DesertGreener operates within the cryptocurrency MLM area of interest. The corporate supplies a company deal with in Austria on its web site.

DesertGreener operates within the cryptocurrency MLM area of interest. The corporate supplies a company deal with in Austria on its web site.

Heading up DesertGreener we have now the “inventor” of the corporate Carl Albrecht Waldstein.

So far as I can inform, Waldstein doesn’t seem to have an MLM historical past.

So far as I can inform, Waldstein doesn’t seem to have an MLM historical past.

Waldstein deserted his private FaceBook profile in 2021. Presumably as a result of language-barriers, I used to be unable to search out some other info on Waldstein.

DesertGreener operates from two identified web site domains; “desertgreener.sale” and “desertgreener.io” (redirects to .SALE area).

Each of DesertGreener’s web site domains have been registered on January 18th, 2024. The proprietor of each domains is Klimates AG by an Austrian deal with.

Learn on for a full evaluation of the DesertGreener MLM alternative.

DesertGreener’s Merchandise

DesertGreener has no retailable services or products.

Associates are solely in a position to market DesertGreener affiliate membership itself.

DesertGreener’s Compensation Plan

DesertGreener associates make investments euros into DGRX tokens:

- Bronze – make investments €250 EUR and obtain 2500 DGRX tokens

- Silver – make investments €500 EUR and obtain 5000 DGRX tokens

- Gold – make investments €1000 EUR and obtain 10,000 DGRX tokens

- Platin – make investments €2500 EUR and obtain 25,000 DGRX tokens

- Hero – make investments €5000 EUR and obtain 51,250 DGRX tokens

- HeroPlus – make investments €10,000 EUR and obtain 105,000 DGRX tokens

- HeroPro – make investments €25,000 EUR and obtain 268,750 DGRX tokens

- HeroVIP – make investments €50,000 EUR and obtain 550,000 DGRX tokens

As soon as acquired, DGRX tokens are used to spend money on DesertGreener NFT positions. That is achieved on the promise of passive returns:

The DGRX token is an e-money token that you should use to purchase services.

DGRX Gross sales GmbH will supply an NFT (Non-Fungible Token) that you may instantly buy with DGRX tokens.

This NFT entitles the holder to obtain additional DGRX tokens sooner or later relying on income and primarily based on the variety of NFTs held.

The MLM aspect of DesertGreener pays on recruitment of affiliate traders.

Notice that DesertGreener withholds 20% of paid MLM commissions. These funds should be used to spend money on DGRX tokens.

Referral Commissions

DesertGreener associates earn a 7% fee on euros invested by personally recruited associates.

Residual Commissions

DesertGreener tracks residual commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel group, with each personally recruited affiliate positioned instantly underneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel group.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

DesertGreener pays residual commissions on invested euros.

A 14% coded residual fee is paid out on all EUR funding, primarily based on the next standards:

- generate 1000 EUR in downline funding and obtain a 1% residual fee fee

- generate 2500 EUR in downline funding and obtain a 2% residual fee fee

- generate 5000 EUR in downline funding and obtain a 3% residual fee fee

- generate 10,000 EUR in downline funding and obtain a 4% residual fee fee

- generate 25,000 EUR in downline funding and obtain a 5% residual fee fee

- generate 50,000 EUR in downline funding and obtain a 6% residual fee fee

- generate 100,000 EUR in downline funding and obtain a 7% residual fee fee

- generate 250,000 EUR in downline funding and obtain an 8% residual fee fee

- generate 500,000 EUR in downline funding and obtain a 9% residual fee fee

- generate 1,000,000 EUR in downline funding and obtain a ten% residual fee fee

- generate 2,500,000 EUR in downline funding and obtain an 11% residual fee fee

- generate 5,000,000 EUR in downline funding and obtain a 12% residual fee fee

- generate 10,000,000 EUR in downline funding and obtain a 13% residual fee fee

- generate 25,000,000 EUR in downline funding and obtain a 14% residual fee fee

The coded nature of DesertGreener’s residual commissions sees increased certified associates paid the distinction on residual commissions earned by their decrease certified downline.

