GSPartners has acquired a securities fraud stop and desist from New Hampshire.

GSPartners has acquired a securities fraud stop and desist from New Hampshire.

As per New Hampshire’s Bureau of Securities Regulation’s November sixteenth order, GSPartners is successfully banned throughout the state.

Respondents named in BSR’s order are:

- GSB Gold Commonplace Financial institution (dba GS Good Finance, Gold Commonplace Companions, GSPartners, GS Companions & GSP)

- GSB Gold Commonplace Banking Company PLC

- GSB Gold Commonplace Company AG

- GSB Gold Commonplace Pay Kommanditbolag (aka GSB Gold Commonplace Pay LTD, performing beneath the model identify GSDEFI)

- GSB Gold Commonplace Commerce

- Swiss Valorem Financial institution LTD

- Josip Dortmund Heit (GSPartners’ proprietor)

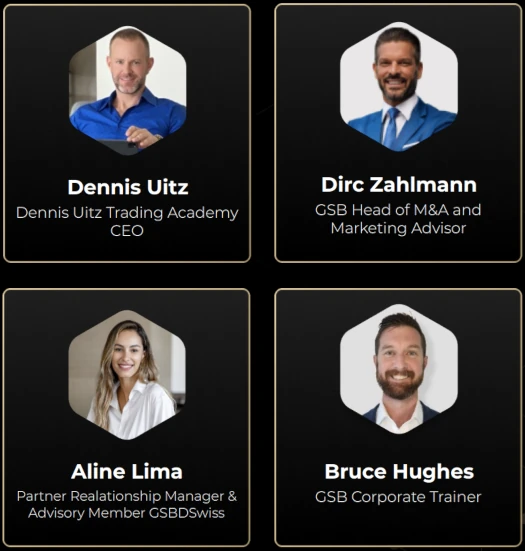

- Bruce Innes Wylde Hughes (GSPartners’ Company Coach)

- Aline Lima (GSPartners’ Accomplice Relationship Supervisor) and

- Dirc Zahlmann (GSPartners’ CEO)

Collectively, BSR refers to GSPartners as

a world coalition … of assorted fraudulent funding schemes which might be threatening rapid and irreparable public hurt.

This evaluation relies on a joint investigation by

securities regulators from america and Canada, (who) recognized the risk introduced by GSB Group and arranged a working group to collectively examine its dealings.

As per BSR’s order, GSB Gold Commonplace Financial institution began off as GCC Gazella Company Capital GmbH, a German shell firm “concerned within the manufacture, import, export and distribution of chemical substances, plastics, plant safety merchandise, and dyes.”

GCC Gazella Company Capital was owned by Josip and Kristina Heit. BSR doesn’t state when it occurred, however in some unspecified time in the future GCC Gazella Company Capital modified its identify to GSB Gold Commonplace Banking Company AG.

This new shell firm was owned by Josip Heit, Kristina Heit, Ulf Lammers and Andrey Labuzdko.

In 2021, GSB Gold Commonplace Banking Company AG modified its identify as soon as once more to Gold Commonplace Company AG.

It’s this firm identify that Heit’s GSPartners Ponzi scheme has operated beneath (launched in 2021, the present iteration is “Swiss Valorem Financial institution“).

Heit’s Ponzi scheme is run by a collection of “proprietary inner tokens”, which BSR casts doubt on even current.

The proprietary inner tokens are represented by the tickers GEUR, CVEUR, LEUR and DEUR.

They’re extremely illiquid property, will not be traded on most if not all exterior cryptocurrency exchanges and have little or no honest market worth.

Furthermore, Respondent GSP shouldn’t be offering shoppers with entry to dam explorers for GEUR, CVEUR, LEUR and DEUR, and they aren’t disclosing info referring to their consensus mechanisms, their contract addresses or their contracts.

Merely put, Respondent GSP shouldn’t be offering shoppers with ample info to indicate GEUR, CVEUR, LEUR and DEUR truly exist.

In a nutshell, BSR has decided GSPartners’ MLM alternative constitutes a securities providing.

Respondents GSP and Hughes mistakenly and falsely (declare) Respondent GSP makes use of proprietary tokens like CVEUR, which represents convertible euro, as a substitute of exterior tokens like BTC and ETH, so it could pay rewards while not having a securities license.

Their statements are materials misrepresentations in violation of (New Hampshire regulation) as a result of:

-Utilizing inner proprietary tokens corresponding to CVEUR as a substitute of BTC or ETH doesn’t influence the regulation of the Elemental and Success Sequence Certificates and investments within the LYS Staking Pool by the Securities Act, and

-The Elemental and Success Sequence Certificates are regulated as securities whatever the use (of) inner methods, ledgers, blockchains or tokens.

