CashFlowNFT has banned affiliate promoters from sharing details about the corporate.

CashFlowNFT has banned affiliate promoters from sharing details about the corporate.

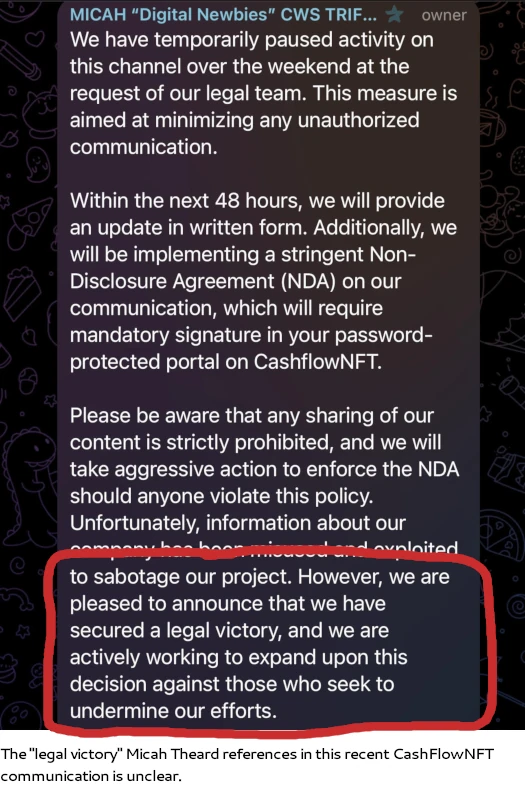

As per a latest communication despatched out by founder Micah Theard;

We shall be implementing a stringent Non-Disclosure Settlement (NDA) on our communication, which would require necessary signature in your password-protected portal on CashFlowNFT.

Please remember that any sharing of our content material is strictly prohibited, and we’ll take aggressive motion to implement the NDA ought to anybody violate this coverage.

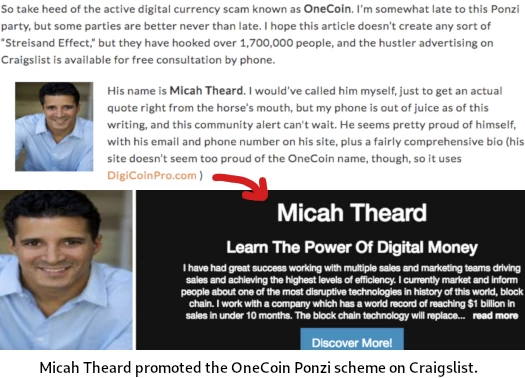

Theard (proper), a former promoter of the OneCoin Ponzi scheme, goes on to assert that data shared with associates “has been misused and exploited to sabotage our challenge”.

Theard doesn’t present any examples. We’re actually curious what CashFlowNFT promoters are banned from sharing.

Sadly for Theard, now that he’s initiated that entire MetaTerra Corp circus, he doesn’t have a alternative. Both full disclosure is made public by SEC filings, or he and CashFlowNFT proceed to commit securities fraud within the US.

MetaTerra Corp’s subsequent SEC submitting, it’s annual 10-Ok, is due 90 days from December thirty first, 2023 (~March thirty first, 2024).

Something lower than full disclosure to the SEC of CashFlowNFT’s full audited financials and MLM funding alternative will represent ongoing securities fraud.

Of specific curiosity shall be MetaTerra Corp disclosing to the SEC that CashFlowNFT has already been committing securities fraud by promoting digital shares to US residents.

CashFlowNFT’s continued acts of securities fraud mirror Theard’s persevering with to exhibit a lack of information of US securities legislation.

In typical crypto bro trend, Theard frames regulation of cryptocurrency securities to “assaults”. He additionally incorrectly appears to assume cryptocurrency doesn’t fall beneath US securities legislation.

[1:49:42] Many corporations are doing issues, that they don’t know for certain, in the event that they’re going to get in bother. As a result of America has no crypto rules in place. They solely have (the) SEC.

It’s not, there’s no establishment saying, “Hey, we’re the crypto regulatory physique. And listed below are the crypto rules”.

So far as cryptocurrency funding schemes working afoul of US securities legislation, there doesn’t should be a “crypto regulatory physique” or separate “crypto rules”.

The US Securities and Alternate Act has been round since 1933. The Howey Take a look at, generally used to find out an funding contract for the aim of making use of securities legislation, was a US Supreme Court docket resolution courting again to 1946.

