Blue Ocean Society fails to offer possession or govt info on its web site.

Blue Ocean Society fails to offer possession or govt info on its web site.

By its personal admission, Blue Ocean Society deliberately withholds essential due-diligence info from customers:

Blue Ocean Society (BOS) is an unique, invitation-only non-public wealth membership that brings collectively visionary people searching for extraordinary alternatives for progress and prosperity.

We curate entry to blue-chip alternatives usually reserved for ultra-high-net-worth people and establishments, making them accessible by way of our collective method.

Our society is constructed on the pillars of privateness, safety, and cautious curation.

Membership is by invitation solely. You should be invited by an current member who is aware of, likes, and trusts you personally.

One identify we are able to connect to Blue Ocean Society is “Kerianne”:

The above, from an official Blue Ocean Society investor electronic mail, cites Kerianne as a “Supervisor” of the corporate.

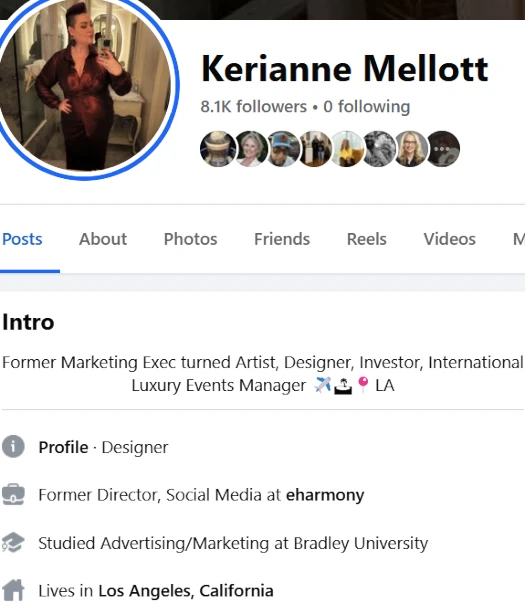

On social media Kerianne Mellott cites herself as a “Former Advertising and marketing Exec turned Artist, Designer, Investor, Worldwide Luxurious Occasions Supervisor”.

Mellot can be a resident of California within the US.

Who Mellot works with to run Blue Ocean Society is unclear however they’re most certainly additionally based mostly within the US.

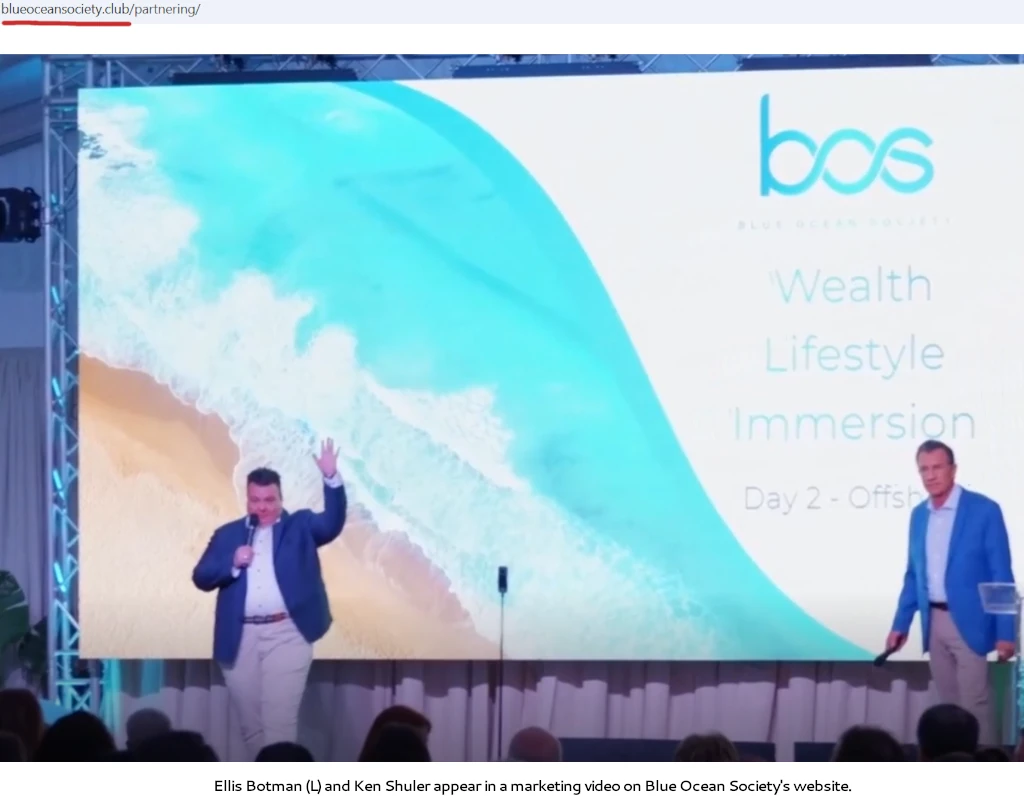

To that finish two unconfirmed names who seem like connected to Blue Ocean Society are Ellis Botman (aka Elisabeth Botman) and Ken Shuler (aka Doyle Shuler).

