Household First Life’s (former?) CFO, circa 2022, is alleged to have referred to the corporate’s compensation plan as a “Ponzi scheme”.

Household First Life’s (former?) CFO, circa 2022, is alleged to have referred to the corporate’s compensation plan as a “Ponzi scheme”.

Integrity Advertising and marketing Group (IMG) personal Household First Life, the insurance coverage area of interest MLM firm.

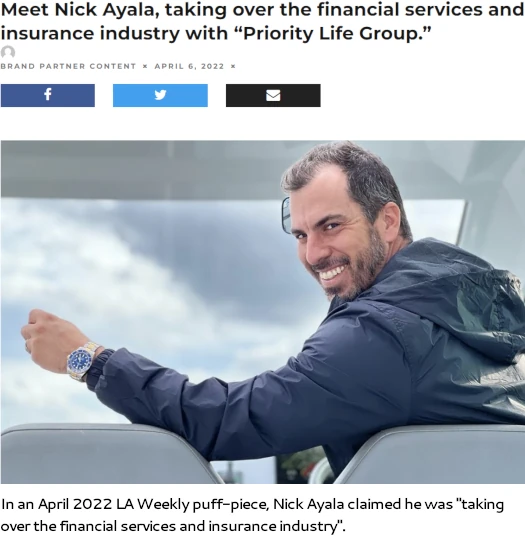

As alleged by IMG in a March third, 2023 filed lawsuit, defendants Nicholas Ayala, Michael Killimett, Ryan Montalto and Matthew Smith

wrongfully induced Integrity to pay them tens of millions of {dollars} in alternate for his or her companies, materials guarantees, and associated providers.

Defendants not solely didn’t stay up their guarantees; it additionally seems that they by no means meant to take action.

Ayala, Killimett, Montalto and Smith are all cited as “former Integrity govt worker(s)”.

- Nicholas Ayala owned Precedence Life Insurance coverage Company LLC

- Michael Killimett owned FFL Southeast

- Ryan Montalto owned FFL United and

- Matthew Smith owned FFL Northwest

IMG claims it purchased the above entities from the Defendants in 2020.

These insurance coverage companies – Precedence Life, FFL Northwest, FFL Southeast and FLL United – then turned wholly owned subsidiaries of Integrity.

As a part of the acquisition, Ayala, Killimet, Montalto and Smith signed Employment Agreements with IMG.

Every Employment Settlement offered that every Defendant would “function President” of his respective Company after Integrity acquired that Company.

In a nutshell, IMG argues that, based mostly on ongoing month-to-month monetary studies, the Defendants didn’t uphold their finish of acquisition settlement.

On the time of Integrity’s acquisition of every Company, every Company was producing web revenue of between $600,000 and $1.2 million yearly.

In 2023, every Company reported destructive annual web revenue.

Integrity offered every Defendant with month-to-month monetary studies to asses the continuing efficiency of his respective Company.

Integrity recognized extreme and ongoing underperformance in reference to every Defendant’s administration of his respective Company.

On info and perception, every Defendant has didn’t commit his greatest efforts, full enterprise time, or consideration, or all of them, to the enterprise and affairs of his respective Company.

In an try to deal with the collapse of the 4 Household First Life companies, IML met with the Defendants in February 2023.

Integrity met with every Defendant to elucidate the steps the Defendant should take, constant together with his Employment Settlement, to enhance his respective Company’s enterprise.

IMG adopted up with “required fast steps” calls for and a “Companion Motion Plan”.

On the time of submitting its lawsuit, IMG claims

on info and perception, no Defendant progressed in taking the fast steps required by the Companion Motion Plan to enhance his respective Company’s enterprise outcomes.

IMG asserts that every of the Defendants as an alternative have been centered on “set up(ing) and operat(ing) his personal impartial advertising group”. This may allegedly be a violation of the Defendant’s Employment Agreements.

By the tip of February 2023 the Defendants seem to have had sufficient. On February twenty seventh every of the Defendants “threatened to resign”.

IMG responded by terminating the Defendants later the identical day.

IMG’s filed lawsuit asserts

- breach of contract

- tortious interference with present contract

- civil conspiracy

- fraudulent inducement and

- unjust enrichment

IML is in search of damages in extra of $5 million, and a declaratory judgment confirming every of the Defendants was correctly terminated.

On June fifth, the Defendants filed an Amended Reply to the Grievance. The Reply is the standard denials however what’s fascinating is the connected Counterclaims.

Versus them going off and constructing their very own “impartial” organizations, the Defendants declare the 4 entities failing is a results of “IMG’s conduct”,

IMG makes use of a extremely misleading, complicated, and convoluted compensation construction.

Though the Administration Members continued to provide important progress for IMG, IMG and (Shawn) Meaike started manipulating the Bonus Scheme by altering numerous incentives and transferring credit score for brokers round to keep away from having to pay important bonuses to the Administration Member’s companies.

Meaike would additionally use the cash that was imagined to be paid to the Administration Members’ companies for his personal private pleasure and acquire.

Oddly sufficient, none of that is talked about in IML’s unique lawsuit.

