On April tenth, 2024, BehindMLM turned fifteen. MLM information saved me from publishing this earlier however as we speak we’re looking again on the previous twelve months.

On April tenth, 2024, BehindMLM turned fifteen. MLM information saved me from publishing this earlier however as we speak we’re looking again on the previous twelve months.

Welcome to BehindMLM’s State of the Rip-off 2025.

MLM crypto scams

The decline of the MLM crypto rip-off area of interest, first noticed round This fall 2023, continued all through 2024.

All of the crypto ruses are largely lifeless (a minimum of to the purpose no person actually believes them any extra). “AI buying and selling bots” is getting lengthy within the tooth and there hasn’t been a “shiny new object” follow-up shortly.

The one exception has been the nonsensical Chinese language “click on a button” app Ponzis. Though “massive hits” have been far and few between.

Elevated regulatory response throughout Asia has thrown Chinese language-run rip-off factories into mainstream discourse, however there’s nonetheless a lot to be accomplished.

As for the scams themselves, we appear to have settled into low-effort app scams that come and go weekly. Undecided what the revenue margin is there however evidently it’s sufficient for the crime gangs to persist.

Exterior of the Chinese language apps we haven’t seen any main MLM crypto frauds stand up during the last 12 months. Taking into account your entire crypto “trade” is a musical chairs con recreation, I’d prefer to say that’s resulting from client consciousness. It may simply as simply be resulting from tightening of wallets although (or a mix of each).

General we’re in a reasonably good place so far as MLM crypto scams failing to achieve traction. However trying ahead what considerations me is for a way lengthy?

Politics isn’t actually one thing we get into right here on BehindMLM and that’s as a result of, in very best circumstances, politics has nothing to do with regulation of fraud. Administrations come and go, the underlying regulation and enforcement stays the identical.

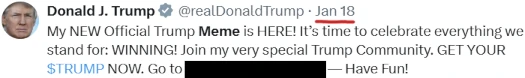

I can provide the exact date that every one modified although: January 18th, 2025.

Yeah, apparent rip-off (wire fraud, securities fraud, potential cash laundering, international corruption and many others.), however what it means for regulation of MLM crypto fraud has but to play out.

The intertwining of politics with crypto associated monetary fraud is problematic in that regulators charged with investigating and implementing the regulation are additionally a part of the federal government.

There’s an clearly broad inherent battle of curiosity.

To that finish we’ve seen the DOJ disband its crypto enforcement staff on direct order of President Trump.

Established in 2022;

the Nationwide Cryptocurrency Enforcement Workforce (NCET) was established in February 2022 to handle the problem posed by the felony misuse of cryptocurrencies and digital belongings.

The staff is comprised of attorneys from throughout the Division, together with prosecutors with backgrounds in cryptocurrency, cybercrime, cash laundering and forfeiture.

It’s in all probability not a coincidence NCET ramping up over the previous few years corresponds with a basic decline in MLM associated crypto fraud based mostly within the US.

Over on the SEC, its dropping crypto fraud associated instances like hotcakes. Instances towards Ripple Labs, Kraken and Coinbase have all been dropped, fortunately none of that are MLM associated.

Nonetheless, what does that say about present MLM associated fraud instances. Or worse nonetheless pending instances focusing on MLM associated crypto fraud over the previous few years?

Typically talking, a lot of the latest motion on the SEC has targeted on cryptocurrency in a broad sense. That’s past the scope of this text and, if I’m being sincere, not likely related to MLM crypto.

Regulation of MLM crypto schemes ties into the identification of an funding contract (utilizing the Howey Check). By their very nature all MLM crypto schemes provide funding contracts, requiring them to register with the SEC.

None of them do as a result of, regardless of the exterior income ruse is, none of them do what they declare to be doing. It’s all the time a advertising ruse, which having to file third-party audited with regulators turns into much more tough to drag off.

What did catch my eye was a latest SEC “roundtable” on crypto buying and selling.

Crypto buying and selling is after all one of the vital widespread MLM crypto fraud ruses (“we’re crypto buying and selling!” advertising on the frontend, basic Ponzi on the backend).

The SEC’s Division of Company Finance seems to grasp the significance of funding contracts with respect to crypto schemes – a minimum of because it pertains to “crypto asset markets”.

Appearing SEC Chairman Mark Uyeda’s statements nevertheless are a bit regarding. In his printed remarks following the roundtable, Uyeda lays the muse for why crypto schemes needs to be exempt from present securities regulation.

Federal securities legal guidelines and rules might current challenges for broker-dealers and nationwide securities exchanges in search of to supply buying and selling in tokenized securities.

For instance, nationwide securities exchanges can solely checklist registered securities and most tokenized securities out there as we speak are unregistered.

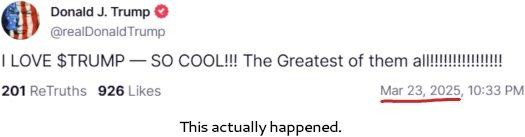

The rationale they’re unregistered is as a result of they’re scams that primarily facilitate fraud. We now have entire “memecoin” marketplaces set as much as facilitate this – with as of but no response from US authorities.

As of February 2025, 810,000 crypto wallets have misplaced over $2 billion to Trump Coin. Trump himself has pocketed round $100 million.

