Final November the long-running foreign exchange rip-off IM Mastery Academy rebooted as Iyovia.

Final November the long-running foreign exchange rip-off IM Mastery Academy rebooted as Iyovia.

No official motive was given for the rebranding, prompting me to take a position;

If I needed to guess, IM Mastery Academy rebranding as Iyovia most likely indicators we’re getting near the result of the FTC’s investigation.

On Could 1st the FTC and Nevada filed a joint swimsuit in opposition to IM Mastery Academy, alleging over $1.2 billion in fraud.

The FTC’s filed lawsuit names IM Mastery Academy (dba Iyovia), its executives and a number of other promoters as defendants;

- Worldwide Markets Dwell Inc, dba Iyovia, iMarketsLive, IM Mastery Academy, IM Academy, IM Mastery Academy LTD

- Assiduous Inc – Delaware shell firm affiliated with iMarketsLive, solicits cryptocurrency funds for IM Mastery Academy/Iyovia

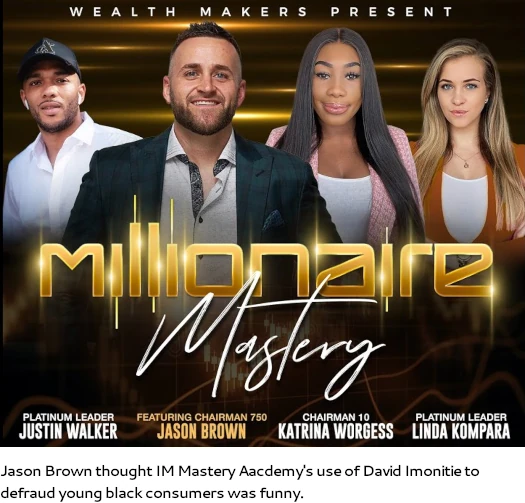

- International Dynasty Community LLC (GDN) – Nevada shell firm owned by Jason Brown and Matt Rosa, obtained $33 million from IM Mastery Academy/Iyovia

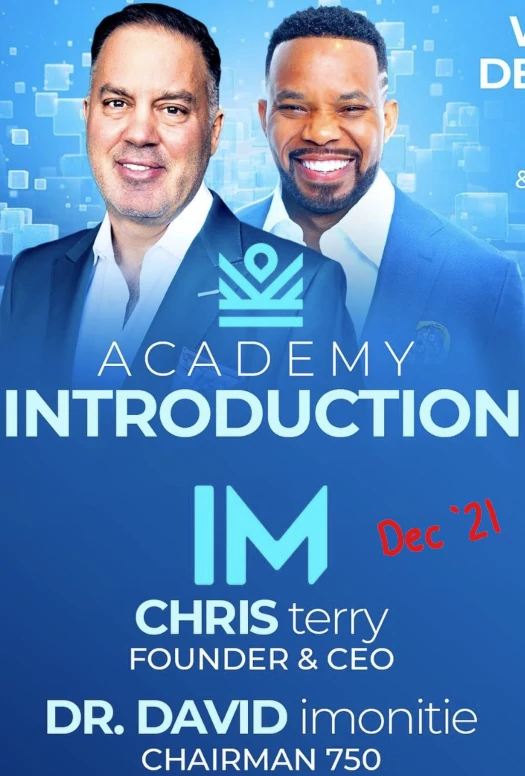

- Christopher Terry – IM Mastery Academy/Iyovia founder, co-owner and CEO

- Isis Terry, fka Isis De La Torre – Chris Terry’s spouse and co-owner of IM Mastery Academy/Iyovia

