CashFlow NFT’s newest grift is BG Way of life Membership, a “CPU possession” fraudulent funding scheme.

CashFlow NFT’s newest grift is BG Way of life Membership, a “CPU possession” fraudulent funding scheme.

The launch follows an electronic mail from proprietor Micah Theard making excuses for CashFlow NFT investor losses.

“I’m so pissed off with Miracle Money & Extra! I invested two years in the past, and I nonetheless haven’t seen a return!”

We perceive that sentiment, and we’ve heard it from others as nicely. It’s pure to really feel this fashion, so we wished to take the time to handle it instantly.

In trying to elucidate away investor losses, Theard trots out nonsense about “regulatory challenges”.

This ruse is centered round new MiCA legal guidelines in Europe.

Issues disintegrate upon consideration MiCA has nothing to do with securities legislation and securities regulation. However it was the identical ruse used to break down the Mavie International Ponzi scheme.

Of further be aware in Theard’s electronic mail is the declare;

Collectively, our neighborhood owns over 30% of Miracle Applied sciences/Metaterra, and as we push within the subsequent 3 years towards a $100 billion valuation, the neighborhood’s stake might develop to over $30 billion, solidifying our place in historical past.

And that CashFlow NFT is

days away from delivering our capitalization contract to the SEC to capitalize the corporate to 500 million.

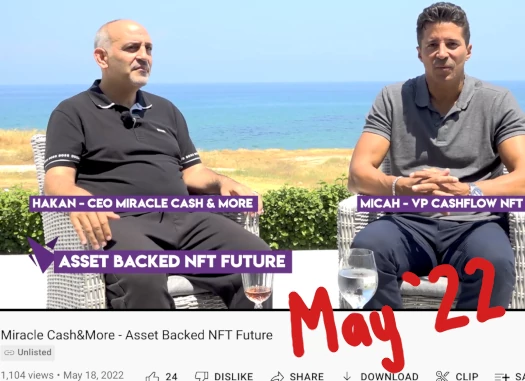

Miracle Applied sciences, aka Miracle Money & Extra, is related to CashFlow NFT, they’re successfully one and the identical.

MetaTerra, a shell firm CashFlow NFT acquired as a part of efforts to create legitimacy round its unregistered funding scheme, is presently delinquent in its SEC filings.

MetaTerra’s Annual 10-Okay report for the monetary yr ending December 2023 was due on April 1st, 2024. It’s now seven and a half months overdue.

There may be additionally no point out of any of CashFlow NFT’s funding schemes in any of MetaTerra’s filings. Formally, MetaTerra’s filed enterprise description with the SEC is “promoting auto elements”.

Shifting on to BG Way of life Membership, Theard and enterprise companion Hakan Törehan are soliciting funding on claims of purported

agreements with two of the world’s largest service provider processing corporations, with entry to 100 million energetic terminals in 120+ international locations.

The ruse is that these corporations aren’t accepting crypto funds, which is the place CashFlow NFT and begging extra for extra funding is available in.

To earn from these terminals, retailers have to be notified about their choice to simply accept crypto. This growth requires funding, and that’s the place you are available.

The enterprise mannequin sees already rinsed CashFlow NFT traders deposit $900 on the promise of $30 or extra “per asset monthly and rising with community success”.

I.e. the extra folks make investments, the upper the returns.

BG Way of life Membership has its personal referral commissions, paid out down three ranges of recruitment:

- degree 1 (personally recruited associates) – 8%

- ranges 2 and three – 3%

Notice that Theard doesn’t specify the funding quantity however does present referral fee charge examples:

Tier 1 (10 referrals at 8%): $720.00

Reverse math’ing the above we get $900 per funding.

Lastly there’s additionally a shit token ROI part to BG Way of life Membership;

Each member begins with each day earnings of a minimum of $1 in Phoenic tokens. Over time, this revenue can develop because the community expands and the token worth will increase.

CashFlow NFT launched Phoenic token final yr and, not surprisingly, thus far it’s gone nowhere. Look ahead to hassle when BG Way of life Membership begins solely paying out in Phoenic tokens.

Pending any additional updates, particularly the SEC taking motion on MetaTerra’s delinquent filings, we’ll hold you posted.