The CFTC has secured an asset-freeze in opposition to Fundsz and house owners Rene Larralde, Juan Pablo Valcarce, Brian Early and Alisha Ann Kingrey.

The CFTC has secured an asset-freeze in opposition to Fundsz and house owners Rene Larralde, Juan Pablo Valcarce, Brian Early and Alisha Ann Kingrey.

As alleged by the CFTC, Fundsz house owners

have fraudulently solicited, accepted, and pooled probably thousands and thousands of {dollars} of contributions.

Juan Pablo Valcarce (Florida), Brian Early (Louisiana), Rene Larralde (Florida) and Alisha Ann Kingrey ( Arkansas), appeared on Fundsz advertising and marketing materials as members of its Advisory Board.

Primarily based on Fundsz’ advertising and marketing, the CFTC estimates the Ponzi scheme solicited “thousands and thousands of {dollars}” from “greater than 14,000” members.

BehindMLM reviewed Fundsz in June 2022. We accurately recognized Fundsz as a Ponzi scheme, providing traders a weekly passive ROI.

Fundz Ponzi ruse was the “staking” mannequin, purportedly funded by “proprietary algorithm” buying and selling.

As alleged by the CFTC, in actuality Fundsz “didn’t commerce in any respect.”

The reality is present in Fundsz advertising and marketing supplies that just lately started to be posted within the Fundsz Telegram group, which state: “[w]e don’t commerce.”

The returns that Fundsz projected and reported weren’t based mostly on precise income from buying and selling participant funds. Fairly, every week the Defendants merely made up a fictional return for the previous week to report back to members.

Defendants additionally made different misrepresentations of fabric reality, together with that Fundsz had made on time and correct funds to members for over seven years, and that the costs of cryptocurrencies like bitcoin and ether, also called digital asset commodities, have been rising dramatically in periods by which the costs of these cash had really fallen.

The lie that Fundsz had been round and making funds for 7 years was central to its advertising and marketing:

The CFTC notes Fundsz solely “got here into existence in 2020”.

As an alternative of buying and selling, Fundsz’ house owners used invested funds to financially enrich themselves.

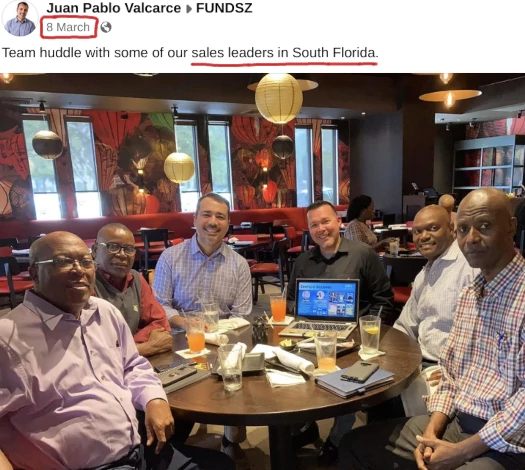

The CFTC cites Rene Larralde, sitting behind the laptop computer within the picture above, for example;

Between roughly September 14, 2021, and October 5, 2022, Defendant Larralde made 35 deposits of digital asset commodities valued at $216,398 from sure digital asset wallets related to Fundsz into an account in Larralde’s identify at Digital Asset Buying and selling Platform A.

And between roughly December 7, 2021, and October 9, 2022, Larralde made 34 withdrawals of U.S. {dollars} from that very same account at Digital Asset Change A, sending $210,388 in fiat foreign money to his private account at a separate monetary establishment, Financial institution B.

Fundsz insiders will know that in June 2023 Fundsz disabled withdrawals and exit-scammed.

Seems this was a direct response to subpoenas issued by the CFTC.

On or about June 23, 2023, after the Particular person Defendants discovered of the Fee’s investigation by advantage of getting obtained subpoenas from the Fee, Defendants halted all participant withdrawals and refused to permit members to withdraw their cash.

An announcement within the Fundsz Telegram group said:

“[E]ffective instantly all withdrawals have been positioned on maintain till we’re capable of tackle our compliance obligation.”

After members apparently complained that they weren’t capable of withdraw cash, on June 23, 2023, Defendant Kingrey responded, within the official Fundsz Telegram group:

“To begin with, watch the way you discuss to me. Fundsz is my Firm and FUD [fear, uncertainty, and doubt] won’t be tolerated.”

As a part of the “we’re a non-public firm” ruse, Fundsz’s house owners additionally escalated makes an attempt to hide Fundsz’s fraud.

After she turned conscious of the Fee’s investigation, Defendant Kingrey additionally instructed Fundsz members to take down all social media posts or movies about Fundsz, saying “[i]f you discover a Fundsz video and you realize the one that owns it, contact them and inform them to unlist it.”

Defendant Early echoed this sentiment, stating “ALL FACEBOOK POSTS WITH THE FUNDSZ LOGO HAVE TO BE DELETED IMMEDIATELY.”

