Utherverse Inc. and founder Brian Shuster have sued Joshua Denne, Jeremy Roma and Blockchain Alliance.

Utherverse Inc. and founder Brian Shuster have sued Joshua Denne, Jeremy Roma and Blockchain Alliance.

Of their January tenth filed go well with, Utherverse Inc. and Shuster allege violations of the Racketeer Influenced and Corrupt Organizations Act (RICO).

There are 9 named defendants in Shuster’s go well with;

- Brian Quinn

- Joshua Denne

- Blockchain Funding Inc. (Wyoming)

- Blockchain Alliance LLC (Arizona)

- Masternode Companions LLC (Wyoming)

- Lynne Martin, Josh Denne’s mom and a member of Masternode

- NIYA Holdings LLC (Nevada)

- Nima Momayez, sole member of NIYA and

- Jeremy Roma

Denne and Roma each have prior appearances on BehindMLM.

Denne launched Blockchain Alliance in 2023. Previous to Blockchain Alliance Denne was selling Daisy Foreign exchange, a part of the collapsed Daisy World/Daisy AI Ponzi run by Jeremy Roma.

Each Blockchain Alliance and Daisy World have collapsed. At the moment Denne and Roma are operating BioLimitless, an MLM complement firm constructed round funding in $5 million greenback clinics.

Outdoors of MLM Denne is a twice convicted felon on drug and gun expenses in 1998, and insurance coverage fraud in 2011. Denne was additionally tied to COVID-19 masks contract grifting in California in 2020.

Utherverse’s and Shuster’s lawsuit pertains to Denne and Blockchain Alliance, with Roma accused of additionally being concerned.

This case is about an elaborate and premeditated scheme by Defendants appearing in live performance to defraud Plaintiffs, embezzle and extort cash from them and others, and ultimately bankrupt UI and Utherverse Digital, Inc. (“UDI”) to cowl up their scheme.

To maintain factor easy, from right here on I’ll be referring to Plaintiffs Utherverse Inc. and Shuster (Proper) as “UI”.

To maintain factor easy, from right here on I’ll be referring to Plaintiffs Utherverse Inc. and Shuster (Proper) as “UI”.

On the middle of UI’s alleged scheme to defraud is Brian Quinn. UI claims Quinn and his conspirators focused them

due to their involvement in digital world environments able to using cryptocurrency inside a metaverse, and their vulnerability ensuing from the necessity for money for growth of the digital world environments.

Quinn just isn’t identified to BehindMLM however does have a historical past of securities fraud. In October 2022, Quinn settled allegations pertaining to a “fraudulent microcap manipulation scheme” with the SEC for $230,464.

Utherverse was a part of Blockchain Alliance’s advertising pitch, which allegedly happened after

Quinn and Denne satisfied Shuster they had been reliable, might infuse hundreds of thousands of {dollars} of investments into UI and UDI for digital world growth, and will help within the launching of a cryptocurrency for buying and selling and use in these digital worlds.

Quinn and Denne are expert on the artwork of deception, utilizing quite a lot of strategies to keep up Shuster’s belief, together with presenting themselves as trustworthy household males by texting photographs of actions and time spent with their youngsters.

The deception by Denne and Quinn continued when, in an additional try to regulate UI, Denne satisfied Shuster that UI should buy inventory in Blockchain Alliance.

In a nutshell, Shuster was determined for funds to maintain Utherverse alive and Quinn and Denne offered themselves as monetary saviours.

By allegedly reached agreements, Quinn and Denne “promised to”

- pay as much as $5 million US {dollars} to cowl all the prices of to organize

- market and quickly launch a prime cryptocurrency that may fund all of the growth and growth prices of UDI’s digital world software program

- establish and convey to UI buyers taken with buying UI inventory and

- market and presell cryptocurrency tokens, to be often known as “UTHER” tokens

What really occurred is the everyday “behind the scenes” crypto challenge shenanigans.

Quinn and Denne bought inventory in UI that they’d no proper to promote, presold UTHER tokens beneath falsified Easy Agreements for Future Tokens (“SAFTs”) and pocketed the cash resulting from UI from the gross sales.