- Jason Brown – high IM Mastery Academy/Iyovia promoter and officer

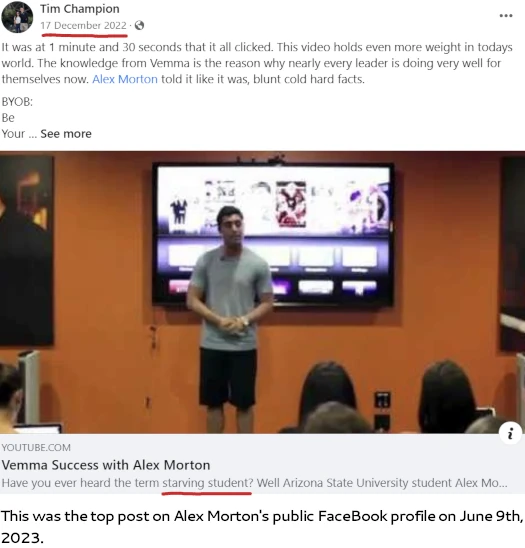

- Alex Morton – high IM Mastery Academy/Iyovia promoter and officer, obtained over $76 million from IM Mastery Academy/Iyovia

- Matthew Rosa – IM Mastery Academy/Iyovia promoter and International Dynasty Community LLC member

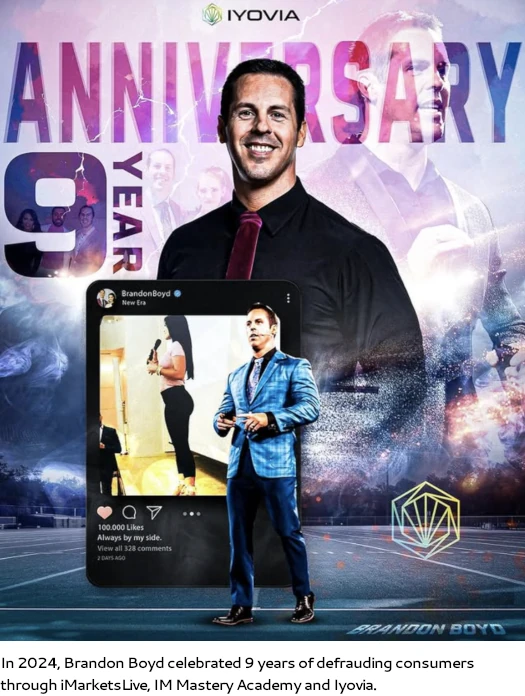

- Brandon Boyd – IM Mastery Academy/Iyovia promoter

The FTC’s case cites alleged violations of FTC Act, Telemarketing and Shopper Fraud and Abuse Act, Restore On-line Customers’ Confidence Act and Nevada Misleading Commerce Practices Act.

For an in depth historical past of how we arrived at IM Mastery Academy and Iyovia (BehindMLM has documented Terry’s fraud since 2013 as iMarketsLive, seek advice from the linked Iyovia reboot article above).

As alleged by the FTC;

Since at the very least 2018, Defendants have operated a big misleading funding coaching scheme focusing on younger adults, together with Black and Latino customers.

Defendants characterize that IML instructors will train customers find out how to make vital revenue buying and selling within the international alternate, binary choices, cryptocurrency, and inventory markets (IML’s “Buying and selling Coaching Providers”).

Defendants, nevertheless, lack help for his or her lavish, and sometimes made up or false, earnings representations. In reality, a considerable proportion of purchasers of the Buying and selling Coaching Providers lose cash buying and selling, on high of the hefty sum they pay IML.

Moreover, lots of IML’s instructors should not profitable merchants. And Defendants’ personal knowledge present that the overwhelming majority of IML salespeople lose cash or make negligible revenue.

The FTC alleges IM Mastery Academy/Iyovia and its earlier incarnations have defrauded customers out of over $1.242 billion since 2018.

Defendants revenue handsomely from the misleading earnings claims of their salespeople, which have generated greater than $1.242 billion in worldwide gross sales since 2018.

As an alternative of disciplining or terminating high-earning salespeople when confronted with proof of their misleading earnings claims, IML and IML CEO Christopher “Chris” Terry usually reward them with profitable payouts.

Defendants IML, Alex Morton, Jason Brown, and Matthew “Matt” Rosa have even instructed IML’s salespeople on find out how to make these claims whereas escaping the detection of IML’s compliance program and legislation enforcement.

When the FTC’s investigation into IM Mastery Academy/Iyovia started is unclear. What we do know is the FTC first reached out to IM Mastery Academy and Chris Terry in October 2021.

