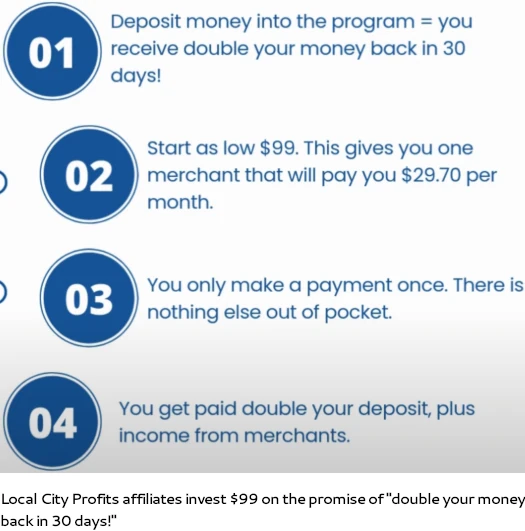

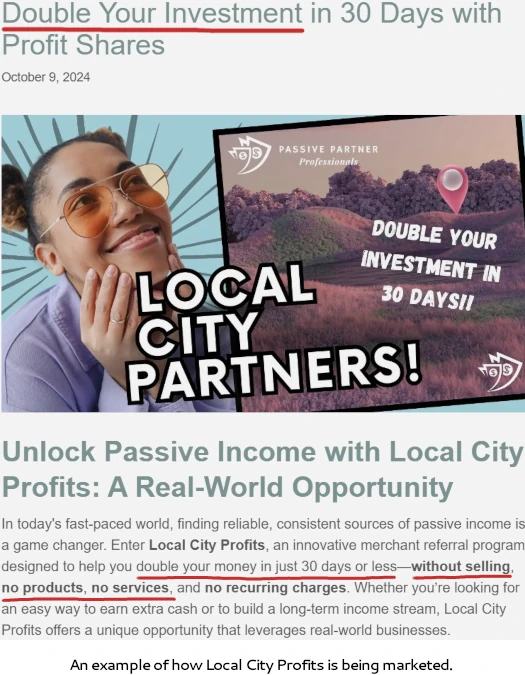

Native Metropolis Locations has launched a $99 funding scheme promising “double your a reimbursement in 30 days!”

Native Metropolis Locations has launched a $99 funding scheme promising “double your a reimbursement in 30 days!”

The brand new passive returns funding scheme follows Native Metropolis Locations’ failed “enterprise listing” scheme earlier this 12 months.

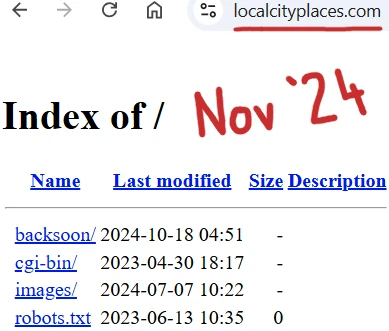

A go to to Native Metropolis Locations’ web site presently returns this:

Rather than the collapsed MLM firm we now have Native Metropolis Offers and Native Metropolis Income.

Native Metropolis Offers nonetheless has Native Metropolis Locations branding and seems to be a web based voucher platform:

Native Metropolis Offers’ web site seems to have been unexpectedly put collectively and stays unfinished:

I may very well be incorrect however I don’t assume Native Metropolis Income has its personal web site. It seems to be run from inside Native Metropolis Offers.

Native Metropolis Income, aka Native Metropolis Companions, presents the ruse that buyers are shopping for income derived from retailers Native Metropolis Offers indicators on.

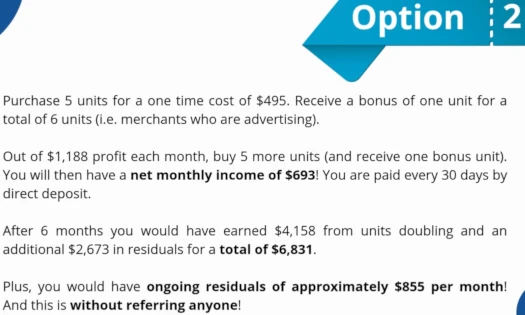

Native Metropolis Income’ investments are pitched as $99 “items”, capped at twenty items per week ($1980). A bonus funding unit can be awarded per 5 items invested into.

Returns are paid as $29.70 a month. On prime of that Native Metropolis Income pays “double your cash each 30 days”.

E.g. You make investments $99 initially of a month. Thirty days later Native Metropolis Income pays you $198. On the finish of the month you obtain a further $29.70.