In addition they satisfied Shuster to enter into quite a lot of loans and agreements that had been in the end determinantal to UI and UDI, primarily based on false and deceptive statements, amongst quite a few different misdeeds and violations of the regulation.

UI alleges that whereas Quinn and Denne did inject money into Utherverse, they did so with solely sufficient to maintain it “on the verge of chapter”.

To make the plan work, Defendants wanted UI to remain solvent, but in addition to be shut sufficient to insolvency that UI wouldn’t make any public bulletins about ceasing funding rounds.

As I perceive it, Blockchain Alliance was the automobile by which Denne and Quinn solicited Utherverse funding from customers.

Blockchain Alliance was pitched to Shuster as an enormous community advertising firm that may promote UI’s digital belongings, together with however not restricted to cryptocurrency, nonfungible tokens (NFTs) and membership packages to its community members with a considerable portion of the income going to UI as earned earnings, to extend the earnings of UI and make the IPO extra

profitable.Nonetheless, UI by no means obtained any earnings from Blockchain Alliance, and on data and perception, Blockchain Alliance didn’t have an enormous community of members, and both by no means accomplished organising for the sale of UI’s digital belongings or bought a portion of UI’s digital belongings and pocketed the cash.

Moreover, on data and perception, and in breach of its fiduciary obligation, Blockchain Alliance bought UI inventory that it was not licensed to promote to “buyers” who then appeared on UI’s Cap Desk. UI by no means obtained cash from the buyers to whom Blockchain Alliance bought inventory.

Quinn and Denne bought shares in UI and “rights” to buy cryptocurrency that they didn’t personal or have the best to promote.

Quinn and Denne, appearing in live performance, collected hundreds of thousands of {dollars}, and diverted the funds from UI to their private financial institution accounts and/or cryptocurrency wallets.

The defrauded buyers had been left believing that they’d bought and now owned inventory in UI, rights to future tokens, or each, and UI and UDI had been left with out funding {dollars}, believing the tales of Quinn, Denne, and the opposite defendants that for one cause or one other, the buyers selected to not make investments.

As alleged by UI, funding solicited by Quinn and Denne was diverted to Blockchain Funding Inc., an organization owned by Denne.

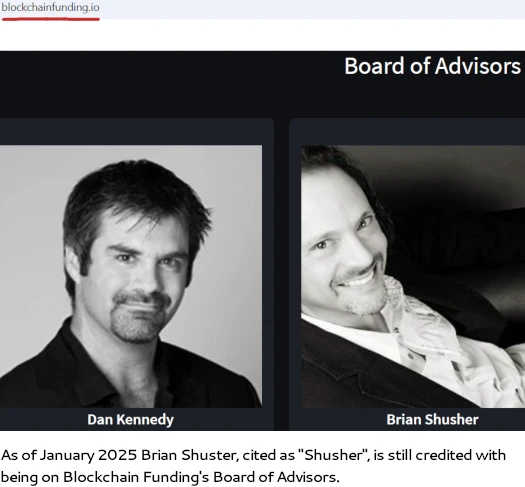

Blockchain Funding is owned by Denne and continues to be lively right now. On its web site, Blockchain Funding claims it “safe[s] options for limitless web3, metaverse, blockchain and NFT initiatives”.

We will help with cutting-edge applied sciences, together with financing, architectural design, planning, and deployment utilizing our community of execs and accredited buyers.

Curiously, Shusher continues to be offered as being on Blockchain Funding’s Board of Advisors:

Getting again to Utherverse, it and Blockchain Funding

entered right into a Consulting Settlement pursuant to which Blockchain Funding was to supply sure providers in reference to the launch and launch of UTHER tokens, together with paying as much as $5 million towards all bills regarding the token launch and ongoing token upkeep in alternate for 12% (360 million) of the three billion tokens to be minted.

Pursuant to the Consulting Settlement, a lot of the tokens Blockchain Funding was to obtain had been for use for the good thing about UDI for the promotion of, and so as to add worth to the token.

Consequently, Denne insisted that Blockchain Funding’s 360 million tokens don’t have any vesting schedule and be instantly unlocked, permitting Blockchain Funding to instantly switch its tokens.

