![]() US authorities have lastly taken motion towards The Merchants Area Ponzi scammers.

US authorities have lastly taken motion towards The Merchants Area Ponzi scammers.

On September thirtieth the CFTC filed go well with towards Merchants Area FX LTD and a number of other further company and particular person defendants.

Whereas The Merchants Area itself wasn’t an MLM alternative, the rip-off is of curiosity to BehindMLM resulting from a number of MLM Ponzis feeding into it.

The Merchants Area was additionally promoted by a number of well-known MLM figures.

All up there are sixteen named defendants within the CFTC’s The Merchants Area lawsuit;

- Merchants Area FX LTD., dba The Merchants Area, St. Vincent and the Grenadines shell firm

Fredirick Teddy Joseph Safranko, aka Ted Safrank (proper), co-founder of The Merchants Area

Fredirick Teddy Joseph Safranko, aka Ted Safrank (proper), co-founder of The Merchants Area- David William Negus-Romvari, co-founder of The Merchants Area

- Ares World LTD., dba TruBlueFX, Saint Lucia shell firm

- Algo Capital LLC, Miami shell firm

- Algo FX Capital Advisor LLC, nka Quant5 Advisor LLC, Delaware shell firm

- Robert Collazo Jr., co-owner of Algo FX Capital Advisor LLC

- Juan Herman, aka JJ Herman, co-owner of Algo FX Capital Advisor LLC

- John Fortini, Vice President of Algo FX Capital Advisor LLC

- Steven Likos, Algo FX Capital Advisor LLC gross sales rep

- Michael Shannon Sims, aka Mike Sims, The Merchants Area promoter and insider

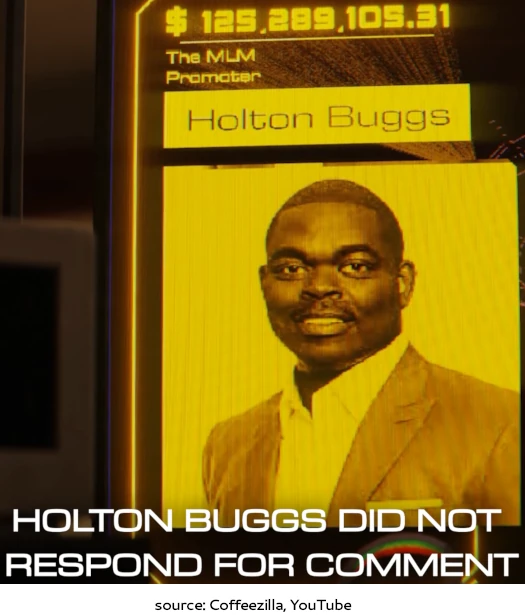

- Holton Buggs Jr., The Merchants Area promoter

- Centurion Capital Group INC, Florida shell firm

- Alejandro Santiestaban, aka Alex Santi, co-owner Centurion Capital Group INC

- Gabriel Beltran co-owner of Centurion Capital Group INC, and

- Archie Rice, Centurion Capital Group INC gross sales rep

As alleged by the CFTC;

From not less than November 2019 by means of current, Merchants Area FX LTD. d/b/a/ The Merchants Area, by and thru its officers, workers, and brokers, (“TD”) and its co-owners Frederick Teddy Joseph Safranko a/okay/a/ Ted Safranko (“Safranko”) and David Negus-Romvari (“Negus-Romvari”), individually and as controlling individuals of TD (collectively, the “TD Defendants”) orchestrated a multi-layered scheme to solicit funds for the aim of buying and selling leveraged or margined retail commodity transactions … in addition to assorted different commodities, by means of pooled and particular person accounts.

What made The Merchants Area a Ponzi scheme is the represented buying and selling, and related income, was all a sham.

TD misappropriated buyer funds by accepting buyer cash by way of third occasion financial institution accounts, cost processors, and crypto wallets, however failing to make use of not less than a few of these funds to commerce XAU/USD and by charging commissions on purported buying and selling income that didn’t exist.

And after The Merchants Area, the fraud continued by means of Ares World and TruBlueFX.

As well as, TD, and later it’s successor in curiosity Ares World d/b/a/ Trubluefx (“Trubluefx”), misappropriated buyer funds by failing to return buyer funds regardless of repeated makes an attempt by 1000’s of shoppers to entry and/or liquidate their accounts.

