Final week BehindMLM reviewed DAO1. Primarily based on numerous knowledge factors, we suspected it was one more reboot of the collapsed GSPartners funding scheme.

Final week BehindMLM reviewed DAO1. Primarily based on numerous knowledge factors, we suspected it was one more reboot of the collapsed GSPartners funding scheme.

At present BehindMLM can verify DAO1 is the fifth GSPartners reboot. The identical individuals tied to GSPartners’ mother or father firm, Gold Normal Company (GSB), are working DAO1 behind the scenes.

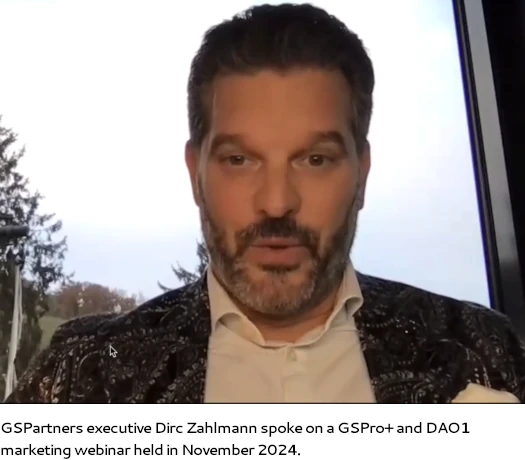

Final November DAO1 held what’s believed to be its first company webinar for traders.

GSB govt Bruce Innes Wylde Hughes opened the webinar.

Hughes is a South African nationwide and works as GSB’s Company Coach. Hughes can be a named Respondent in standing regulatory enforcement actions from Texas, California and New Hampshire.

For what needs to be apparent causes, Hughes pleaded with traders to maintain the DAO1 webinar non-public.

We wish to remind you to not edit, file or share this exterior of the context it’s created for. That is clearly a lawfully punishable offence.

Hughes doesn’t cite any particular legal guidelines as a result of, effectively… there aren’t any.

Confirming DAO1 is simply GSPartners rebooted, Hughes directs traders to direct any questions they’d about DAO1 to a GSPro area hosted electronic mail tackle.

In a nutshell, DAO1 is a part of what Hughes refers to as “GSPro Plus”. To raised perceive the place we’re at, right here’s a listing of GSPartners reboots:

- GSPartners – authentic fraudulent funding scheme, launched in 2021 and underwent a number of funding mannequin reboots until it settled on “metaportfolio certificates” in 2023

- Swiss Valorem Financial institution – launched in mid 2023 after Canadian GSPartners fraud warnings, deserted inside a number of months in favor of returning to GSPartners branding

- GSPro – second GSPartners reboot after an avalanche of US regulatory fraud warnings and enforcement orders issued in late 2023, DOA by the tip of Q1, 2024

- Billionico – third GSPartners reboot launched in March 2024, successfully DOA after Texas issued Billionico fraud order in April 2024

- Auratus – fourth GSPartners reboot launched in Might 2024, successfully DOA exterior of a small group of promoters in Australia whose downlines carried over from GSPartners

Auratus has gone by means of three funding scheme iterations since launch.

First there was a “gold vault” funding scheme, then “gold factors” scheme tied to Zai Playing cards, and eventually a “storage bins” scheme.

Now we’ve GSPro+, connected to which is DAO1.

Hughes doesn’t get into specifics however a part of GSPro+ is promoting “GSPay+ playing cards” for as much as 7500 EUR.

GSPro+ additionally sells “modules” costing 1000’s of euros:

Via a “common module”, GSPro+ traders are supplied entry to GSPartners’ collapsed metaportfolio certificates funding scheme.

US regulators have cited GSPartners’ metaportfolio certificates as a “fraudulent funding scheme” that took in over a billion {dollars}.

In September 2024 GSB and proprietor Josip Heit (proper) entered right into a settlement with North American regulators.

As per a September ninth executed time period sheet, GSB and Heit agreed to stop and desist

providing, promoting, or renewing any safety within the Settling Jurisdictions with out first complying with all authorized necessities or exemptions for gives or gross sales of securities set forth in statutes, rules, caselaw, or different sources enacted by, adopted by, or in full power and impact within the Settling Jurisdictions.

Offering customers entry to GSPartners’ metaportfolio certificates funding scheme by means of GSPro+ would seem to violate this settlement.

After revealing GSPartners’ metaportfolio certificates have been nonetheless being pitched to customers, Hughes introduced on GSB govt Dirc Zahlmann.

Zahlmann is a GSB govt and former GSPartners CEO. Zahlmann can be a named Respondent in standing regulatory enforcement actions from Texas, California and New Hampshire.

Hughes introduces Zahlmann and DAO1 as “the subsequent iteration of the place this neighborhood can transfer and develop into”.

In Zahlmann’s personal phrases, he “created” DAO1 as

the subsequent stage that we’re engaged on … welcome to DAO1.

We already confirmed you, so very quickly we’ll introduce it to you and then you definitely could be a part of it and entry the whole lot that you’ve, the whole lot that was up to now instances ten.

Zahlmann presents DAO1 as an “autonomous” entity that members have management of.

Everybody decides for the entire group. It’s a transparent organizational background, nobody is concerned in [making] govt choices anymore.

An important factor is the DAO system provides you the chance to regulate what’s occurring with all the opposite members collectively.

