TrageTech has obtained a securities fraud warning from the Texas State Securities Board (TSSB).

TrageTech has obtained a securities fraud warning from the Texas State Securities Board (TSSB).

TSSB’s October tenth enforcement order additionally cites promoter Eric Ture Muhammad, cited as a GSPartners and Billionico promoter.

Named respondents in TSSB’s October tenth fraud enforcement order are:

- Trage Applied sciences Restricted, a Marshall Islands shell firm

- Graeme Gary Hearn, registered agent of Trage Applied sciences Restricted

- Michael “Mike” Holloway, registered agent of Trage Applied sciences Restricted

- Kingdom Wealth Group LLC aka Kingdom Wealth Creators LLC

Darrell Porter (proper), a Texas resident and founder and CEO of Kingdom Wealth Group

Darrell Porter (proper), a Texas resident and founder and CEO of Kingdom Wealth Group- Eric Ture Muhammad, a Georgia resident

As put forth as “findings of truth” by the TSSB;

Darrell Porter is a Minister from Killeen, Texas, and the founding father of Kingdom Wealth Group LLC. Eric Ture Muhammad is a self-described Wealth Minister from Fairburn, Georgia. Porter, Kingdom Wealth and Muhammad have been leveraging affinity and faith-based relations when selling quite a few multilevel advertising schemes.

Porter, Kingdom Wealth, Muhammad and numerous different multilevel entrepreneurs at the moment are selling Trage Applied sciences Restricted in or from Texas.

The agency started working in early 2024 and is now providing investments in an automatic cryptocurrency arbitrage buying and selling program that purportedly pays beneficiant commissions and permits purchasers to double their cash each three months.

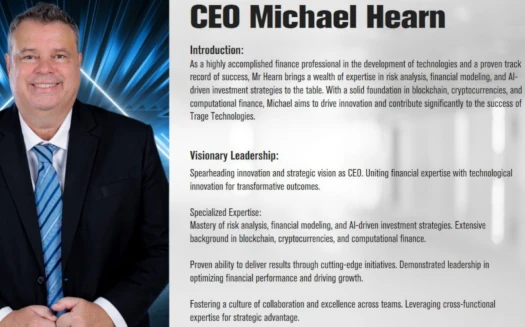

TrageTech is a Boris CEO buying and selling bot Ponzi, fronted by fictional CEO Michael Hearn (performed by UK nationwide Daniel Poole).

As of September 2024, SimilarWeb tracked 1.1 million month-to-month visits to TrageTech’s web site. 63% of TrageTech’s web site visitors originates from the US, adopted by 22% from Canada.

As of October 2024, TSSB has tracked over $6.4 million invested into TrageTech being stashed in a single crypto pockets.

In reference to the supply of the Crypto Arbitrage Investments, Respondents Trage Applied sciences, Holloway and Hearn are deliberately failing to reveal that Respondent Trage Applied sciences isn’t utilizing belongings deposited by purchasers to conduct arbitrage buying and selling per representations to buyers, and this info constitutes a fabric

truth.

Certainly one of TrageTech’s advertising factors is that it’s registered with the SEC.

As famous by TSSB, it is a misrepresentation of a sole filed Type D exemption.

Trage Applied sciences Restricted and its principals, Graeme Gary Hearn and Michael “Mike” Holloway, are touting the legitimacy of Trage Applied sciences Restricted by claiming it’s registered with america Securities and Trade Fee.

In reality and actually, Trage Applied sciences Restricted isn’t registered with america Securities and Trade Fee.

As an alternative, on February 22, 2024, Respondents Trage Applied sciences and Hearn filed a Type D for Respondent Trage Applied sciences with the SEC.

On June 4, 2024, Respondents Trage Applied sciences amended the Type D.

The Types D declare secure harbor for securities issued by Respondent Trage Applied sciences pursuant to Regulation D, Rule 506(c).

This federal regulation serves as a foundation for preempting the Texas State Securities Board from administering state legal guidelines that defend buyers by requiring the registration of securities.

Issuers qualify for secure harbor pursuant to Regulation D, Rule 506(c), after they restrict gross sales to accredited buyers and take cheap steps to confirm purchasers are, actually, accredited buyers.

Respondent Trage Applied sciences isn’t limiting gross sales to accredited buyers and it isn’t taking cheap steps to confirm purchasers are, actually, accredited buyers.

Due to this fact, Respondent Trage Applied sciences doesn’t qualify for secure harbor pursuant to Regulation D, Rule 506(c).

Furthermore, the Types D don’t relate to the Crypto Arbitrage Investments.

The Types D have been filed to assert secure harbor for fairness securities … Respondent Trage Applied sciences isn’t providing or promoting fairness securities.

Respondent Trage Applied sciences isn’t registered with the SEC and doesn’t qualify for secure harbor pursuant to Regulation D, Rule 506(c),

With respect to Darrel Porter and Eric Ture Muhammed, TSSB notes TrageTech is promoted as a GSPartners observe up;

Respondents Kingdom Wealth and Porter are touting Respondent Porter’s means to “get double digit returns utilizing a blockchain ecosystem, the place firms work so that you can improve your wealth” and representing that Respondent Porter has “chosen GS Companions as my car for God to make use of to convey this to move.”

GS Companions refers to GSB Gold Normal Financial institution LTD dba GS Companions, a agency named as a respondent in Order No. ENF-23-CDO-1879, entered by the Securities Commissioner on November 16, 2023. It’s no lengthy[er] in enterprise.

Respondents Kingdom Wealth and Porter at the moment are selling Respondent Trage Applied sciences and its investments in digital asset buying and selling in and from Texas.