On October 26, 2021 the FTC despatched Defendant IML the Synopses Regarding Cash-Making Alternatives and Testimonials and Endorsements.

Alex Morton and different high IM Mastery Academy/Iyovia promoters had been contacted in December 2022;

On December 9, 2022 the FTC despatched Defendants Alex Morton and Matthew Rosa the Synopsis Regarding Cash-Making Alternatives.

By public disclosure, BehindMLM first realized of the FTC’s investigation in Could 2023.

In each communications the FTC warned the IM Mastery Academy/Iyovia recipients they “might be topic to civil penalties for violations of the FTC Act in reference to their advertising claims”.

The Synopses said that it’s an unfair or misleading commerce apply to make false, deceptive, or misleading representations in regards to the income or earnings a participant in a money-making alternative can count on or to have interaction in sure acts or practices associated to shopper testimonials.

The FTC notes that, regardless of being warned, IM Mastery Academy/Iyovia and its promoters continued to defraud customers.

Defendants IML, Morton and Rosa, nevertheless, have continued to make use of misleading or unsubstantiated earnings claims of their advertising even after receiving the Synopses.

With respect to the person IM Mastery Academy/Iyovia defendants, Christopher Terry

communicated with fee processors about IML’s excessive bank card chargeback charges and is conscious of a number of U.S. and international legislation enforcement actions in opposition to IML.

The CFTC filed an enforcement motion in opposition to iMarketsLive in 2018. iMarketsLive and Terry settled the CFTC’s alleged fraud prices for $150,000.

[Terry] knew that Matthew Thayer, considered one of IML’s hottest instructors, posted pretend buying and selling outcomes and profited by referring customers to unregulated offshore brokers.

He’s additionally conscious that different IML officers have suggested IML salespeople on methods to evade IML’s compliance program and legislation enforcement.

Chris Terry is conscious of quite a few shopper complaints about IML, the Buying and selling Coaching Providers, and the Enterprise Enterprise.

Collectively along with his spouse, Defendant Isis Terry, Chris Terry has obtained at the very least $20 million from Defendants’ scheme.

Isis Terry

manages all monetary operations of IML, together with managing IML’s relationships with banks and fee processors.

Isis Terry is conscious that IML’s high salespeople make misleading earnings claims and has entry to the database IML has used to trace these earnings claims.

She has communicated with fee processors about IML’s excessive chargeback charges and is conscious that a number of fee processors have terminated IML’s account as a consequence of issues about shopper hurt.

She can be conscious of a number of U.S. and international legislation enforcement actions in opposition to IML, and of quite a few shopper complaints about IML’s Buying and selling Coaching Providers and the Enterprise Enterprise.

Jason Brown (proper) is a

Vice President of Subject Operations at IML, a high salesperson for IML and a managing member and proprietor of GDN.

Brown has made misleading earnings claims in promoting IML’s Buying and selling Coaching Providers and Enterprise Enterprise.

As an IML vp and shut advisor of Chris Terry, Brown is conscious of misleading earnings claims made routinely by different

salespeople and instructors.He has mentioned with Chris Terry find out how to deal with salespeople’s earnings claims and the way to answer international legislation enforcement actions.

To additional IML’s scheme, he has employed a 3rd occasion to publish pretend optimistic evaluations about IML underneath a pseudonym.

He has directed IML’s compliance guide to search out methods to disable the social media accounts of people who’ve criticized IML’s practices on-line.

And he has suggested high salespeople at IML on find out how to publish misleading earnings claims on-line in methods that can evade legislation enforcement.

Defendant Brown has obtained greater than $36 million from Defendants’ scheme, together with $3 million in direct funds and $33 million in funds to GDN.

Alex Morton

is a “Chairman Elite” and Govt Vice President of Gross sales for IML. He’s IML’s highest paid salesperson and makes misleading earnings claims to lure customers into the IML scheme.

For his success in doing so, he has obtained over $76 million from IML. He’s additionally the beneficiary of a contract with IML, underneath which he’s reimbursed as much as $10,000 per 30 days for “journey and leisure” bills.