Once more, we’re talking in broader phrases right here. However the additional crypto regulation strays from established US securities regulation, the higher the chance loopholes will emerge. And these will be exploited by dangerous actors.

A few of these dangerous actors shall be MLM crypto scammers.

Mixed with lowered enforcement (worldwide enforcement of crypto associated fraud outdoors of the US is already abysmal), it’s a recipe for a return to the OneCoin period.

Strictly talking so far as MLM crypto schemes go, present legal guidelines are greater than enough. Current civil and felony legal guidelines adequately handle wire fraud, securities fraud, conspiracy to commit each and cash laundering. Enforcement is ever the issue.

I hate to be all doom and gloom about this however, given every part else, it definitely feels like a Howey Check exemption for crypto schemes is on the playing cards.

That doubtlessly places BehindMLM in a precarious place. The underlying fraud continues to be there, but when legalized to the purpose of non-enforcement, civilian journalists equivalent to myself can’t be the tip of the spear with nothing in the best way of regulatory help behind us.

Greatest to not sound alarm bells over what hasn’t occurred but nevertheless it’s definitely one thing I’m holding at the back of my thoughts because the now day by day circus of US “flood the zone with shit” model politics performs out.

I’ll proceed to look at nevertheless it’s tough at occasions to not simply give in to outright pessimism. Correlation doesn’t suggest causation, nevertheless it’s getting actual onerous to not view developments as a way to facilitate monetary fraud from the highest down.

On the brilliant aspect there’s been nothing from the CFTC. Assuming nothing has modified there with respect to MLM crypto regulation.

Additionally as an apart, for those who’re questioning why there’s no “non-crypto MLM rip-off” part, just about each MLM rip-off is run in crypto today. There’s no level.

The MLM trade on the whole

The contraction of the MLM trade has additionally continued over the previous 12 months.

Amid the inevitably MLM Ponzi and pyramid collapses, we’ve additionally seen Awakend, Tupperware, Epicure, Modere and Natural Alchemy chew the bullet. There have additionally been a lot of acquisitions and mergers.

A basic recurring theme appears to be shifting client habits. A few of that’s little doubt the price of dwelling disaster but in addition maybe how customers are shopping for items – significantly the youthful generations.

If you happen to took the MLM trade as a complete, there’s in all probability some similarities between it and international locations grappling with ageing populations.

Nonetheless, we’re fairly clearly removed from bottoming out. BehindMLM’s pending MLM evaluate checklist at the moment sits at round thirty corporations. I haven’t gotten to emails over the previous few days so there’s in all probability one other 5 to 10 additions ready.

We’ll in all probability see extra closures all year long however aside from that I’m not anticipating any important developments. Moreso given the FTC is at the moment limping together with simply two “loyal” Commissioners.

Authorized proceedings have been initiated to problem the allegedly unlawful conduct however who is aware of how lengthy that’ll play out.

All to the continuing detriment of US customers sadly. Talking of which the Shopper Monetary Safety Bureau and Overseas Corrupt Practices Act are additionally gone.

The latter specifically has been used to reign in international corruption by Avon, Nu Pores and skin, HerbaLife and NewAge (alleged).

BehindMLM Housekeeping

I’m pleased to report that the results of the MLM trade downturn this previous 12 months weren’t as important because the earlier 12 months. We’ve type of reached a baseline with reader curiosity, spiking when one thing important occurs (Modere collapsing being a latest instance).

The largest problem BehindMLM confronted over the previous 12 months was getting Josip Heit’s GSB subpoena quashed within the New York Supreme Courtroom.

Primarily resulting from a scarcity of supporting proof and due course of failure, we overturned the granted subpoena on attraction in Could 2024.

As of April 2025, Heit’s regulatory authorized troubles within the US proceed to play out. Fruitlessly attacking journalists seems to have taken a backseat to (allegedly) attempting to drag a quick one over US authorities.

Aside from that it’s been a reasonably straight-forward 12 months. This let’s me get on with analysis and reporting on the MLM trade, which is in spite of everything what you’re all right here for.

Following some private challenges final 12 months I’m in a little bit of a greater spot. As anybody who works on-line will inform you, balancing life with on-line work will be tough. Even fifteen years in I’m nonetheless making changes.

I haven’t misplaced any drive however I’d be mendacity if the continuing assault on non-immigration associated regulation and order within the US wasn’t disheartening. Reflecting on that, I’m type of torn between “what’s the purpose?” and “effectively, somebody’s gotta do it”.

I don’t wish to rehash what I’ve already written however I assume what I’m attempting to say is I’m taking part in it by ear. Such as you I don’t know daily what’s going to occur, not to mention how BehindMLM suits into altering authorized and regulatory frameworks.

With BusinessForHome offered off just a few months in the past to an MLM firm proprietor, I’m conscious about BehindMLM’s impartial standing greater than ever. It’s a accountability I’m at occasions not solely snug with but in addition type of the entire level.

To not take something away from the AntiMLM subreddit or varied creators on YouTube.

The query of why there aren’t extra “BehindMLMs” since we launched fifteen years in the past inadvertently places to mattress a variety of the conspiracy theories scammers provide you with.

General BehindMLM is in place to proceed offering customers with the newest on the MLM trade. Going into 12 months fifteen we additionally now have a catalog of 10,469 articles and over 185,000 feedback to help with analysis.

Thanks for studying for one more 12 months!