Respondents Kingdom Wealth and Porter are publishing content material in social media that claims Respondent Trage Applied sciences is registered with the SEC.

Though Respondent Trage Applied sciences isn’t registered with the SEC and doesn’t qualify for secure harbor pursuant to Regulation D, Rule 506(c), Respondents Kingdom Wealth and Porter are representing Respondent Trage Applied sciences is compliant with legal guidelines regulating the securities business.

For instance, Respondents Kingdom Wealth and Porter are claiming Respondent Trage Applied sciences is “SEC Compliant and doing issues the suitable method” and that “these guys have finished what they wanted to do to do enterprise on this nation.”

Respondent Muhammad purports to be “The Wealth Minister” and a “Wealthbuilding Coach” affiliated with unincorporated advertising and wealth-building organizations generally known as WealthBuildersWorldwide aka Wealth Builders Worldwide and TeamBelieve aka Crew Imagine.

Respondent Muhammad and/or Wealth Builders Worldwide have been topic to the next latest enforcement actions filed by state securities regulators:

A. Respondent Muhammad and Wealth Builders Worldwide have been named as respondents in Order No. ENSC-241162, entered on January 22, 2024, by the Commissioner of Securities of the State of Georgia, and

B. Wealth Builders Worldwide was named as a respondent in Order No. CD-2023- 0-21, entered on November 16, 2023, by the Alabama Securities Fee.

Respondent Muhammad can be a multilevel marketer that has promoted the next investments allegedly issued by the next:

A. GSB Gold Normal Financial institution LTD dba GS Companions, a agency named as a respondent in Order No. ENF-23-CDO-1879, entered by the Securities Commissioner on November 16, 2023. It’s now not in enterprise.

B. Billionico Academy aka Billionico, a company named as a respondent in Order No. ENF-24-1882.

Respondent Muhammad is now selling Respondent Trage Applied sciences by means of Wealth Builders Worldwide and Crew Imagine.

Respondent Muhammad can be representing Respondent Trage Applied sciences is “SEC Compliant and doing issues the suitable method.”

He’s additional representing that purchasers can “[t]rust in a platform that’s totally registered with the SEC” as a result of its registration is “guaranteeing compliance and transparency.”

GSPartners was a fraudulent funding scheme run by convicted felony Josip Heit (proper).

GSPartners was a fraudulent funding scheme run by convicted felony Josip Heit (proper).

Coinciding with an avalanche of regulatory fraud warnings and enforcement actions throughout North America, GSPartners collapsed in December 2023.

Billionico is a GSPartners spinoff additionally believed to be run by Heit. TSSB issued a Billionico fraud warning in April 2024.

With TrageTech not being registered with the SEC or qualifying for a Type D secure harbor, TSSB is alleging securities fraud in Texas.

Respondent Trage Applied sciences has not been registered as a supplier with the Securities Commissioner.

The Crypto Arbitrage Investments haven’t been registered by qualification, notification or coordination and no allow has been granted for his or her sale in Texas at any time materials hereto.

Respondent Kingdom Wealth is performing as a supplier or an agent of Respondent Trage Applied sciences however it has not been registered as a supplier or agent with the Securities Commissioner.

Respondent Porter is performing as an agent of Respondent Trage Applied sciences however he has not been registered as an agent with the Securities Commissioner.

Respondent Muhammad is performing as an agent of Respondent Trage Applied sciences however he has not been registered as an agent with the Securities Commissioner.

Events providing the Crypto Arbitrage Funding in Texas are providing unregistered securities in violation of Part 4003.001 of the Securities Act.

Events providing the Crypto Arbitrage Funding in Texas are providing securities in violation of Part 4004.051 of the Securities Act except the events are registered as sellers or brokers in Texas.

Citing TrageTech’s, Porter’s and Muhammad’s conduct as “fraud and deceit”, TSSB has issued an emergency stop and desist order.

The Crypto Arbitrage Investments are securities as that time period is outlined in Part 4001.068 of the Securities Act.

Respondents are partaking in fraud in reference to the supply on the market of securities.

Respondents are making gives containing statements which are materially deceptive or in any other case more likely to deceive the general public.

Respondents’ conduct, acts, and practices threaten rapid and irreparable public hurt.

It’s due to this fact ORDERED that Respondents instantly CEASE AND DESIST from providing on the market any safety in Texas till the safety is registered with the Securities Commissioner or is obtainable on the market pursuant to an exemption from registration below the Texas Securities Act.

It’s additional ORDERED that Respondents instantly CEASE AND DESIST from performing as securities sellers, brokers, funding advisers, or funding adviser representatives in Texas till they’re registered with the Securities Commissioner or are performing pursuant to an exemption from registration below the Texas Securities Act.

It’s additional ORDERED that Respondents instantly CEASE AND DESIST from partaking in any fraud in reference to the supply on the market of any safety in Texas.

It’s additional ORDERED that Respondents instantly CEASE AND DESIST from providing securities in Texas by means of a suggestion containing a press release that’s materially deceptive or in any other case more likely to deceive the general public.

Failing to stick to TSSB’s order is a felony offense as per Texas regulation.

You’re suggested below Part 4007.206 of the Securities Act that any understanding violation of an order issued by the Securities Commissioner below the authority of Part 4007.104 of the Securities Act is a felony offense punishable by a nice of no more than $10,000.00, or imprisonment within the penitentiary for 2 to 10 years, or by each such nice and imprisonment.

TrageTech, Porter and Muhammad have 31 days to request a listening to to problem TSSB’s findings.