Regardless of being promoted, so far as I do know DEFI Cash Membership doesn’t but have a web site. Or if it does, it’s not being shared with the general public.

Regardless of being promoted, so far as I do know DEFI Cash Membership doesn’t but have a web site. Or if it does, it’s not being shared with the general public.

Why the secrecy?

On November sixteenth, 2024, serial rip-off promoter Sal Khan revealed a YouTube video citing Daniel Pacheco as DEFI Cash Membership’s CEO.

Along with CEO, Khan additionally cites Pacheco because the “creator of DEFI Cash Membership”.

Daniel Pacheco, aka Danny Pacheco, made a reputation for himself circa 2013 as a promoter of the Lucrazon International Ponzi scheme.

Pacheco would go on to launch his personal rip-off, iPro Community, in 2017.

iPro Community was hooked up to the ProCurrency altcoin (PROC). iPro Community offloaded pre-generated PROC onto its associates, on the same old guarantees of riches.

On the MLM aspect of issues, iPro Community paid commissions on recruitment of latest affiliate buyers.

By mid 2018 iPro Community itself had collapsed. In a determined bid to maintain the corporate going the affiliation was PROC was deserted (typical MLM altcoin exit-scam).

It was round this time that iThrive Community was introduced. iThrive Community dropped iPro Community’s crypto Ponzi to solely concentrate on “schooling package deal” pyramid recruitment.

The SEC sued Pacheco in Could 2019, alleging iPro Community was a $26 million greenback pyramid scheme.

IPro was a fraudulent pyramid scheme. IPro’s inevitable collapse was hastened by Pacheco’s fraudulent use of investor funds, which included, amongst different issues, the all-cash buy of a $2.5 million residence and a Rolls Royce.

Pacheco’s misappropriation accelerated the speed at which IPro turned unable to pay the commissions and bonuses due its buyers.

Pacheco’s preliminary response to the SEC’s lawsuit noticed him declare he couldn’t be sued, as a result of “the SEC didn’t endure any precise damages”.

Pacheco would go on to settle iPro Community fraud claims with the SEC in December 2022. A $2.1 million ultimate judgment was entered in opposition to Pacheco in September 2023.

Now, roughly a 12 months later, Pacheco has resurfaced with DEFI Cash Membership.

Learn on for a full evaluation of DEFI Cash Membership’s MLM alternative.

Defi Cash Membership’s Merchandise

There are three parts to DEFI Cash Membership:

- DEFI Gold Membership – a purported “gold backed” NFT funding scheme

- DEFI Buying and selling Academy – schooling package deal pseudo-compliance with buying and selling alerts service

- Omni – passive returns by way of purported automated foreign currency trading

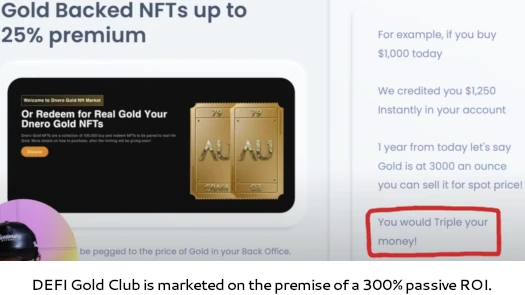

DEFI Gold Membership sees DEFI Cash Membership promote NFT funding positions. The corporate claims the NFT values are pegged to gold, providing potential buyers a possible passive ROI.

Entry to DEFI Gold Membership prices between 500 and 7000 tether (USDT):

- Gold 1 – 500 USDT entry payment, capable of make investments as much as ($10,000?) with a ten% funding bonus

- Gold 2 – 1000 USDT entry payment, capable of make investments as much as $25,000 with a 15% funding bonus

- Gold 3 – 3000 USDT entry payment, capable of make investments as much as $50,000 with a 20% funding bonus

- Gold 4 – 7000 USDT entry payment, capable of make investments as much as $100,000 with a 25% funding bonus

DEFI Buying and selling Academy is a buying and selling alerts service bundled with buying and selling schooling programs.