A. Events providing the Elemental Certificates, Success Sequence Certificates, and investments within the LYS Staking Pool in or from New Hampshire are violating (New Hampshire regulation), referring to the registration of events that supply and promote securities, and

B. Events that supply or promote the Elemental Certificates and Success Sequence Certificates in or from New Hampshire are violating (New Hampshire regulation), referring to the registration and allowing of securities.

GSPartners’ use of the phrase “financial institution” in Swiss Valorem Financial institution branding can also be a cited regulatory situation;

Respondents Swiss Valorem Financial institution and GSP are utilizing the time period “financial institution” of their names and describing Respondent GSP as a financial institution.

These statements are materials misrepresentations in violation of (New Hampshire regulation) as a result of:

-Respondents Swiss Valorem Financial institution and GSP are providing securities in or from New Hampshire and never licensed or chartered as a financial institution by the New Hampshire Banking Division, and

-New Hampshire residents that buy Elemental Certificates, Success Sequence Certificates, and different merchandise promoted by Respondent GSP will not be protected by FDIC insurance coverage or state legal guidelines designed to guard banking customers.

Moreover BSR additionally cites retaliatory authorized motion initiated by GSPartners. The primary instance is a Virginia lawsuit filed in opposition to Chris Saunders in 2021.

For instance, Christopher Saunders is a resident of Virginia that operated numerous social media channels, together with a YouTube channel named Grit, Grind, Gold (@gritgrindgold) for brand new entrepreneurs searching for new methods to generate profits on-line.

He used his social media channels to publish detrimental details about sure members of GSB Group.

On December 16, 2021, Respondent GS Company AG, Respondent Heit, Antonio “Tony” Euclides Meneses De Gouveia (as an impartial affiliate of Respondent GS Company AG) and Michael Dalcoe (an impartial affiliate of Respondent GS Company AG) filed a grievance in opposition to Mr. Saunders in GSB Gold Commonplace Company AG et al. v. Saunders, Case No. 1:21-cv-01398-RDAIDD, in america District Court docket for the Japanese District of Virginia, Alexandra Division.

The lawsuit claims Mr. Saunders “makes use of his Social Media Channels to publish purported statements of reality associated to varied corporations working within the cryptocurrency area.”

Additionally they declare Saunders revealed at the very least 99 movies in social media “that broadcast a litany of false and defamatory factual statements relating to GSB.”

On August 2, 2022, the case was dismissed with out prejudice by stipulation of all events, together with Respondents GS Company AG and Heit.

BSR additionally cites GSPartners’ New York Supreme Court docket petition focusing on BehindMLM.

Additionally, Behind MLM operates a web site accessible at behindmlm.com.

The nameless principal referred to as Oz acknowledged “[t]right here’s numerous garbage MLM assessment and information websites on the web that masquerade solely as lead technology instruments” and purportedly created the web site to “present the general public with related and

correct MLM info, information, and firm opinions.”Behind MLM has been posting details about GSB Group and argued its members are operating a Ponzi scheme.

Respondent GS Company AG decided the IP tackle for behindmlm.com is hosted by Google, LLC, and that its area is registered with GoDaddy, Inc.

On or about December 20, 2022, Respondent GS Company AG filed a petition within the Supreme Court docket of the State of New York, County of New York, Index No. 160880, in opposition to Google LLC and Go Daddy Inc.

The petition was verified by Respondent Heit because the Chairman to the Board of Administrators of Respondent GS Company AG.

Respondent Heit licensed the petition, and it describes Respondent GS Company AG as follows:

A. Respondent GS Company AG is “a number one software program producer which, within the IT and Blockchain sector, provides subtle “white label” software program merchandise in addition to {hardware} buying and selling modules and platforms to be used within the monetary trade,” and

B. Respondent GS Company AG “offers a set of high-quality providers that rely by itself blockchain, and collectively varieties an elite group and a structured ecosystem.

Amongst these providers is a decentralized cryptocurrency, G999, which makes use of blockchain expertise to supply its customers with a dependable, safe, and confidential service to successfully construct and develop non-public financial relations.”

It additionally alleges the unknown particular person or people who function behindmlm.com have posted “quite a few defamatory and false statements about GSB, labeling GSB as a fraud and a Ponzi scheme.”

It sued Google, LLC, and Go Daddy, Inc., to compel them to determine the person or people working the web site as a result of its “world repute for integrity and transparency is of paramount significance to its enterprise.”