TD and Safranko additionally falsified buying and selling data, and the TD Defendants did not register as required beneath the Act.

As beforehand said, The Merchants Area wasn’t MLM however did incentivized recruitment by means of direct referral commissions.

Not solely did the TD Defendants straight solicit prospects, the overwhelming majority of whom lived within the U.S., however additionally they engaged different people and entities (“sponsors”) to solicit U.S. prospects on TD’s behalf-with every sponsor appearing like a spoke extending from the TD hub.

That is the place well-known MLM figures, who undoubtedly ought to have recognized higher, enter the image.

Along with the numerous sponsors unfold everywhere in the United States and internationally, the TD Defendants recruited the “Sponsor Defendants” ( collectively with the TD Defendants and Trubluefx, “Defendants”), 4 distinct teams named on this criticism which drove the most important variety of prospects and funds to the TD Pool:

(i) Algo Capital LLC (“Algo Capital”) and Algo FX Capital Advisor, LLC (“Algo FX”), now referred to as Quant5 Advisor, LLC, by and thru their officers, workers, and brokers ( collectively, “Algo”), Robert Collazo, Jr. (“Collazo”), Juan Herman (“Herman”), John Fortini (“Fortini”), and Stephen Likos (Likos) (collectively, the “Algo Defendants”);

(ii) Michael Shannon Sims (“Sims”);

(iii) Holton Buggs (“Buggs”); and

(iv) Centurion Capital Group, Inc., by and thru its officers, workers, and brokers (“Centurion”), Alejandro Santiestaban a/okay/a Alex Santi (“Santi”), Gabriel Beltran (“Beltran”), and Archie Rice (“Rice”) (collectively, the “Centurion Defendants”).

Mike Sims and Holton Buggs are of curiosity right here. The opposite people and firms I’m not aware of.

Mike Sims, a central determine within the associated OmegaPro MLM crypto Ponzi, is believed to have stolen $84 million by means of The Merchants Area.

Holton Buggs is an MLM veteran relationship again to Organo Gold. Circa 2018 Buggs started transitioning to MLM crypto fraud.

This culminated in Buggs launching the Meta Bounty Hunters sequence of Ponzi schemes. Buggs is believed to have stolen $125 million by means of The Merchants Area.

Alongside his MLM crypto fraud scamming, Buggs owns and operates iBuumerang. Buggs cannibalized iBuumerang and fed distributors into his fraudulent crypto dealings.

The CFTC teams Sims and Buggs as “Sponsor Defendants”.

Though the Sponsor Defendants every meant the funds they solicited from prospects to be traded within the TD Pool, not less than some Sponsor Defendants presupposed to be asking for their very own swimming pools or “hedge funds.”

The Sponsor Defendants solicited funds for the TD Pool regardless that every knew or ought to have recognized that TD was not buying and selling the funds as represented.

Every of the Sponsor Defendants turned conscious ofred flags that put them on discover that TD was not a legit buying and selling operation.

The Sponsor Defendants confronted a selection: stop selling TD in gentle of the alarming info they knew or observe the sturdy monetary motivations they needed to ignore the pink flags and proceed to gather beneficiant commissions on the purported buying and selling.

Every of the Sponsor Defendants selected the latter. The Sponsor Defendants actively downplayed the pink flags and continued to solicit prospects, serving to to create the misunderstanding that prospects have been taking part in legit buying and selling even because the scheme was on the point of collapse.

Every of Sponsor Defendants knowingly made oral and written fraudulent and materials misrepresentations and omissions on social media, by way of textual content messages, by phone, and in particular person to potential and present prospects that they knew or ought to have recognized have been false.

The Sponsor Defendants misappropriated buyer funds, together with by accepting funds meant for buying and selling into financial institution accounts they managed and/or accumulating commissions on buyer income regardless of that the Sponsor Defendants knew or ought to have recognized that TD was not buying and selling the funds as purported.

A few of the Sponsor Defendants additionally commingled buyer funds and most weren’t registered as required beneath the Act.

Safranko … established relationships with different sponsors, together with Sims and Buggs. Safranko communicated with Sims and Buggs by way of phone and/or messaging functions.

