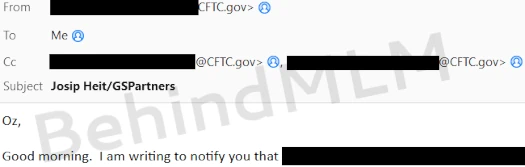

BehindMLM can affirm that GSPartners and proprietor Josip Heit are the topics of a number of federal and state regulatory investigations within the US.

BehindMLM can affirm that GSPartners and proprietor Josip Heit are the topics of a number of federal and state regulatory investigations within the US.

Investigations we’re conscious of are the CFTC, SEC and Alabama Securities Fee.

Sadly because of the private nature of US regulatory investigations, we are able to’t present any specifics. What I can inform you is I’ve personally spoken with Senior Trial Attorneys placing collectively one of many circumstances.

Affirmation of those investigations is critical, as the vast majority of GSPartners buyers are US residents.

Sometimes BehindMLM wouldn’t report on non-publicly verifiable data however I discover myself in a precarious place – extra on that later at the moment.

Typically talking and impartial from my communication with US regulators, right here’s what every company is more likely to be inspecting.

The CFTC investigating GSPartners & Heit

The CFTC is a federal US regulator that primarily investigates commodities fraud.

With respect to GSPartners, it will probably pertain to the illustration that, by way of its “metaverse certificates” funding scheme, revenue is generated by way of foreign currency trading, real-estate and renewable vitality.

GSPartners pitches passive returns on its commodities providing as excessive as 5% per week.

At no time has GSPartners, Josip Heit or any of GSPartners’ related shell firms been registered with the CFTC.

This on face worth constitutes commodities fraud.

The SEC investigating GSPartners & Heit

Though simplified, an usually cited rule of thumb on BehindMLM is “MLM + passive funding scheme = securities providing”.

The SEC is a US federal regulator that primarily investigates securities fraud.

To ascertain a securities providing, an MLM firm have to be confirmed to offer customers an funding contract.

Below US legislation, the existence of an funding contract is set by way of the Howey Take a look at.

Below the Howey check, an “funding contract” exists when there’s the funding of cash in a typical enterprise with an inexpensive expectation of earnings to be derived from the efforts of others.

Damaged down, beneath the Howey Take a look at you’ve got “the funding of cash … in a typical enterprise … with the expectation of revenue … to be derived from the efforts of others”.

With respect to GSPartners’ metaverse certificates funding scheme:

- GSPartners solicits funding in tether.

- GSPartners buyers make investments into GSPartners immediately, making it a typical enterprise.

- GSPartners markets its metaverse certificates scheme on the promise of weekly returns, creating an “expectation of revenue” amongst buyers.

- GSPartners’ metaverse certificates scheme is fully passive for buyers. Any earnings acquired are derived solely “from the efforts of others” (the assorted exterior income ruses GSPartners presents to buyers).

Upon satisfying the existence of an funding contract, a securities providing is established. MLM firms providing securities to US residents must be registered with the SEC.

Past registration, periodic submitting of audited monetary studies is a authorized requirement. That is the one strategy to confirm that an MLM firm claiming to have interaction in income producing actions is doing what they declare to be.

At no time has GSPartners, Josip Heit or any of GSPartners’ related shell firms been registered with the SEC.

This on face worth constitutes securities fraud.

The SEC warns customers that unregistered firms engaged in securities fraud are more likely to be Ponzi schemes.

We’re involved that the rising use of digital currencies within the world market might entice fraudsters to lure buyers into Ponzi and different schemes by which these currencies are used to facilitate fraudulent, or just fabricated, investments or transactions.

The fraud can also contain an unregistered providing or buying and selling platform.

These schemes usually promise excessive returns for getting in on the bottom flooring of a rising Web phenomenon.

Ponzi scheme organizers usually use the newest innovation, expertise, product or development business to entice buyers and provides their scheme the promise of excessive returns.

Ponzi schemes usually contain investments that haven’t been registered with the SEC or with state securities regulators.

The Alabama Securities Fee investigating GSPartners & Heit

Whereas the CFTC and SEC conduct civil investigations, the Alabama Securities Fee’s circumstances are each civil and felony in nature.

Additionally whereas the CFTC and SEC are more likely to be investigating GSPartners at an organization degree, state regulators usually additionally hone in on native promoters.

Any motion introduced by the ASC might embody civil and felony prices, going after GSPartners promoters concentrating on residents of Alabama.

Closing ideas

Whereas we’re in a position to affirm a number of US regulatory investigations into GSPartners at this stage, this shouldn’t be taken as a definitive checklist. There would possibly very properly be different US investigations we’re presently not conscious of.

Every time it occurs, civil and probably felony fraud prices might be filed and made public. BehindMLM will in fact be reporting on and monitoring the assorted circumstances.

With the SEC and CFTC investigating, there’s a excessive likelihood the DOJ may also be operating its personal federal felony case. The scope of GSPartners and fraud perpetrated towards US residents would definitely warrant it.

I count on past GSPartners and Josip Heit (proper), GSPartners executives and insiders can even be focused.

I count on past GSPartners and Josip Heit (proper), GSPartners executives and insiders can even be focused.

Within the meantime, the place does this depart GSPartners buyers?

GSPartners confirmed the primary indicators of collapse in September 2023. This occured by the use of sudden withdrawal delays.

In an tried cowl up, buyers who publicly mentioned the delays had their funds seized and accounts terminated.

A couple of weeks later, on October 1st, GSPartners disabled weekly returns for buyers who had been withdrawing. So as to reinstate their weekly returns, these buyers needed to deposit round 27% of their preliminary funding.

This successfully “reset” anybody who had invested up to now six months or so. It additionally worn out anybody who didn’t wish to cough up one other ~27% of their preliminary funding.

A couple of days after this announcement, GSPartners then rolled out a compulsory 50% withdrawal price. Following backlash from buyers, this was scaled again to as little as 12.5% for GSPartners’ earliest metaverse certificates buyers.

New buyers on GSPartners’ newest funding plans are nonetheless slugged with the 50% price.

For anybody aware of MLM Ponzi schemes, what is going on is clear.

Should you’re a GSPartners investor studying this, you already know the mantra: Your cash is gone – squirreled away by Heit to who is aware of the place.

You additionally know that numbers on a display screen are meaningless if the withdrawal gates are closed, as has occurred twice already.

As your cash is stolen from you thru a posh MLM Ponzi net of lies, you may both sit quietly or take motion.

Complaints might be filed with the CFTC, SEC and ASC on their respective web sites.

Replace 2nd November 2023 – Considerably associated to GSPartners being beneath investigation, is BehindMLM beneath risk on account of Josip Heit’s abuse of worldwide and US courts.