Morton is conscious of misleading earnings claims made by different salespeople and IML instructors. He has suggested high salespeople on find out how to publish misleading earnings claims on-line in methods that can evade IML’s compliance program and legislation enforcement.

Morton has additionally on quite a few events intervened with IML’s compliance workers and govt officers on points starting from salesforce compensation and retention to disciplinary and recruitment issues.

Matthew Rosa

is a high salesperson for IML and a managing member and proprietor of GDN.

As probably the most extremely paid salespeople for IML, Matt Rosa makes misleading earnings claims and engages in telemarketing to promote IML’s companies.

Defendant Rosa is conscious of quite a few misleading earnings claims made by different salespeople and IML instructors.

He has suggested high salespeople at IML on find out how to publish misleading earnings claims on-line in methods that can evade legislation enforcement investigators. He has additionally directed and coached IML salespeople on find out how to telemarket IML’s companies.

Defendant Rosa, alongside along with his enterprise companion Defendant Jason Brown, has obtained greater than $33 million from Defendants’ scheme by funds to Rosa and Brown’s firm – GDN.

Brandon Boyd

is an IML salesperson and teacher. Boyd narrates IML coaching movies educating customers find out how to recruit customers to the IML scheme.

He’s considered one of IML’s highest compensated salespersons.

Boyd makes misleading earnings claims and is conscious of misleading earnings claims made by different IML salespeople and instructors. He engages in telemarketing to promote IML’s companies and directs IML salespeople to make use of misleading earnings claims to telemarket IML’s companies to customers.

Defendant Boyd has obtained greater than [redacted] from Defendants’ scheme.

On who IM Mastery Academy/Iyovia and its promoters particularly focused to defraud, the FTC writes;

The scheme has disproportionately harmed younger Black customers. Defendants know that their scheme advantages from promotion to younger folks.

As Defendant Chris Terry wrote to Defendant Jason Brown: “That’s the beauty of community [marketing]…They preserve making new 18 yr olds on a regular basis.”

Defendants’ salespeople have marketed IML through posts to the social media pages of schools and universities, and sometimes pepper their posts with slang generally utilized by younger folks.

And IML leaders, together with Defendant Morton, have advisable that when promoting IML in particular person, salespeople ought to ask customers, “[y]ou go to highschool man?”

IML is conscious that quite a few minors have bought IML’s Buying and selling Coaching Providers.

It ought to be famous that IM Mastery Academy/Iyovia’s focusing on of younger folks was probably on the course of Alex Morton.

Morton oversaw Vemma directing its advertising efforts at “school college students and different younger adults”.

The FTC sued Vemma in 2015, alleging the now defunct MLM firm was a $200 million pyramid scheme. Vemma settled for $238 million and agreed to cease defrauding customers in December 2016.

Morton was not a named defendant within the FTC’s Vemma lawsuit.

Getting again to IM Mastery Academy/Iyovia;

Defendants relied closely on David Imonitie, a Black IBO, in advertising to Black customers.

Defendant Brown, in a Could 2019 textual content message chat with an IML salesperson, requested why IML ought to ship David Imonitie to an occasion in St. Louis.

The salesperson responded:

As a result of the demographic is blacks bro[.] They should see a [Black person] come up[.]

Like that’s all they should see to imagine[.] Wealthy black folks[.] Out right here man they don’t inform them find out how to come up so him educating bro it will likely be silly…

Avg revenue is like 30-40k a yr… Promote ‘highest paid African American in business, teaches how to achieve success’ or sum like that lol.

Brown responded to the above with “Lol.”

Defendants promoted Imonitie as a highly-paid Black entrepreneur of their advertising focusing on Black customers.

Because of his defrauding customers by IM Mastery Academy/Iyovia, Imonitie obtained over $30 million.

In mid 2022 David Imonitie went off to launch Nvisionu, his personal IM Mastery Academy clone.

