Following a assessment of seventy MLM earnings disclosures, FTC workers have concluded they’re “complicated” and “ambiguous”.

Following a assessment of seventy MLM earnings disclosures, FTC workers have concluded they’re “complicated” and “ambiguous”.

Particular points with MLM earnings disclosure statements cited by the FTC embrace:

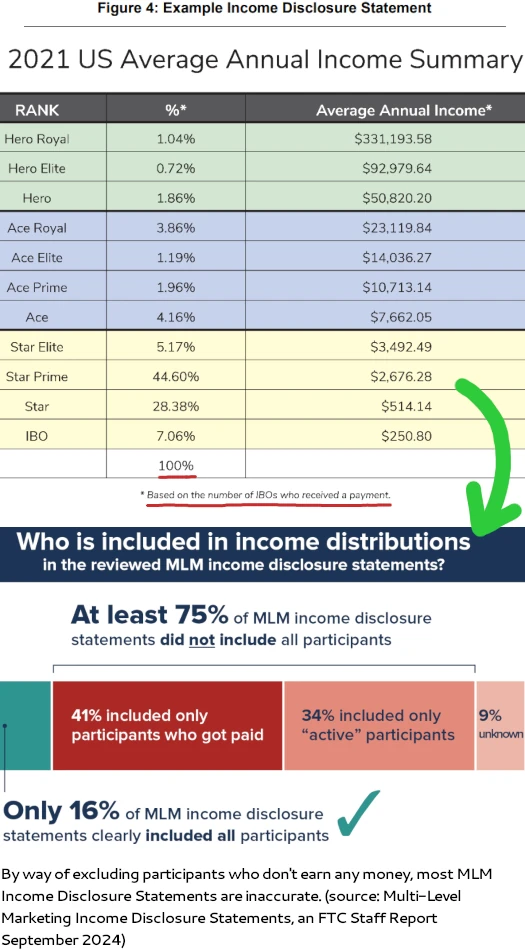

- exclusion of contributors (associates or distributors) who “obtain little or no earnings”;

- no accounting for bills;

- unbalanced deal with excessive incomes earned by “small variety of contributors”;

- presentation of knowledge is “doubtlessly complicated or ambiguous”;

- vital knowledge that’s introduced is finished so inconspicuously; and

- claims are sometimes made with none clear supporting supply

From the FTC’s govt abstract;

Workers’s assessment of 70 disclosure statements exhibits that almost all:

(a) current earnings knowledge that excludes contributors who made little or no earnings and infrequently don’t clearly

clarify the limitation;(b) don’t account for bills incurred by contributors, and infrequently don’t clearly state the limitation, despite the fact that bills can, and in some MLMs usually do, outstrip earnings;

(c) emphasize excessive greenback quantities obtained by a comparatively small variety of contributors;

(d) don’t embrace details about the restricted earnings that almost all contributors obtain, or present it solely inconspicuously;

and(e) current earnings knowledge in doubtlessly complicated or ambiguous methods.

Furthermore, not one of the reviewed earnings disclosure statements clearly explains what knowledge is being introduced to shoppers.

They prominently state that they’re sharing details about “earnings” and “earnings,” however don’t conspicuously clarify what the phrases imply.

For instance, do they embrace knowledge about all forms of earnings that may very well be earned, or simply some? Are they internet of all or any bills?

The shortage of readability on this level is confirmed by the truth that many earnings disclosure statements outline these phrases—comparable to “earnings” and “earnings”—in another way, or in no way.

Moreover, Fee workers’s evaluation of knowledge within the earnings disclosure statements, together with the info hidden in nice print, exhibits that many contributors in these MLMs obtained no funds from the MLMs, and the overwhelming majority obtained $1,000 or much less per yr—that’s, lower than $84 per thirty days, on common.

The FTC’s full ninety-five web page report (most of which is appendices), is out there on the regulator’s web site.

My tackle MLM Earnings Disclosure Statements is that they sometimes don’t precisely current an entire image. That is primarily as a result of, because the FTC famous, contributors who don’t earn earnings are sometimes excluded.

The argument for that is that individuals who don’t earn earnings aren’t contributors. I disagree on the premise in the event you join an MLM alternative, you’re a participant no matter your monetary end result.

Excluding individuals who don’t become profitable bumps the typical earnings per participant, which works in favor of MLM corporations who do that. It’s deceptive and why you sometimes received’t discover Earnings Disclosure Statements cited in BehindMLM critiques.

The broader misleading practices the FTC noticed are an issue, however I really feel secondary to the basic (in)accurateness of most MLM Earnings Disclosure Statements.

And even when the Earnings Disclosure Statements had been correct, a secondary downside is availability.

Workers reviewed the web sites of every of the over 600 MLMs recognized to workers. Solely 79 made an earnings disclosure

assertion publicly obtainable.

Whereas conclusions from the report are introduced by the FTC, what precisely they intend to do with their findings isn’t.

All that’s talked about is the report took place as a part of the FTC’s inside investigation into “ought to begin a rulemaking to manage earnings claims.”

On March 10, 2022, the Fee revealed an Advance Discover of Proposed Rulemaking (“ANPR”) concerning Misleading or Unfair Earnings Claims.

The ANPR sought touch upon whether or not the Fee ought to begin a rulemaking to manage earnings claims.

The overwhelming majority of feedback obtained in response associated to MLMs.

Personally I don’t suppose something additional will come of particular person examples cited within the FTC’s research. Until the FTC requires MLM corporations to publish Earnings Disclosure Statements, enforcement motion now will seemingly lead to Earnings Disclosure Statements disappearing.

Pending any additional studies, I suppose the following step is the FTC proposing what new regulation for misleading or unfair earnings claims would appear like.

No timeline however let’s hope no matter’s subsequent doesn’t take one other two and a half years.