Digital Financial savings (aka Digital Financial savings Funding and Digital Funding), fails to offer possession or govt info on its web site.

Digital Financial savings (aka Digital Financial savings Funding and Digital Funding), fails to offer possession or govt info on its web site.

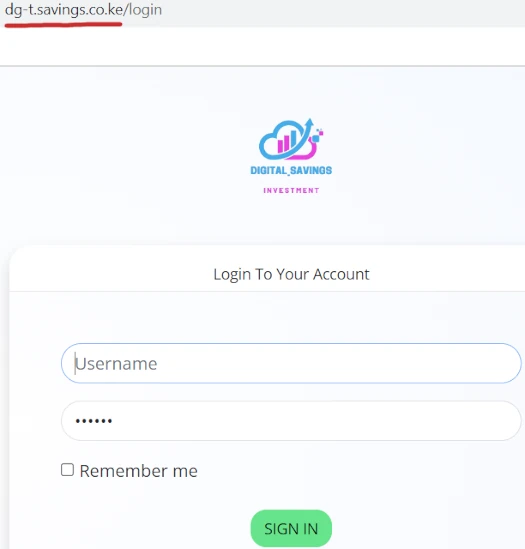

In actual fact as I write this, Digital Financial savings’ web site is nothing greater than an affiliate log in kind:

Digital Financial savings’ web site area (“dg-t.financial savings.co.ke”), was registered with bogus particulars on August fifteenth, 2023.

As at all times, if an MLM firm is just not brazenly upfront about who’s working or owns it, suppose lengthy and exhausting about becoming a member of and/or handing over any cash.

Digital Financial savings’ Merchandise

Digital Financial savings has no retailable services or products.

Associates are solely capable of market Digital Financial savings affiliate membership itself.

Digital Financial savings’ Compensation Plan

Digital Financial savings associates make investments 100 or extra Kenyan Shillings or tether equal (USDT).

That is executed on the promise of 4% a day, paid out for 90 days.

Digital Financial savings pays referral commissions on invested funds down three ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 7%

- degree 2 – 3%

- degree 3 – 2%

Becoming a member of Digital Financial savings

Digital Financial savings affiliate membership is free.

Full participation within the hooked up revenue alternative requires a minimal 100 KES funding.

Digital Financial savings solicits funding in Kenyan Shillings or a tether (USDT) equal.

Digital Financial savings’ Conclusion

Digital Financial savings doesn’t even attempt to current a ruse to masks its fraudulent funding scheme. It’s a easy Ponzi scheme pitching 4% a day.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This may starve Digital Financial savings of ROI income, finally prompting a collapse.

The mathematics behind Ponzi schemes ensures that once they collapse, nearly all of contributors lose cash.