On the advertising guarantees IM Mastery Academy/Iyovia made to customers relating to its merchandise, the FTC writes;

By its personal admission, IML has taken no affirmative steps to determine whether or not customers who use its Buying and selling Coaching Providers are reaping the income that Defendants’ advertising promised.

In actual fact, IML has no info on whether or not these customers are buying and selling within the monetary markets. Certainly, Defendants are conscious of many purchasers incurring buying and selling losses.

The rationale for that is easy, IM Mastery Academy and Iyovia have by no means been about buying and selling.

Furthermore, Defendants’ claims of providing top-notch funding coaching are belied by how rapidly customers cease paying for the Buying and selling Coaching Providers.

Based mostly on IML knowledge, 90% of purchasers drop the companies inside six months. And almost 60% drop their Buying and selling Coaching Providers inside a month.

With such retention charges, it’s little marvel that IML doesn’t solicit evaluations from its college students relating to the standard of its Buying and selling Coaching Providers.

The buying and selling facet of IM Mastery Academy and Iyovia is a ruse to push an MLM pyramid scheme.

Defendants are additionally nicely conscious that the overwhelming majority of IBOs make little or no cash, if any, and most stop shortly after signing up.

IML’s revenue disclosure statements constantly present that the overwhelming majority of IBOs make little or no or no cash.

For instance, IML’s 2022 IDS … exhibits that just about 80% made lower than $500 in 2022. For these salespeople, the typical annual earnings was $77.51, and the median IBO made no cash in any respect.

And even these figures are inflated, as a result of they don’t account for any promoting prices or different bills that salespeople would possibly incur, equivalent to journey and lodging at IML gross sales occasions and conferences

IML has additionally generated persistently excessive chargeback ratios. Traditionally, one of many major indicators a service provider is engaged in fraudulent conduct is a excessive chargeback price.

IML’s service provider accounts had been repeatedly positioned in chargeback monitoring packages as a consequence of excessive chargebacks, and the Firm had quite a few service provider accounts closed as a consequence of excessive chargebacks and fee processors’ issues concerning the legality of IML’s advertising practices.

Repeatedly, since at the very least 2018, Isis Terry has communicated with fee processors relating to issues these processors have raised about IML’s excessive chargebacks, shopper complaints, and worldwide authorized actions taken in opposition to the Firm.

IML has additionally struggled to open new service provider accounts due to its misleading earnings claims and associated issues, equivalent to extreme chargebacks.

For instance, an IML workers particular person knowledgeable Defendant Isis Terry in a January 5, 2021 e mail {that a} fee processor denied IML’s service provider account utility due to the Firm’s “unrealistic earnings claims” and “extreme chargebacks which are past the usual threshold.”

As Defendant Brown knowledgeable different high IML salespeople in December 2020 — together with Defendants Morton, Rosa, and Boyd — “Our chargeback ratio was higher than 1% for 3 years… When your chargebacks are over 1% nobody wanna do enterprise with you until they maintain a reserve of 10+% of your cash.”

Opposite to Defendants’ claims, the Buying and selling Coaching Providers didn’t present customers with a straightforward path to wealth buying and selling within the monetary markets.

IML instructors sometimes have little expertise or significant coaching, and no accreditation. Furthermore, customers who’ve bought IML’s Buying and selling Coaching Providers usually complain that the supplies lined within the video curriculum can be found without spending a dime on-line.

In Could 2023, Defendant Brown confirmed that truth in sworn deposition testimony.

Certainly, lots of IML’s purported high instructors are actually salespeople appearing as instructors and have woefully poor backgrounds within the monetary markets. Defendants are conscious of this and that purchasers of their Buying and selling Coaching Providers have suffered consequently.

Defendants have asserted that the “core worth” of IML’s Buying and selling Coaching Providers is within the GoLIVE periods, led by IML instructors.

Many of those instructors, nevertheless, lack any formal funding coaching, as an alternative acquiring their “coaching” from IML or by watching movies on YouTube.

Furthermore, most of the instructors don’t possess securities business licenses or accreditation. And, opposite to Defendants’ advertising claims, most of the instructors lack real-world buying and selling expertise and success.

