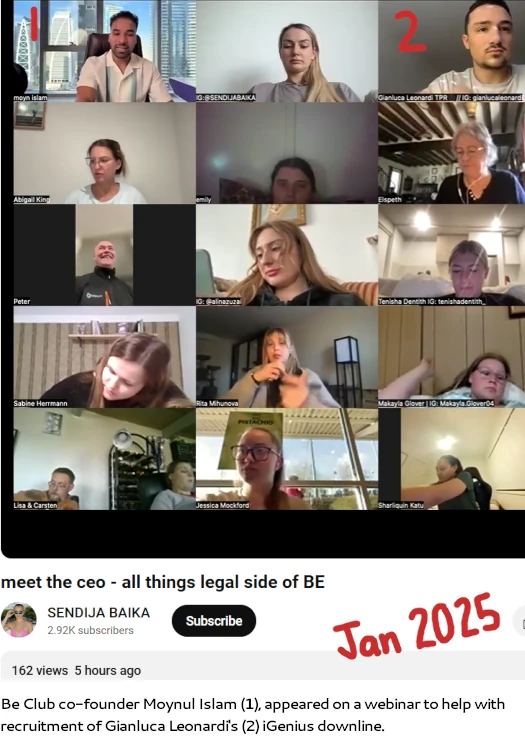

Just a few days in the past a BehindMLM reader reached out to me relating to a Be Membership webinar that includes co-founder Moynul Islam (higher often known as Moyn).

Just a few days in the past a BehindMLM reader reached out to me relating to a Be Membership webinar that includes co-founder Moynul Islam (higher often known as Moyn).

The decision, hosted by former iGenius promoter Gianluca Leonardi, seems to be a part of an try and recruit Leonardi’s iGenius downline into Be Membership.

Be Membership desperately wants an injection of latest suckers. For December 2024 SimilarWeb tracked simply ~3100 month-to-month visits to Be Membership’s web site.

88% of the site visitors originated from Italy, which simply occurs to be the place Gianluca Leonardi is from.

Now that you realize the context of the webinar, we are able to transfer onto the webinar itself.

Evidently a big a part of convincing Leonardi’s iGenius downline emigrate over to Be Membership is to deal with it’s a number of regulatory fraud warnings.

Earlier than we get into Islam’s deception on that although, it’s price noting that mentioned deception begins proper from the start.

Within the webinar Moyn, slightly than be sincere about becoming a member of OneCoin, stealing a bunch of cash after which fleeing to Dubai, spins a narrative about becoming a member of ACN, not making a lot cash, fast-forward to 2018 and Moyn and his brothers launch their very own MLM firm.

After setting himself up, Moyn will get into Be Membership’s regulatory warnings. To clean over Be Membership’s regulatory warnings, which pertains to Be Membership’s fraudulent enterprise mannequin, Moyn trots out a “everyone will get regulatory fraud warnings” ruse.

[17:32] It’s quite common for many corporations to get some stage of warning and fines.

We now have seen the businesses in our house, not solely they bought a warning, however they bought fined. Each single firm that you realize of in our house, on the subject of foreign exchange and buying and selling training, they’ve obtained warnings from regulatory our bodies.

First off “everyone is doing fraud, we’re not the one ones!”, isn’t a confidence-inspiring excuse.

Placing that apart for the larger image, the rapid disconnect between Moyn’s assertion and actuality is none of Be Membership’s regulatory fraud warnings pertain to “foreign exchange and buying and selling training”.

Be Membership began off as Melius. Launched in 2018, Melius noticed the Islam brothers cover behind CEO Jeremy Prasetyo. Melius’ enterprise mannequin mixed commodities fraud with pyramid recruitment.

Melius collapsed in 2020 and was rebooted as Higher Expertise, higher often known as simply “Be”.

Be initially dropped Meliu’s commodities fraud however retained its pyramid scheme. In mid 2024 Be rebooted as Be Membership.

By way of its “SageMaster”, Be Membership noticed a return to commodities fraud with added securities fraud. To one of the best of my information the SageMaster funding scheme stays the present iteration of Be Membership.