The CFTC has charged Fundsz, Larralde, Valcarce, Early and Kingrey with violating the Commodity Change Act.

The CFTC is in search of a everlasting injunction in opposition to the Fundsz Defendants, in addition to disgorgement of ill-gotten positive factors, restitution and a civil financial penalty.

The CFTC’s Criticism was initially filed beneath seal on July thirty first. Accompanying the Criticism was an emergency movement, requesting entry of an ex-parte statutory restraining order (SRO) and preliminary injunction.

The SRO was granted on August 2nd. As per the SRO order;

The CFTC has made a prima facie exhibiting that since October 2020, Defendants Rene Larralde, Juan Pablo Valcarce, Brian Early, Alisha Ann Kingrey, and Fundsz have made materials misrepresentations concerning the usage of participant funds, anticipated funding returns, and historic funding returns.

Primarily based on this conduct, there’s good trigger to consider that Defendants, have, are, or are about to have interaction in conduct in violation of seven U.S.C. § 9(1) and 17 C.F.R. § 180.1(a)(1)–(3).

Beneath the phrases of the SRO, the Fundsz defendants’ property have been frozen until August twenty third. A Non permanent Receiver has been put accountable for Fundsz and the frozen property.

The Fundsz Defendants, having been served, have been directed to attend a Present Trigger listening to, additionally scheduled for August twenty third.

Defendant Rene Larralde isn’t too comfortable concerning the upcoming anticipated steamrolling in courtroom.

Defendant Rene Larralde isn’t too comfortable concerning the upcoming anticipated steamrolling in courtroom.

On August eleventh Larralde (proper) filed an emergency movement, requesting the granted SRO be dissolved.

Larralde is head of family and gives for his spouse and three kids.

As a result of SRO, Larralde has little to no remaining monetary sources to cowl vital dwelling bills and lawyer’s charges.

The SRO was entered by this Courtroom on an ex parte foundation – regardless of Larralde’s ongoing rolling manufacturing of paperwork in response to a subpoena issued by the Commodity Futures Buying and selling Fee (“Plaintiff”) – based mostly upon a one-sided presentation of allegations asserted by Plaintiff.

Plaintiff’s memorandum in help is totally bereft of any applicable foundation for the issuance of the aid sought and obtained.

Usually we don’t see carveouts on the subject of MLM fraud asset freezes.

Furthemore, Larralde’s movement was accompanied by a sworn declaration.

Pounced on by the CFTC inside hours, Larralde’s declaration may now have implications for the remainder of the Fundsz Defendants.

Following Larralde’s declaratory submitting, the CFTC filed a discover claiming a listening to on its Movement for a Preliminary Injunction wasn’t wanted.

The CFTC believed it had decided that defendant Fundsz was not really a authorized entity, however fairly a d/b/a.

Nonetheless, defendant Larralde’s declaration signifies that he’s “an proprietor” of Fundsz, implying that it’s a authorized entity.

Since Larralde is an proprietor of Fundsz, service on Fundsz was completed by service Larralde pursuant to Fla. Stat. §§ 48.061(1), 48.062(2)(a), or 48.081(1)(a).

No evidentiary listening to is critical to find out that the CFTC has glad its burden for a preliminary injunction.

And to enjoin future violations, the CFTC should solely “present an affordable probability of future violations along with a prima facie case of illegality.”

This low normal is definitely glad by the proof the CFTC has already offered, in addition to by extra proof the CFTC could connect to an extra submitting in help of its movement.

Actually, Larralde’s movement to dissolve the SRO and declaration in help primarily establishes the illegality that befell in Fundsz.

For instance, Larralde admits that Defendants claimed Fundsz traded by means of a proprietary algorithm and admits there was no “literal algorithm.”

Larralde admits that Defendants that Fundsz advertising and marketing supplies falsely claimed that cryptocurrencies had appreciated by wildly inflated percentages, however argues that these false statements have been simply “generalized figures” that have been by some means “expressions of opinion available on the market.”

Larralde implicitly admits that Fundsz has reported false weekly returns of three% to its members “all through its existence,” noting that “at numerous occasions” buying and selling was “stopped,” and due to this fact there was no method for Fundsz to have really achieved 3% returns.

And Larralde even primarily admits that he misappropriated cash from Fundsz traders, stating “I made a number of transfers from Fundsz accounts to accounts in my identify” for functions that embrace “normal distributions [to Larralde] as an proprietor.”

If that is the proof Defendants intend to current, then the preliminary injunction might be issued on the papers. Reside testimony is pointless.

If the preliminary injunction listening to stays scheduled, the CFTC goes on to advise it indents to name defendants Larralde and Valcarce as witnesses.

The CFTC anticipates that it might have the ability to current its proof in an hour or much less.

Being an emergency movement, it’s anticipated Larralde’s movement will probably be dominated on early subsequent week. Keep tuned…