This time period was atypical for the presale of tokens within the cryptocurrency market.

Pursuant to Blockchain Funding’s Utherverse Consulting Settlement;

On the time the Consulting Settlement was executed, Quinn promised that if UI/UDI wanted cash, all Shuster needed to do was decide up the cellphone and name him and the cash could be obtainable the subsequent day.

Nonetheless, when UI/UDI wanted cash for token growth and/or launch, the cash was not forthcoming.

Blockchain Funding failed to supply the agreed to funding for the launch and launch of UTHER tokens.

Though preliminary funds had been made, in 2023, Blockchain Funding, at Quinn and Denne’s instruction, ceased making funds for authorized, public relations, and administration charges associated to the launch of tokens.

As an alternative, to maintain the launch of tokens shifting ahead, Shuster was pressured to pay out of pocket for these authorized, public relations, and administration charges.

And pursuant to Denne making calls for about his presale tokens;

On data and perception, Blockchain Funding bought a portion of the tokens it was allotted beneath the Consulting Settlement.

Such tokens had been restricted and never permitted to be supplied, bought or in any other case transferred, pledged or hypothecated, particularly as a result of they carried no vesting or launch schedule.

Additional, as a substitute of the proceeds from Blockchain’s unauthorized token gross sales getting used for the good thing about UI and UDI, the funds from the token gross sales had been diverted to Denne, Quinn, or Blockchain Funding’s financial institution accounts and/or crypto wallets and used for Defendants’ private profit.

UTHER tokens did ultimately enter presale in July 2022.

Nonetheless as of July 25, 2022, UI had not obtained any funds and Shuster questioned the delay in receiving funds, however Denne falsely assured Shuster that nothing was incorrect, the accreditation course of takes time, and investments could be forthcoming.

Shuster later realized that Denne had instructed the developer of the presale software program to alter the digital pockets that was to obtain funds such that the funds could be wrongfully diverted to Quinn and/or Denne, who then obtained and pocketed the funds from the IDO as a substitute of UI.

Particular to Shuster personally getting allegedly defrauded, a scheme is detailed whereby Quinn and Denne offered

potential buyers [who] had been taken with shopping for UI or UDI inventory.

Quinn and Denne would then pump up the investor as having massive quantities of cash and being very taken with investing in UI.

Shuster would then conduct conferences with one or each of Quinn and Denne and the potential “buyers”. It was not unusual for the potential buyers to say that they very a lot needed to take a position after attending a number of conferences.

Nonetheless, with only a few exceptions, the potential buyers would simply evaporate, with Quinn and Denne telling Shuster they’d misplaced curiosity.

One of many offered buyers who didn’t “evaporate” was Disruptive Applied sciences, a defunct Estonian shell firm allegedly owned by Jeremy Roma.

In alternate for fifteen p.c (15%) of the excellent shares of UDI, 300 million UTHER tokens, and different consideration, Disruptive Know-how agreed to distribute $30 million to Sellers, $2.5 million of which was to be paid in September 2022, $2 million in October 2022, $2.5 million in November 2022, and the stability of $23 million in April 2023.

Nonetheless, the cash was by no means distributed.

Proper earlier than the primary cost was to be made, Quinn, Denne and Roma met, and shortly thereafter, Quinn instructed Shuster {that a} disgruntled former affiliate of UDI contacted Disruptive Applied sciences, telling Disruptive Applied sciences that Shuster was a fraud, amongst different lies.

Quinn additionally mentioned that the previous affiliate indicated he would quickly be suing Shuster, which induced Disruptive Applied sciences to drag out of the deal.

On data and perception, the story that the previous affiliate contacted Disruptive Applied sciences was fabricated by Quinn, Denne, and Roma to maintain UDI in a weak place financially whereas persevering with to divert funds to themselves.

On data and perception, the communication from the previous affiliate by no means occurred and as a substitute the deal between Disruptive Applied sciences and Sellers was a sham and a part of the scheme to defraud UI, UDI and Shuster.

