![]() Having exhausted its fictional buying and selling Ponzi throughout at the very least three collapsed reboots, Daisy’s new Ponzi ruse is “Blockchain Sports activities” NFTs.

Having exhausted its fictional buying and selling Ponzi throughout at the very least three collapsed reboots, Daisy’s new Ponzi ruse is “Blockchain Sports activities” NFTs.

Regardless of the identify, Daisy’s Blockchain Sports activities funding alternative has nothing to do with sports activities.

NFT funding positions are tied to soccer gamers, with the person worth of the NFT arbitrarily tied to tracked participant efficiency all through a season.

Who the gamers Daisy will connect to its NFT positions is unclear.

In fact no one in Daisy cares about any of that. They’re solely there to take a position new cash and hope to claw again earlier losses from new suckers.

Daisy’s new Blockchain Sports activities NFT grift Ponzi was revealed at their latest “Limitless” Dubai advertising and marketing occasion. The brand new scheme is ready up at “iamlimitlness.io”, privately registered a couple of weeks in the past on February 4th, 2024.

The “Blockchain Sports activities” a part of the grift is ready up on “bcsports.io”, first registered in Might 2023. The non-public blockchain sports activities area registration was final up to date on October thirtieth, 2023.

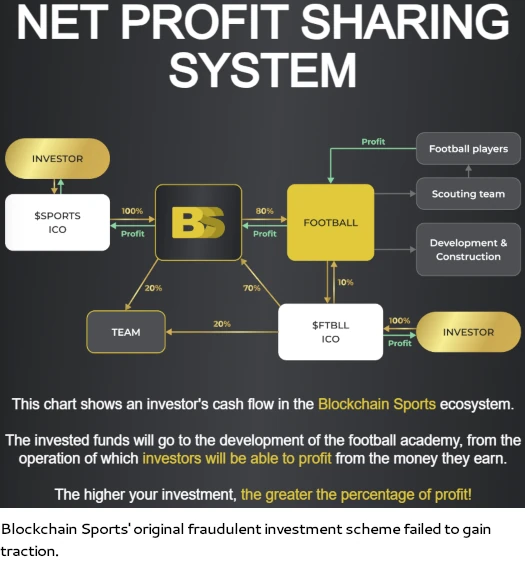

As seen through the WayBack Machine, the unique Blockchain Sports activities incarnation was a shitcoin rip-off constructed round SPORTS and FTBLL tokens.

That in fact all flopped and went nowhere…

…so no we’ve Blockchain Sports activities rebooted as Daisy’s newest Ponzi ruse.

One identify to notice right here is blockchain sports activities’ CEO Dmitriy Saksonov.

As per his LinkedIn profile, Saksonov is predicated out of Brazil. He’s a small-time crypto bro with a couple of crypto mining grifts to his identify.

Daisy’s Blockchain Sports activities reboot is constructed round ATLA, a brand new shitcoin to interchange the failed SPORTS and FTBLL token scams.

Daisy’s Blockchain Sports activities NFT grift Ponzi sees buyers put money into “founders positions”. These begin at 100 USDT, however this solely gives entry to recruitment commissions.

Entry to Daisy’s Blockchain Sports activities Ponzi prices much more:

- Pack 1 prices 500 USDT and gives one “node” funding place, NFT royalties and entry to a 2% Rewards Plan

- Pack 2 prices 2000 USDT and gives 4 “node” funding positions, NFT royalties and entry to a 3% Rewards Plan

- Pack 3 prices 8000 USDT and gives sixteen “node” funding positions, NFT royalties and entry to the MLM comp plan (recruitment commissions)

- Pack 4 prices 25,000 USDT and gives fifty “node” funding positions and NFT royalties (additionally presumably consists of MLM recruitment commissions)

- Pack 5 prices 50,000 USDT and gives 100 “node” funding positions and NFT royalties (additionally presumably consists of MLM recruitment commissions)

- Pack 6 prices 100,000 USDT and gives entry to 200 “node” funding positions and NFT royalties (additionally presumably consists of MLM recruitment commissions)

Node funding place returns are paid in ATLA, which will also be staked to generate larger returns (this in fact additionally places off withdrawals).

The MLM aspect of Daisy’s Blockchain Sports activities Ponzi is straightforward: It’s a ten-level deep unilevel workforce funded by new funding.

- stage 1 (personally recruited associates) – 4%, out there to all Daisy associates

- stage 2 – 2% to 4% (not disclosed), persuade others to take a position 1000 USDT

- stage 3 – 2% to 4% (not disclosed), persuade others to take a position 5000 USDT

- stage 4 – 2% to 4% (not disclosed), persuade others to take a position 25,000 USDT

- stage 5 – 2% to 4% (not disclosed), persuade others to take a position 100,000 USDT

- stage 6 – 2% to 4% (not disclosed), persuade others to take a position 250,000 USDT

- stage 7 – 2% to 4% (not disclosed), persuade others to take a position 500,000 USDT

- stage 8 – 2% to 4% (not disclosed), persuade others to take a position 1,000,000 USDT

- stage 9 – 2% to 4% (not disclosed), persuade others to take a position 2,000,000 USDT

- stage 10 – 2% to 4% (not disclosed), persuade others to take a position 5,000,000 USDT

Additionally observe that ranges 2 to 10 are restricted behind undisclosed downline funding quotas.

Whereas EndoTech’s buying and selling ruse has been dropped, buying and selling continues to be a part of Daisy’s newest Ponzi scheme.

Blockchain Sports activities is, out of the blue, buying and selling 25% of company-wide funding. When 400% in whole is generated, affiliate’s who’ve generated 1000 USDT in personally recruited downline funding obtain a 100% ROI on their preliminary funding.

That is most likely only a matrix cycler simply shuffling round new funding to pay earlier buyers.

There some bonus swimming pools I haven’t coated right here as a result of Daisy hasn’t launched official documentation to the general public but.

In any occasion the remainder of Daisy’s Blockchain Sports activities compensation plan is extra of the identical, shuffle new funding round to repay high recruiters and/or earlier buyers.

On the company stage, Daisy continues to be headed up by US nationwide Jeremy Roma.

Though he’s a US nationwide, Roma spends most of his time hiding out in Dubai.

Neither Daisy, Jeremy Roma, Dmitriy Saksonov or anybody else related are registered to supply securities in any jurisdiction.

So far the one regulator to take motion has been the British Columbia Securities Fee (see Nov 2023 securities fraud warning).

Not anticipating any additional vital updates (barring Daisy’s fourth collapse), however we’ll maintain you posted.