BioLimitless has introduced an as much as 250,000 tether (USDT) funding acess charge.

BioLimitless has introduced an as much as 250,000 tether (USDT) funding acess charge.

The charge disclosure was made on a September twenty fifth advertising and marketing webinar hosted by BioLimitless co-founder Jeremy Roma.

As per the advertising and marketing slide above, the BioLimitless funding charge permits an investor to take a position as much as 400% of the charge paid. E.g. Cost of a 100,000 USDT entry charge permits for an funding of as much as 400,000 USDT.

BehindMLM first reported on BioLimitless’ passive returns funding scheme on September 14th. Naturally with neither BioLimitless or Roma being registered with the SEC, our main concern was securities fraud.

Two days later, on September sixteenth, BioLimitless filed a Type D with the SEC via Biolimitless Facilities of Excellence, Inc., a Delaware shell firm.

A Type D is notification of a securities providing to the SEC that the offeror believes qualifies from registration exemption.

Of notice is BioLimitless’ filed Type D stating the “minimal funding accepted from any exterior investor [is] $20,000 USD”. That is at odds with BioLimitless advertising and marketing, which specifies a minimal 100 USDT funding.

Use of the cryptocurrency tether is just not disclosed in BioLimitless’ Type D submitting.

As to the exemption, BioLimitless is looking for exemption beneath Rule 506(c).

Rule 506(c) permits issuers to broadly solicit and customarily promote an providing, supplied that:

- all purchasers within the providing are accredited buyers

- the issuer takes affordable steps to confirm purchasers’ accredited investor standing and

- sure different circumstances in Regulation D are glad

Purchasers in a Rule 506(c) providing obtain “restricted securities.” An organization is required to file a discover with the Fee on Type D inside 15 days after the primary sale of securities within the providing.

BioLimitless addresses the problem of accredited buyers in a second advertising and marketing slide:

“Restricted securities” primarily means the BioLimitless funding positions can’t be shared.

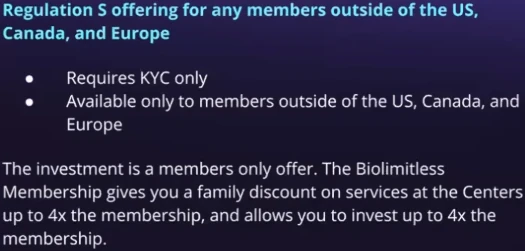

Curiously, exterior of many of the western world (US, Canada and Europe), BioLimitless is letting anyone make investments.

It ought to be famous that if BioLimitless’ securities providing isn’t registered in nations with regulated monetary markets exterior of the US, Canada and Europe, that constitutes securities fraud.

To this point BioLimitless hasn’t indicated it has registered its “clinic” funding scheme in any nation exterior of the US.

Between securities fraud exterior of the US, Canada and Europe and accredited buyers, I’m going to exit on a limb and counsel “Part 1” of BioLimitless’ funding scheme disqualifies 99.99% of Daisy AI Ponzi victims.

Roma’s reply to that could be a pending second funding providing;

We’re registering a Reg D providing. That shall be accomplished earlier than our official launch in Dubai.

And as soon as that’s accomplished we will open up the crowdfunding to retail buyers as nicely.

BioLimitless’ Dubai launch is scheduled for someday in March 2025.

With BioLimitless passive returns funding scheme fairly clearly constituting an funding contract as per the Howey Take a look at, I’m not seeing the way it can legally open up funding to retail buyers. Not via a Type D exemption as said anyway.

Pending additional info on BioLimitless’ Part 2 scheme, we’ll preserve you posted.

As regards to Daisy AI Ponzi losses, there have been no updates since Daisy AI’s last collapse in December 2023.

Whereas thousands and thousands in Daisy AI investor funds stay unaccounted for, Roma and spouse Umida look like doing high quality.

SimilarWeb tracked simply ~12,700 month-to-month visits to Blockchain Sports activities’ web site, Daisy AI’s direct Ponzi successor, for August 2024. And that was up 33%, with month-to-month visits for July dipping under 10,000.