Observe that in violation of US commodities legislation, DEFI Cash Membership fails to reveal the origin of DEFI Buying and selling Academy alerts.

Entry to DEFI Buying and selling Academy is 1800 USDT yearly.

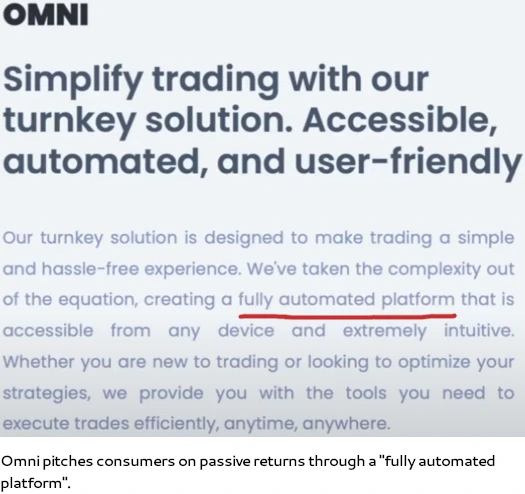

Omni provides buyers passive returns by way of purported foreign currency trading.

Omni operates utilizing the “lulz can’t contact our cash!” mannequin. The “lulz can’t contact our cash!” mannequin permits associates to speculate funds in their very own change account.

That is performed on the promise of passive returns, derived by way of Omni’s purported buying and selling of unknown origin.

Entry to Omni prices between 500 and 7000 USDT:

- entry to at least one buying and selling technique = 500 USDT yearly

- entry to a few buying and selling methods = 1000 USDT yearly

- entry to seven buying and selling methods = 2000 USDT yearly

- entry to fifteen buying and selling methods = 4000 USDT yearly

- entry to all buying and selling methods = 7000 USDT yearly

Omni additionally prices a 20% month-to-month payment on generated returns.

DEFI Cash Membership’s Compensation Plan

DEFI Cash Membership’s compensation plan pays on the sale of its companies to retail clients and recruited associates.

DEFI Cash Membership Affiliate Ranks

There are seven affiliate ranks inside DEFI Cash Membership’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- Advisor – join as a DEFI Cash Membership affiliate and generate 1000 GV

- Senior Advisor – generate 3000 GV

- Govt Advisor – generate 50,000 GV

- Director – generate 100,000 GV

- Senior Director – generate 200,000 GV

- Govt Director – generate 500,000 GV

- Senior Vice President – generate 1,000,000 GV

GV stands for “Group Quantity”. GV is gross sales quantity generated by way of the sale of DEFI Gold Membership, DEFI Buying and selling Academy and Omni to retail clients and recruited associates.

Observe that for the aim of rank qualification, not more than 40% of required GV can come from anybody unilevel crew leg.

Referral Commissions

DEFI Cash Membership pays a ten% referral fee on gross sales quantity (GV) generated by DEFI Gold Membership, DEFI Buying and selling Academy and Omni entry gross sales.

DEFI Gold Membership

- sale of Gold 1 DEFI Gold Membership NFT place = 35 USDT referral fee

- sale of Gold 2 DEFI Gold Membership NFT place = 70 USDT referral fee

- sale of Gold 3 DEFI Gold Membership NFT place = 210 USDT referral fee

- sale of Gold 4 DEFI Gold Membership NFT place = 490 USDT referral fee

DEFI Buying and selling Academy

- sale of DEFI Buying and selling Academy = 1000 GV

Omni

- sale of 1 Omni technique = 500 GV

- sale of three Omni buying and selling methods = 700 GV

- sale of seven Omni buying and selling methods = 1400 GV

- sale of fifteen Omni buying and selling methods = 2800 GV

- sale of all Omni buying and selling methods = 4900 GV

- 10% of the 20% month-to-month payment on DEFI Buying and selling Academy earnings can be paid out as a referral fee

Residual Commissions

DEFI Cash Membership pays residual commissions by way of a binary compensation construction.