Moreover, on a variety of events, Safranko participated in phone and video conferences with potential or present prospects that Buggs was soliciting.

On not less than one event, Safranko traveled with Buggs to Dubai in reference to TD.

Like the opposite Sponsor Defendants, the TD Defendants paid Buggs and Sims commissions based mostly on the shoppers that they recruited for the TD Pool.

Particular to Mike Sims;

Starting in not less than September 2021 by means of current (the “Related Sims Interval”), Michael Sims fraudulently solicited prospects to deposit cash for the aim of taking part in pooled buying and selling of leveraged or margined XAU/USD by his “hedge fund” by making materials misrepresentations and omissions to potential and precise prospects.

In reality, Sims was utilizing buyer funds to take part within the TD Pool although Sims knew or ought to have recognized TD was not buying and selling buyer funds because it purported.

As well as, Sims misappropriated buyer funds and did not register as required beneath the Act.

Pursuant to this scheme, not less than 42 Sims prospects deposited at least $22 million for the needs of buying and selling leveraged or margined XAU/USD.

After working with different sponsors to solicit buyer for TD, starting in not less than September 2021, Sims started soliciting prospects for his personal “hedge fund,” by means of phone calls, textual content messages, messaging apps, and in-person conferences.

Sims made quite a few fraudulent misrepresentations and omissions about:

(i) the possession and operation of the buying and selling enterprise,

(ii) the revenue and threat related to the purported buying and selling, and

(iii) capability and timeliness of buyer withdrawal requests.

From the outset, Sims advised potential prospects that he was soliciting funds for his hedge fund.

Sims claimed his hedge fund had been in operation for greater than 10 years and employed a workforce of skilled merchants to commerce leveraged or margined XAU/USD on behalf of its prospects.

These statements have been false.

Sims was not soliciting funds on behalf of a hedge fund. Sims didn’t personal any “hedge fund” not to mention one which had been in operation for greater than 10 years and employed a workforce of merchants.

Neither Sims, personally, nor any hedge fund or different entity owned by him traded any funds on behalf of shoppers.

Reasonably, as Sims later admitted to a buyer, he was a sponsor that recruited prospects for the TD Pool.

Lastly, along with misrepresenting the id and placement of the buying and selling operation, Sims additionally omitted to inform not less than one potential buyer that he can be charging commissions, and sizeable ones at that.

Solely after this buyer acquired his first account assertion did he discover a sizeable withdrawal from his account.

When the client questioned Sims in regards to the withdrawals, Sims knowledgeable him that there can be “day by day and month-to-month commissions” which might vary from 40-50%.

Sims didn’t clarify who can be receiving these commissions, nor what share Sims himself would take.

Sims additionally made misrepresentations to potential and present prospects in regards to the timeframe and skill to withdraw their funds permitting the scheme to proceed for months after it initially started to unravel.

When prospects requested Sims in regards to the standing of those withdrawal requests, Sims repeatedly made excuses for delays and supplied false statements in regards to the timing of the withdrawals.

Sims additionally tried to dissuade prospects from taking withdrawals from their accounts.

Later, Sims stopped responding to the shoppers communications looking for details about the pending withdrawal.

Along with the opposite indications of fraudulent TD exercise about which Sims knew or ought to have recognized, Sims demonstrated his data that TD was engaged in probably unlawful and problematic actions by directing potential prospects to disguise their funding funds.

Even if Sims knew or ought to have recognized that TD was not buying and selling buyer funds as purported, Sims directed tens of millions of {dollars} in buyer funds to the TD Pool, and misappropriated buyer funds by taking sizable commissions. Sims’ fee ranged from 40-50% of the purported buying and selling revenue.

Particular to Holton Buggs;

Starting in not less than February 2021 persevering with by means of current (the “Related Buggs Interval”), Buggs fraudulently solicited prospects to deposit cash for the aim of taking part within the TD Pool by making materials misrepresentations and omission to precise and potential prospects.

Buggs solicited prospects for the TD Pool although Buggs knew or ought to have recognized TD was not buying and selling buyer funds because it purported

As well as, Buggs misappropriated buyer funds and did not register as required beneath the Act.

Pursuant to this scheme, not less than 517 Buggs prospects deposited at least $54 million for the aim of buying and selling leveraged or margined XAU/USD.