I’m not 100% certain on this however the direct involvement of Disruptive Applied sciences and Roma might tie into Daisy World buyers being funnelled into Quinn and Denne’s alleged UI funding grift.

On data and perception, Disruptive Applied sciences and different buyers transferred funds (both money or cryptocurrency) to Quinn, Denne, or one of many different Defendants (e.g., Blockchain Funding, Masternode, and many others.), who in flip offered the buyers with solid paperwork and false guarantees that they had been now buyers.

On account of the alleged theft of investor funds, UI claims it was left “closely compromised”.

Quinn, Denne and different Defendants persistently reassured Shuster that funding was imminent, that massive funding alternatives had been across the nook, and they’d personally fund UI ought to the alternatives fall by.

These misrepresentations had been repeated as a part of practically each communication Defendants had with Shuster.

Examples of representations made are detailed in UI’s Grievance;

- On or about April 14, 2022, Quinn represented that he had created a “huge alternative to convey collectively the blockchain leisure consortium BEC” and “Worst case, you could have 8 – 10 metaverse shoppers who will license your

IP/use your token” and “Finest case we discover a strategy to mix forces and go huge for extra like 150 mil [$150 million dollar] increase…”- On or about April 16, 2022, Quinn suggested that he might join UI to a portal service with 300 million members. He additionally suggested that he would usher in Tong Soo Chung who “can seize all of the Asia cash”.

- On June 17, 2022, Quinn instructed Shuster that Quinn was at a dinner with buyers able to investing $50 billion.

- On July 7, 2022, Quinn instructed Shuster that he was with individuals at dinner who had been price “Perhaps 18b[illion dollars]”. On data and perception, Quinn knew on the time that they weren’t going to switch any funds to UI.

- On July 12, 2022, Quinn acknowledged that “Josh [Denne] and I simply off ! Acquired the entire advisor, partnership, exchanges, new deck and many others deal inked”, and that Denne, Quinn and UI would get cryptographic tokens in one other firm. Such tokens had been by no means delivered to Shuster or UI.

- On or about July 17, 2022, Quinn falsely promised that “Koreans” would take UI public.

- On or about July 25, 2022, Quinn promised that “I’ve some huge cash and I’ve a fund we’ll by no means go wanting cash simply stick with the plan I promise you if we ever get in a good spa [SIC, should be spot] I’ll bail us out”. This assertion was false.

- On or about August 10, 2022, Quinn falsely promised he would wire to UI $0.50 million in two tranches of $250K every. The quantities had been by no means wired.

- On or about August 23, 2022, Quinn falsely represented that an investor (Disruptive Applied sciences) “Agreed to the two.5m[illion] then 2m[illion] then 2.5m[illion].” The funds had been a part of what was to be a $30 million deal.

- On August 25, 2022, Quinn instructed Shuster that the Binding Letter had been signed, locking within the $30 million deal. Nonetheless, aside from a $66 “take a look at” cost, not one of the $30 million was ever obtained by UI. As an alternative, Shuster

was instructed by Quinn and Denne {that a} third social gathering had induced the investor to withdraw from the deal.The myriad of false representations by each Quinn and Denne about having funding offers continued into late 2022, all through 2023 and into early 2024.

As alleged by UI, Quinn’s and Denne’s exit-scam plan was to bankrupt Utherverse and make

the defrauded third-party putative buyers imagine that the inventory that Defendants “bought” to them was worthless in order that the buyers would by no means uncover that they’d been defrauded and didn’t maintain inventory.

With respect to promoting buyers Utherverse crypto tokens that didn’t exist;

A similar plan was utilized by Defendants associated to future tokens, with the objective of inflicting UI to bankrupt with out ever minting the tokens.

When Defendants realized that chapter may not occur in time to stop minting of tokens, they resorted to extorting Shuster to not mint the tokens that Defendants pretended to have bought to the third-party victims.

It’s not price stepping into specifics as a result of it’s all extremely boring (bought UTHER crypto tokens that didn’t exist are known as “Easy Settlement for Future Tokens” or SAFT and many others.), nevertheless it ought to be famous the “SAFT” scheme is the place Lynn Martin and MasterNode Companions LLC match into the alleged scheme to defraud.