A binary compensation construction locations an affiliate on the high of a binary crew, cut up into two sides (left and proper):

The primary degree of the binary crew homes two positions. The second degree of the binary crew is generated by splitting these first two positions into one other two positions every (4 positions).

Subsequent ranges of the binary crew are generated as required, with every new degree housing twice as many positions because the earlier degree.

Positions within the binary crew are stuffed by way of direct and oblique recruitment of associates. Observe there isn’t a restrict to how deep a binary crew can develop.

On the finish of every week DEFI Cash Membership tallies up new gross sales quantity on each side of the binary crew.

Associates are paid 10% of latest gross sales quantity generated on their weaker binary crew aspect.

As soon as paid out on, gross sales quantity is matched in opposition to the stronger binary crew aspect and flushed. Any leftover quantity on the stronger binary crew aspect carries over.

Matching Bonus

DEFI Cash Membership pays a Matching Bonus by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel crew, with each personally recruited affiliate positioned immediately underneath them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel crew.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

DEFI Cash Membership caps the Matching Bonus at seven unilevel crew ranges.

The Matching Bonus is paid as a proportion of earnings from downline associates throughout these seven ranges based mostly on rank:

- Consultants earn a ten% match on degree 1 (personally recruited associates)

- Senior Consultants earn a ten% match on ranges 1 and a pair of

- Govt Consultants earn a ten% match on ranges 1 to three

- Administrators earn a ten% match on ranges 1 to 4

- Senior Administrators earn a ten% match on ranges 1 to five

- Govt Administrators earn a ten% match on ranges 1 to five and 5% on degree 6

- Senior Vice Presidents earn a ten% match on ranges 1 to five and 5% on ranges 6 and seven

Management Bonus

Utilizing a separate set of ranks, DEFI Cash Membership rewards associates for reaching month-to-month GV targets:

- Silver – generate 200,000 GV in a month and obtain 2000 USDT

- Ruby – generate 500,000 GV in a month and obtain 7500 USDT

- Emerald – generate 1,000,000 GV in a month and obtain 10,000 USDT

- Sapphire – generate 2,000,000 GV in a month and obtain 20,000 USDT

- Gold – generate 3,000,000 GV in a month and obtain 30,000 USDT

Becoming a member of DEFI Cash Membership

DEFI Cash Membership affiliate membership is 50 USDT yearly.

DEFI Cash Membership Conclusion

As per the Howey Take a look at, there are two clearly identifiable funding contracts inside DEFI Cash Membership:

- passive returns generated by way of DEFI Gold Membership NFT positions

- passive returns generated by way of Omni’s purported automated foreign currency trading

Neither of those two choices is prohibited outright, however with the intention to be made legally require registration with the SEC.

At time of publication neither DEFI Cash Membership, DEFI Gold Membership, DEFI Buying and selling Academy, Omni or Daniel Pacheco are registered with the SEC.

This constitutes securities fraud, which Pacheco is explicitly prohibited from committing additional acts of as per his iPro Community settlement injunction.

Moreover, Omni’s purported buying and selling for foreign exchange to generate passive returns requires it to register with the CFTC. A search of the NFA’s BASIC database reveals not one of the DEFI Cash Membership entities are registered with the CFTC.

This provides commodities fraud to DEFI Cash Membership’s chargesheet.

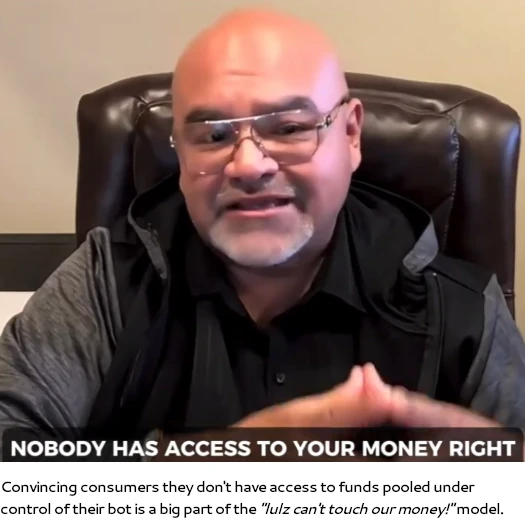

Instantly addressing the legality of DEFI Advertising and marketing Membership, within the beforehand cited interview with Sal Khan, Pacheco states at [15:54];

Right here in america, as you understand, we’ve gone by way of the entire authorized hurdles, the entire authorized challenges.