Round February 2021 , Buggs bought a buying and selling schooling firm, and regardless of not being a licensed dealer, started increasing the corporate past coaching and schooling.

Buggs constructed upon his already massive community of MLM companies and business acquaintances to start soliciting prospects for the TD Pool.

A number of months after the acquisition of his buying and selling firm, Buggs started working as a “sponsor” to solicit prospects for the aim of buying and selling XAU/USD after which directed their funds to the TD Pool.

Utilizing his present MLM companies and the associates affiliated with them, Buggs held out the chance to take part in his “non-public buying and selling hedge fund” by means of his “non-public dealer” as a reward for hitting sure gross sales tiers in his different MLM companies.

As soon as associates hit the “emerald” stage they got the chance to take part within the buying and selling by way of Buggs’ “non-public dealer,” creating an aura of exclusivity.

Buggs hid the id of TD till associates reached the upper “diamond” stage and executed a non-disclosure settlement.

Buggs additionally solicited potential prospects past his pre-existing MLM community by means of in-person occasions. For instance, in early 2022, Buggs invited roughly fifteen potential prospects to a dinner assembly in San Diego, California.

Equally, in 2022 Buggs attended a convention in Miami, Florida, throughout which he solicited not less than two prospects for the commodity pool.

In the course of the Related Buggs Interval, Buggs fraudulently solicited prospects by means of, phone, messaging apps, and in-person occasions comparable to conferences and dinners- to deposit cash for the needs of buying and selling leveraged and margined XAU/USD although he knew or ought to have recognized that TD was not buying and selling the funds as purported.

Utilizing his MLM companies and community of business connections, Buggs touted the unbelievable returns that the commodity pool generated by means of leveraged or margined buying and selling ofXAU/USD.

He advised potential prospects that the commodity pool had an “unbelievable successful streak” and claimed that it “by no means had a dropping month”.

Buggs boasted to a enterprise affiliate by textual content that “I HA VE A MONEY PRINTING MACHINE.”

In some situations, Buggs used the Buying and selling App to indicate potential prospects the purported XAU/USD buying and selling historical past and accounts that he managed with “balances” of roughly $80 million and $650 million.

These assertions about unbelievable positive factors have been on their face, unrealistic and unattainable.

Buggs knew or ought to have recognized that these purported buying and selling returns have been false.

In 2021 , not less than one potential buyer advised Buggs that he had performed a background test on Safranko and was involved in regards to the destructive info and critiques he had seen on-line.

When assuring this potential buyer in regards to the TD and Safranko warnings that he raised, Buggs made further fraudulent statements.

Buggs reassured this buyer that he traded “proper beside [Safranko]”; that Buggs was “answerable for [his customers’] funds. ”

These statements have been false and deceptive. In reality, Buggs didn’t commerce his personal prospects’ funds, nor was he in management over the funds purportedly despatched to TD.

And, regardless of understanding in regards to the numerous warnings about and destructive critiques of TD and Safranko, Buggs continued to solicit new prospects for the TD Pool and failed to inform present prospects about these warnings and destructive critiques.

Buggs continued to make false assurances in regards to the capability of shoppers to withdraw funds even after prospects started to expertise vital withdrawal difficulties and delays within the Fall of 2022.

In February 2023, when one buyer contacted Buggs to inquire in regards to the delay in acquiring his withdrawal, Buggs falsely assured him that “withdrawals have steadily gone out” from TD.

Buggs knew or ought to have recognized that this assertion was false: Withdrawals had not steadily gone out since August 2022.

In an effort to insulate himself from claims that he was complicit in a fraudulent scheme, Buggs additionally claimed to a complaining buyer that he additionally “had not withdrawn my buying and selling income as they sit in TD.”

Buggs knew that this assertion was false : Whereas common prospects withdrawals had been stalled for months, Buggs, and his household, had taken not less than 1,000,000 {dollars} in purported buying and selling income from TD accounts throughout this time interval.

Buggs knew or ought to have recognized that TD was engaged in unlawful and fraudulent conduct as a result of, as an agent of TD, Buggs was directing potential and present prospects to disguise the aim of their funding funds and nations of origin.

Buggs, himself and thru his assistant, instructed potential and present prospects to hide the aim of those deposits by directing that they use sure opaque language within the wire switch memorandum.