Commonsense apart, the SEC has made it very clear that it doesn’t matter what you utilize to violate securities legislation.

Cryptocurrency is only a new automobile for fraud and, as demonstrated by the growing variety of regulatory lawsuits and DOJ legal enforcement actions, isn’t exempt from current US securities legislation.

The above quote from Theard is from a two hour “reality” video, uploaded to Theard’s Boogie Gopher Membership YouTube channel on January twenty ninth, 2024.

Many of the video is Theard rambling on about irrelevant speaking factors (he doesn’t tackle CashFlowNFT committing securities fraud), however there are some fascinating factors to notice.

Again in Might 2023 BehindMLM reported on traders in Oscar Garcia’s collapsed Batched Ponzi being funneled into CashFlowNFT.

Since then issues have fallen aside.

Theard now refers to Garcia (proper) as “the largest scammer I’ve ever met”. Each events are claiming the opposite facet doesn’t have what they represented they did.

Theard now refers to Garcia (proper) as “the largest scammer I’ve ever met”. Each events are claiming the opposite facet doesn’t have what they represented they did.

In his personal phrases, that is Garcia’s tackle the failed deal;

[20:20] So I bought concerned like many traders, the place I used to be launched to Micah and so they promised me and so they instructed me that they had a number of issues already in place.

I used to be contracted to make all their stuff look phenomenal. And lots of people bought actually excited after I began working for the primary 90 days.

However after that I came upon actually rapidly that lots of issues that they promised was simply lies. And I’m fulfilling individuals’s… I’m fulfilling my contract greater than the rest.

Right here’s Theard’s model of occasions;

[17:24] We did a contract with Oscar to buy expertise from him. He additionally bought kind of a consultancy settlement with us, to seek the advice of.

And in order that was for $10,000 a month, which was actually about UI, UX, serving to us with web sites.

Then there was, y’know, a um, sure sum of money for getting his expertise. Which implies that it must be price cash and it must be expertise.

Not like a front-end web site. Not some form of … mainly front-end consumer expertise, front-end no matter. It was expertise referred to as nodes, that will do one thing. That had a operate, validating transactions – which he ended up not having.

Theard additionally reiterates CashFlowNFT’s MetaTerra digital shares scheme.

[1:10:12] That’s one thing that I stated on a video name. I stated, “Hey we’ll name them Nasdaq Submitting Tokens.” Proper?

That’s not the precise definition, as a result of they don’t truly exist. What exists is MetaTerra shares.

That’s what they’re getting, so it doesn’t matter what was stated. It was form of a “pun joke”.

As a result of individuals have been saying that we bought NFTs to American traders. Not true. What we bought was shares. What they’re getting is shares.

The opposite tidbit price noting from Theard’s video is Theard claiming Ofinans OU, an Estonian shell firm ties to CashFlowNFT, misplaced its Estonian digital foreign money license in 2021 as a result of it stopped paying charges.

Theard doesn’t clarify why charges weren’t paid. He additionally doesn’t tackle why, in November 2023, Miracle Pay (one other firm tied to CashFlowNFT), to this present day nonetheless references the suspended license quantity on its web site.

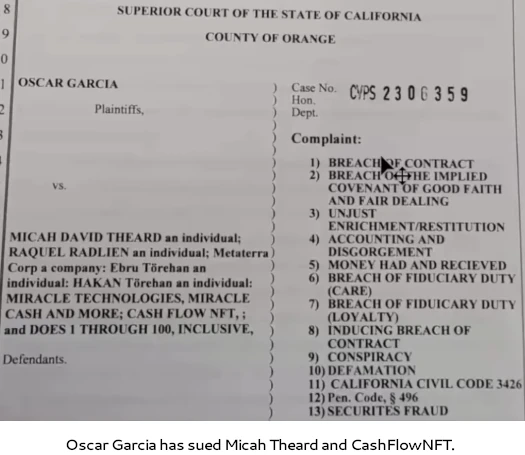

Oh and apparently Garcia has sued CashFlowNFT and Theard. And Theard reckons he has or is about to sue Garcia again in type.

Sadly, not less than so far as Garcia’s lawsuit goes, these are state filings and I don’t have entry to them.

Pending submitting of MetaTerra’s annual 10-Ok subsequent month, keep tuned…