We’ve structured with one among our co-founders of Omni, and I’m not a co-founder of Omni, however you understand I do know the construction there trigger we’ve had a relationship for the final decade, and our legal professional, not solely is he a licensed legal professional that turned out judgeship to be working 100% on Omni, however he holds the licensing proper, the credentials and the sequence three and the sequence sixty-three.

The entire completely different licenses that he must be one among a few thousand folks within the US that, due to his expertise and his licensing, permits Omni to be a authorized product right here within the US with an precise exemption that different, that simply doesn’t exist.

It ought to be apparent that, opposite to Pacheco’s claims, neither securities or commodities fraud is authorized within the US.

To reiterate a degree, as Pacheco states in his interview with Sal Khan at [34:50];

You’re making a living each month on Omni … oh by the way in which you’re making one other, you understand, 10% a month on full automation.

An unnamed legal professional whose identification is hidden from customers shouldn’t be the equal of or substitute for an MLM firm providing passive returns registering with the SEC and/or CFTC (NFA).

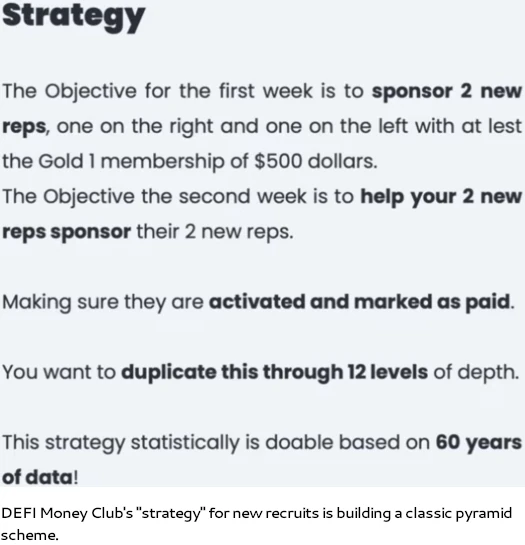

As with iPro Community, it’s clear that DEFI Cash Membership is meant to be run as a pyramid scheme.

Whereas retail gross sales are attainable, DEFI Cash Membership’s personal official coaching instructs new recruits to focus solely on recruiting:

An MLM firm focusing solely on recruitment on the expense of retail gross sales is the traditional MLM pyramid mannequin.

This, mixed with Pacheco’s prior securities fraud settlement, is sufficient to avoid DEFI Cash Membership.

Breaking down DEFI Cash Membership’s providing additional nonetheless;

The gold aspect of DEFI Gold Membership ties into DEFI Cash Membership claiming to have a partnership with Mac Mining Group.

Mac Mining Group is a faceless firm put collectively in November 2023, two months after Pacheco’s iPro Community judgment was finalized.

On its web site Mac Mining Group claims to be based mostly out of Nevada. The corporate additionally immediately solicits funding from the general public;

By becoming a member of our neighborhood of buyers, you’re not simply taking a monetary stake in our gold mine challenge; you’re turning into part of a wealthy mining legacy within the making.

This isn’t merely an funding; it’s a possibility to contribute to the historical past of Nevada’s gold trade, to be amongst those that believed within the potential of this area and helped form its future.

Collectively, we’re forging a path towards sustainable and accountable mining practices, creating a long-lasting impression on each the native financial system and the worldwide gold market.