[A] long-standing IML teacher, who was recruited by Defendant Chris Terry, was additionally touted by IML as a “Grasp Dealer.”

The teacher has no formal funding coaching, possesses no funding licenses or accreditation, and his buying and selling outcomes had been adverse – making no income from buying and selling from 2018 by 2021.

By comparability, throughout the identical interval, the whole return for the S&P 500 index was over 78%.

IBO and teacher Lisaldo Tavarez was marketed to customers to be a “Prime Educator;” nevertheless, in September 2021 he admitted to a bunch of senior salespeople that “Yeah thats why I be trustworthy and inform folks im [sic] not a guru dealer I truly actually suck simply do teacupsn [sic]” – “Teacups” being a purported technique utilized with an Add-On product referred to as “Gold Cup.”

Likewise, IBO and teacher Gustavo Alaniz, who IML touted to be a “Prime Dealer,” informed the identical group of senior salespeople: “Yea I don’t even travel with [racial epithet deleted] relating to buying and selling. I don’t know shit about buying and selling.”

Most IML instructors are salespeople masquerading as top-notch funding professionals, seeking to leverage their place as an teacher to construct their downlines, and Defendants are nicely conscious of that.

IML supplied sworn testimony in federal courtroom in Could 2022 that IML IBOs need to turn out to be instructors “as a result of it provides them extra publicity as an IBO,” resulting in extra customers signing up with IML by that IBO, and higher compensation for the IBO.

Likewise, Chris Terry testified in a July 2023 deposition that IBOs who grew to become instructors would have “instantaneous credibility” and “assist [the IBOs to] have relevance within the firm,” which might “assist them develop their enterprise.”

A lot of IML’s instructors have been compensated primarily based on the sale of Add-On merchandise; not the efficiency of their “college students” within the monetary markets. Nevertheless, IML has taken steps to cover the truth that lots of its instructors are actually salespeople.

An express instance of IM Mastery Academy/Iyovia protecting up its deception is Matthew Thayer.

(thayer)

When IML will get proof of false claims by IML instructors, the Firm has gone to nice lengths to cover it from customers.

For instance, Matthew Thayer was a celebrated IML teacher and chief between 2018 and 2021. Defendants lionized his buying and selling prowess, and Defendant Boyd urged IML’s salesforce to take Thayer’s buying and selling outcomes and “[p]ost weekly” as a result of that might “entice[] folks to USE our companies and training.”

Thayer, nevertheless, was a sham. IML found that he was doctoring his buying and selling outcomes, coming into into undisclosed preparations with unregulated offshore buying and selling platforms, and that his “$15 million buying and selling account” was pretend. In the end, IML terminated Thayer.

As an alternative of being trustworthy about Thayer, IM Mastery Academy/Iyovia “labored to cowl up the scandal.”

In a chat group that included Defendants Chris Terry, Rosa, Brown, and Boyd, Thayer’s misconduct was mentioned.

Brown then implored his fellow salesmen “[p]lease DO NOT display screen shot and don’t blast this in public.”

One other IML salesman advised that the chat group delete the publish discussing Thayer’s conduct as “it getting out in the sort of manner within the unsuitable palms can do injury that we actually don’t want proper now being that we’ve been selling [Thayer’s trading success] over a yr. Which can make us look unhealthy.”

IML’s executives additionally believed that they need to not disclose Thayer’s conduct to IML customers as a result of, within the phrases of IML’s Director of Training, Product Improvement, and Regulatory Compliance Anita “Ari” Barton, “if not dealt with correctly, this can be a public popularity nightmare amongst different points, particularly for the reason that dealer interface was displayed on GoLive throughout [Thayer’s] periods.”

Maybe the saddest a part of all of that is Christopher Terry knew what he was doing all alongside.

In a June 2021 message to high salespeople at IML, Chris Terry said:

I went by Instagram, I’ve been going by lots of people’s accounts, and I’m mortified by the approach to life claims that we’ve got. We’re going to finish up getting shut down by the feds. I promise you.