On or about March 18, 2022, Denne confirmed that he was exchanging details about his work with Shuster and UI along with his mom, Lynne Martin.

Martin, working in live performance with Denne and Quinn in furtherance of the scheme, and on behalf of Masternode, represented in writing that Masternode had the total authorized capability and authority to execute the Masternode SAFT and carry out its obligations thereunder.

On data and perception, this assertion was false and was made with intent to deceive as a result of on the time of execution of the Membership Settlement, Masternode was not in good standing with the State of Wyoming and was or was quickly to be an administratively dissolved firm.

On data and perception, the Masternode SAFT was simply one other method for Defendants to place UI into additional debt, thereby aiding in driving them to chapter in furtherance of the scheme.

Moreover, on data and perception, Masternode bought tokens to buyers that it was not licensed to promote and Martin and/or Masternode pocketed the funds obtained from such token gross sales.

When Shuster ultimately pushed again on the sale of non-existent tokens and inventory, he requested “documentation of inventory and token transactions”.

Quinn allegedly responded;

“we don’t care about any of the inventory… The purpose is that as you realize, between Josh [Denne] and I, we’ve got all these tokens… It’s actually none of your online business of who we gave tokens to.”

On the time Quinn made these statements, no tokens had been minted, and Defendants refused to supply details about the putative transferees.

Regardless, Shuster repeatedly requested for documentation of inventory and token transactions, however Quinn and Denne refused

to supply it.

Shuster additional alleges makes an attempt had been made to “compromise” him, by the use of presenting unaccredited to him as accredited buyers.

Moreover, and together with the $1.35 million mortgage from NIYA, Quinn tried to get UI to pay commissions for arranging the mortgage to unlicensed brokers.

Whereas no fee had been mentioned or agreed to, on April 13, 2022, Quinn despatched an bill to Shuster asking that UI “ship mark and Frankie fee $67,500” and included wiring directions to Luxurious Asset Lending LLC.

Nonetheless, Luxurious Asset Lending LLC was not owned by “mark” or “Frankie”, however as a substitute listed Quinn as “Chief Government Officer”, “Proprietor”, “Member”, and “Managing Member”.

On data and perception, this was an try and defraud Utherverse out of $67,500 and entrap Shuster and UI into making funds to brokers not licensed in accordance with the regulation.

Shuster did make a cost to Quinn for $67,500 however the cost was for bills associated to social media advertising.

Nima Momayez and MIYA Holdings match into the alleged scheme by the use of “convinc[ing] Shuster to enter into mortgage agreements on behalf of UI and UDI primarily based on false guarantees.”

On data and perception, the aim of this mortgage, whereas offering preliminary funding to proceed the event of the software program, was a part of the scheme to create a big legal responsibility for UI/UDI and supply an avenue by which Quinn, Denne, and Momayez might trigger UI/UDI to go bankrupt when the mortgage was known as in or in any other case grew to become due.

Moreover, consistent with the conspirators’ insistence that there was an urgency to hurry growth, to speed up growth of the software program, UDI additionally expanded employees, thereby growing prices, on reliance of conspirators’ guarantees that extra funding was forthcoming.

To that finish;

Following the expiration of the time period of the NIYA Be aware (August 1, 2024), Momayez, on behalf of NIYA, started demanding that NIYA be repaid instantly and in full.

Defendants knew the fraud would quickly be found, in order that they tried to bankrupt UI/UDI by doing what they’d promised they’d not do – demanding rapid reimbursement of the NIYA Be aware as a substitute of changing half or the entire Be aware.

Subsequently, Denne and Quinn tried to barter an exit that would depart them with substantial, unearned compensation. Nonetheless, as a result of their calls for had been so excessive and concerned money of which UI was wanting due to Defendants’ fraud, the negotiations failed.

Quinn then grew to become combative, telling Shuster that he “had shut mates on the SEC” and would be certain that Shuster was bankrupted and imprisoned if he minted the token. Quinn additionally made quite a few statements to Peter Gantner of Nexus saying he would destroy UI, take UI shares to zero and have Shuster prosecuted.