For instance, he instructed one buyer that the deposit ought to say “providers (ONLY!)” and if the wire “reference embrace[ d] the rest, the wire will likely be returned & the associated account closed. No exceptions!”

Different prospects have been equally instructed that to be able to take part within the pool by means of Buggs, that they have to wire funds with the memo line for “Companies.”

Buggs additionally instructed TD prospects to take misleading steps when funding their TD account by means of cryptocurrency. When prospects opted to fund TD accounts with cryptocurrency, they have been requested their nation ofresidence within the TD account set-up directions.

Buggs and/or his assistant instructed US prospects that they need to select “crypto” of their nation of origin, quite than the USA.

As an alternative of heeding or investigating the quite a few pink flags signaling that TD was a fraud and never engaged in legit buying and selling, Buggs downplayed the warnings and continued to solicit prospects for the TD Pool, accumulating tens of millions of {dollars} in commissions on purported buying and selling income.

Buggs misappropriated some TD buyer funds by accepting TD a portion of buyer funds into financial institution accounts he managed and utilizing these funds for private use.

For instance, though he began with a checking account stability of roughly $45,000, between April 11-Thirteenth, Buggs accepted 4 wires from TD prospects every together with memo strains incorporating the phrase “Companies,” totaling $370,000.

Buggs didn’t wire or in any other case switch these funds to any recognized brokerage or buying and selling entity. Buggs additionally took in an extra $110,000 from one other supply into the account.

On April 14, 2022, Buggs used all or a number of the $370,000 to wire $465,000 to a 3rd occasion with a memo “Steadiness for Lambo.”

In one other instance, on the finish of April 18, 2022, Buggs had a stability of roughly $70,000 in his checking account.

Buggs accepted wires, every of which with memo strains together with the outline “Companies,” from three prospects totaling $545,000 into this account.

Buggs did not switch the funds to any recognized brokerage or buying and selling entity. Two days after the shoppers wired the funds to Buggs’ account, Buggs wired $350,000 for the acquisition of a apartment.

Buggs additionally misappropriated TD buyer funds by taking sizable commissions on purported buying and selling income when he knew or ought to have recognized that income mirrored within the TD Pool account have been false.

The Merchants Area collapsed in late 2022, producing tens of millions in shopper losses.

Within the fall of 2022, the scheme started to unravel, and prospects started to expertise excessive withdrawal delays and/or have been unable to withdraw their funds.

To influence prospects that the withdrawal points weren’t a sign of fraud, the TD Defendants supplied quite a few, conflicting excuses for the delays-including, in June 2023, asserting that TD had been acquired by Trubluefx.

The TD Defendants falsely assured prospects that their funds have been secure and withdrawals can be processed. However the numerous withdrawal delays, the Sponsor Defendants ignored or downplayed the withdrawal points and continued to solicit funds from new and present prospects to be traded within the TD Pool.

These misstatements allowed Defendants to proceed their fraudulent scheme for greater than six months and bilk prospects out of tens of millions of further {dollars}.

Not less than a few of Defendants’ conduct is ongoing-upon info and perception, the vast majority of buyer funds haven’t been returned.

Until restrained and enjoined by this Court docket, Defendants will probably proceed to interact in acts and practices alleged on this Criticism and related acts and practices.

The CFTC cites “at least $283 million” in The Merchants Area losses throughout “not less than 2046 prospects”. Based mostly on leaked investor knowledge, The Merchants Area is estimated to have taken in round $3.3 billion.

In the course of the Related Interval, TD straight and … by means of the Sponsor Defendants, triggered at least $180 million in buyer funds to be deposited into financial institution accounts held within the title of varied third-party entities that TD managed by means of a TD agent who was the signatory on these accounts.

None of those third occasion entities have been companies that engaged in buying and selling. Not one of the funds deposited in these third occasion financial institution accounts have been ever despatched to TD or another agency that engaged in buying and selling.

As an alternative, TD directed its agent to make use of buyer funds deposited into the third-party financial institution accounts to make funds unrelated to buying and selling and to make Ponzi-style funds to different prospects.

In its filed lawsuit the CFTC alleges fraud throughout a number of violations of the Commodity Change Act.

The CFTC is looking for an injunction towards The Merchants Area defendants, prohibiting additional violations of the Commodities Change Act.