Shuler and Botman had been cited in a Reddit thread discussing Blue Ocean Society in late 2024:

The thread has a number of Blue Ocean Society buyers complaining about withdrawal delays, which we’ll additional discover within the conclusion of this overview.

Shuler and Botman additionally popped up in electronic mail communications I’ve had with Blue Ocean Society buyers. I don’t have something official tying both to Blue Ocean Society however this isn’t shocking given the secrecy of the scheme (once more additional explored within the conclusion beneath).

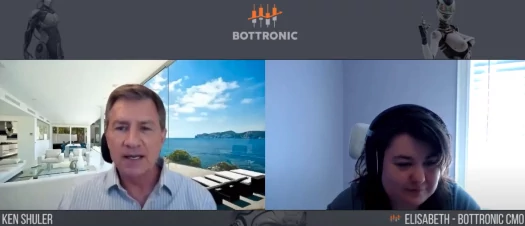

BehindMLM final got here throughout Shuler and Botman working collectively in BotTronic, an fraudulent MLM crypto funding scheme launched in 2021.

(Sidenote: Elisabeth Botman seems to have transitioned to “Ellis” someday after BotTronic.)

Replace twenty seventh January 2025 – This slipped my consideration after I was doing my preliminary spherical of analysis; Ellis Botman and Ken Shuler each seem on a background advertising video on Blue Ocean Society’s web site (click on to enlarge):

From this it’s wanting extremely seemingly Botman and Shuler are behind Blue Ocean Society. /finish replace

Blue Ocean Society’s web site area (“blueoceansociety.membership”), was first registered in August 2022. The non-public registration was final up to date on August twelfth, 2024.

Official Blue Ocean Society communication emails cite the shell firm Blue Ocean Administration LLC (registration unclear), tied to an undisclosed deal with in St Kitts & Nevis.

St Kitts & Nevis is a tax haven with little no identified regulation of MLM associated fraud.

As all the time, if an MLM firm is just not brazenly upfront about who’s working or owns it, suppose lengthy and arduous about becoming a member of and/or handing over any cash.

Blue Ocean Society’s Merchandise

Blue Ocean Society has no retailable services or products.

Associates are solely capable of market Blue Ocean Society affiliate membership itself.

Blue Ocean Society’s Compensation Plan

Blue Ocean Society associates spend money on numerous supplied unregistered funding schemes.

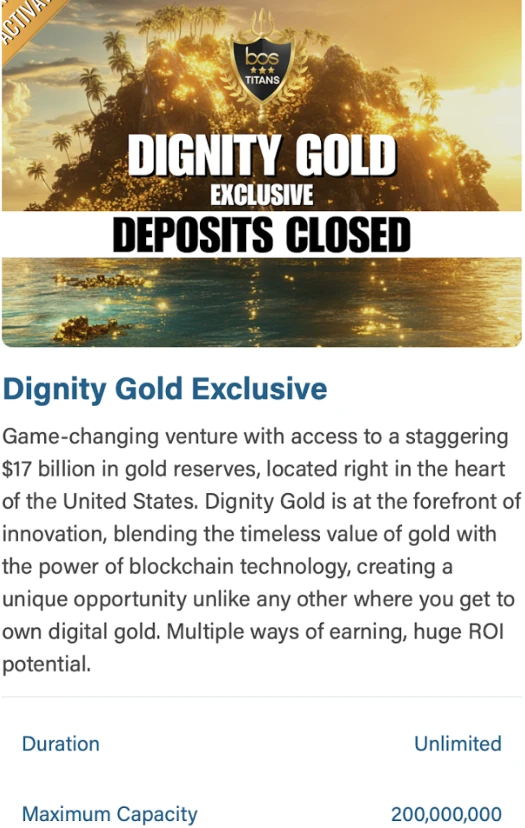

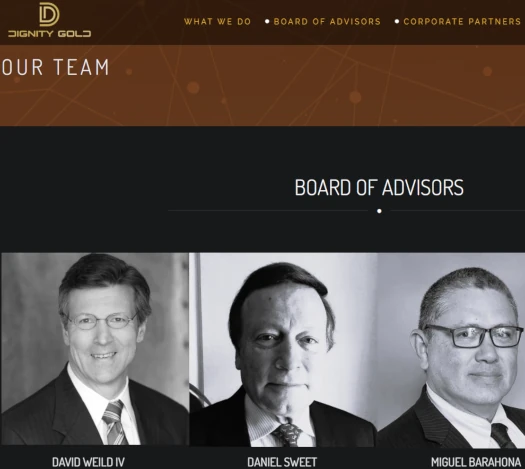

Dignity Gold

Unregistered crypto funding scheme by way of which Blue Ocean Society pitches “big ROI potential”.