On the regulatory entrance:

None of those regulatory fraud warnings have been challenged and all stay in pressure and efficient as at time of publication.

…however you wouldn’t know that to listening to Moyn.

[18:20] We’re the one firm on this house within the final six years with [a] clear report.

As per the very a lot nonetheless lively and enforced regulatory fraud warnings above, Moyn’s assertion is a flat out lie. You may confirm this your self by seeing the warnings on the respective regulator’s web sites and contacting them if you’ll want to.

[18:30] I need to present you guys one thing actually essential, and since final thing that I need any of you on this name to be fearful about, [is] if we’re compliant and authorized.

As a result of for [the] final six years, that’s all I’ve carried out. I’ve targeted on ensuring that each nation that we launched, each nation that we’re in, we’re on the fitting aspect of the regulation.

Once more, discuss with the a number of in impact Be and Be Membership regulatory fraud warnings cited above.

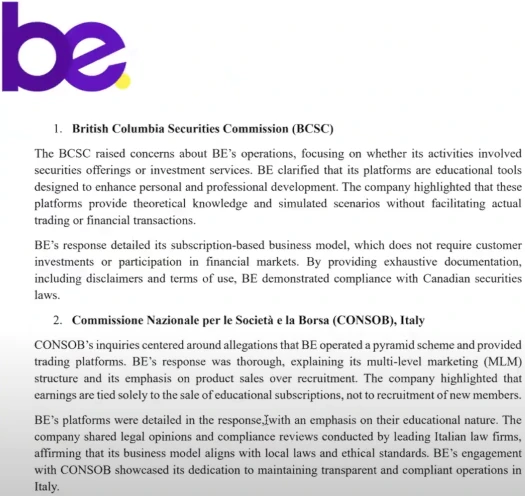

Moyn goes on to trot out a PDF documented dated January seventh, 2025.

Observe that the doc cites communication with the British Columbia Securities Fee, Italy’s CONSOB, Belgium’s FSMA and Quebec’s AMF. To one of the best of my information these regulators haven’t issued public warnings pertaining to Melius, Be or Be Membership.

That doesn’t imply pyramid, securities and commodities fraud is authorized in these jurisdiction, solely that I can’t communicate particularly to any motion taken.

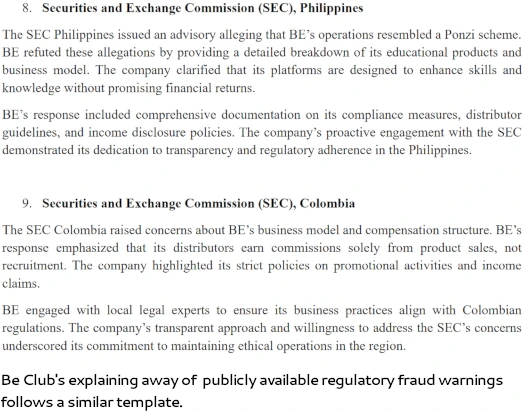

Exterior of those two jurisdictions, Moyn’s “regulators” doc may be boiled all the way down to:

- a regulator flagged Be or Be Membership as a fraudulent scheme

- Be employed some native legal professionals

- native legal professionals allegedly despatched a number of emails to the regulator

- see, we did one thing

This isn’t how regulation works.

When a regulator issued a fraud warning the corporate cited sometimes has a window to formally reply and problem the underlying investigation.

If an MLM firm is profitable at presenting its case at a listening to or hearings, the general public fraud warning is withdrawn.

Opposite to Moyn’s claims, this has not occurred in any jurisdiction by which a regulator has issued a public Be or Be Membership fraud warning.

Moyn goes on to assert Be’s and Be Membership’s fraud warnings come down regulators “not understanding what we do”. That is basic scammer copium.

With respect to working a pyramid scheme, you both have extra retail prospects than affiliate promoters by gross sales quantity otherwise you don’t.

With respect to securities and commodities fraud, both you’re registered with monetary regulators otherwise you aren’t. Neither Melius, Be, Be Membership or Moyn and his brothers have registered with monetary regulators.