So there’s nobody concerned anymore, like us. There’s nobody concerned anymore to inform you, “OK we’ve to go this, we’ve to go this fashion, this fashion.

That is what you resolve altogether as members of the DAO system.

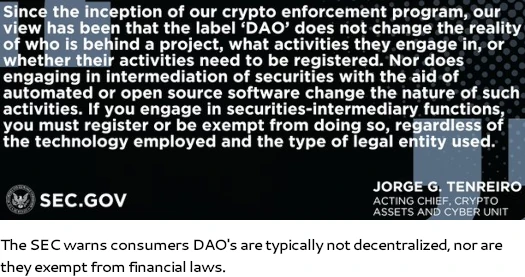

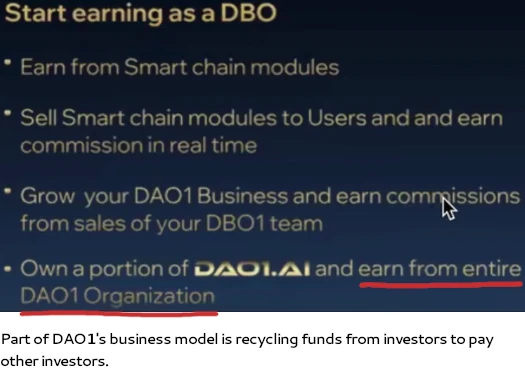

It is a frequent ruse utilized by scammers who arrange DAOs. What they don’t inform you is choices are made through vote, and sometimes creators of a DAO maintain probably the most votes – normally by a big margin.

Like Hughes, Zahlmann confirms DAO1 is a GSPartners reboot.

That is the subsequent evolvement of GSPartners, GSPro, GSPro+.

Right here you’ll be able to see your entire property and the whole lot you’ve carried out on this group, with the group collectively. So that is the subsequent stage.

The thought this time round is to keep away from regulators by pretending GSPro+ and DAO1 aren’t being run by Josip Heit, Dirc Zahlmann and the remainder of the nonetheless lively GSB govt group.

DAO programs are already legally acknowledged by means of completely different varieties of nations, with the intention to have the protected haven, let me say it that approach, from the regulatory aspect.

It needs to be famous that no nation with a regulated monetary system makes an exemption for DAOs, or the individuals working them, for committing securities and/or commodities fraud.

The third speaker on the webinar was Josip Heit.

In distinction to Hughes and Zahlmann, Heit learn off a PR corpo-speak script.

We launched the GSProPloos [sic], a platform that embodies our dedication to driving progress and empowering your neighborhood.

And so forth.

Addressing the elephant within the room, Heit reads a short assertion relating to allegations of fraud within the US.

We talked about our exceptional achievement we have been made, together with a major milestone. The decision of regulatory matter involving greater than twenty-two US states and Canada.

I’ve to level out that the North American GSPartners settlement hasn’t been “resolved” as Heit claims. Full execution of the settlement stays pending at time of publication.

Heit goes on to falsely declare the settlement “exonerates” him from “any allegations of fraud”.

After refunding traders, within the second a part of the settlement

GSB Group and Mr. Heit will consent to the entry of an enforcement order that concludes they illegally provided and/or bought securities that weren’t registered pursuant to state regulation.

Moreover it needs to be famous that, as per Joe Rotunda, Director of Enforcement on the Texas State Securities Board, Hughes and Zahlmann are discovered to have “engaged in securities fraud [and] threatened quick and irreparable hurt to the general public” by means of GSB and GSPartners.

The regulatory findings towards Hughes and Zahlmann are “ultimate and never topic to enchantment”.

As with Hughes and Zahlmann, Heit confirms DAO1 is a continuation of GSPartners and the related GSB schemes.

At present I’m proud to announce that with DAO1 we’re totally bringing the imaginative and prescient to life.

For our neighborhood, they’ll swap from GSPro+ to DAO freed from cost and entry a number of industries and their merchandise.

By decentralizing [???] and determination making, DAO permits enterprise to function with complete autonomy. Making certain that property are protected against the vulnerables [sic] of conventional centralized programs.

Having already been convicted and sentenced to jail for monetary fraud in Luxembourg, why “defending property” is so necessary to Heit needs to be apparent.

With DAO1 we’ll construct a platform that aligns completely with our mission.

This innovation provides us the aggressive edge to dominate the marketplace for the subsequent decade. That is just the start.

Having solely simply damaged it down myself final week, it’s unclear whether or not US regulators are conscious of DAO1.

Additionally unclear is what impact Heit, urgent ahead with violating securities and commodities legal guidelines by means of GSPro+ and DAO1, may need on finalizing execution of the agreed GSB settlement.

Outdoors of North America GSB, GSPartners and Heit obtained regulatory fraud warnings from Canada, Australia, South Africa, the Bahamas and New Zealand.

Any nation with a regulated monetary market has related securities and commodities legal guidelines to the US.

At time of publication neither Heit, GSPro+, DAO1, GSB or any of its executives are registered to supply securities or function as a commodities dealer in any jurisdiction.

That is and stays a regulatory compliance difficulty, as DAO1’s enterprise mannequin is pitching customers on passive returns, purportedly derived by means of automated buying and selling.

Pending any additional updates, we’ll maintain you posted.