E.g. a newly recruited DesertGreener affiliate invests 100 EUR. The affiliate who recruited them certified for a 7% residual fee fee, so that’s what they’re paid.

This leaves 7% nonetheless left to be paid out in residual commissions (14% minus the 7% paid out).

The system searches upline for a better ranked certified affiliate to pay the remaining 7% out to. This could be a single 7% fee or a number of smaller share funds, relying on how certified the upline associates are.

World Pool Bonus

DesertGreener takes 4% of month-to-month company-wide funding quantity and locations it into the World Pool Bonus

The World Pool Bonus is made up of two smaller bonus swimming pools; WP1 and WP2.

DesertGreener associates qualify for shares in WP1 and WP2 as per the next standards:

WP1

- generate 3500 EUR in downline funding quantity (1400 EUR from exterior your strongest unilevel leg) and recruit one affiliate investor = one share in WP1

- generate 7000 EUR in downline funding quantity (2800 EUR from exterior your strongest unilevel leg) and preserve one recruited associates investor = two shares in WP1

- generate 17,500 EUR in downline funding quantity (5600 EUR from exterior your strongest unilevel leg) and recruit two affiliate traders = 4 shars in WP1

- generate 35,000 EUR in downline funding quantity (11,200 EUR from exterior your strongest unilevel leg) and preserve two recruited affiliate traders = eight shares in WP1

- generate 70,000 EUR in downline funding quantity (22,400 EUR from exterior your strongest unilevel leg) and recruit three affiliate traders = sixteen shares in WP1

WP2

- generate 175,000 EUR in downline funding quantity (56,000 EUR from exterior your strongest unilevel leg) and preserve three recruited affiliate traders = one share in WP2

- generate 350,000 EUR in downline funding quantity (112,000 EUR from exterior your strongest unilevel leg) and recruit 4 recruited affiliate traders = two shares in WP2

- generate 700,000 EUR in downline funding quantity (224,000 EUR from exterior your strongest unilevel leg) and preserve 4 recruited affiliate traders = 4 shares in WP2

- generate 1,750,000 EUR in downline funding quantity (448,000 EUR from exterior your strongest unilevel leg) and recruit 5 affiliate traders = eight shares in WP2

- generate 3,500,000 EUR in downline funding quantity (875,000 EUR from exterior your strongest unilevel leg) and preserve 5 affiliate traders = sixteen shares in WP2

Becoming a member of DesertGreener

DesertGreener month-to-month affiliate membership charges are tied to how a lot an affiliate earns in commissions:

- earn as much as 14.99 EUR a month in commissions = no charge

- earn 15 to 149.99 EUR a month in commissions = 2.50 EUR a month charge

- earn 150 to 499.99 EUR a month in commissions = 5 EUR a month charge

- earn 500 EUR or extra a month in commissions = 7.50 EUR a month charge

DesertGreener

It needs to be apparent {that a} random Austrian outdated fart with not a lot of a digital footprint isn’t operating DesertGreener’s MLM crypto scheme.

It needs to be apparent {that a} random Austrian outdated fart with not a lot of a digital footprint isn’t operating DesertGreener’s MLM crypto scheme.

This brings us to DGRX Gross sales GmbH, an Austrian shell firm Alexander Braun claims to be the CEO of.

DGRX Gross sales GmbH is a restricted legal responsibility firm in Austria. The corporate is 100% owned by KLIMATES AG in Switzerland, which controls and steers the fortunes of the corporate. KLIMATES AG, in flip, is intently linked with HEMPMATE AG in Switzerland.

DesertGreener’s web site cites two founders of the “DGRX gross sales group”; Alex Braun and Thomas Pfeifer.

The ruse behind DesertGreener is solar-powered desalination.

DESERT GREENER know-how represents a groundbreaking methodology for optimally bundling photo voltaic vitality. Heated water is evaporated and free of salt, minerals, impurities and different deposits.

What does that must do with investing in a shit token, shopping for an NFT, getting extra of stated shit token and cashing out different subsequently invested funds?

Completely nothing.

DesertGreener fails to offer verifiable proof it’s producing income to fund DGRX token withdrawals.

On the regulatory entrance, DesertGreener’s passive returns NFT funding scheme constitutes a securities providing.