Dignity Gold is purportedly tied to claimed gold belongings within the US (no verifiable proof offered). Constructed round collapsed DIGau tokens.

Raverus

Unregistered funding scheme promising 20% a yr.

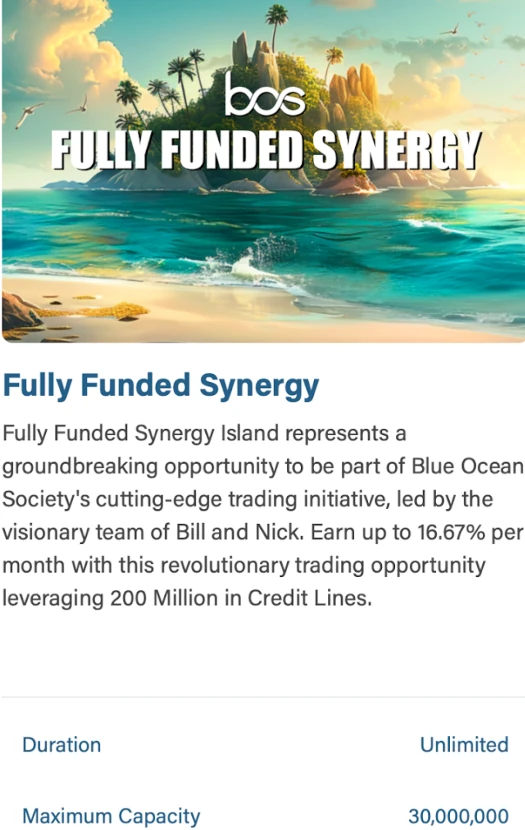

Absolutely Funded Synergy

Unregistered funding scheme pitching 16.67% a month. Purportedly run by “Invoice and Nick”.

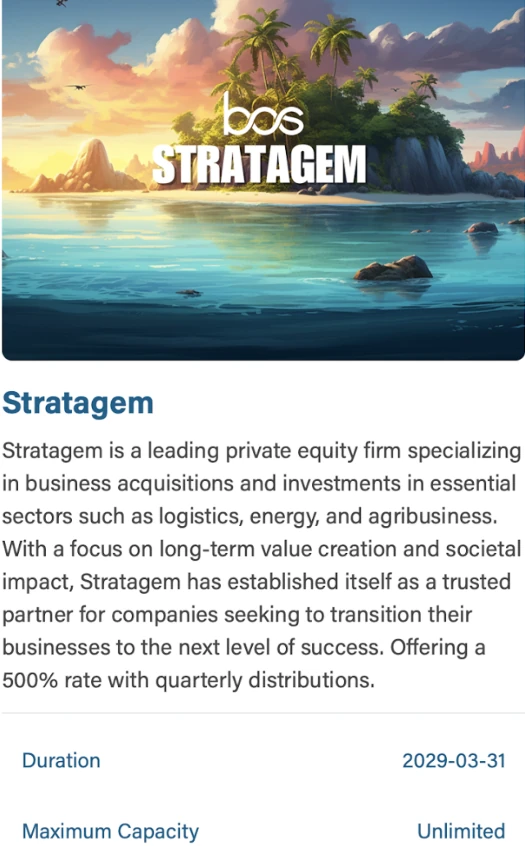

Stratagem

Claimed “non-public fairness agency” funding alternative pitching 500% yearly, paid quarterly.

Tribe360i

“Fintech ecosystem” funding scheme by way of which Blue Ocean Society pitches “72% assured annual curiosity”.

SuperCo

“300% to 500% in lower than 8 months” passive returns funding scheme (particular particulars withheld by Blue Ocean Society).

PTI

Crypto funding schemes by way of which funding is solicited on a lot of unverifiable advertising claims.

South One

“Utilizing AI to rip-off Africans” unregistered crypto funding scheme pitching 8% a month.

VoiceLife

In-house funding scheme pitching “a doubtlessly excessive ROI … that may present passive earnings for years, if not many years”.

Legacy Buying and selling

Unregistered buying and selling funding alternative pitching a “normal 18% month-to-month return”.

A “Legacy Buying and selling – One Yr” variant pitches 12% a month:

TAP Reset

An unregistered buying and selling “funding alternative … with projected returns of 300-500%” over six months.

Vicksburg Prospect (Gasoline) Alternative

Purported Texas-based funding scheme run by Sung Kim. “Potential returns” purportedly derived by way of undisclosed “accountable drilling and manufacturing methods”.

Energy Pulse

“Passive earnings” pitched by way of a purported “strategic alliance with DME Vitality”.

DME Vitality holds itself out to be a “a modern-day oil and gasoline firm” based mostly out of Texas.