I ought to level out that Shawn Meaike is the unique founder and President of Household First Life. He offered the corporate to IMG in October 2019.

I ought to level out that Shawn Meaike is the unique founder and President of Household First Life. He offered the corporate to IMG in October 2019.

As a part of the acquisition, Meaike was given an possession stake in Integrity Advertising and marketing Group and different perks.

Meaike obtained a 5 p.c kickback for every FLL “companion” acquired by IMG.

Due to this kickback, Meike used the Bonus Scheme to shift cash to different FFL managed companies to inflate their income to make them extra engaging for IMG to buy.

As soon as acquired by IMG, Meike would then shift cash out of those companies to make them much less worthwhile.

The Defendants declare, upon studying of “the fraudulent scheme of manipulating their financials”, they confronted IMG’s CFO and Director of Gross sales Operations.

This govt will not be named within the Defendant’s Counterclaim. Household First Life’s web site fails to listing a CFO.

In any occasion, Defendants go on to say;

After assembly with Ayala and searching into the difficulty intimately, the Gross sales Director referred to as the bonus construction a “Ponzi scheme,” and he or she stated they might work out an answer.

Nonetheless, nothing was performed thereafter to rectify the issue.

As an alternative, Ayala was advised to “cling in there” and to proceed “doing what he was doing”.

As of November 2022, Matthew Smith claims his FFL Agent place earnings “have been minimize by greater than 75%, although manufacturing considerably elevated”.

The IMG Gross sales Director additionally advised Smith the bonus program was a “Ponzi scheme”, and he or she confirmed that their bonuses have been being lowered so IMG and Meike might seem extra worthwhile.

Right here’s the beforehand referenced February 2023 showdown, this time as recounted by the Defendants;

On February 8, 2023, regardless of understanding every Administration Members’ financials have been merely incorrect, IMG despatched a letter to every Administration Member falsely accusing them of getting decrease “monetary consequence … for the 2022 fiscal 12 months, as in comparison with the monetary outcomes of [their agencies] when Integrity acquired the enterprise …”

The Defendants go on to allege they got directions that “would make it almost unattainable to succeed in the targets of the motion plan”.

Presently, it turned clear that IMG was making an attempt to manufacture a for “Trigger” termination so it might not must pay FMV for the Administration Members Rollover Items.

The Defendants preserve they didn’t threaten to resign however did in actual fact resign on February twenty seventh.

Thereafter, IMG acknowledged receipt of the Administration Member’s resignation letters, however claimed IMG was now terminating all of them – after the very fact – “for trigger”.

In the identical termination letter, IMG’s actual motivation was revealed, as IMG said that it might be exercising its proper to repurchase every Administration Members Rollover Items, ensuring to emphasise the for “Trigger” language of their Employment Agreements.

“Rollover Items” are a part of a monetary association reached when IMG purchased the Defendants’ FFL companies.

Every Administration Member offered capital contributions in alternate for “Class A Widespread Items” and/or “Class A Most popular Items” (Rollover Items).

The Defendants argue that FFL was adamant it terminated them for “Trigger”, in an effort to get out of paying out regardless of the Rollover Items have been value on the time.

The Defendant’s Counterclaim alleges breach of contract and customary legislation fraud.

Declaratory judgment pertaining to the Defendants resigning, and IMG not terminating them for “Trigger” can also be sought.

BehindMLM reviewed Household First Life in November 2021. I didn’t see a Ponzi scheme however I additionally wasn’t conscious Meaike was allegedly manipulating Agent positions.

Initially, an govt manipulating an MLM compensation plan for their very own profit is a due-diligence pink flag. It’s additionally most likely proof of fraud ought to the FTC ever file go well with.

Taking a step again from each IMG’s unique lawsuit and the counterclaim, it seems revenue within the 4 Defendant’s positions dried up.

This was possible a mixture of Meaike’s alleged manipulation and that resulting in an absence of effort. Why work more durable when the man working the corporate is simply going to screw you out of more cash?

Finally the positions bumped into the pink, bringing us to the February 2023 showdown.

I’m additionally curious as to what particularly led Household First Life’s CFO to check with the corporate as a Ponzi scheme. Both the time period was misused interchangeably to explain a pyramid scheme, or there’s some funding shenanigans happening Household First Life I’m not conscious of.

A CFO would by definition be in-charge of and totally conscious of Household First Life’s financials. They’d after all additionally learn about unlawful manipulation of Agent’s revenue to learn Meaike and anybody he was working with.

That Household First Life at present doesn’t seem to have a CFO, or not less than publicly acknowledge having one, is ominous.

That stated, personally I’m leaning to “Ponzi scheme” getting used to check with a “pyramid scheme”. Within the absence of additional clarification nonetheless, I can’t affirm.

Sadly IMG’s lawsuit and the Defendant’s Counterclaim have been filed in a state-level Texas District Courtroom.

This implies I can’t monitor them on Pacer and, because of this, BehindMLM gained’t be capable of monitor the case. Unique filings lined on this article have been courtesy of NAAIP.

Pending any updates we’re capable of share, we’ll maintain you posted.