At a latest BioLimitless advertising occasion, proprietor Jeremy Roma pitched customers on a passive funding alternative.

At a latest BioLimitless advertising occasion, proprietor Jeremy Roma pitched customers on a passive funding alternative.

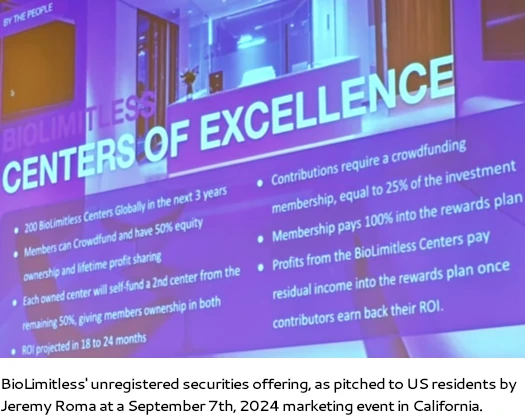

Roma represented customers may spend money on “BioLimitless Facilities of Excellence”, the operation of which might perpetually fund rising returns over time.

Roma pitched BioLimitless’ securities providing at a September seventh advertising occasion, held on the Sonesta Irvine John Wayne Airport resort in California.

As a substitute of being trustworthy in regards to the passive returns funding alternative, BioLimitless advertising frames it as a “crowdfunding mannequin”.

That stated, Roma opened his funding pitch by claiming BioLimitless’ funding alternative was “totally registered in america”.

We’ve a chance [for] you thru a crowdfunding mannequin, totally registered in america, globally.

We’ll get into whether or not BioLimitless is “totally registered in america” later within the article.

An individual can have the flexibility, actually to come back in and make investments 5 hundred {dollars} if they need. And truly have actual fairness possession in these clinics, within the BioLimitless Facilities.

Roma (beneath) goes on to state BioLimitless’ objective is to open 200 clinics over the subsequent three years, increasing to 2 thousand clinics “over the subsequent a number of years”.

Every BioLimitless Middle would require $5 million in funding, apparently solicited in cryptocurrency.

Members of [the] crowdfund can have fifty % fairness … possession and lifelong revenue sharing.

So the best way it really works is we’ll elevate 5 million {dollars} per clinic and each one that’s part of that group belongs to a sensible contract that’s linked to that clinic.

And fifty % of all of the income of that clinic return to the person buyers.

The perpetual nature of passive returns supplied by way of BioLimitless pertain to clinics funding future growth.

Every personal clinic will self fund a second middle. Nicely what does that imply?

So we elevate 5 million {dollars} for a middle in Orange County, for instance.

We construct that middle. That middle does ten million {dollars} in income. 5 million of that goes again to the buyers.

Now the buyers have made an entire ROI. All their cash is made again, proper? Accomplished.

The opposite 5 million goes to opening up a second clinic. And that second clinic can also be owned by the buyers who crowdfunded the primary clinic.

Now that particular person has not solely made their ROI, however they now have lifetime revenue sharing of their share of fifty % of the entire income of clinic primary and clinic quantity two.

I’m conscious of the maths drawback in that the belief is BioLimitless’ proposed clinics will generate any revenue in any respect. BehindMLM reviewed BioLimitless final month and famous the MLM firm marketed grossly overpriced dietary supplements.

To be trustworthy I’m not even positive what these “BioLimitless Facilities of Excellence” are even for. However all of that could be a dialogue for an additional time.

BehindMLM’s concern at this level is Roma is clearly pitching customers on a passive returns funding alternative.

If we apply the Howey Take a look at to BioLimitless’ $500 a pop clinic funding scheme, we now have:

- customers investing $500 or extra in cryptocurrency into BioLimitless (a typical enterprise);

- funding made on the “affordable expectation of income” (BioLimitless advertising initiatives a ROI in “18 to 24 months”); and

- income purportedly funding BioLimitless investor returns are “derived from the efforts of others” (clinic operation, which buyers don’t have anything to do with).

Roma claims BioLimitless is “totally registered in america”. As of September 14th (i.e. after Roma made the “registered” declare), a search of the SEC’s EDGAR database reveals neither BioLimitless or Jeremy Roma are registered.

And so we now have BioLimitless pitching US resident customers on an unregistered securities providing, in obvious violation of US securities regulation.

This after all isn’t a shock. Roma has been violating US securities regulation along with his Daisy AI Ponzi schemes for years. The final iteration of Daisy AI collapsed in October 2023, prompting a Blockchain Sports activities reboot.

With buyers questioning the place funds they pumped into Daisy AI went, Blockchain Sports activities has been a flop. Roma and his Daisy AI co-conspirators proceed to gaslight Daisy AI buyers with respect to their losses.

Now we now have BioLimitless, encompassing overpriced dietary supplements and an unregistered clinic funding alternative.

Pending any additional updates, BioLimitless has introduced a March 2025 launch occasion in Dubai.