GPayBack fails to offer possession or govt info on its web site.

GPayBack fails to offer possession or govt info on its web site.

GPayBack’s web site area (“gpayback.io”), was privately registered on November twenty fourth, 2023.

Additional analysis reveals a GPayBack advertising and marketing video hosted on Simon Stepsys’ YouTube channel:

Within the video, Andre Heber is launched as GPayBack’s founder.

Andre Heber popped up on BehindMLM’s radar in 2016, as proprietor of the collapsed Infinity DailyWin Ponzi.

By way of a convoluted voucher ruse, Infinity DailyWin pitched shoppers on a 120% to 135% ROI.

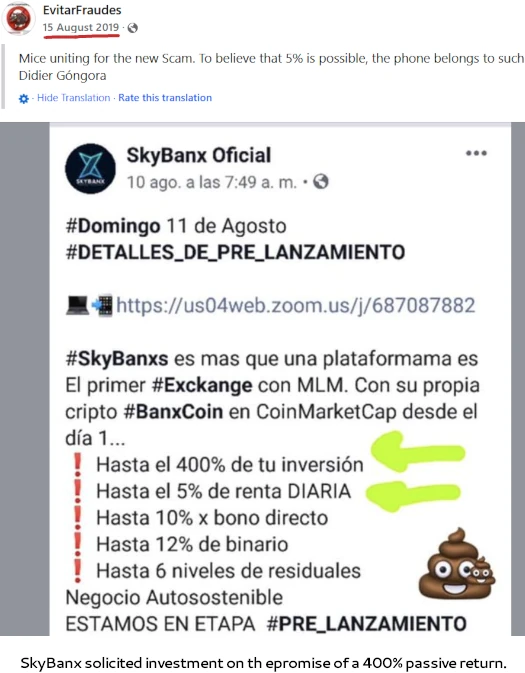

In 2019 Heber resurfaced as CEO of SkyBanx.

SkyBanx was an MLM crypto Ponzi that focused Spanish audio system. SkyBanx pitched shoppers on a 400% ROI, paid out at 5% a day.

Returns had been purportedly generated through a non-existent buying and selling bot.

SkyBank ran its fraudulent funding scheme via BanxCoin. At this time neither SkyBanx or BanxCoin exist.

Within the GPayBack advertising and marketing video on Simon Stepsys’ channel, Heber states he “lives within the Caribbean.”

As at all times, if an MLM firm is just not overtly upfront about who’s working or owns it, suppose lengthy and laborious about becoming a member of and/or handing over any cash.

GPayBack’s Merchandise

GPayBack has no retailable services or products.

Associates are solely in a position to market GPayBack affiliate membership itself.

GPayBack’s Compensation Plan

GPayBack associates buy “packages”. The extra spent on a package deal, the extra a GPayBack affiliate can load onto a MasterCard branded debit card.

- Fundamental – pay $100 and be capable to load as much as $5000

- Plus – pay $300 and be capable to load as much as $10,000

- Advance – pay $1000 and be capable to load as much as $40,000

- Professional – pay $4000 and be capable to load as much as $90,000

- Elite – pay $10,000 and be capable to load as much as $500,000

As soon as the load restrict is reached or a 12 months is up, a brand new package deal have to be bought to proceed incomes.

Hooked up to GPayBack’s playing cards is an funding scheme.

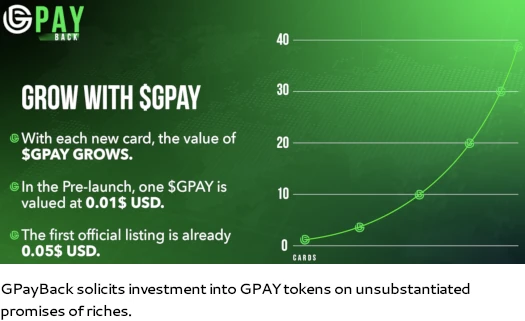

- GPayBack associates obtain the equal they pay for a package deal in GPAY tokens

- as customers spend cash with their GPayBack card, a 5% cashback is paid in GPAY tokens.

GPAY tokens are then staked with GPayBack on the promise of an annual passive return:

- Fundamental tier associates obtain 4.75% a 12 months on staked GPAY tokens

- Plus tier associates obtain 6.25% a 12 months on staked GPAY tokens

- Advance tier associates obtain 8.25% a 12 months on staked GPAY tokens

- Professional tier associates obtain 8.75% a 12 months on staked GPAY tokens

- Elite tier associates obtain 10.25% a 12 months on staked GPAY tokens

The MLM aspect of GPayBack pays referral commissions on package deal purchases down three ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 10%

- degree 2 – 7%

- degree 3 – 3%

Becoming a member of GPayBack

GPayBack affiliate membership is free.

Full participation within the hooked up earnings alternative requires a $100 to $100,000 package deal buy.

GPayBack Conclusion

There are primarily two tiers to GPayBack, each of which circle again to securities fraud.

The primary tier is “package deal purchases” are funding upon consideration of corresponding GPAY tokens.

Make investments $300 on the Plus tier and obtain $300 value of GPAY tokens. Make investments $10,000 on the Elite tier and obtain $10,000 value of GPAY tokens and so forth.

The funding loop is accomplished by staking GPAY tokens (you’ll be able to’t do the rest with them), on which passive returns are paid.

The GPAY token itself is a BSC-20 shit token GPayBack created and, at time of publication, solely exists internally.

BSC-20 tokens could be created in a couple of minutes at little to no value.

The second tier of GPayBack is the “cashback” of GPAY tokens corresponding with card spend. As beforehand acknowledged, GPayback generates GPAY tokens out of skinny air on demand, so providing “cashback” doesn’t value the corporate something.

What does value GPayBack one thing is paying out ROI withdrawals. Because it stands the one supply of verifiable earnings getting into GPayBack is package deal funding.

It doesn’t make any sense to pay $10,000 to load a MasterCard up with $500,000, with out the hooked up GPayBack funding scheme.

Thus it follows that and not using a verifiable supply of exterior income, both fully or partly, GPayBack is recycling package deal funding to pay GPAY ROI withdrawals.

That is your traditional “staking” Ponzi mannequin.

On the regulatory aspect of issues, GPayBack fails to offer proof it has registered its “staking” funding scheme with monetary regulators in any jurisdiction.

This constitutes securities fraud, which tracks with GPayBack working a Ponzi scheme.

On the subject of regulators, I’m additionally noting GPayBack’s MasterCard providing is extraordinarily suss.

KYC isn’t non-obligatory for retailers providing entry to MasterCard’s community. GPayBack claiming they will supply MasterCard playing cards with out KYC suggests one thing extraordinarily dodgy is happening.

Usually while you see MasterCard or Visa playing cards touted by an MLM firm committing securities fraud, entry is thru a shell firm hooked as much as a dodgy service provider.

GPayBack don’t disclose how they’re providing MasterCard playing cards however do recommend it’s being executed via Mexico.

The GP Card relies in Mexican Peso (MXN). Financial institution commissions are unique and decided by the respective establishments.

Ought to MasterCard examine, GPayBack’s whole funding scheme falls aside.

Stated scheme can be contingent on Google and Apple not detecting or taking motion on GPayBack’s verifiable securities fraud.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

It will starve GPayCard of ROI withdrawal income, finally prompting a collapse.

The maths behind Ponzi schemes ensures that after they collapse, the vast majority of contributors lose cash.

One want solely look to Andre Heber’s earlier schemes, Infinity DailyWin and SkyBanx, to see this in motion.