UniLive fails to supply possession or govt info on both of its web sites.

UniLive fails to supply possession or govt info on both of its web sites.

UniLive operates from two identified web site domains:

- unilive.io (advertising web site) – privately registered on August eleventh, 2024

- h.lulin.prime (affiliate login/signup) – registered in September 2023, non-public registration final up to date on November eleventh, 2024

As a substitute of being trustworthy about its founders and administration, in its advertising materials UniLive presents fictional executives represented by cartoons:

Over on social media UniLive ditches the cartoons…

…however we’re nonetheless solely left with CEOs “Steve” and “Hunter” represented by images of unknown origin.

A UniLive rented workplace advertising video doing the rounds appears like somebody employed out an AirBNB and put up short-term UniLive signage.

UniLive’s advertising represents the corporate relies out of Singapore:

Chinese language additionally options on UniLive’s web sites:

And UniLive’s web site area makes use of Alibaba name-servers.

Placing all of this collectively, we will seemingly confirm UniLive is being run by:

- Singaporean admins;

- Chinese language admins working out of Singapore; or

- Singaporean and Chinese language admins working collectively out of Singapore.

As at all times, if an MLM firm shouldn’t be overtly upfront about who’s working or owns it, assume lengthy and exhausting about becoming a member of and/or handing over any cash.

UniLive’s Merchandise

UniLive has no retailable services or products.

Associates are solely in a position to market UniLive affiliate membership itself.

UniLive’s Compensation Plan

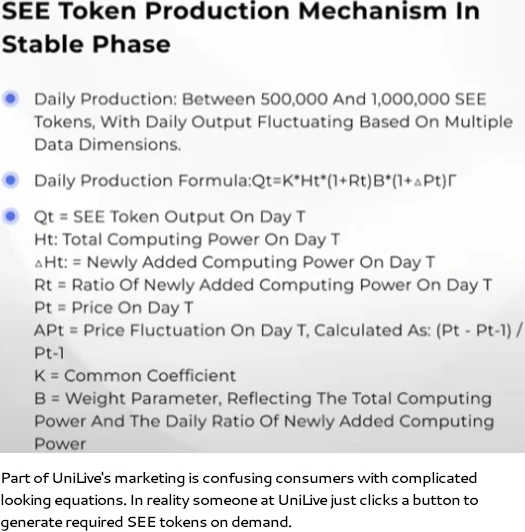

UniLive associates make investments 100 to 10,000 tether (USDT) into “items”. These items purportedly correspond with OpenSee token (SEE) mining.

A less complicated means to have a look at it’s UniLive associates make investments USDT on the promise of a day by day return, paid in SEE tokens:

- make investments 100 to 4999 USDT and obtain a 1x day by day ROI multiplier

- make investments 5000 to 9999 USDT and obtain a 1.15x day by day ROI multiplier

- make investments 10,000 USDT (or extra) and obtain a 1.3x day by day ROI multiplier

Be aware:

- UniLive units the day by day SEE token base ROI quantity every day

- ROI is capped at 300% of invested USDT, which contains MLM commissions

- as soon as the 300% ROI cap is reached new funding is required to proceed incomes

- UniLive fees a 5% to eight% withdrawal payment

The MLM facet of UniLive pays on recruitment of affiliate traders.

Referral Commissions

UniLive pays a ten% fee on 35% of the day by day SEE token returns paid to personally recruited associates.

Spark Reward

UniLive pays a ten% fee on new funding quantity generated by an affiliate’s recruitment efforts, divided by 35% of the overall company-wide new funding quantity for that day.

Residual Commissions

UniLive tracks residual commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel crew, with each personally recruited affiliate positioned straight below them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel crew.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

Every unilevel crew leg corresponds to a personally recruited UniLive affiliate.

Residual commissions are calculated as the overall quantity of recent funding throughout the unilevel crew, excluding the strongest unilevel crew leg.

That’s to say the unilevel crew leg with essentially the most funding isn’t counted.

Residual commissions are thus paid as regardless of the sum complete of day by day new funding within the lesser unilevel crew legs is, multiplied by 35% of 80% of no matter UniLive has set the day by day SEE token ROI charge for that day at.

Becoming a member of UniLive

UniLive affiliate membership is free.

Full participation within the connected earnings alternative requires a minimal 100 USDT funding.

Be aware the extra a UniLive affiliate invests, the upper their earnings potential.

UniLive Conclusion

UniLive is an easy MLM crypto Ponzi hidden behind a livestreaming platform ruse.

Though it doesn’t have a functioning web site, UniLive is offered because the livestream platform front-end:

UniLive as a streaming platform has nothing to do with its MLM alternative and may be ignored.

This leaves with UniLive’s OpenSee “SEE” token funding scheme, which is all anybody is signing up with UniLive for.

OpenSee is offered with the standard “ChatGPT, write me a generic jargon-riddled spiel for blockchain” crypto bro script:

OpenSee is a complete computing service engine tailor-made for the web3 ecosystem, emphasizing cutting-edge, technology-driven options to ship environment friendly and open computing capabilities.

By harnessing the facility of superior proof of energy (POP) consensus and clever computing.

The platform is purpose-built to speed up enterprise progress inside the web3 area.

OpenSee introduces a transformative expertise, pushed by data-centric operations, agile growth cycles, and sturdy help for clever processes, heralding a brand new period in sensible enterprise and innovation.

On the backend of UniLive we’ve affiliate traders investing tether into its SEE token scheme.

UniLive owns and generates SEE on demand out of skinny air.

The funding scheme is successfully a staking mannequin, whereby USDT is staked for SEE tokens however traders don’t get their USDT again on the finish of the staking time period.

Staking is capped at 300% of the invested USDT worth, which incorporates MLM commissions (a pyramid scheme in its personal proper).

UniLive is pitched because the income generator however, with no audited monetary reviews filed with regulators, shouldn’t be a confirmed income.

This leaves new funding as the one supply of verifiable income coming into UniLive. Recycling invested USDT to permit UniLive associates to money out SEE tokens can be a Ponzi scheme.

As to who’s getting scammed; as at February 2025 SimilarWeb was monitoring 100% of UniLive’s web site site visitors from Ukraine.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

It will starve UniLive of ROI income, finally prompting a collapse.

The maths behind Ponzi schemes ensures that when UniLive collapses, the vast majority of members lose cash.

Being a shit token Ponzi, UniLive’s collapse will translate into the vast majority of traders bagholding yet one more nugatory Ponzi token.