That is horrible what’s happening on the market. It’s not a superb factor… I’m taking a look at myself, I’m taking a look at a whole lot of you high leaders’ Instagrams.

The jets, the watches, the diamonds, the vehicles…we obtained to [sic] adhere to sure legal guidelines which are in place.

And if we don’t then there’s penalties. The results are that we are going to be shut down.

Regardless of full-well realizing IM Mastery Academy/Iyovia and its promoters had been working illegally, and having the facility to place a cease to it, Terry continued to defraud customers – even after the FTC got here knocking.

IML’s compliance program is a facade. Whereas Defendants do have the aptitude to self-discipline salespeople by suspending funds or terminating IBOs, Defendants proceed to let profitable salespeople make misleading earnings claims to promote IML’s companies with out consequence.

Furthermore, Defendants and IML’s compliance staff members have conspired to additional neuter the compliance program by instructing salespeople find out how to proceed to make misleading claims “underneath the radar” of the compliance program and legislation enforcement.

IML’s compliance workers have obtained tons of of studies of earnings claims by salespeople and have reviewed 1000’s of such earnings claims.

Regularly, compliance workers have advisable the termination of salespeople who had made repeated misleading claims, however these suggestions have usually been overturned by Chris Terry.

In a 2021 textual content alternate with a salesman in Bryce Thompson’s gross sales staff, Terry wrote that Thompson and his gross sales staff engaged in “[d]eceptive advertising,” and “predatory advertising [to] [m]inors[,] 14-16 yr olds.”

He additionally famous that the staff’s success was “all primarily based on bullshit claims” and “we’ve got [an] FTC investigation for all their shit that was allowed and inspired.”

Regardless of this data, Terry continued to authorize the fee of enormous sums to Thompson and his staff.

As Defendant Brown remarked to Chris Terry in a 2021 textual content, “Bryce [Thompson] ought to be kissing your toes…Significantly…You let all his leaders off the hook principally.”

Between 2018 and 2023, 21 high salespeople and instructors—collectively paid over $242 million by IML—repeatedly made misleading earnings claims that violate IML’s insurance policies.

Nevertheless, slightly than terminating them, IML continued to make profitable payouts to lots of them, together with Defendants Brown, Morton, Rosa, and Boyd.

As Morton commented to a different IML salesperson about different high leaders’ misleading claims: “It’s insanely absurd… It’s out of hand.” That IML salesperson responded: “However you posting a personal jet and [Rolls Royce] doesn’t assist lol.”

The FTC’s Could 1st filed complaints alleges the next violations over ten counts:

- false or unsubstantiated earnings claims relating to Defendants’ buying and selling coaching companies (FTC, all defendants)

- false earnings claims relating to the enterprise enterprise (FTC, all defendants)

- different misrepresentations relating to Defendant’s companies (FTC, all defendants)

- misleading telemarketing calls in violation of the TSR (FTC, all defendants)

- violations of ROSCA (FTC, iMarketsLive/Iyovia, Chris Terry and Isis Terry)

- violations of Nevada Revised Statute § 598.0915(5) (Nevada, three counts, all defendants)

- violations of Nevada Revised Statute § 598.0923(1)(c) (Nevada, all defendants)

- violations of Nevada Revised Statute § 598.0923(1)(c) (Nevada, iMarketsLive, Chris Terry and Isis Terry)

The FTC and Nevada are looking for a everlasting injunction, preliminary injunctive reduction, financial reduction and authorized prices.

If the FTC prevails, a monitor will even be appointed to supervise Iyovia’s enterprise operations (as a consequence of rampant fraud it will spell the tip of the corporate).

The FTC notes that, along with its personal enforcement motion,

no fewer than 21 worldwide authorities companies have issued warnings concerning the scheme, and Canadian legislation enforcement has taken authorized motion in opposition to IML.

There have additionally been a number of iMarketsLive and IM Mastery Academy arrests made overseas.

I’ve added the FTC’s IM Mastery Academy/Iyovia enforcement motion to BehindMLM’s calendar. Keep tuned for updates as we proceed to trace the case.