Every month thereafter you proceed to obtain $29.70 on that unit.

Native Metropolis Income promoters are encouraging potential buyers to compound. In a single instance $855 a month plus $6831 inside six months is pitched off an preliminary $495 funding.

Hooked up to Native Metropolis Income’ funding scheme is a seven-level deep MLM compensation plan.

Native Metropolis Income pays referral commissions on recruited affiliate funding by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel workforce, with each personally recruited affiliate positioned instantly below them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel workforce.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

Native Metropolis Income caps payable unilevel workforce ranges at six.

Referral commissions on unit funding is paid throughout these six ranges as follows:

- stage 1 (personally recruited associates) – 10%

- ranges 2 to five – 5%

- ranges 6 and seven – 2.5%

With nothing marketed or bought to retail clients, the MLM aspect of Native Metropolis Income is a pyramid scheme.

Native Metropolis Locations, Native Metropolis Offers, Native Metropolis Income and Native Metropolis Companions are all owned and run by Troy Warren.

Warren (proper) is US resident primarily based out of Arizona.

Warren (proper) is US resident primarily based out of Arizona.

As documented by Ivan Penn for the St. Petersburg Instances (now Tampa Bay Instances) in 2009, Warren has a protracted historical past of promoting and ecommerce associated fraud.

• A lawsuit by MasterCard Worldwide in 1991 that accused Warren and greater than a dozen different defendants of taking hundreds of thousands from shoppers by means of false affords of low-rate bank cards below an organization they ran, referred to as Listworld. The case was settled and dismissed.

Listworld filed chapter and reached a settlement with the Federal Commerce Fee, which shut the operation down for misleading practices.

• A chapter submitting that left Warren with a judgment for $1.9 million that he was declared answerable for in an order in 2006.

• An order by the Arizona Company Fee that Warren pay $20,000 in restitution to buyers for promoting inventory he didn’t register for a charitable Web enterprise, FreeFundRaisingPrograms.com Inc.

• The Higher Enterprise Bureau gave Warren an “F” for his failed SearchBigDaddy.com Web services and products enterprise due to complaints, failure to reply to complaints and lack of enterprise background.

Warren additionally has been sued at the very least 5 instances for failing to pay state and federal taxes within the tens of hundreds of {dollars}, from the early Nineteen Nineties to 2005.

As per the Howey Take a look at, Native Metropolis Income’ passive returns funding scheme constitutes an funding contract.

The Howey Take a look at is 4 standards an asset should meet to qualify as an “funding contract.”

If the asset is an “funding of cash in a standard enterprise, with an inexpensive expectation of income to be derived from the efforts of others” it’s thought-about a safety.

In Native Metropolis Income, affiliate buyers make investments $99 or extra into Native Metropolis Income (a standard enterprise). That is completed on the promise of 200% inside 30 days and $29.70 a month thereafter (an inexpensive expectation of income).

Mentioned income are represented to be derived from the enterprise actions of Native Metropolis Offers (the efforts of others).

Being an funding contract, Native Metropolis Income’ passive returns funding scheme is a securities providing that should be registered with the SEC.

A search of the SEC’s public EDGAR database reveals neither Native Metropolis Offers, Native Metropolis Income, Native Metropolis Companions or Troy Warren are registered with the SEC.

Providing unregistered securities to US residents constitutes securities fraud.

Past that, Native Metropolis Income’ passive returns funding scheme fails the Ponzi logic check.

We are able to verify from the migration from Native Metropolis Locations to Native Metropolis Offers that Warren’s enterprise is unsustainable. No matter retailers exist aren’t sufficient to maintain the corporate afloat.

SimilarWeb tracked simply ~3000 month-to-month visits to Native Metropolis Offers’ web site as of September 2024, so there’s not a lot happening there both.

Even when we purchase into the “income are from retailers” baloney although, if that was the case why does Native Metropolis Income want your cash then?

Apparently all Warren wants is $99 to pump out $227 inside a month after which $29.70 every following month.

Logically is that have been the case, certainly you’d simply quietly run the enterprise, compound 200% every month and retire because the world’s richest individual inside just a few years?

Because it stands, the one verifiable income coming into Native Metropolis Income is new funding. Utilizing new funding to fund ROI withdrawals, even partially, would make Native Metropolis Income a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This can starve Native Metropolis Income of ROI income, ultimately prompting a collapse.

The maths behind Ponzi schemes ensures that after they collapse, nearly all of members lose cash.