365

Unregistered buying and selling funding alternative. $15 million in funding sought on the promise of “1% per day”.

Gold Harbor

Unregistered buying and selling funding alternative run by “Sean R.” 100% ROI pitched each “buying and selling cycle” (length not disclosed).

Santa Rally 2023

Unregistered buying and selling funding alternative pitching 100% (“double your deposit”) “on the finish of the time period” (length not disclosed).

DAV Alternative

Unregistered “dynamic algorithm enterprise” buying and selling alternative for “BOS Titans”. $10 million solicited on the promise of “a minimal month-to-month return of 11.5%”.

Rally 3

Unregistered buying and selling funding alternative “aiming to attain 25% month-to-month revenue”.

Rally 5

$5 million in funding requested for, no particulars offered.

Rally 7

Unregistered buying and selling funding alternative “aiming to attain 25% month-to-month revenue”.

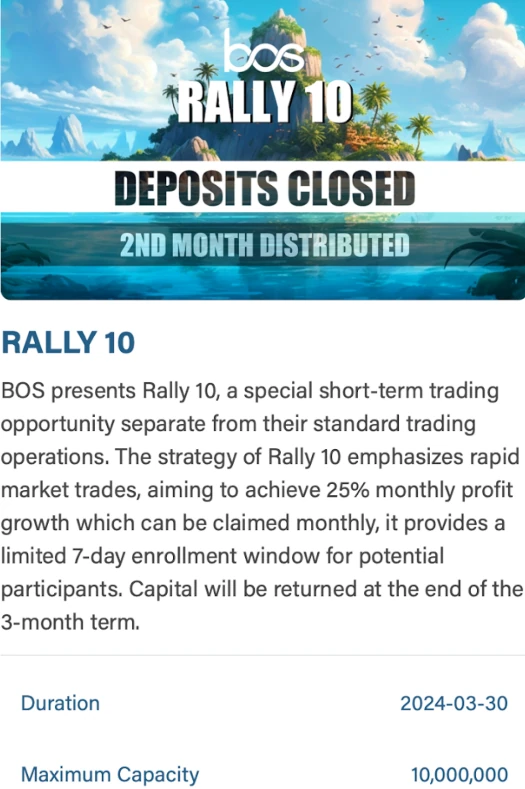

Rally 10

Unregistered buying and selling funding alternative “aiming to attain 25% month-to-month revenue”.

Rally Hybrid

Unregistered buying and selling funding alternative “aiming to attain 25% month-to-month revenue”. Funding locked up for one yr.

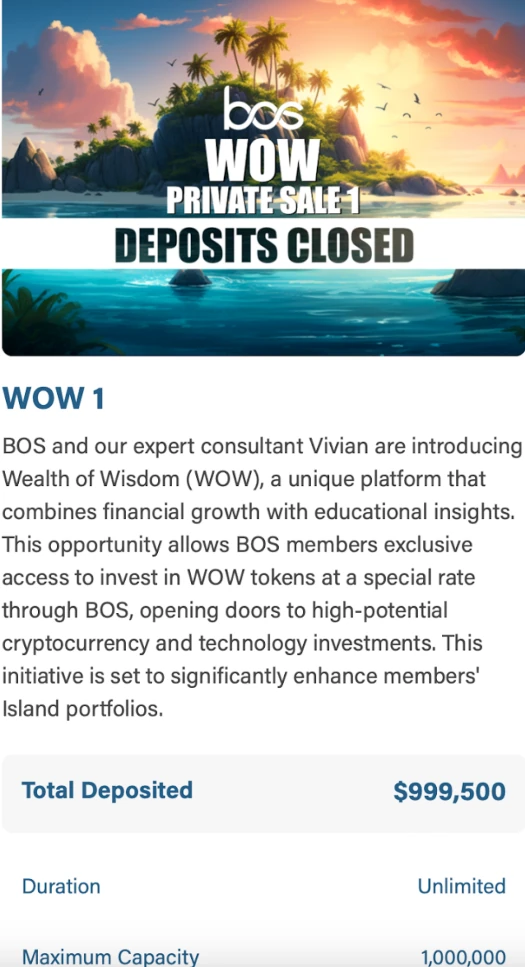

WOW 1

Wealth of Knowledge unregistered crypto funding scheme run by way of WOW tokens.

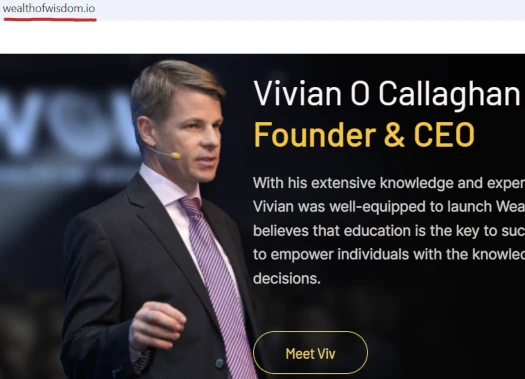

Wealth of Knowledge is run by Vivian O Callaghan.