A search of the SEC’s Edgar database reveals Mac Mining Group shouldn’t be registered to supply securities within the US. This implies the funding aspect of Mac Mining Group can be fraudulent (securities fraud).

The schooling packages tied to DEFI Buying and selling Academy are primarily a continuation of that aspect of iPro Community and iThrive Community (I suppose iDefi Buying and selling Academy was too apparent).

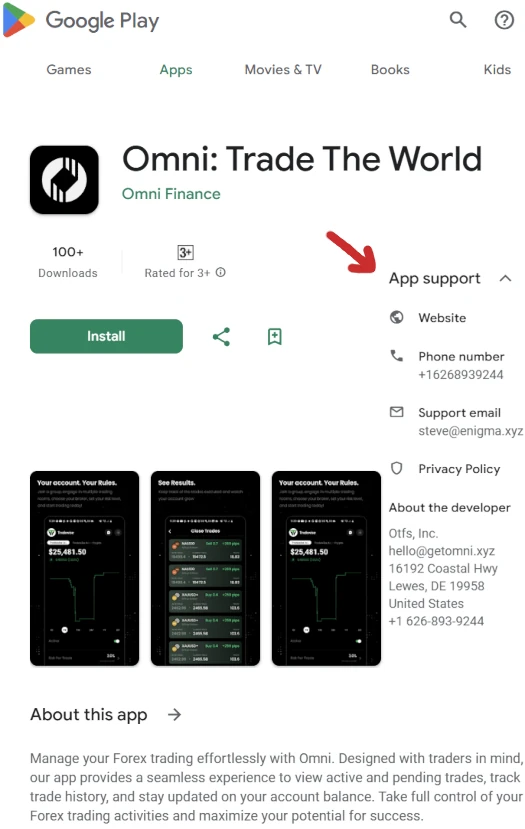

Omni is accessed by way of an app, with listings on each the Google and Apple app shops.

Omni’s Google Play retailer itemizing offers us some extra details about the corporate:

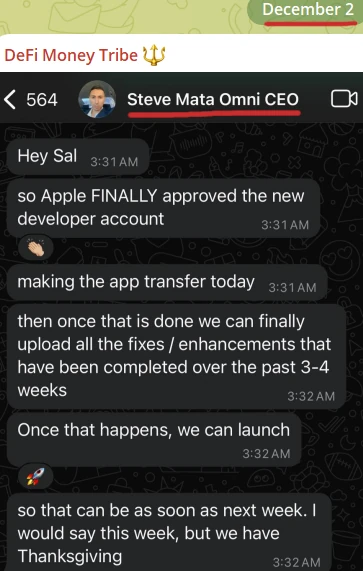

“Steve” refers to Steve Mata, who cites himself as Omni’s CEO.

In a November twelfth interview with Sal Khan, Mata (proper) cites “Dylan” as the opposite co-founder of Omni.

In a November twelfth interview with Sal Khan, Mata (proper) cites “Dylan” as the opposite co-founder of Omni.

Mata seems to be a California-based health bro turned app bro. Mata additionally isn’t registered with the SEC or CFTC.

The Enigma area in Steve’s app e-mail deal with hosts an an e-mail harvester web site:

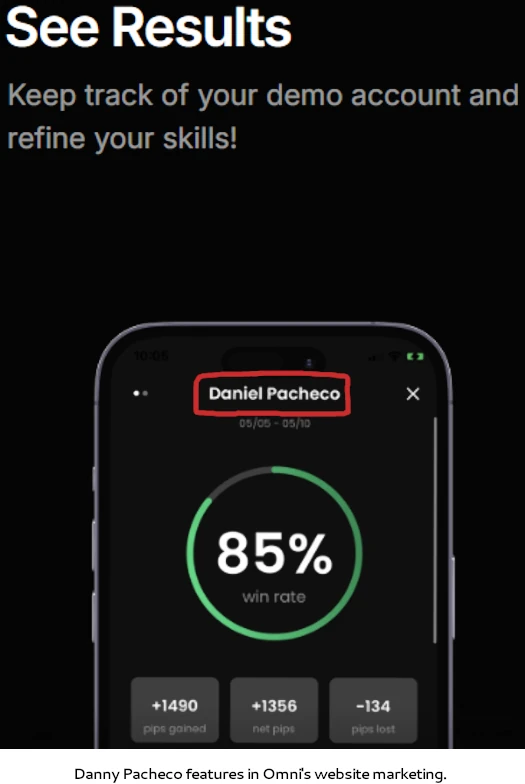

The “get Omni” area hosts Omni’s standalone web site. On the web site we discover advertising and marketing that includes Daniel Pacheco and boasting an 85% buying and selling win fee:

Otfs Inc. is a Delaware shell firm registered in Could 2024.

Omni’s “lulz can’t contact our cash!” mannequin sees it dupe buyers into believing their funds can’t be stolen as a result of they’re traded in their very own dealer/change accounts.

That is false. Sometimes “lulz can’t contact our cash!” schemes exit-scam by way of blowing the bot up or rigged trades.

Undermining each “lulz can’t contact our cash!” scheme is the truth that if the purported buying and selling was worthwhile within the long-term, scammers would simply deploy it for themselves.

Pending Omni buying and selling losses are along with funds misplaced by way of its pyramid scheme. This alone will have an effect on the vast majority of Omni associates when stated pyramid scheme inevitably collapses.

One more purple flag is DEFI Cash Membership’s potential ties to Dubai.

Within the beforehand cited Steve Mata interview with Sal Khan, at [38:35] Mata states;

We have now all these merchants and um, it’s a mix of like merchants you understand, hedge funds, and so forth. coming to us proper now.

Like for instance, um you understand, we had this you understand a few hedge funds in Dubai. Um there’s one particularly that um has over 100 methods. They’ve round $100 million of their fund that they commerce with, proper?

In order that they’re taking numerous the methods and wish to make them accessible to retail merchants they usually’re utilizing Omni at a platform to distribute that.

Because of the proliferation of scams and failure to implement securities fraud regulation, BehindMLM ranks Dubai because the MLM crime capital of the world.

BehindMLM’s pointers for Dubai are:

- If somebody lives in Dubai and approaches you about an MLM alternative, they’re making an attempt to rip-off you.

- If an MLM firm is predicated out of or represents it has ties to Dubai, it’s a rip-off.

Lastly we’ll circle again round to iPro Community and the title of this evaluation; “iPro Community fraud continues”.

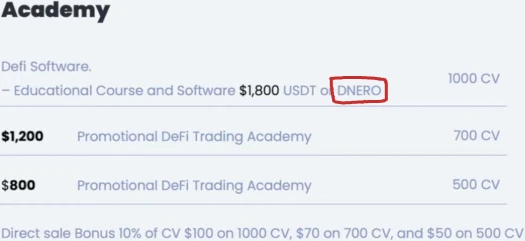

DEFI Cash Membership’s official DEFI Buying and selling Academy advertising and marketing cites DNERO:

DNERO is a shitcoin Pacheco launched as a part of iThrive Community, after iPro Community and PROC collapsed.

DNERO first got here on BehindMLM in Could 2019, as a part of a dialogue on the SEC’s iPro Community fraud prices.

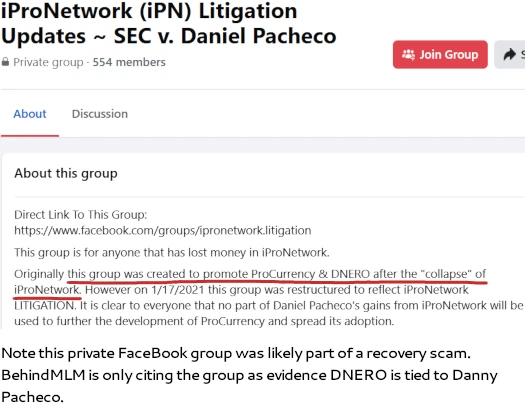

This iPro Community sufferer group on FaceBook additionally cites Pacheco launching DNERO after iPro Community:

At present DNERO survives as “DNERO Protocol”.

