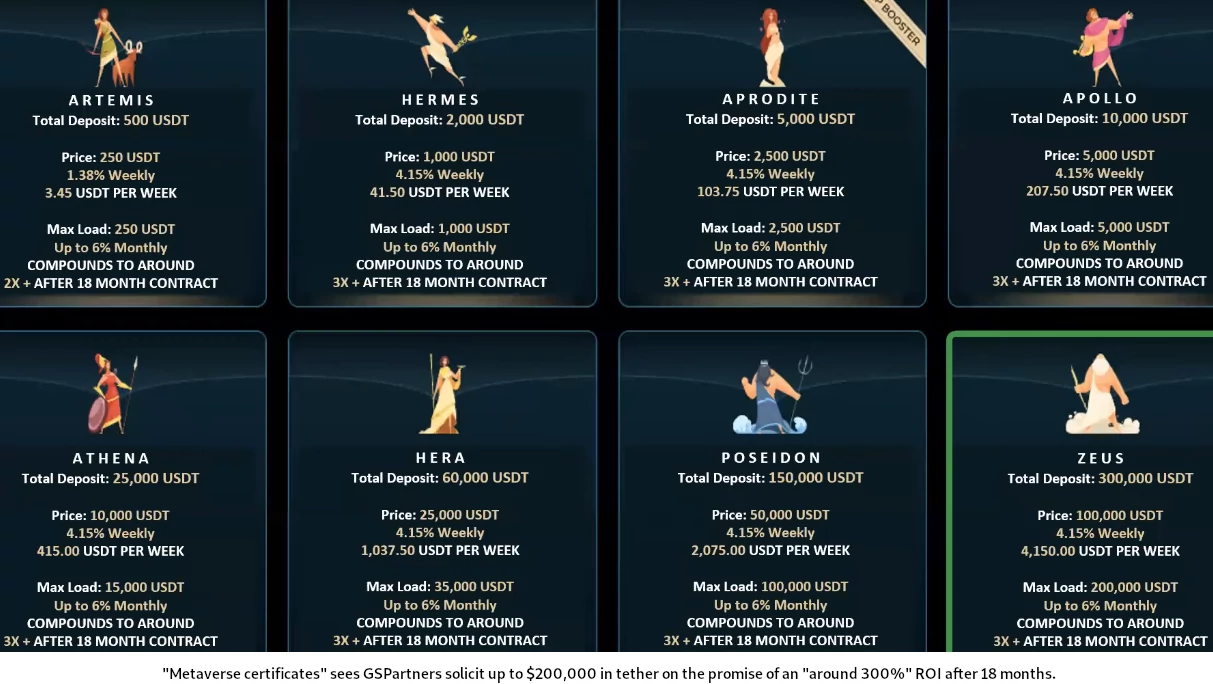

The brand new Swiss Valorem Financial institution web site additionally fails to reveal GSPartners’ metaverse certificates funding scheme, by which buyers are pitched a 300% passive ROI over 18 months (click on beneath to enlarge).

Again in June 2022 the Central Financial institution of Comoros issued a GSB Gold Normal Financial institution LTD banking fraud warning.

Extra just lately Canadian authorities have taken motion in opposition to GSPartners.

On March ninth Quebec’s Autorite des Marches Financiers issued a GSPartners securities fraud warning.

The warning included an inventory of 52 domains related to GSPartners and GSB Gold Normal Financial institution LTD, together with the corporate’s web site and GSTrade.

On March fifteenth the Alberta Securities Fee added GSTrade and G999 to its funding warning listing, advising the businesses “look like partaking” in securities fraud “or could also be scams”.

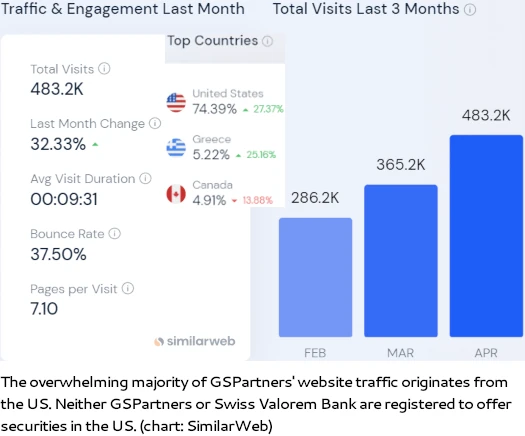

Neither GSPartners or Swis Valorem Financial institution itself are registered to supply securities within the jurisdictions they actively solicit funding in.

This consists of the US, which makes up the majority of GSPartners web site site visitors.

GSPartners’ web site site visitors knowledge corresponds with nearly all of GSPartners and Swiss Valorem Financial institution buyers being US residents.

With respect to regulation of MLM firms committing securities fraud within the US, the SEC warns that

any funding in securities within the U.s. stays topic to the jurisdiction of the SEC.

We’re involved that the rising use of digital currencies within the international market could entice fraudsters to lure

buyers into Ponzi and different schemes.Ponzi schemes sometimes contain investments that haven’t been registered with the SEC or with state securities regulators.

Pending additional motion by monetary regulators or legislation enforcement, we’ll hold you posted.