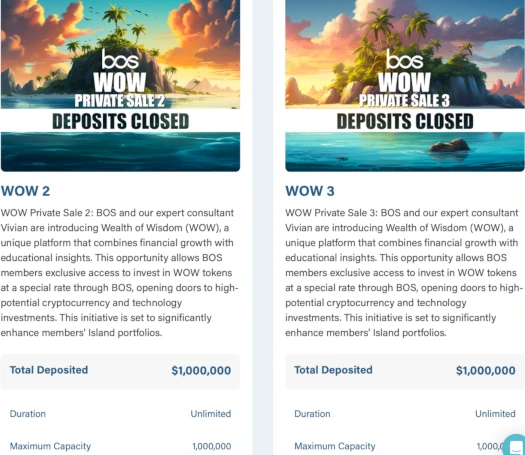

WOW 2 and WOW 3

Wealth of Knowledge unregistered crypto funding schemes run by way of WOW tokens.

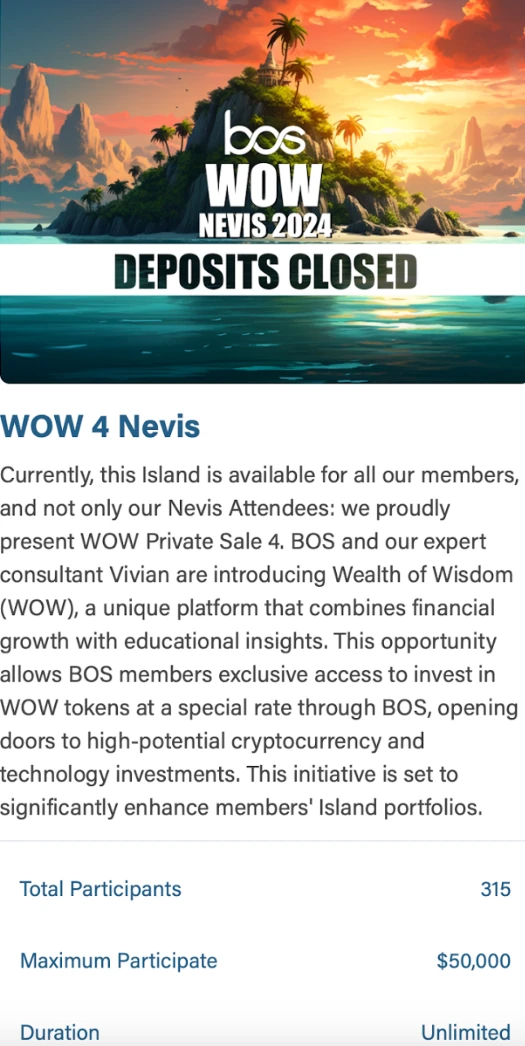

WOW 4 Nevis

“Non-public sale” crypto funding scheme run by way of WOW tokens as a part of Blue Ocean Society’s ties to Wealth of Knowledge.

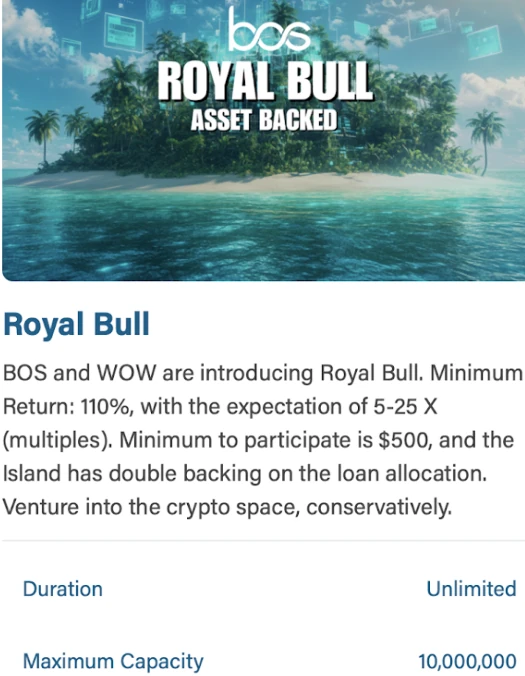

Royal Bull

Claimed crypto funding scheme partnership with “WOW” (Wealth of Knowledge”). “Minimal” 110% ROI pitched.