Moyn additional rests his laurels on there being “no additional motion” taken after regulatory fraud warnings have been issued.

This primarily comes all the way down to Be and Be Membership utterly collapsing in every jurisdiction a regulatory fraud warning was issued in. To a lesser extent it additionally comes all the way down to the Islam brothers fleeing the UK for Dubai as OneCoin was collapsing.

Dubai is the MLM crime capital of the world. Native regulation of MLM associated pyramid, securities and commodities fraud is non-existent.

Maybe not surprisingly, Gianluca Leonardi has additionally relocated to Dubai.

Accompanying Moyn Islam showing on Gianluca Leonardi’s webinar are a collection of paperwork with extra falsehoods.

First we now have “Be Membership: A Legally Criticism and Moral Direct Gross sales Chief within the UK and Globally”.

On this doc Be holds up its shell firm registrations as someway translating to authorized compliance. Shell corporations don’t imply something with respect to regulation and authorized compliance.

Precise authorized compliance would see Be registering with monetary regulators, which it has not.

Be additionally holds up its UAE MLM affiliation memberships. Once more, Dubai is the crime capital of the world. These registrations imply nothing so far as authorized compliance goes.

And at last we now have this nonsense;

The corporate has undergone authorized scrutiny in extremely regulated markets such because the USA and Italy, the place it was discovered to be professional and compliant with all legal guidelines.

BE CLUB has proactively subjected itself to scrutiny in jurisdictions with stringent regulatory necessities:

- USA: Identified for its rigorous enforcement of shopper safety legal guidelines.

- Italy: A market with strict rules on direct promoting and multi-level advertising and marketing corporations.

In each circumstances, BE CLUB was discovered to be a professional enterprise, working in full compliance with the regulation, and it continues to thrive with none fines or penalties.

Be Membership is appropriate within the US being recognized for rigorous enforcement. It’s why Be Membership has by no means taken off within the US.

As an alternative, by its personal admission, Be Membership targets “creating international locations”.

Additionally regulators don’t rubber-stamp corporations. Asserting authorized compliance as a result of a rustic’s regulators haven’t issued fraud warnings is fake equivalence.

Particular to the US you may confirm Be Membership isn’t registered with the SEC or CFTC by respectively looking the EDGAR and NFA databases.

If it have been lively within the US, Be Membership committing securities and commodities fraud in violation of US monetary regulation is verifiable proof it isn’t legally compliant there.

Subsequent we now have “Be Factsheet: Addressing Rumours and Misinformation”.

This doc makes an attempt to downplay the Islam brothers position as OneCoin Ponzi promoters.

BE’s founders, Moyn and Monir Islam, have confronted hypothesis about their involvement.

Nevertheless, the info inform a special story – one which highlights their minor position as buyers and their efforts to show the reality.

The reality is the Islam brothers have been high OneCoin promoters within the UK. They primarily focused migrant communities and, after stealing a bunch of cash from these communities, the Islam brothers dipped and fled to Dubai.

That’s historical past, that’s what occurred. That the Islam brothers can’t even acknowledge these primary truths (that anybody can independently confirm, it’s not just like the Islam brothers promoted OneCoin in secret), speaks to their characters.

Proper now Be Membership is on demise’s door and has been for many of 2024. Ought to Gianluca Leonardi efficiently plunder his iGenius downline and recruit them into Be Membership – triggering a lift in native recruitment, I think it gained’t be lengthy earlier than we see a CONSOB Be Membership fraud warning.

Failing which pyramid recruitment, securities fraud and commodities fraud are all unlawful in Italy in any case.

In the event you’re in Gianluca Leonardi’s iGenius downline and are considering of signing up with Be Membership, ask your self why no one from prior international locations Be Membership has had a run in are nonetheless round. Why is it exterior of Leonardi’s current concentrate on his Italian iGenius downline is there nothing happening in Be Membership?

You may confirm your self that Be Membership and the Islam brothers aren’t registered with CONSOB. So far as precise due-diligence goes, except you’re snug with fraud that needs to be the tip of it.