![]() Asset Revenue Edge Market fails to offer verifiable possession or government data on its web site.

Asset Revenue Edge Market fails to offer verifiable possession or government data on its web site.

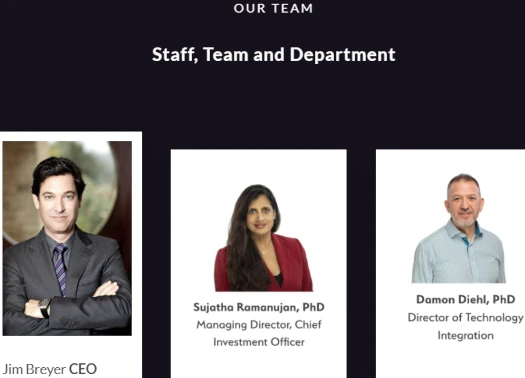

Whereas Asset Revenue Edge Market does present an inventory of executives on its web site…

…these are stolen identities that don’t have anything to do with the corporate. One can confirm this by way of a number of easy Google searches.

Asset Revenue Edge Market’s web site area (“asset.profitedgemarket.com”), was privately registered on September sixth, 2024.

In an try to look official, Asset Revenue Edge Market gives a poorly doctored UK shell firm certificates on its web site.

As at all times, if an MLM firm shouldn’t be overtly upfront about who’s operating or owns it, assume lengthy and exhausting about becoming a member of and/or handing over any cash.

Asset Revenue Edge Market’s Merchandise

Asset Revenue Edge Market has no retailable services or products.

Associates are solely in a position to market Asset Revenue Edge Market affiliate membership itself.

Asset Revenue Edge Market’s Compensation Plan

Asset Revenue Edge Market associates make investments USD equivalents in cryptocurrency.

That is accomplished on the promise of marketed passive returns:

- Trial Plan – make investments $100 to $4999 and obtain 35% a day

- Prolonged Plan – make investments $5000 to $9999 and obtain 50% a day

- Mining Plan – make investments $10,000 to $49,999 and obtain 75% a day

- Diamond Plan – make investments $50,000 or extra and obtain 100% a day

Asset Revenue Edge Market pays referral commissions on invested cryptocurrency down three ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 8%

- ranges 2 and three – 8%

Becoming a member of Asset Revenue Edge Market

Asset Revenue Edge Market affiliate membership is free.

Full participation within the hooked up revenue alternative requires a minimal $100 funding.

Asset Revenue Edge Market solicits funding in numerous cryptocurrencies.

Asset Revenue Edge Market Conclusion

Asset Revenue Edge Market gives a kitchen sink of typical MLM Ponzi ruses:

Asset gives diversified monetary companies, with its primary enterprise being in asset administration, actual property, funding banking and cryptocurrency asset, inventory buying and selling, oil and fuel, hospitality administration, actual property ,gold mining and non-farm payroll (NFP).

No verifiable proof of Asset Revenue Edge Market producing exterior income of any form is supplied.

That’s as a result of, like Asset Revenue Edge Market’s fictional executives and UK shell firm, there may be none.

Because it stands the one verifiable income coming into Asset Revenue Edge Market is new funding.

Utilizing new funding to pay ROI withdrawals would make Asset Revenue Edge Market a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

It will starve Asset Revenue Edge Market of ROI income, ultimately prompting a collapse.

The mathematics behind Ponzi schemes ensures that once they collapse, nearly all of members lose cash.