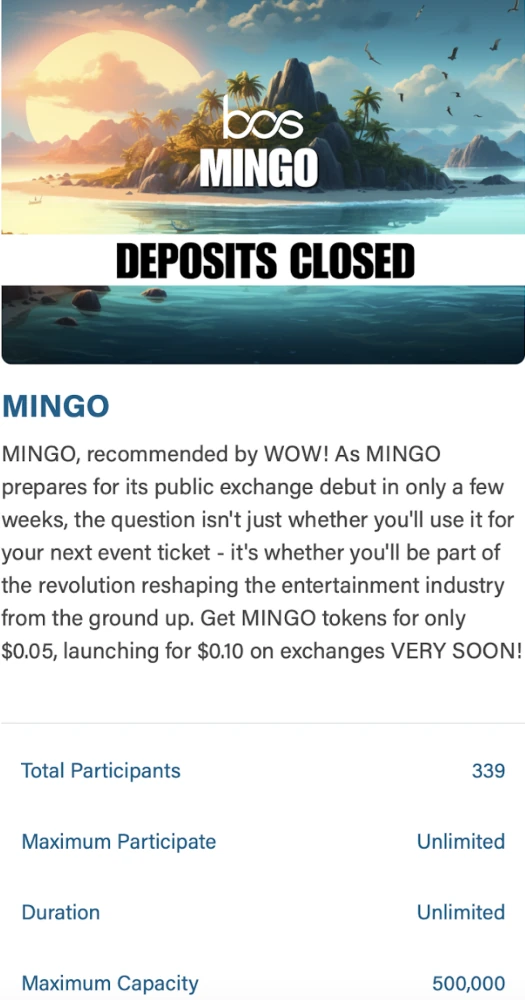

Mingo

One other partnership with “WOW”. Crypto pump and dump scheme constructed round MINGO tokens.

The MLM aspect of Blue Ocean Society pays on recruitment of affiliate buyers.

Gratitude System

Blue Ocean Society pays commissions on downline funding exercise and ROI funds. Blue Ocean Society refers to those commissions as “gratitude charges”.

As an alternative of getting an open and clear compensation plan, Blue Ocean Society manipulates commissions on downline funding.

That is achieved below the ruse of commissions being “made on a randomized foundation”.

BOS Gratitude payouts are intentionally made on a randomized foundation.

Accordingly, there will likely be moments when you’ll be able to provoke transfers of Gratitude charges to your BOS Most important Stability.

The timing of every of those Gratitude switch home windows will likely be decided by our Accounting Staff and won’t accord with any set or pre-determined schedule.

As BOS Gratuities are frequently accumulating, we’ve got established randomized home windows throughout which these quantities might be transferred to your Most important Stability.

Notice that withdrawals of Blue Ocean Society are additionally solely permitted on a randomized foundation (to the “BOS Most important Stability”). This seems designed to lure as a lot cash in Blue Ocean Society for so long as attainable.

Becoming a member of Blue Ocean Society

Blue Ocean Society affiliate membership prices should not disclosed on the corporate’s web site.

Required funding quantities for every supplied unregistered alternative differ.

Blue Ocean Society Conclusion

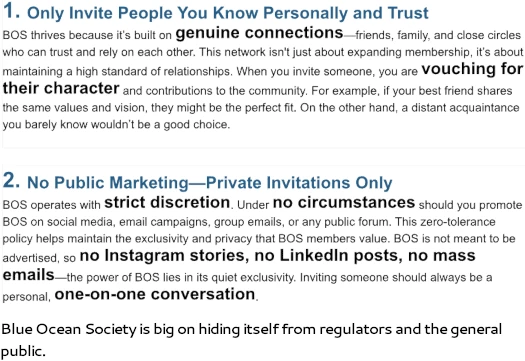

Blue Ocean Society seems to have been designed from the bottom up with an emphasis on regulatory non-compliance and evading detection by regulators and authorities.

To that finish we’ve got Blue Ocean Society

- failing to reveal possession and govt info on its web site;

- failing to reveal funding particulars to customers;

- failing to register any of its passive returns funding alternative with the SEC and/or CFTC (buying and selling schemes the place relevant);

- deceptive affiliate buyers on the character of the corporate’s MLM compensation plan; and

- instructing recruited buyers to reduce the chance of public publicity by working with “strict discretion”

Along with verifiable securities and commodities fraud, disclosure fraud and deception goes hand in hand with Blue Ocean Society working a Ponzi scheme.

Supporting that is claims from buyers of withdrawal delays. From the beforehand cited Reddit thread;

I imagine these excuses are stalling strategies to proceed the rip-off as I do know individuals who have been making an attempt to get their promised returns for over a yr, however are unable to.

**

I’m personally invested with six figures in Blue Ocean for 2 years. There have been delayed withdrawal payouts for his or her preliminary buying and selling fund. That’s anticipated to be resolved in October 2024.

**

I’m a part of the Blue Ocean Society Membership. Sadly, I’m in the identical boat. I invested a excessive six determine and since December 2023 I requested withdrawal of a excessive six however was solely supplied $10,000, with the promise that the remainder would come.

Sadly, like many different, I’m nonetheless ready. I’m virtually in restoration mode however they proceed to stall with new guarantees.