As of June 2024, SimilarWeb tracked high sources of site visitors to DesertGreener’s web site as Germany (38%), Austria (19%), Switzerland (18%), the Netherlands (14percent0 and Hungary (11%)

DesertGreener fails to offer proof it has registered with monetary regulators in any of those international locations. Thus, at a minimal, DesertGreener and its related shell firms are committing securities fraud.

Funds invested into DesertGreener seem like laundered by Malta.

Why is the IBAN of the financial institution connection so lengthy?

The IBAN consists in a different way in several international locations and may due to this fact have completely different lengths. Our financial institution is predicated in Malta. IBANs in Malta include 31 characters.

Regulation clever Malta is a dodgy jurisdiction with little to no energetic regulation of MLM and/or cryptocurrency associated securities fraud.

DGRX is an ERC-20 shit token. These could be created in a couple of minutes at little to no value.

DesertGreener creates DGRX on demand and flogs it off to affiliate traders. This works so long as new new funding doesn’t exceed withdrawals.

As soon as it inevitably does, DGRX goes into deficit and ultimately collapses.

Ponzi math thus ensures that when DesertGreener inevitably collapses, nearly all of members will lose cash.

Nonetheless lengthy it takes, it will finally present itself in DesertGreener associates bagholding yet one more nugatory Ponzi token.

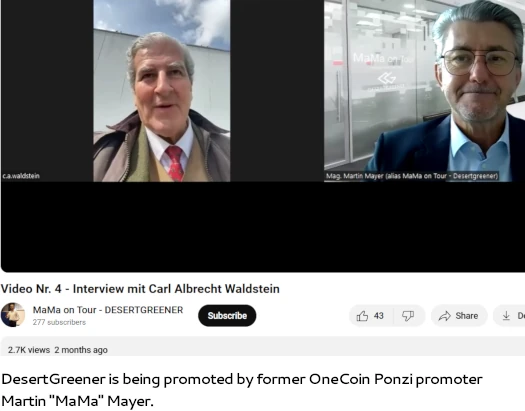

One closing factor I’ll go away you with is DesertGreener’s oblique connections to OneCoin.

In researching Carl Albrecht Waldstein I got here throughout infamous OneCoin Ponzi promoter Martin Mayer:

This isn’t the one OneCoin connection. From DesertGreener’s whitepaper we have now;

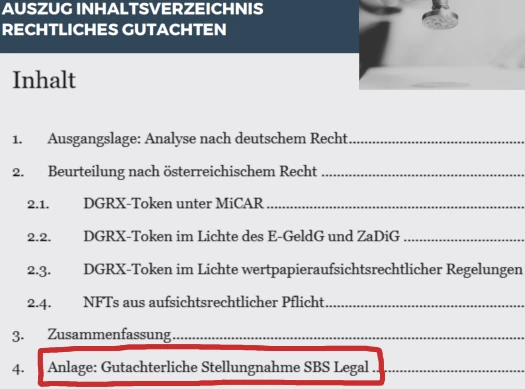

A really famend and acknowledged regulation agency has ready an professional opinion on the enterprise mannequin underneath German, Austrian and EU regulation.

DesertGreen’s “very famend and acknowledged regulation agency” is none aside from SBS regulation.

SBS Legislation, previously Schulenberg & Schenk, are finest identified within the MLM trade for giving OneCoin the all-clear in 2015.

OneCoin would after all develop to develop into a $4 billion greenback plus Ponzi scheme earlier than collapsing in 2017. OneCoin’s founder, Ruja Ignatova, is presently the world’s most wished girl.

No matter SBS Legal guidelines’ DesertGreener authorized opinion, securities fraud may be very a lot unlawful in Germany, Austria and the broader EU.

Regardless of Schulenberg & Schenk’s OneCoin authorized opinion, Germany would ultimately go on to arrest and imprison OneCoin scammers.

To be clear, SBS Legislation offering DesertGreener doesn’t robotically make it a fraudulent funding scheme. Why that’s so is detailed on this evaluation.

What I’m getting at is be cautious of any MLM firm with a authorized opinion that runs opposite to widespread sense and logical utility of the regulation.