Saskatchewan’s Monetary and Shopper Affairs Authority has requested GSPartners buyers get involved.

Saskatchewan’s Monetary and Shopper Affairs Authority has requested GSPartners buyers get involved.

Buyers are requested to contact the FCAA’s Securities Division if they’ve invested with GSPartners. All the time test registration first earlier than investing.

As above, the FCAA’s request was made on their public Twitter profile on June fifteenth. It follows the FCAA issuing a GSPartners securities fraud warning on June 1st;

The Monetary and Shopper Affairs Authority of Saskatchewan (FCAA) warns buyers of the web entity GSPartners.

This entity claims to supply Saskatchewan residents a possibility to spend money on crypto property.

GSPartners is just not registered to commerce or promote securities or derivatives in Saskatchewan.

The FCAA cautions buyers and shoppers to not ship cash to corporations that aren’t registered in Saskatchewan, as they might not be reliable companies.

Along with Saskatchewan, Alberta (GSTrade, G999 and GSPartners), Quebec and British Columbia have additionally issued comparable GSPartners associated securities fraud warnings.

The Central Financial institution of the Comoros additionally issued a GSB Gold Commonplace Financial institution fraud warning in June 2022.

Within the midst of Canadian regulatory fraud warnings, GSPartners rebranded to Swiss Valorem Financial institution final month.

As of Might 2023, SimilarWeb tracked Canada because the second largest supply of visitors to GSPartners’ web site.

The overwhelming majority of GSPartners web site visitors originates from the US (66%). Authorities there have but to make any investigations into GSPartners public.

By cryptocurrency “certificates”, Swiss Valorem Financial institution affords buyers passive returns of as much as 5% per week for 52 weeks.

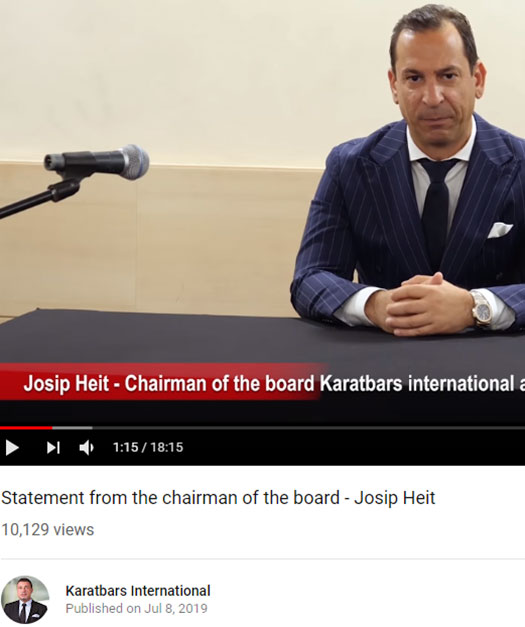

Neither GSPartners, Swiss Valorem Financial institution or proprietor Josip Heit are registered to supply securities in any jurisdiction.

The SEC advises that securities fraud and cryptocurrency is a powerful indicator of a Ponzi scheme.

We’re involved that the rising use of digital currencies within the world market could entice fraudsters to lure

buyers into Ponzi and different schemes wherein these currencies are used to facilitate fraudulent, or just

fabricated, investments or transactions.The fraud might also contain an unregistered providing or buying and selling platform. these schemes typically promise excessive returns for getting in on the bottom ground of a rising Web phenomenon.

Federal and state securities legal guidelines require sure funding professionals and their companies to be licensed or registered.

Many Ponzi schemes contain unlicensed people or unregistered companies.

GSPartners and Swiss Valorem Financial institution are run by former Karatbars Worldwide govt Josip Heit.

Heit, initially from Croatia however believed to carry a German passport, runs GSPartners and Swiss Valorem Financial institution from Dubai.