Whereas unverified testimonials needs to be taken with a grain of salt, there may be additional proof to help Blue Ocean Society’s withdrawal issues.

From the identical Reddit thread is that this textbook instance of Ponzi stalling;

Based mostly on our meticulous preparations and knowledgeable consultations from the consulting group who helps us with the whole lot, right here is the anticipated timeline for processing of the Authorities Bond Monetization (Plan A):

October ninth: Entry to Gov Bond Liquidity

Up to date October ninth: We’ve got obtained information that entry is forthcoming, however because of the substantial quantity the monetization financial institution wants 4 extra days. We count on entry now on October 14th, however most certainly October fifteenth.

Up to date October 14th: We’ve got moved into the entry part! This can be a important milestone within the course of, because it permits us to start coordinating with the financial institution for the subsequent important step.

At this stage, we are going to work intently with the financial institution to facilitate the switch of liquidity from the monetization get together to the designated vacation spot account.

This marks an necessary development, bringing us yet another step nearer to efficiently finishing the transaction.

The monetizer has notified us that on Thursday October seventeenth, a gathering is scheduled with coordinating events on either side, in addition to the signing off on the switch of the liquidity.

October tenth & eleventh: Coordination with the financial institution to provoke the switch from the Gov Bond Monetization course of to our checking account

Up to date October ninth: Because of the reality the financial institution wants extra time, the coordination to provoke the switch will transfer to October sixteenth & seventeenth.

Up to date October 14th: We’re nonetheless moderately on observe right here, the coordination assembly is on October seventeenth, and would possibly stretch to October 18th with the clearance of the transaction. Nonetheless, we’re heading into the proper course. Step by Step.

The Gov Bond Monetization financial institution is positioned in Singapore, with our use of a financial institution in Switzerland. It is going to take roughly 5 – 7 enterprise days for the funds to achieve Switzerland.

Up to date October 14th: We’ve been suggested that it’s extremely seemingly that the precise switch will begin on the primary enterprise day after the weekend, which will likely be October twenty first. That is in fact pending the coordination assembly and signing off on October seventeenth and probably stretches to October 18th.

Subsequently, we are going to switch the funds from our Swiss financial institution to the change for conversion to USDT / USDC.

The transformed funds will then be directed to the BOS Distribution Wallets, marking the start of processing the batches of withdrawals to the Most important Stability of every member who’s awaiting a withdrawal from the trading-related Islands.

Upon reaching the BOS Distribution wallets, we are going to course of the transactions in batches. Our system can handle a number of batches day by day and course of limitless quantities as soon as it’s in place. We’re well-prepared and prepared to proceed!

That’s from October 2024 and strongly jogs my memory porky pies Michael Glaspie fed buyers in his “Mike G Deal” rip-off.

Quick ahead to January twenty third, 2025, and Blue Ocean Society is in fact nonetheless trotting out excuses (notice “buying and selling islands” refers to Blue Ocean Society’s a number of unregistered funding schemes):

Once we realized that our Island Companion—who was accountable for the Buying and selling Islands—may now not fulfill their obligations, we discovered ourselves in a troublesome scenario that, whereas fully out of BOS’s management, posed a severe threat to our members’ balances.

We perceive how irritating it may be to see sudden adjustments in your monetary preparations, and we empathize with any doubts or issues you’ll have.

Earlier in 2024, we got down to safe exterior liquidity so that everybody’s withdrawal requests might be met whereas the Island Companion tried to resolve issues.

However as we arrived in the direction of the top of the yr, it grew to become clear that the companion’s unprecedented challenges would drastically restrict how a lot of the present Island Balances may really be lined if we relied solely on that route.

We knew that wasn’t acceptable.

Leaving anybody empty-handed goes in opposition to the whole lot BOS stands for. We decided to dissolve the connection, and to maneuver the reconciliation course of with the Island Companion to the back-end so no member of BOS can be adversely affected by it.

The unnamed companion Blue Ocean Society refers to is Sean J Robertson (aka Sean James Robertson). Robertson has reportedly cashed out and disappeared.

Take into consideration having your life financial savings in a financial institution that all of the sudden shuts down. If solely a portion of deposits is insured, some individuals would possibly get again solely a fraction of their financial savings—whereas others may find yourself with nothing.

That’s unfair and goes in opposition to our mission of economic empowerment.

So reasonably than simply hope for the perfect, we selected to interchange the Buying and selling Island Balances with a brand new asset on our personal stability sheet—Dignity Gold safety tokens.

These tokens are backed by bodily gold and carry a corporate-guaranteed flooring worth of $2, which means the construction we put in place makes you 25% up on high of what we had been capable of reconcile, at a naked minimal.

It’s not about “forcing” anybody into a brand new Island possibility; it’s about defending the complete BOS group and making certain nobody is left behind. We understand change might be unsettling, however this transformation is geared toward providing you with extra safety, not much less.