On November 3, 2023, the Court docket denied motions to quash the subpoenas filed by behindmlm.com. On the identical day, counsel for Behind MLM filed a discover of attraction to the Supreme Court docket Appellate Division, First Division.

Respondent Swiss Valorem revealed the next details about the litigation involving Behind MLM on the Swiss Valorem Web site:

… Because of present ongoing authorized motion in opposition to a bunch of criminals, and the platforms they use for his or her criminality, our authorized group, alongside with the Model and Relationship Administration group, have issued directions to suspends [sic] the accounts of a small variety of offending members who’re working with the criminals to additional their trigger.

Whoever is discovered to be spreading this unlawful content material, may even be thought of equipment, and their particulars handed over to the authorized group dealing with these circumstances.

The criminals are utilizing the BehindMLM platform, in addition to smaller platforms to cover their identities…

… We’ll NOT tolerate criminals or acts of abuse in opposition to our model, related manufacturers, services or products.

At time of publication Heit’s retaliatory NYSC petition focusing on BehindMLM stays energetic.

Along with securities fraud and retaliatory litigation, BSR additionally notes a number of disclosure violations.

These pertain to GSPartners failing to speak in confidence to customers, amongst different issues, “the identification of its homeowners” and “property, liabilities, income, and different monetary info related to its capitalization and operations”.

Respondents GS Company AG, GSP, Heit, and Zahlmann are deliberately failing to reveal the identification of corporations, organizations or initiatives that compromise the blockfolios tied to Elemental Certificates and Success Sequence Certificates.

Respondents GS Company AG, GSP, Heit, and Zahlmann are deliberately failing to reveal the operations, income, capitalization, profitability, and placement of corporations, organizations, and merchandise tied to every blockfolio.

In gentle of BSR discovering GSPartners is committing securities fraud and different acts that represent “fraud and deception”, BSR concludes;

A. Respondents are violating the Securities Act and conducting their enterprise in a fashion that isn’t legally sound, and

B. As described herein, Respondents GSP, Heit, and Zahlmann have applied an unlawful multilevel advertising and marketing system that compensates members for promoting securities in or from New Hampshire with out correct licensure.

Reduction sought by BSR consists of GSPartners Respondents

- instantly ceasing and desisting from additional violations of New Hampshire regulation;

- instantly ceasing and desisting from “omitting info in reference to providing securities in New Hampshire”;

- instantly ceasing and desisting from “offering materials misrepresentations in reference to the providing of securities in New Hampshire”;

- instantly ceasing and desisting from “providing unregistered securities in New Hampshire”;

- be completely barred from acquiring a securities license in New Hampshire;

- pay a to be decided superb and restitution to GSPartners victims in New Hampshire; and

- pay BSR’s authorized prices

GSPartners has thirty days from November sixteenth to request a listening to to dispute BSR’s order, failing which the unopposed requested aid will probably be granted.

Along with New Hampshire, Arkansas, Wisconsin, Kentucky, California, Washington, Alabama and Texas have all taken regulatory motion in opposition to GSPartners and Josip Heit.

BehindMLM additionally not too long ago confirmed ongoing CFTC and SEC investigations into GSPartners.

Outdoors of the US, GSPartners has acquired seven securities fraud warnings from Canadian authorities; British Columbia, Ontario, Alberta (G999, GSTrade and GSPartners), Quebec and Saskatchewan.

As a part of a joint operation with their US counterparts, earlier this week the British Columbia Securities Fee took additional motion in opposition to three GSPartners promoters.

The Australian Securities and Investments Fee added GSPartners to its Investor Alert Record on November fifteenth. South Africa’s FSCA additionally issued a GSPartners securities fraud warning on November twenty second.

Given the scope of GSPartners’ fraud throughout the US and involvement of federal regulators, it’s extremely probably the DOJ are additionally constructing a felony case.

So far neither Josip Heit or any GSB executives have addressed the GSPartners regulatory enforcement actions.

As an alternative, someday over the previous few days GSPartners introduced a “booster” scheme.

Underneath the brand new booster scheme, GSPartners traders are inspired to make a further 20% funding of their unique deposit.

That is accomplished on the promise of

- a 50% elevated end-of-contract bonus;

- resetting of current 52 week contracts; and

- a brand new equal worth funding place in GSPartners’ new “Success Sequence” certificates scheme (equal to the unique quantity invested into a previous certificates scheme)

Notably, the booster scheme successfully pushes again the lump sum bonus GSPartners has to pay out on the finish of current contracts by as much as 30 months.

In gentle of regulatory enforcement motion from the US, Canada, South Africa and Australia, why GSPartners is determined to dodge upcoming end-of-contract payouts must be apparent.