As a part of what seems to be ongoing efforts to defraud shoppers by way of securities fraud, Dan Putnam has launched Avasar.

As a part of what seems to be ongoing efforts to defraud shoppers by way of securities fraud, Dan Putnam has launched Avasar.

By means of Avasar, Putnam is pitching shoppers on passive month-to-month returns – purportedly paid from the earnings of Amazon storefronts.

Avasar operates on the area “avasar.com”, the non-public registration of which was final up to date on August fifth, 2024.

There isn’t a indication on the web site that Avasar is owned by Putnam.

The one clue Putnam runs Avasar is the point out of Rubi AI:

BehindMLM first got here throughout Rubi AI in August 2023, as a part of Flex.

Launched as a standalone MLM alternative, Flex permits members to steal and regurgitate copyrighted content material.

Constructing on that, we now have Rubi AI connected to Avasar.

Avasar fees $39.95 a month for some fundamental providers:

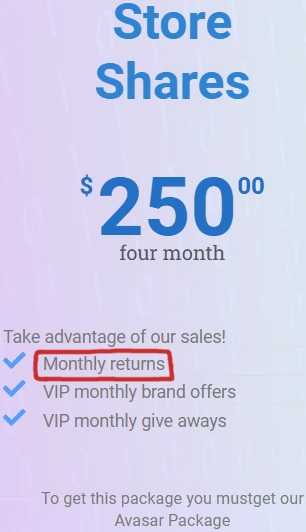

The passive returns “retailer shares” alternative prices an extra $250 quarterly:

As above, taken straight from Avasar’s web site, Avasar associates pay $250 1 / 4 on the promise of “month-to-month returns”. Mentioned month-to-month returns are purportedly tied to Amazon storefronts.

We’re one of many largest E-Commerce corporations within the USA, headquartered in Salt Lake Metropolis, Utah, with intensive warehouses throughout the USA.

With many years of expertise, we’ve achieved hundreds of thousands in gross sales and proceed to steer the business.

Think about being a part of our huge stock and reaping substantial earnings! We proudly inventory famend manufacturers like Nike, Adidas, Reebok, and extra, guaranteeing high quality and status. Hurry—shares in our shops are extraordinarily restricted!

As per the Howey Check, Avasar’s “retailer shares” funding alternative constitutes a securities providing.

Avasar associates are

- investing $250 with the corporate each quarter (an funding of cash in a typical enterprise);

- on the promise of “month-to-month returns” (with an inexpensive expectation of earnings); and

- “month-to-month returns” are purportedly paid out of the income of Avasar managed Amazon storefronts (derived from the efforts of others)

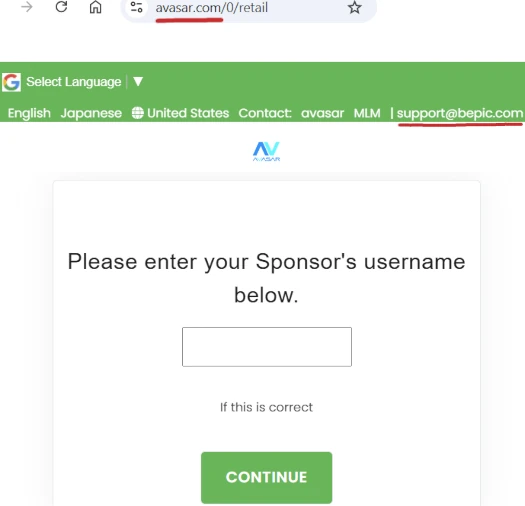

Clicking the “be part of” button on Avasar’s web site redirects guests to an Avasar skinned model of B-Epic’s web site:

B-Epic is one other MLM firm owned by Putnam.

Pertinent to Putnam (proper) persevering with to commit securities fraud by way of Avasar, neither B-Epic, Avasar or Putnam are registered with the SEC.

Pertinent to Putnam (proper) persevering with to commit securities fraud by way of Avasar, neither B-Epic, Avasar or Putnam are registered with the SEC.

In December 2022 Putnam settled a $12 million securities fraud lawsuit filed by the SEC. The SEC’s filed 2020 lawsuit accused Putnam and two accomplices of defrauded shoppers by way of three MLM crypto Ponzis.

In March 2024 BehindMLM famous Putnam seemingly violating his SEC fraud settlement by way of Aiscend.

Aiscend, one other standalone MLM alternative, sees Putnam pitch shoppers on “hands-free buying and selling with commerce buddy”. Along with not being registered with the SEC, Putnam and Aiscend aren’t registered with the CFTC both.

There isn’t a buying and selling part to Avasar so solely securities fraud applies.

Whether or not the SEC goes after Putnam for 2 extra documented unregistered securities choices stays to be seen.