Metamask has blocked three GSPartners associated domains for “nefarious exercise”.

Metamask has blocked three GSPartners associated domains for “nefarious exercise”.

Metamask, a US-based software program firm, pitches itself as “the main self-custodial pockets.”

The protected and easy technique to entry blockchain functions and web3. Trusted by tens of millions of customers worldwide.

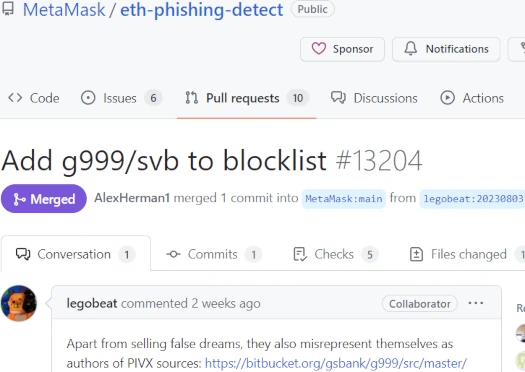

On August 4th, Metamask Safety Engineer “legobeat” requested GSPartners be added to the platform’s blocklist.

As above, legobeat’s reasoning for the request was GSPartners “promoting false goals” and in addition “misrepresent(ing) themselves as authors of PIVX”.

As per its web site, PIVX is a “privacy-focused, proof of stake blockchain”.

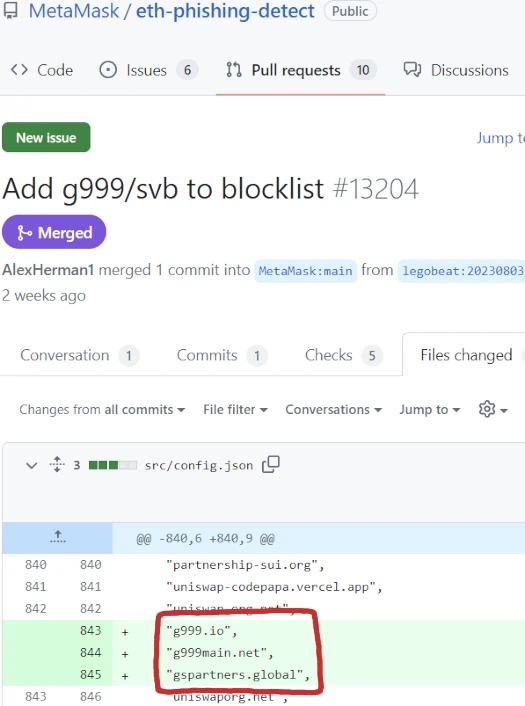

Legobeat’s request was accredited by Help Product Lead Alex Herman on August fifth. Three GSPartners web site domains have been added to Metamask’s blocklist later that very same day.

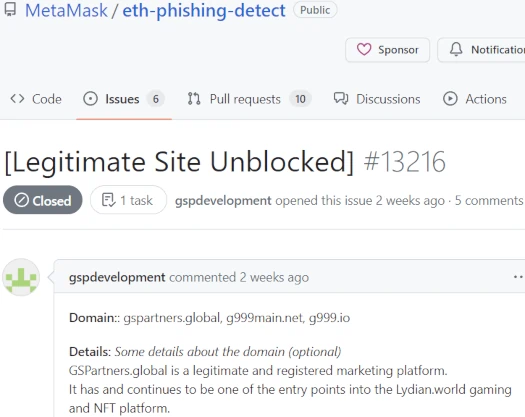

Later nonetheless on August fifth, “gspdevelopment” appeared on Metamask’s Github to beg for a reversal.

The G999 blockchain makes use of Bitcoin Core code in addition to PivX code, as described on the G999main.internet website, with full credit score and licensing attributed to each Core codes.

We hope this brief however detailed rationalization helps you to find the proper info surrounding the websites which have been wrongfully reported.

Following an inner assessment, on August tenth Alex Herman knowledgeable GSPartners “we aren’t unblocking these websites after additional assessment.”

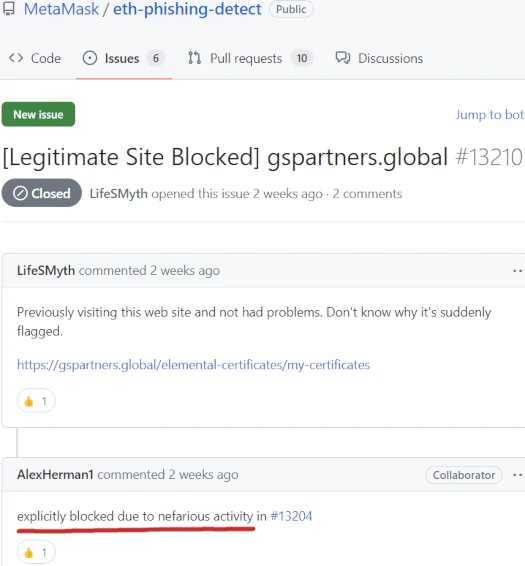

Since then a number of GSPartners buyers have introduced up the block on Metamask’s Github. Because the matter is resolved, these requests have been closed.

On one such request, filed on August fifth, Alex Herman knowledgeable an investor GSPartners has been “explicitly blocked attributable to nefarious exercise”.

Opposite to GSPartners’ illustration to Metamask that it’s “a official and registered advertising platform.”, GSPartners commits securities fraud within the jurisdictions it solicits funding in.

GSPartners rebranded as Swiss Valorem Financial institution after Canadian authorities started issuing GSPartners fraud warnings.

Primarily based on web site visitors, the vast majority of GSPartners’ buyers are US residents.

As per the Howey Check, GSPartners’ passive 5% per week funding alternative constitutes a securities providing.

In violation of US legislation, GSPartners isn’t registered with the SEC or any US state securities regulator.

The SEC warns customers that securities fraud and Ponzi schemes go hand in hand:

We’re involved that the rising use of digital currencies within the international market could entice fraudsters to lure buyers into Ponzi and different schemes through which these currencies are used to facilitate fraudulent, or just fabricated, investments or transactions. The fraud may contain an unregistered providing or buying and selling platform.

These schemes typically promise excessive returns for getting in on the bottom ground of a rising Web phenomenon.

Federal and state securities legal guidelines require sure funding professionals and their corporations to be licensed or registered.

Many Ponzi schemes contain unlicensed people or unregistered corporations.

To this point GSPartners has not publicly addressed Metamask blocking it, or its a number of regulatory fraud warnings.