The Berry Ponzi scheme has collapsed.

The Berry Ponzi scheme has collapsed.

Withdrawals have been disabled, and buyers are being fed a number of exit-scams.

Berry glided by a number of names; Blueberry, Berry Buying and selling App, Fertile Soil International (FS International), Berry FS International, Berry Trade and, extra lately, Berry Max.

Identified web site domains related to Berry embrace:

- berry.im – privately registered in or round June 2022

- berry.band – privately registered on June eleventh, 2022

- berry.suggestions – privately registered on June eleventh, 2022

From what I’ve been capable of put collectively, Berry associates invested cryptocurrency on the promise of passive returns.

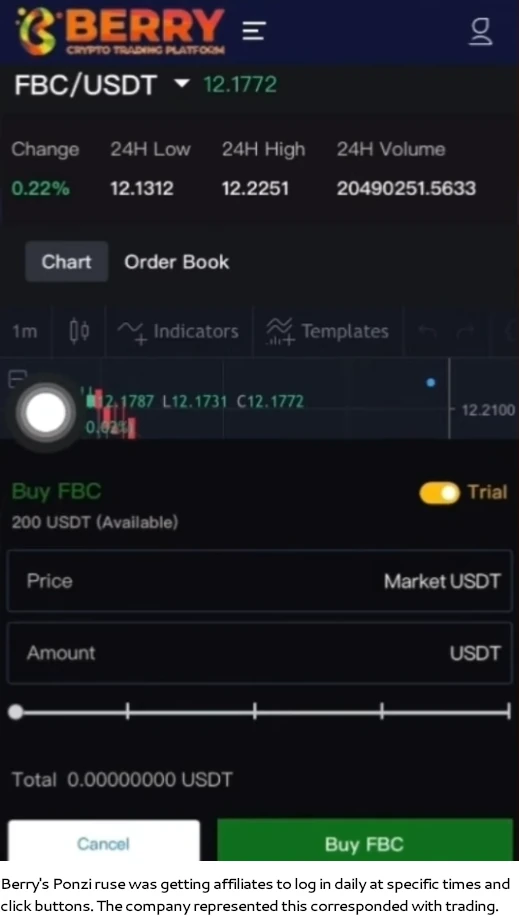

Berry had associates log in and click on buttons, which corresponded with crypto buying and selling.

In actuality this was all an elaborate farce. Logging in to click on buttons at particular instances inside Berry wasn’t connected to precise buying and selling.

Berry had a fee construction tied to “VIP” tiers. That is much like “click on a button” Chinese language Ponzi schemes.

Berry associates might additionally qualify for periodic bonuses, tied to both private recruitment or how a lot they satisfied others to take a position.

Berry collapsed on or round Might 2nd by disabling withdrawals.

Within the lead as much as Berry’s collapse, the Ponzi scheme launched FDPT tokens and an funding promo.

April 18th – 4D printing expertise will open a particular buy session on April 24, 2023, and the undertaking combining synthetic intelligence and 4D printing will likely be launched quickly!

April nineteenth – In an effort to give again to new and outdated customers and turn into the mainstream of the world, the Trade grandly launched the [5+5 Promotion Plan] a referral promotion program which means “Win-Win Exercise” !

Exercise Bonus Pool: 20,000,000 US {dollars} (closed when the quantity have been given out)

Invite your new associates – work collectively to create income and lighten hope!

On Might third, 24 hours after withdrawals had been disabled, Berry trotted out an “acquisition” exit-scam:

The most recent replace for BERRY is filled with constructive information, indicating a vivid future forward!

We’re thrilled to announce that the BERRY trade has obtained an acquisition invitation from a globally famend establishment (world famend establishment).

It is a testomony to the exhausting work and dedication of our staff, in addition to the belief and help of our customers.

As the present new cash had attracted consideration and recognition , the present valuation of the platform has improve 3.3 instances of the unique worth.

The preliminary evaluation of the acquisition will likely be performed concerning the belongings administration , fairness , belongings circulations throughout the Berry Trade.