If granted, the injunction may also bar The Merchants Area defendants from having something to do with commodities buying and selling within the US.

Moreover, disgorgement of ill-gotten positive factors, full restitution of investor losses, pre-judgment and post-judgment curiosity and a civil financial penalty are additionally sought.

As beforehand famous, the CFTC’s The Merchants Area Criticism was filed beneath seal on September thirtieth.

The CFTC requested the Criticism be saved beneath seal in order to

permit the Fee to

(1) receive a Statutory Restraining Order freezing Defendants’ belongings, prohibiting destruction of data, and authorizing the Fee’s instant inspection of uch data and

(2) serve related monetary establishments with the Court docket’s Statutory Restraining Order to effectuate the asset freeze, with out discover ot the Defendants.

The courtroom granted the CFTC’s seal movement on October 1st.

On October third, the courtroom granted the CFTC’s request for an ex-parte statutory restraining order towards The Merchants Area defendants (freezing of belongings and so on.). A Momentary Receiver was additionally appointed.

There’s additionally good trigger for the appointment of a Momentary Receiver to take management of all belongings owned, managed, managed or held by Defendants, or by which they’ve any helpful curiosity (“Defendants’ Property”), in order that the Momentary Receiver could protect belongings, examine and decide buyer claims, decide illegal proceeds retained by Defendants and quantities resulting from prospects as a outcomes of Defendants’ alleged violations, and distribute remaining funds beneath the Court docket’s supervision.

On October eleventh, the CFTC filed a movement with the courtroom requesting the case be unsealed. The courtroom unsealed the case later the identical day.

Whereas it’s far too early to get into specifics, it’s assumed clawback litigation will likely be filed towards The Merchants Area’s prime net-winners in some unspecified time in the future.

Lots of The Merchants Area’s prime net-winners are MLM firm homeowners or prime firm distributors/associates.

It ought to be famous that the CFTC beforehand filed a lawsuit concentrating on Tin Quoc Tran’s SAEG Ponzi scheme. Ted Safranko and Mike Sims are named defendants within the go well with.

Safranko, who’s believed to have gone on the run for the reason that CFTC’s SAEG lawsuit was filed in February 2023, copped a $3.8 million default judgment in September 2023.

Mike Sims settled the CFTC’s alleged SAEG Ponzi fraud costs for $250,000 final month.

Lastly, the most important MLM Ponzi I’m conscious of that fed into The Merchants Area was OmegaPro (estimated $4 billion in shopper losses).

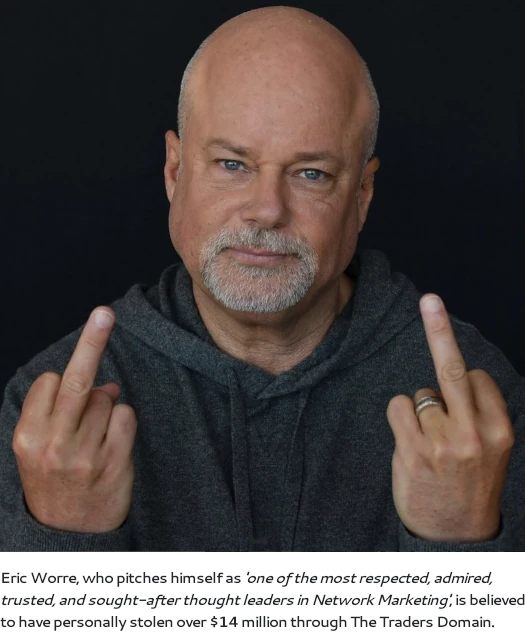

Mike Sims and Eric Worre have been straight tied to OmegaPro. Sims as a co-founder and Worre as OmegaPro’s Official Strategic Coach.

OmegaPro collapsed in late 2022, shortly after The Merchants Area collapsed.

OmegaPro co-founder Andreas Szakacs was arrested in Turkey in July 2024. Dilawar Singh, final recognized to be residing in Spain, has gone underground.

Whether or not there are pending prison costs in relation to The Merchants Area is unknown.

A Present Trigger listening to on the CFTC’s filed TRO movement is scheduled for October twenty ninth. Keep tuned for updates as BehindMLM continues to trace the case.