Breaking down the above, Blue Ocean Society has rolled investor balances and promised returns into a brand new consolidated Dignity Gold funding scheme.

This pressured migration has seen Blue Ocean Society slash pending ROI withdrawal liabilities.

Usually, when a monetary meltdown happens or a partnership dissolves, buyers are fortunate to get cents on the greenback—maybe 20% or 30% of their authentic funding—in the event that they get something in any respect.

Recovering preliminary balances might be extremely difficult, and gathering any accrued curiosity on high of that’s much more troublesome.

In lots of instances, a category motion lawsuit or chapter courtroom course of can drag on for years, with no assure of full compensation.

Nonetheless, BOS approached this fully otherwise. We moved all restoration efforts to the back-end in order that no member can be adversely affected or pressured to attend out difficult proceedings that we as BOS must go in, on behalf of the member.

Our authorized groups will deal with issues with the previous Island Companion.

By stepping in and changing the Island Companion’s obligations, BOS has preserved not simply the unique balances however has multiplied them by two to 4 instances their worth.

Past that, by inserting Dignity Gold safety tokens behind your balances, there’s additionally the potential for future progress—these tokens might be leveraged and could also be liquidated at a lot larger costs over time.

To summarize, Blue Ocean Society will likely be paying investor withdrawals with Dignity Gold safety tokens, that are in fact each printed on demand and nugatory.

Need to money out your nugatory Dignity Gold safety tokens? Not so quick.

In case you want to withdraw, we’ve got labored on acquiring exterior liquidity that permit you to take action with out trouble. The entry to this liquidity is across the nook.

What is out there now could be Blue Ocean Society affiliate buyers having the ability to “leverage [their] new holdings] into Tribe360i.

Tribe360i is yet one more Ponzi launch, constructed on the “lending” ruse pioneered by BitConnect again in 2016.

In case you select to leverage your new holdings, you would doubtlessly develop your wealth with minimal threat to your conventional funds or credit score.

Tribe360i has a peer-to-peer lending platform that connects debtors and lenders in a safe, low-risk setting. The mortgage particularly for the aim of leveraging your asset might be for twenty-four months, and you may pay curiosity solely.

After 24 months, you may repay the mortgage by liquidating a few of your tokens, or paying it off your self; Your Alternative.

As an illustration, utilizing your automobile as collateral for a small mortgage would possibly fear you if it’s your major technique of transportation. However what in the event you may leverage one thing separate—like a gold-backed token—the place, within the worst case, solely that token is at stake?

This blockchain-based lending mannequin features equally, which means a default would merely see the asset liquidated to repay the lender, with out affecting your credit score rating, your house, or any of your different belongings.

One of the highly effective methods to leverage this asset is by taking out a collateralized mortgage of as much as 50% of your Present Token Stability—a proportion that can exceed your Ultimate Island Stability. You should utilize the upcoming Tribe360i app to simply request and handle these loans.

As beforehand famous, Blue Ocean Society is pitching “72% assured annual curiosity” returns by way of Tribe360i.

For Blue Ocean Society affiliate buyers sick of being strung together with new schemes after earlier ones have collapsed;

In case you’re considering long-term and don’t must withdraw or leverage your place instantly, you may merely do nothing in any respect.

By holding onto your asset, you’ll permit it to understand naturally, with the flexibility to liquidate as much as 60% of it in 24 months.

We imagine that by then, every safety token may doubtlessly exceed $40, providing you with a big, life-changing profit at the moment.

Do nothing and we would possibly allow you to withdraw in 24 months (if we discover sufficient new suckers to fund your withdrawals). Possibly.

Like I mentioned, the endless delays and excuses are very harking back to the Mike G Deal. Michael Glaspie was sentenced to 6 months in jail in October 2023. The end result of parallel SEC civil fraud proceedings stays pending.

On that notice, neither Blue Ocean Society, Ken Shuler, Ellis Botman, Sean J. Roberson, Wealth of Knowledge or Dignity Gold are registered with the SEC or CFTC.

Whereas Dignity Gold gives an inventory of “advisors” on its web site, led by Chairman David Weild…

…govt particulars are withheld from the general public.

As of December 2024, SimilarWeb was monitoring ~166,000 month-to-month visits to Blue Ocean Society’s web site.

On its web site Blue Ocean Society claims it has over 7000 members:

SimilarWeb tracked 53% of Blue Ocean Society’s December 2024 web site visitors from the US, adopted by 19% from Canada and 11% from France and the Netherlands respectively.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This may starve Blue Ocean Society of ROI income, ultimately leading to a collapse. Communications from Blue Ocean Society point out this has already occurred, with buyers now in an “extended exit-scam” part.

The maths behind Ponzi schemes ensures that once they collapse, the vast majority of members lose cash.