Later that very same day a 100% cashback on new funding (“recharging”) was additionally introduced:

To point out our gratitude to your help and a spotlight, we’re launching a 100% money again ( rebate exercise ) in your recharge inside a selected time.

This was adopted up with a BRY token launch on Might fifth;

BERRY Token (BRY) is the platform token of BERRY Trade, serving because the spine of your complete BERRY ecosystem.

It is going to be used to help numerous features throughout the platform, akin to transaction price, threat reserve fund, token-to-token exchanges, and as a method of taking part in platform actions akin to voting for brand new token listings and taking part in pre-sales.

In an effort to meet the IPO itemizing necessities of the Nasdaq International Market, the world’s second-largest securities buying and selling market, BERRY Trade should meet strict monetary, capital, and joint administration indicators.

To make sure the graceful progress of the merger, we’ve got determined to not disclose the identification of the accomplice firm at this stage. Nevertheless, we are going to restore the withdrawal channel after the valuation is accomplished.

That is in fact all baloney. It is rather much like QZ Asset Administration’s latest exit-scam, minus the SEC submitting full of bogus data.

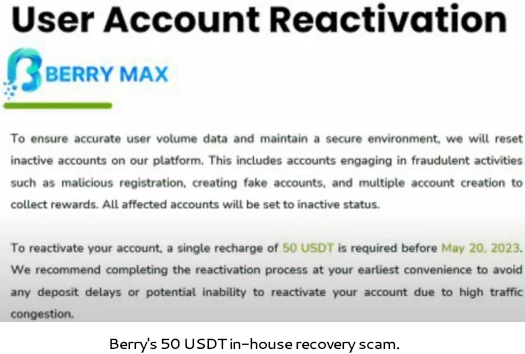

On Might twelfth, Berry knowledgeable customers it was rebooting as Berry Max;

We’re comfortable to announce Berry Trade has reached a preliminary settlement with worldwide establishments for Mergers and acquisitions , and now the trade is formally totally upgraded !

Our official platform title has been re-branded to ‘Berry Max,’ which displays our renewed dedication to offering top-notch buying and selling companies.

This was nothing greater than an in-house restoration rip-off. Berry demanded 50 USDT from its buyers, beneath the guise of “guaranteeing correct person quantity information”.

Berry associates who did not pay up had been threatened with account termination.

A brand new “loyalty program” was additionally introduced, with the goal of screwing gullible buyers out of an extra 500 USDT.

Berry’s loyalty program is scheduled to finish on Might twentieth. That’ll most likely be prolonged (the cashback reload rip-off was prolonged), after which Berry’s web site will likely be taken down.

Principally it comes right down to diminishing returns. Berry’s admins will proceed to pump out new scams so long as sufficient gullible buyers hand over extra money – largely as a result of they assume doing so will unlock withdrawal of cash that doesn’t exist of their backoffices.

When that dries up, 404 web site not discovered.

From what I’m seeing on social media it’s steadily being accepted that Berry was a Ponzi scheme. Actually the restoration scams and IPO baloney have contributed to buyers realizing they’ve been had.

As tracked by SimilarWeb, site visitors to Berry’s main .IM web site climbed all through early 2023. April 2023 peaked at 3.8 million visits, sufficient of a pot for Berry to tug the plug.

The vast majority of Berry web site site visitors originates from Africa; South Africa (36%), Botswana (16%), the UK (12%), Rwanda (11%) and US (8%).

The language utilized by Berry actually has an Asian engrish really feel to it. I really feel like this may be an evolution of the fundamental “click on a button” Ponzi schemes run by Chinese language scammers, however I haven’t seen variations of Berry emerge.

Little bit of a novel thought, getting associates to log in and click on buttons at certains instances to get them to assume they’re buying and selling – however finally nonetheless theatrics to cover a Ponzi scheme.

Aside from the aforementioned rip-off updates and Berry’s web site finally disappearing, not anticipating any substantial updates on this one.