DNERO Protocol operates from the area “dneroproject.io”, privately registered in Could 2022.

Clearly no one outdoors of iPro Community and iThrive Community goes to be holding DNERO. Its acceptance inside DEFI Cash Membership demonstrates Pacheco focusing on iPro Community and iThrive Community victims.

In different phrases, DEFI Cash Membership and every part hooked up to it’s a literal continuation of the fraud Pacheco began with iPro Community.

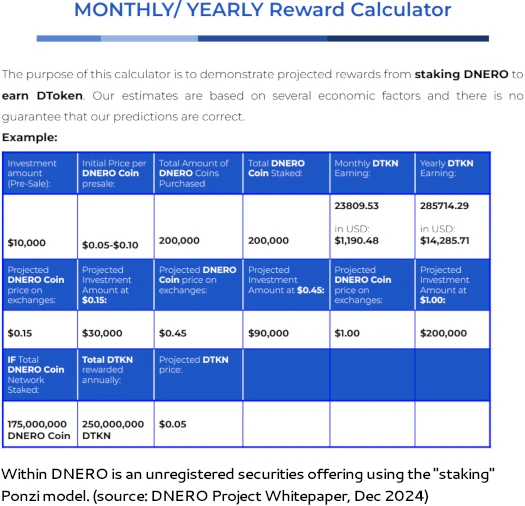

Inside DNERO, now we have yet one more unregistered securities providing:

As above the DNERO Mission, which once more Danny Pacheco owns, solicits funding on the pitch of passively turning $10,000 into $200,000.

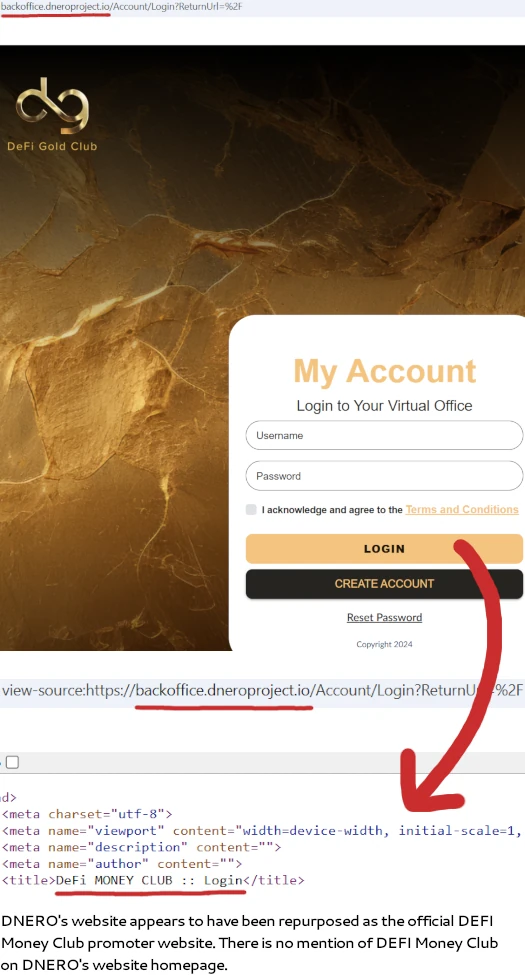

Whereas DEFI Cash Membership doesn’t have a web site, or stated web site is hidden from customers, DNERO’s web site serves as an entry portal for DEFI Cash Membership:

I’m fairly certain the explanation DEFI Cash Membership doesn’t have a readily accessible public web site, is as a result of DNERO’s web site has been repurposed because the defacto DEFI Cash Membership web site.

Why doesn’t DEFI Cash Membership simply have a standalone web site the place every part is brazenly disclosed to customers?

Look no additional than the multitude of DEFI Cash Membership purple flags raised on this evaluation.