This extortion failed, nonetheless, as Shuster was not responsible of wrongdoing and never dissuaded from minting the tokens by Quinn’s threats of regulation enforcement intervention.

Peter Gantner is the co-founder of the collapsed KulaBrands MLM firm and was “secretly” concerned in Blockchain Alliance.

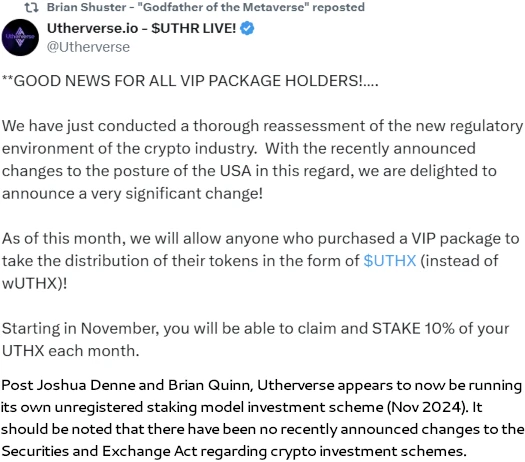

UTHER tokens had been ultimately minted “on or about September 28, 2024.

Shortly after minting the tokens, “buyers” started contacting Plaintiffs asking after they would obtain their tokens.

At that time, it grew to become clear that Quinn, Denne, and the opposite Defendants had diverted cash from SAFTs and UI inventory to their very own financial institution accounts and/or cryptocurrency wallets, and all the guarantees of big investments, minting of tokens, and guarantees of taking UI public was nothing greater than an elaborate scheme by Defendants to defraud Plaintiffs in order that Defendants might line their very own pockets on the expense of Plaintiffs.

With respect to sufferer losses on account of Quinn’s and Denne’s alleged fraud;

To this point, Quinn and/or Denne have misappropriated not less than $1,410,500.00, from a minimum of sixteen (16) buyers, the buyers signing doctored SAFTs, anticipating to obtain tokens when such tokens had been minted.

Plaintiffs anticipate to find that the variety of defrauded buyers and the overall quantity of funds misappropriated by Quinn and Denne are a lot bigger than they at present notice.

As well as, on data and perception, Quinn and Denne bought inventory in UI to 3rd events, whose names then appeared on UI’s Cap Desk, however from whom UI obtained no funding funds.

On data and perception, Quinn, Denne, and the opposite Defendants pocketed in extra of $1 million from the sale of those inventory certificates.

Between Blockchain Alliance and suspected Daisy World investor funneling, I too imagine the quantity misappropriated to be a lot larger.

Throughout eight counts, UI’s go well with alleges:

- violation of the RICO Act (all defendants);

- fraud within the inducement (Quinn, Denne, Blockchain Funding, Masternode, Martin and Blockchain Alliance);

- fraud (Quinn, Denne, Blockchain Funding, Masternode, Martin and Blockchain Alliance);

- conversion (Quinn, Denne, Blockchain Funding, Masternode, Martin and Blockchain Alliance);

- breach of fiduciary obligation (Blockchain Funding);

- aiding and abetting breach of fiduciary obligation (Quinn and Denne);

- tortious interference with contract (Quinn and Denne);

- tortious interference with contract (Quinn, Denne and Roma);

An injunction in opposition to extra illegal acts, together with wire fraud, damages and authorized prices are sought.

It ought to be famous that Denne “and a number of the Defendants” named in UI’s go well with filed their very own go well with in opposition to Shuster in November 2024.

The go well with is referenced in UI’s lawsuit as a “frivolous” motion and an “abuse of course of”. And addressing why a separate lawsuit was filed as a substitute of a response, UI writes;

The motion has a number of deficiencies together with that the courtroom lacks jurisdiction over Shuster, his firms and the opposite defendants, and due to this fact, slightly than counter-complain within the Orange County case, Shuster and UI selected to convey their motion right here, in an applicable discussion board.

Sadly Orange County doesn’t present public entry to state-level filed fits so I can’t present any go well with specifics.

As per UI’s Nevada case docket, summons for the defendants had been issued on January fifteenth.

Keep tuned for updates as BehindMLM continues to trace the case.